- Solana has been extremely volatile over the past month.

- It has bounced from one extreme to the other of a large range, which could help swing traders’ decision-making.

As a seasoned crypto investor with battle-scarred fingers from the rollercoaster ride of digital assets, I must admit that Solana [SOL] has been quite the wildcard over the past month. The whiplash-inducing volatility might make some investors dizzy, but for swing traders like myself, it presents a golden opportunity to cash in on these price swings.

In August, the first Exchange-Traded Fund (ETF) based on Solana [SOL] was given approval in Brazil. This ETF is expected to be released within a timeframe of up to three months.

Based on my years of working in the financial industry, I firmly believe that the approval and trading of a SOL spot ETF could be a game-changer for investors worldwide, especially in economic powerhouses like the U.S. and the UK. With my background in investment strategy and market analysis, I have witnessed firsthand how such products can democratize access to digital assets and offer diversification opportunities. The approval of this ETF could pave the way for a new era of financial inclusion and innovation, making it easier for individuals and institutions to invest in Solana’s rapidly growing ecosystem.

As a researcher delving into the Decentralized PIN (DePIN) sector, I’ve observed that Solana stands out as the frontrunner with an impressive 78 projects under its belt, surpassing other blockchain networks in this space. Furthermore, it has emerged as a favored platform for development activities, hinting at potential growth that may even surpass Ethereum [ETH] in this specific area.

The SOL/ETH price made a new all-time high, further encouraging bulls.

Bullish confluence for Solana

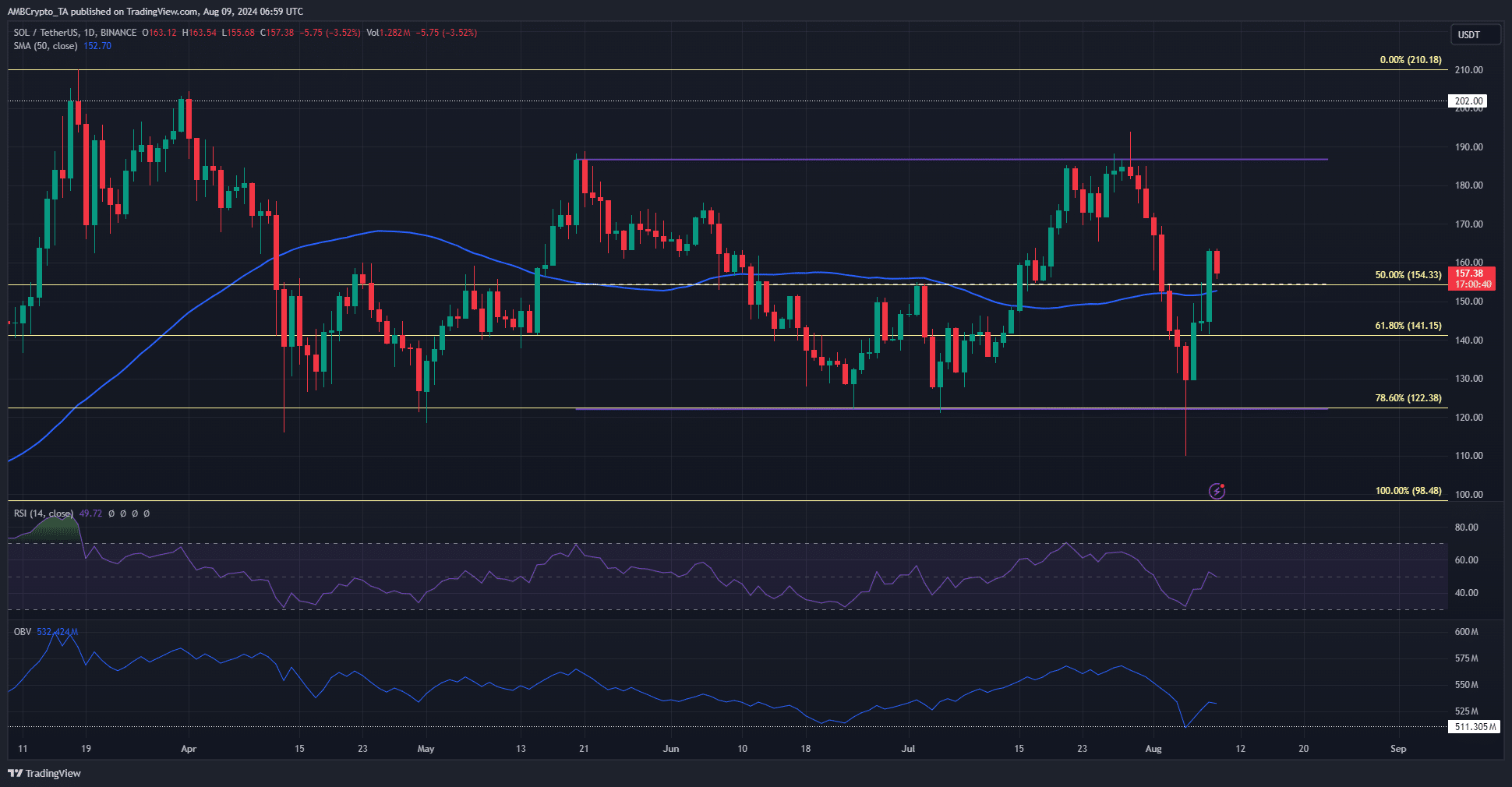

For about three months now (since May), the value of Solana has fluctuated between $122 and $186. The middle point of this range is at $154. Currently, the price of Solana is above the resistance level that comes with being in the mid-range.

