-

SOL recently retreated from a strong resistance line, with the crypto approaching nearest support at press time

On-chain metrics, including liquidation data, pointed to a bearish market bias

As an analyst with over two decades of experience in the cryptocurrency market, I have seen many cycles and trends come and go. The current situation with Solana (SOL) reminds me of the classic rollercoaster ride we all enjoy – a thrilling upswing followed by a sudden drop that leaves us hanging on for dear life.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastOver the last month, Solana (SOL) has exhibited only modest increases, amounting to approximately 3%. As I type this, however, it’s worth noting that SOL has dropped by about 5.29% in the daily market.

Given the current circumstances, it’s not surprising that the overall market outlook is negative, with investors seemingly pushing Solana’s (SOL) value downwards.

Further decline expected to rock SOL

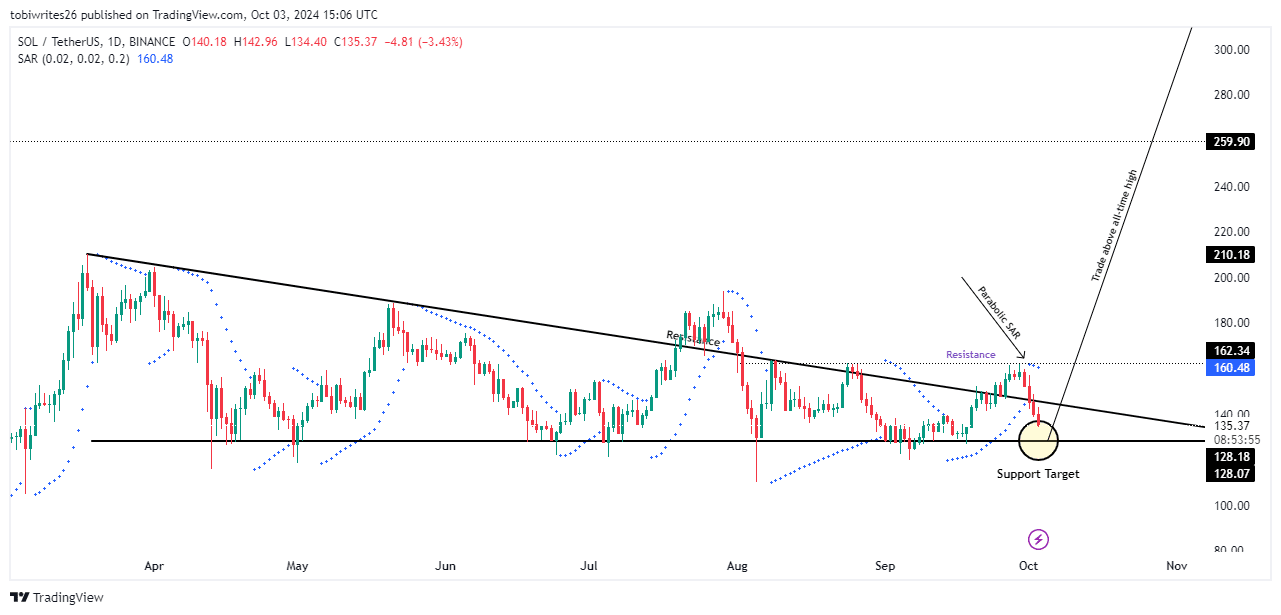

Recently, SOL‘s fall can be linked to its retreat from the resistance area around $160.09, which is a component of a consolidation phase. As a result, the price of SOL experienced a continued decrease as shown on the charts.

Currently, as we speak, the downward trend appears persistent. The price of SOL seems to be finding a temporary respite at around $128.18, a point where it might stabilize momentarily. Afterwards, the market forces will determine the direction for its next shift.

Trading View

Looking closely at the $128.18 support level, its legitimacy could be reinforced by analyzing market sentiment and the Parabolic SAR (Stop and Reverse) indicator. If this analysis aligns, it suggests a potential continuation of the downward trend if the price stays beneath the Parabolic SAR’s dots.

Interestingly, AMBCrypto suggests that Solana (SOL) might be preparing for a significant surge, given its past trends.

