-

SOL has continued declining.

SOL has fallen further into a bear trend due to its price decline.

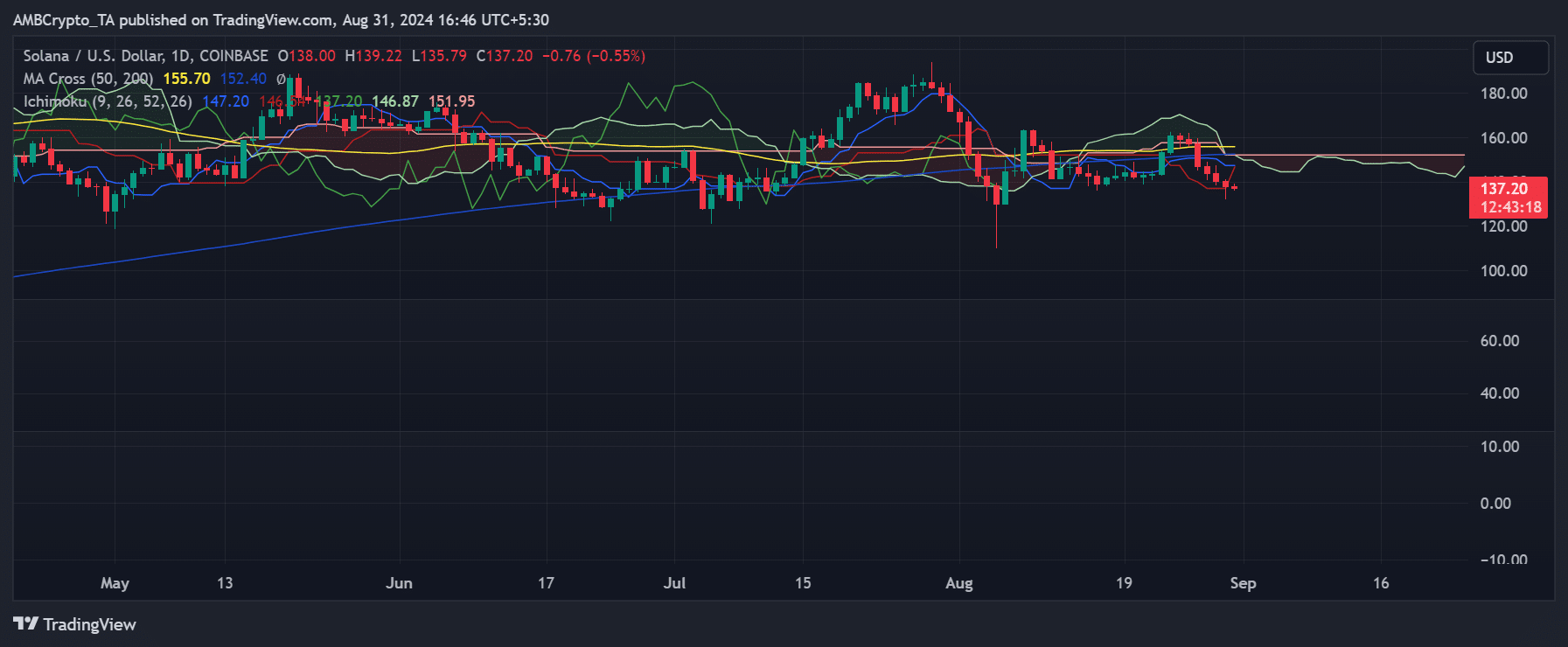

As a seasoned researcher who’s witnessed the crypto market’s rollercoaster ride, I can’t help but feel a sense of deja vu when observing Solana’s [SOL] current trajectory. The consistent decline over the past week has pushed SOL below its Ichimoku Cloud, a bearish sign that resonates with my long-term market intuition.

Lately, the price of Solana (SOL) has been consistently dropping, causing a substantial decrease in its worth. The Ichimoku cloud chart demonstrates the magnitude of this downward trend.

The current trend suggests potential directions for Solana’s future pricing. With its recent dip in value, there’s been less money flowing into Solana, indicating that traders are becoming more reserved in their strategies.

Solana falls below the clouds

Over the last seven days, a detailed examination shows that the value of Solana has consistently dropped, resulting in a current price of around $137.14 at present.

The Ichimoku Cloud analysis revealed that the chart pattern, known as the Kumo, is becoming progressively thinner and starting to tilt slightly downwards.

This change suggests decreasing backing and possible future drops. Moreover, the cost is beneath the cloud, often seen as a bearish symbol.