Moreover, the 50-day moving average was also breached by the recent move to $160.

As a seasoned trader with over a decade of experience under my belt, I find myself always on the lookout for subtle shifts and changes in market trends. In this case, the Relative Strength Index (RSI) hovering just below the neutral 50 line caught my attention, suggesting that a momentum change was imminent. However, upon closer inspection of the On-Balance Volume (OBV), I noticed it bouncing off a multi-month support level. This combination of indicators in my experience often signals a potential turning point, and I’m keeping a close eye on this situation to see if it plays out as predicted.

Lately, it seems sellers have been more active than buyers. Looking ahead, we anticipate a potential push towards the $190 resistance area in the near future.

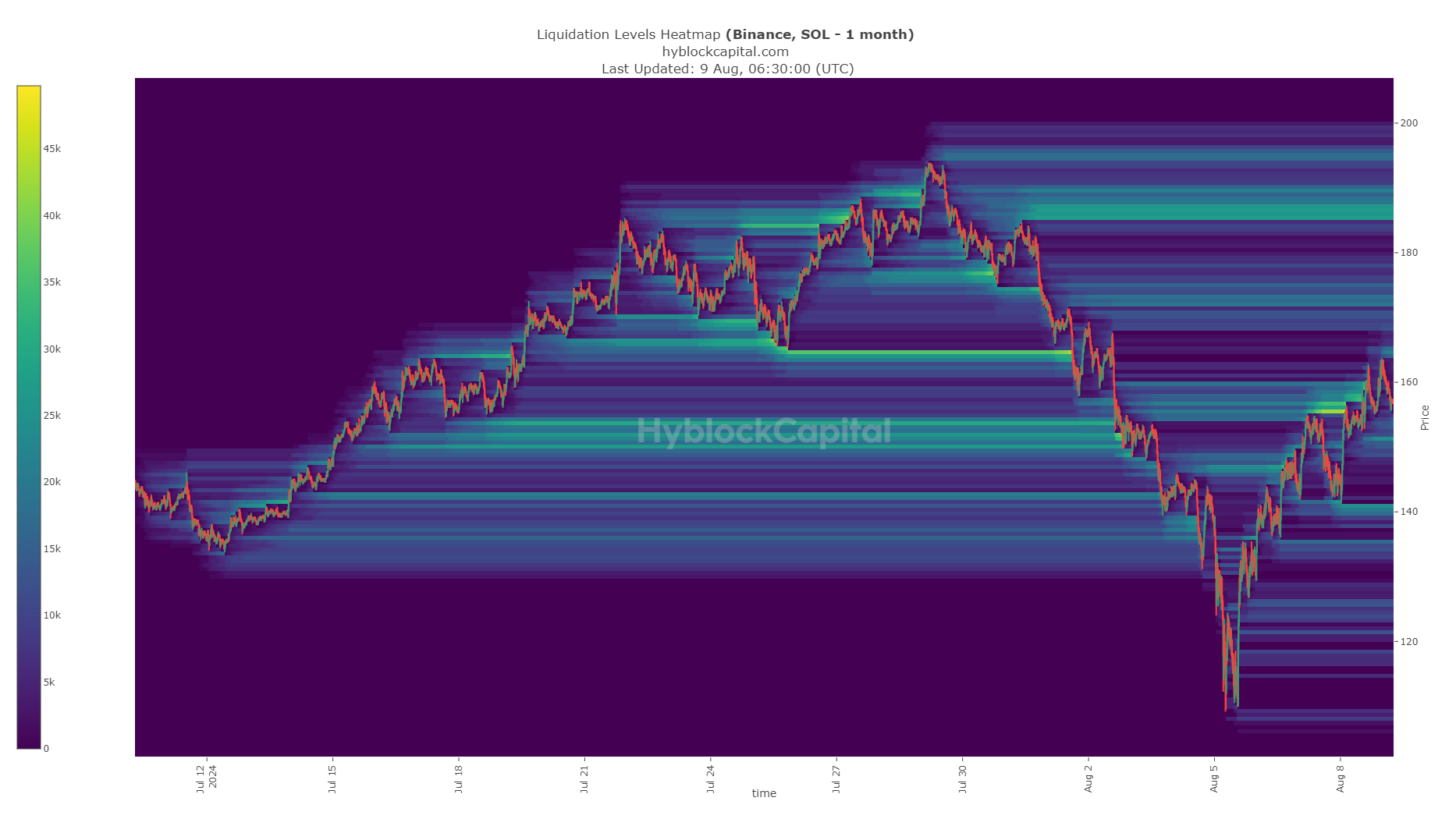

Liquidity clusters underline two potential reversal spots

During the past three months, it appears that $164 could be the immediate upcoming short-term goal. Moving forward, potential areas of interest include the ranges between $171 and $174, as well as $185 to $189. Notably, the latter region holds a larger concentration of liquidity.

Since Solana often oscillates between its price extremes, swing traders might view the return to $154 as a potential buying point, aiming for profits in the range of $185 to $189.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-09 18:31