- Solana has been consolidating between $120 and $210 for over 180 days, suggesting a significant move ahead.

- Analysts predicted a potential breakout that could see Solana’s price surge to $500-$1,000 or higher.

As a seasoned crypto investor with scars from countless bear markets and bull runs, I must say that Solana [SOL] presents an intriguing opportunity at the moment. The asset’s current consolidation phase between $120 and $210 for over 180 days, as per analyst Curb’s analysis, could indeed be setting the stage for a significant price breakout.

🚨 RED ALERT: EUR/USD Forecast Shattered by Trump’s Moves!

Markets react violently to tariff news — stay ahead of the shockwaves!

View Urgent ForecastAs an analyst, I’ve observed some varied movements in Solana [SOL]’s price trajectory. In the last 24 hours, there was a minor dip of approximately 2.2%, but over the past week, it has managed to climb more than 6%. At the moment of writing, it’s trading above $150, indicating a slightly bullish trend.

The shift in this price is garnering notice, especially considering the wider impact of Solana’s continued confinement within a specific price band.

For approximately six months, the value of this digital currency has been fluctuating between around $120 and $210, leading certain market experts to speculate that it may soon experience a major price surge due to this pattern.

Technical outlook on Solana

Known cryptocurrency expert Curb offers his thoughts on Solana’s present market fluctuations, suggesting that significant price growth could occur when the current consolidation period ends.

Through an in-depth examination, it was noted by Curb that extended periods of market consolidation frequently come before significant changes in price.

Based on his analysis, if Solana manages to escape its current price range, there might be a quick ascent toward $400-$500. This could open up possibilities for additional growth, potentially reaching the $800-$1,000 mark or even beyond.

According to Curb’s forecast, such price leaps often follow long phases where assets show little change in value, acting like a trampoline for significant price jumps.

Additionally, he pointed out that the present market circumstances, along with Solana’s robust foundations, are making it more and more plausible for this situation to occur.

In simpler terms, Curb suggested that Solana’s repeated bounce between its monthly support and resistance lines suggests that the market is gradually building up power for a significant breakthrough.

He thought that the accumulation stage was essential for Solana, because it provided the necessary push to surmount formidable resistance barriers.

If these thresholds are exceeded, the progression might accelerate significantly, fueled by a combination of technical aspects and growing investor enthusiasm.

Is a SOL breakout imminent?

Although Curve seems hopeful, it’s important to examine Solana’s core strengths to judge if such a surge could realistically occur in the coming days.

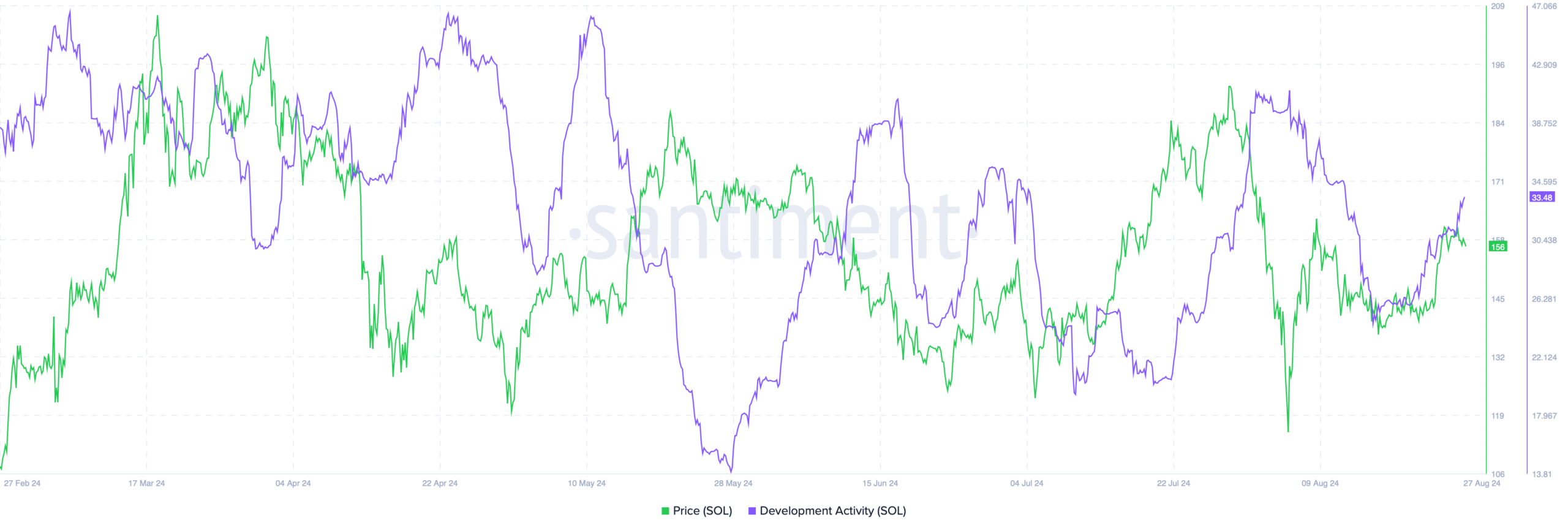

One such example was the network’s development activity, which serves as an indicator of the ongoing interest and innovation within the Solana ecosystem.

