- Solana quietly patched a bug so wild, it could’ve printed tokens like Monopoly money. C’mon!

- Ethereum diehards immediately screamed: “Centralization!”, claiming institutions should panic. 🙄

Picture this: Mid-April, Solana [SOL] finds out there’s a bug big enough for someone to mint unlimited tokens. Unlimited! It’s like finding a golden ticket—if your golden ticket was actually a hacking coupon. Naturally, Solana fixes it ASAP, stays hush-hush for two weeks, and then goes, “Well, surprise! We fixed it—no need to thank us. Please don’t check your wallets.”

How did that announcement go over? Not great, unless you like your debates spicy. Ethereum fanboys came charging in—fewer capes, more keyboard fury—saying, “This is what happens with centralization!”

Solana vs Ethereum: The Web3 Arm Wrestling Match 🥊

Ryan Berckmans, an ETH loyalist, didn’t miss a beat: “Solana might as well have a big ol’ ‘Welcome Hackers’ sign, because they’ve got ONE client running the show. Ethereum? Oh, we’ve got a whole research posse doing protocol work, and did I mention the client diversity? Four! That’s three more than one, which is so much better, obviously.”

“ETH has client diversity and a protocol spec steered by a meaningful research community. SOL has one client.”

All this means, according to Ryan, if you nuke Solana’s single client, you take down the whole protocol. On Ethereum? You’d have to take out an entire football team’s worth of software. Good luck with that!

Solana actually has two validator clients now (go, Agave and Firedancer, go!). But if you blink, someone in Discord will argue it’s just one. Classic crypto.

Ethereum, of course, sits at the tech table going, “We’ve got four live clients, so eat that, single-point-of-failure nerds.” And, you know, he does have a point: more clients, more headaches, less risk of everything going kaboom at once.

Berckmans wouldn’t stop there (why would he?):

“ETH (L1 and L2) is, by far, the best choice for long-term large investment from the world’s corps, institutions, and governments – it’s not even close. Capital flows reflect this.”

Meanwhile, Solana’s head honcho Anatoly Yakovenko? Not impressed. Basically, he says, “Are you kidding me? You realize it’s the same validator crowd on both chains. If Geth needs a patch, sure, I’ll help. No, really. Pass me the duct tape.”

“It’s the same people to get to 70% on Ethereum. All the Lido validators (chorus one, p2p, etc..) Binance, Coinbase, and Kraken. If Geth needs to push a patch, I’ll be happy to coordinate for them.”

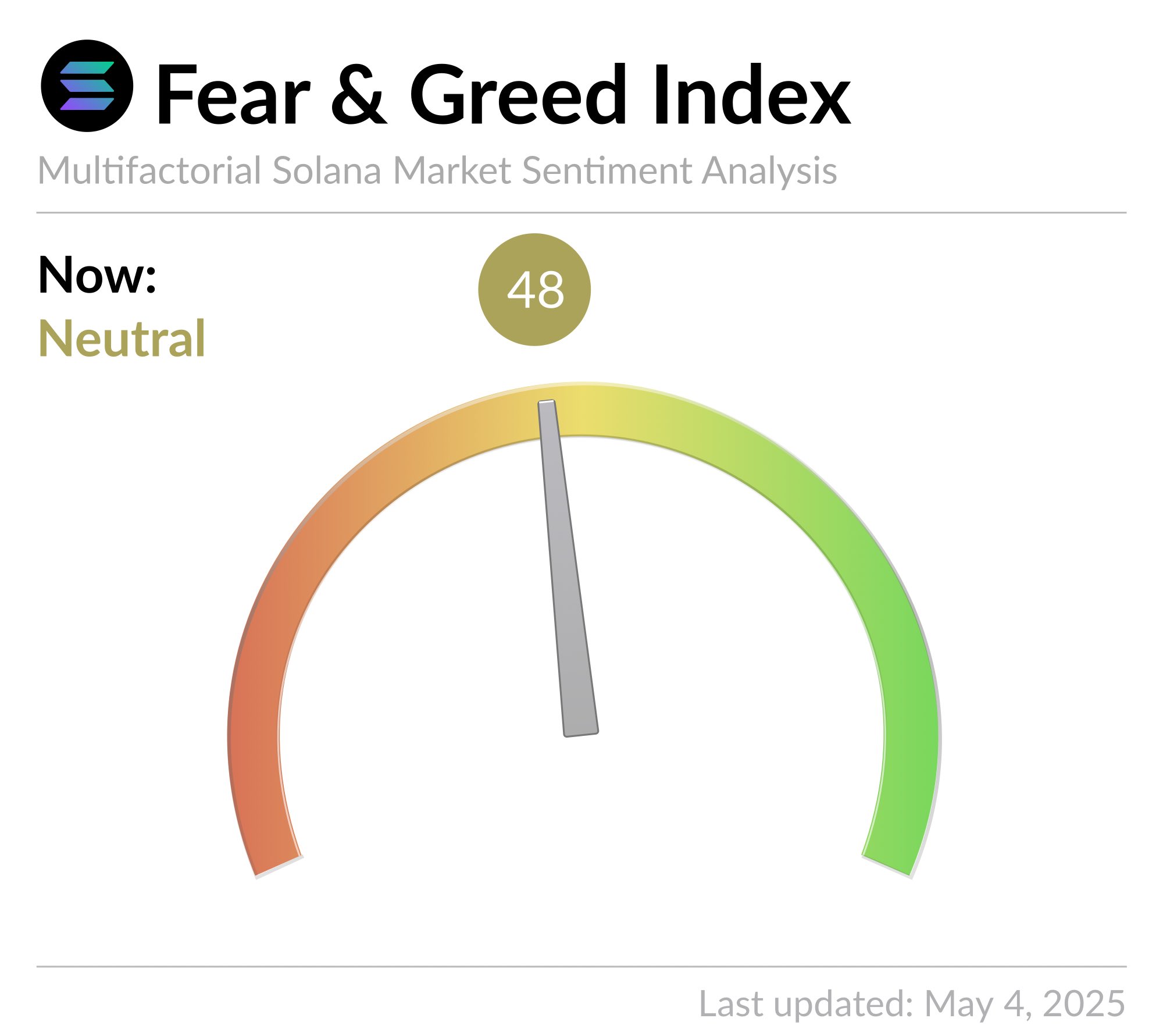

As of right now, Solana’s market is… neutral. Meaning the price could go up, could go down. Or, you know, stay exactly the same. How exciting. 😴

If everyone suddenly panics and sentiment goes full “abandon ship!”, bargain hunters might get their entry. Because nothing says confidence like picking up an asset while everyone else is screaming.

Let’s check those price charts: Solana gave up some of its mid-April gains. Down almost 10% from $157 to $143. Is it a buying opportunity, or is this the beginning of a trip to the land below $132? Place your bets!

If it keeps sliding? Buckle up. A stop at $120 wouldn’t be shocking. Or maybe it rebounds and everyone brags about “buying the dip.” Who knows? Not me. Not you. Definitely not Larry David.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- PGA Tour 2K25 – Everything You Need to Know

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2025-05-06 06:24