-

Solana’s active addresses hit a record-breaking 75.2 million, highlighting growing adoption and interest.

SOL faced resistance at $132 with bearish momentum, as liquidation data reflected ongoing market volatility.

As a researcher with years of experience in the crypto sphere, witnessing the growth and evolution of various blockchain networks has been nothing short of fascinating. Recently, I’ve found myself captivated by Solana [SOL] and its phenomenal progress. With an unprecedented 75.2 million active addresses, SOL has not only broken its own record but also demonstrated a significant surge in user adoption – a testament to the network’s allure and potential.

In an impressive development, Solana’s user base has hit a record high of 75.2 million monthly active addresses, marking a new all-time peak (ATH). This growth spurt indicates a significant rise in user engagement and adoption, underscoring the rising demand and popularity for the network.

Lately, the surge in activity underscores that Solana is drawing in an increasing number of programmers, users, and decentralized applications (dApps) towards it.

With the ongoing expansion of our network, it’s clear that there’s plenty of room for more users to join us, particularly as we introduce exciting new features and upgrades in the near future.

Exponential growth in user activity

Since mid-2023, we’ve seen an extremely rapid growth in the number of active addresses, with a significant surge in user count over the last few months, indicating an exponential trend.

This surge in user activity dwarfs previous peaks, highlighting the remarkable growth in Solana’s ecosystem.

The network has proven to be highly adaptable, becoming one of the leading platforms in the field of decentralized finance (DeFi) and non-fungible tokens (NFTs), capable of handling significant growth.

Solana’s increasing number of users demonstrates its capability to manage high transaction volumes effectively, making it an appealing choice for potential adopters due to this efficiency.

As more advancements unfold, it’s likely that Solana will maintain its lead in the blockchain industry by strengthening its standing even more.