Based on information from Santiment, the development activity for Solana has significantly grown. It dropped to a minimum of 13 in late May but has since risen above 33 as of today.

The increase in development work indicates that the Solana network is undergoing active growth, as it welcomes new projects and enhancements.

As an analyst, I often observe that a surge in development activity is closely linked with heightened investor trust, a factor that can potentially drive prices upwards.

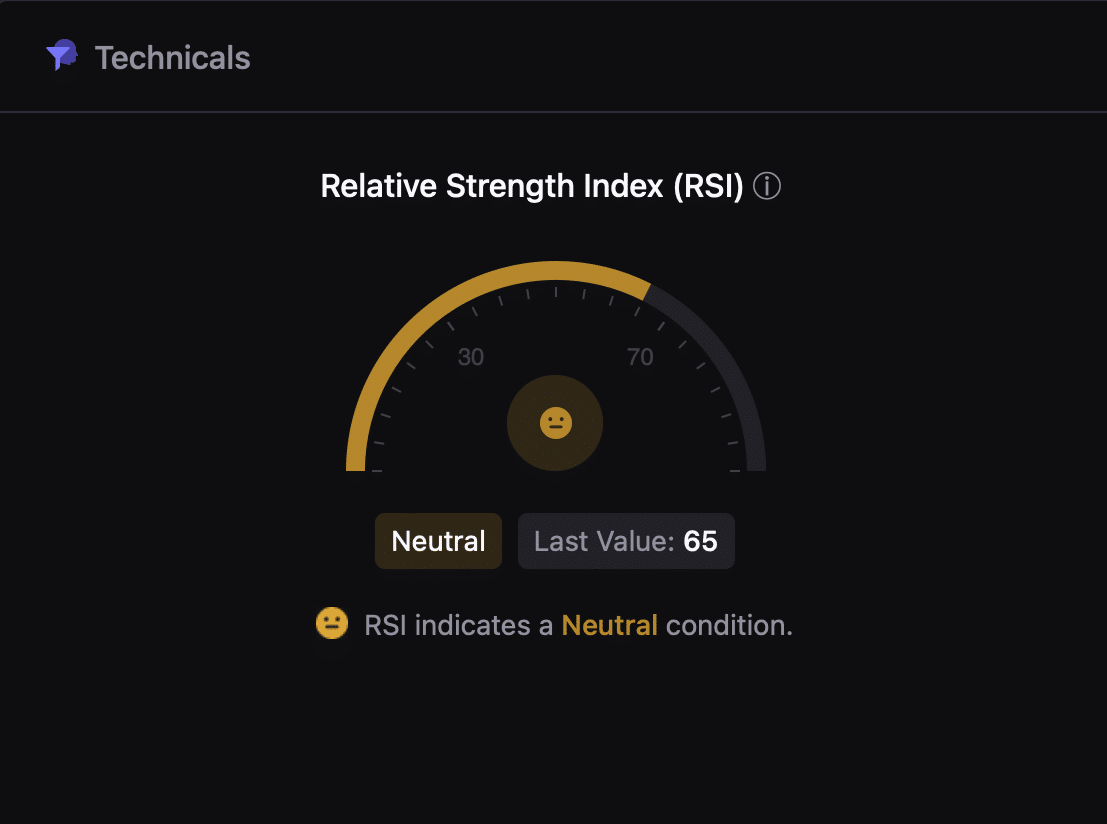

Meanwhile, Solana’s Relative Strength Index (RSI), a tool for determining if an asset is too bought up or too sold, stood at a balanced 65 in the current moment, indicating neither overbought nor oversold conditions.

Read Solana’s [SOL] Price Prediction 2024–2025

A Relative Strength Index (RSI) reading of 65 indicates that Solana’s market condition is neutral, suggesting that it is neither experiencing strong buying pressure (overbought) nor significant selling pressure (oversold), and instead, the market is in an equilibrium state.

In simpler terms, this neutral state for Solana suggests it might go up or down, but considering other positive signs, it could potentially increase if the market stays beneficial.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-08-28 05:12