The colorful lines (Senkou Span A & B) drawn on the chart symbolize potential areas where Solana’s price might encounter support and resistance. Given that these lines are above the current price, they create a zone of resistance, implying that Solana could experience difficulty in pushing past this level in the near future.

Where the SOL price could go from here

As a researcher examining the trends of Solana, my findings suggest that the next substantial support level lies approximately at $130, drawing from historical low points witnessed in June. Should the price dip below this threshold, a potential continued downtrend might ensue, with the next possible target hovering around $120.

On the opposing front, the Ichimoku Cloud signifies the primary obstacle region for resistance, stretching roughly from $146 to $152. In case Solana’s price tries to reverse its trend, it will encounter this zone as the first challenge to surmount.

Above the horizon, the 50-day moving average, approximately at $155, also represents a significant barrier for further price increase. Breaking through this barrier could be key for Solana to move past its current downtrend and potentially initiate an uptrend.

Open Interest in Solana declines

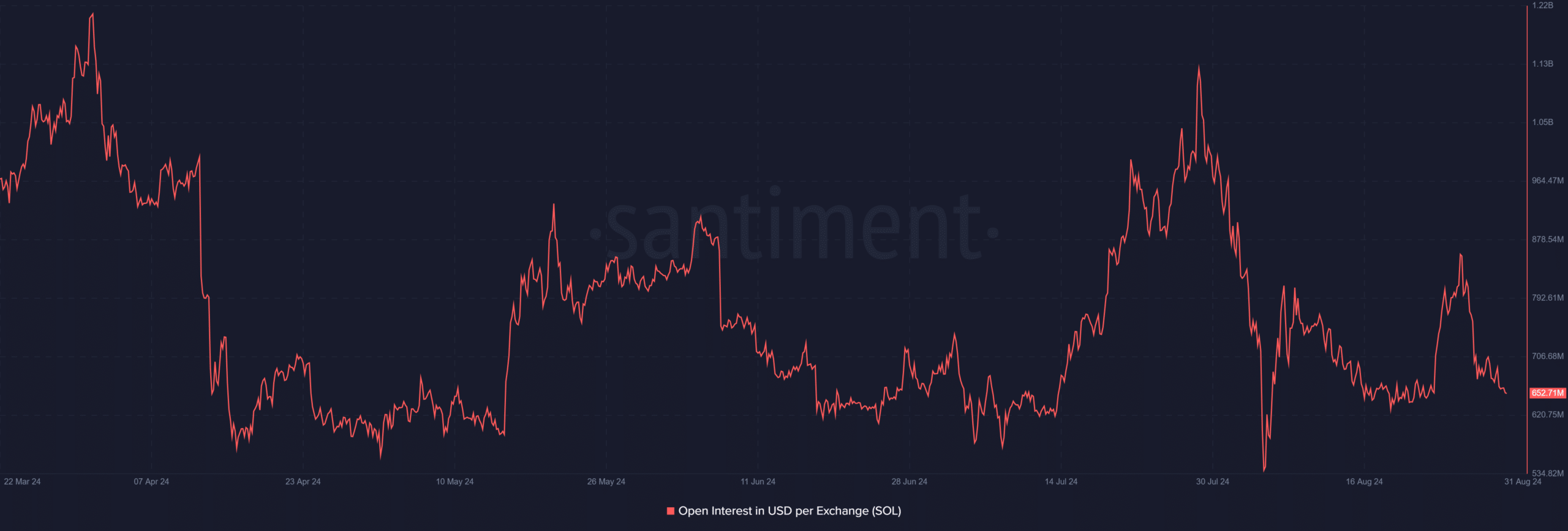

As an analyst, I’ve noticed a striking decrease in Solana’s [SOL] value over the past few periods, which seems to have noticeably diminished enthusiasm among potential investors. This observation aligns with data provided by Santiment.

Over the last five days, a significant decrease in open interest for SOL can be observed. As recently as August 27th, the open interest stood at approximately $817 million, however, it currently hovers around $652 million.

The decrease in open interest implies less money flowing into the market. This suggests that fewer traders are actively participating in Solana trades, possibly indicating decreased excitement and engagement.

Read Solana (SOL) Price Prediction 2024-25

Furthermore, information from CoinMarketCap indicates that Solana has dropped more than 13% in the past week, earning it the title of the most significant decrease among the leading five digital currencies.

Among the leading ten contenders, Solana comes in second as the one that lost the most ground, with Toncoin (TON) taking the lead by experiencing a greater drop of approximately 20% within the same timeframe.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-01 09:12