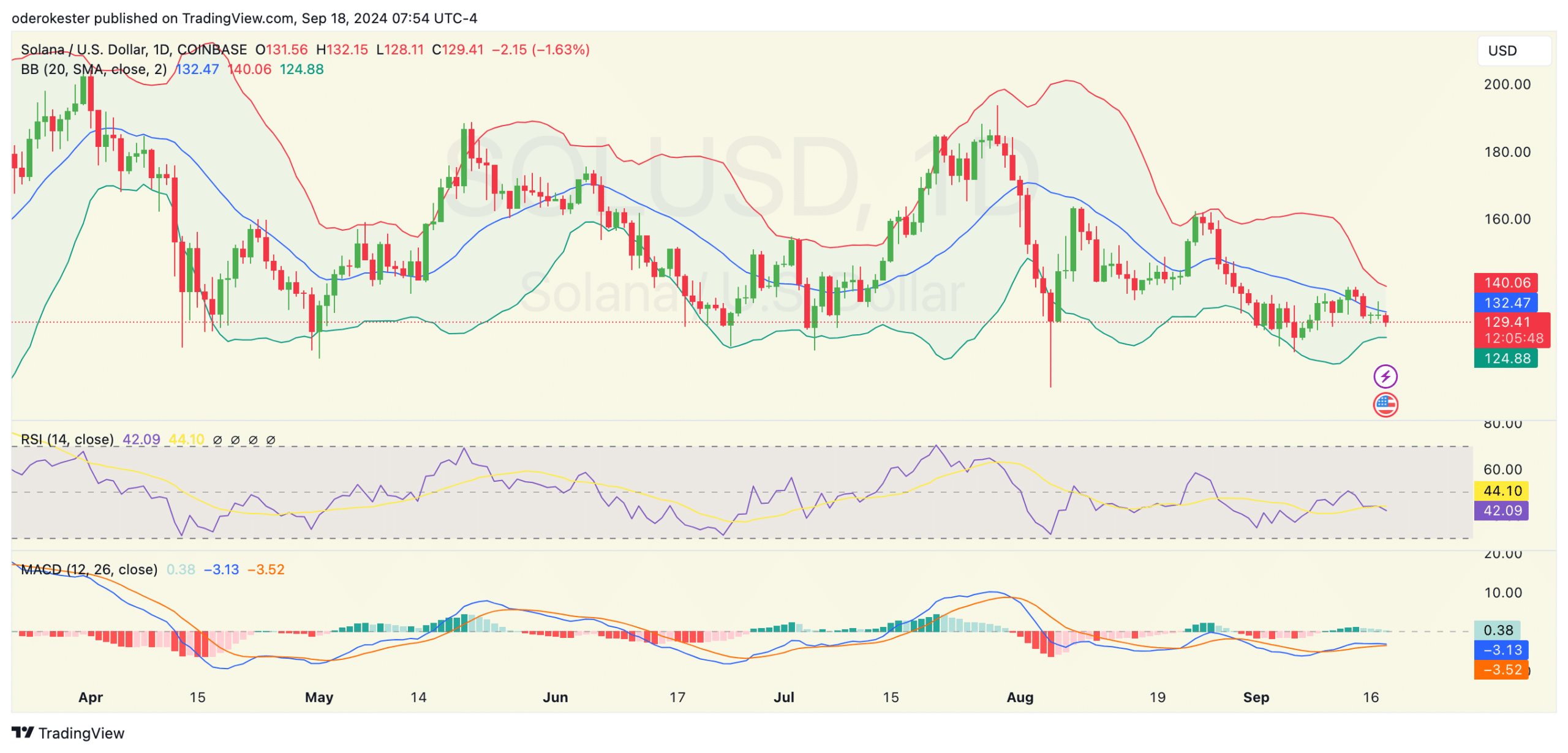

Solana price outlook

At approximately $132.47, Solana’s price seems to be meeting resistance, and the tightening of the Bollinger Bands indicates a potential upcoming move, which could go up or down.

On Solana, the Relative Strength Index (RSI) was at 42.07, suggesting a slowdown in positive momentum and approaching overbought levels. This reading suggests prolonged bearishness might continue, but a potential change in direction could occur if purchasers become active.

As a crypto investor, I’ve noticed that the Moving Average Convergence Divergence (MACD) has recently crossed over in a bearish manner, suggesting an uptick in selling pressure. If this downward trend persists, Solana could potentially approach the lower Bollinger Band at $124.88.

If the price drops beneath the current point, it might find support around $120. Conversely, a turnaround above $132.47 could potentially challenge the $140 resistance point.

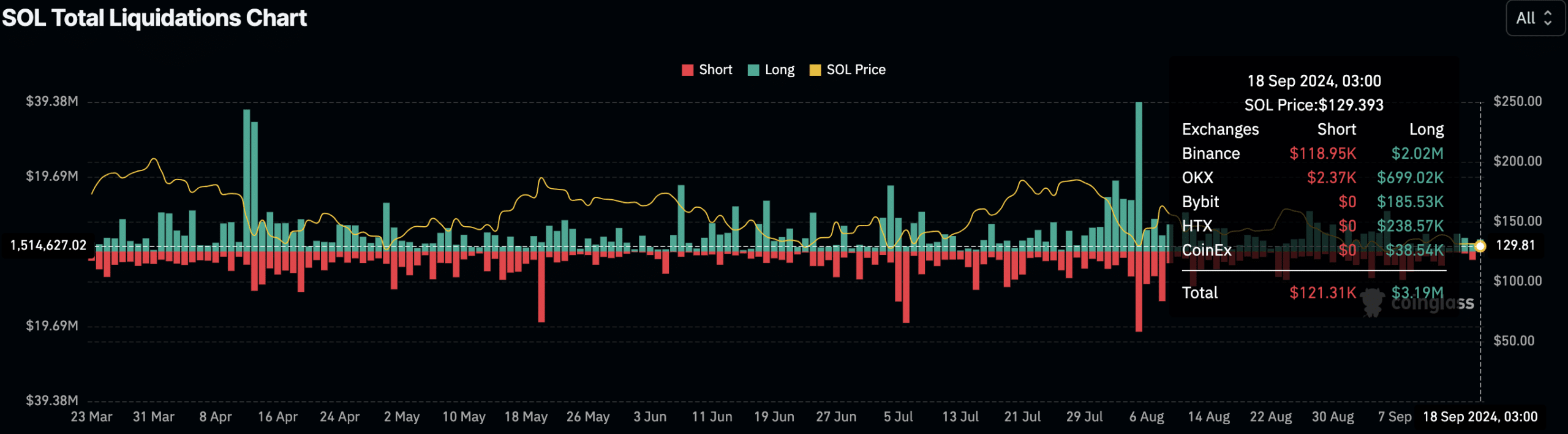

18th September witnessed a significant event for Solana as it experienced a total of $153.69M ($121.31K in short liquidations and $3.19M in long liquidations). This suggests that the effects were particularly noticeable on long-term positions.

Read Solana’s [SOL] Price Prediction 2024–2025

On Binance, a significant amount of long positions were liquidated, totaling approximately $2.02 million, while around $118,950 was liquidated for short positions. This data indicates that there was intense volatility in the Solana market, leading to changes in its price.

At the point when positions were liquidated on Solana, its value stood at approximately $129.39, demonstrating the effect that leveraged transactions are having in the present market. Given this liquidation data, traders should exercise caution as it suggests persistent volatility across various platforms.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-19 04:08