Fall as a precursor to major rally for SOL

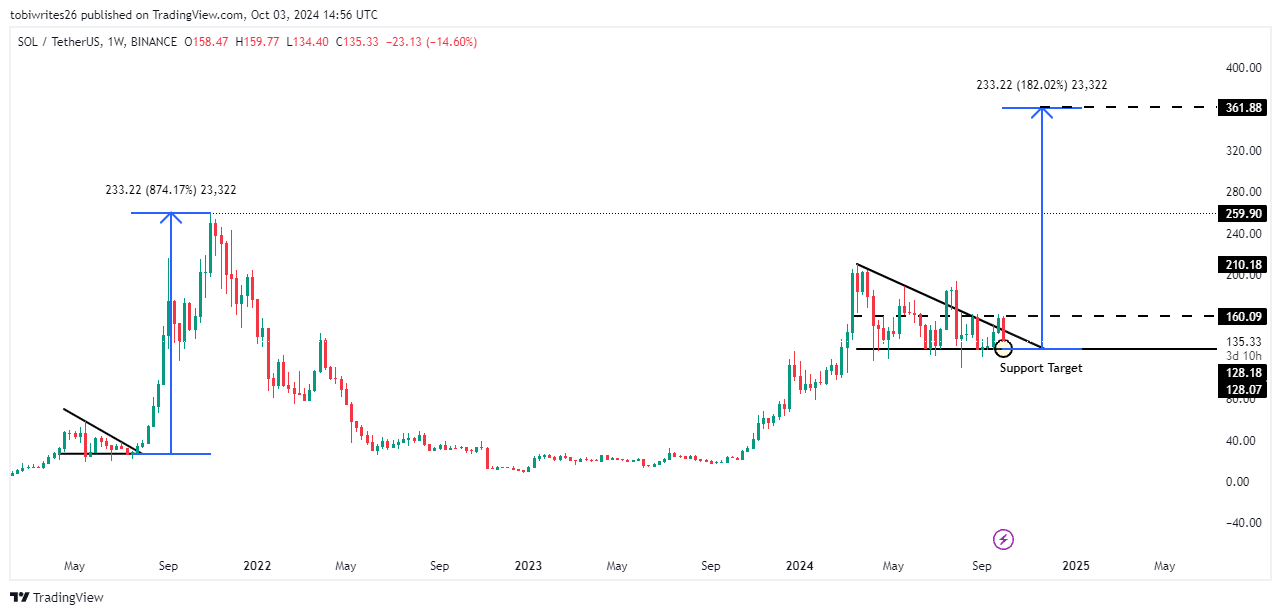

It appears that SOL‘s recent price fluctuations resemble those from last year, leading up to its record high. This trend suggests that SOL could potentially be going through an accumulation stage now, much like it did previously.

A build-up stage refers to a time when traders slowly grow their Solana (SOL) assets, expecting an upcoming surge. By doing this, they prepare themselves to reap greater profits if the price indeed increases.

If the current trajectory persists, it’s quite likely that SOL might increase by approximately 182.02%, potentially peaking at around $361.88.

Declining interest fuels SOL’s price drop and heavy losses

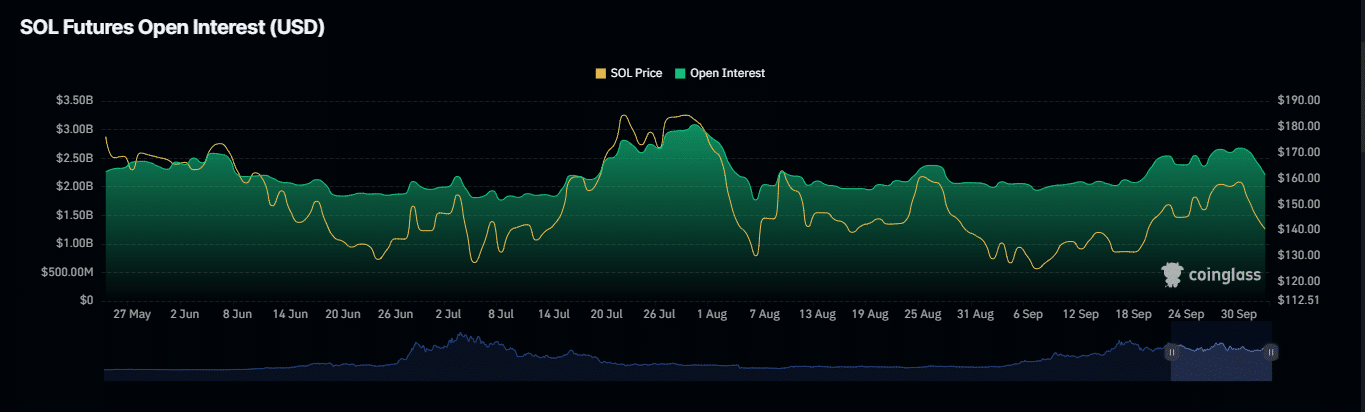

To sum up, the latest data from Coinglass shows that decreased investor enthusiasm might be causing Solana’s (SOL) current downward trend in price.

The decrease in Open Interest, an indicator that reflects the number of outstanding derivative contracts, provided support for this situation. This metric is crucial when determining market sentiment. Specifically, at the moment of reporting, Open Interest had dropped by 8.24%, equivalent to a value of approximately $2.19 billion.

In my experience as a crypto investor, I’ve noticed a significant shift in the Solana (SOL) market, with many traders who were previously bullish on its price increase finding themselves exited due to liquidations amounting to $10.88 million.

Collectively, these advancements indicate that pessimistic elements have gained significant influence, potentially driving Solana’s price towards the crucial support zone around 128.18 as depicted on the graphs.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-04 11:03