-

U.S. political developments to play a role in defining the crypto market trajectory in Q4 and beyond.

SOL and other unproven cryptocurrencies will likely lag ETH and BTC under Harris’s presidency.

As a seasoned researcher with years of experience tracking and analyzing crypto markets, I find myself intrigued by the bullish predictions for Solana (SOL) under a potential Trump presidency. While I must admit that my crystal ball is far from perfect, I have seen enough market cycles to know that political developments can indeed shape a crypto asset’s trajectory.

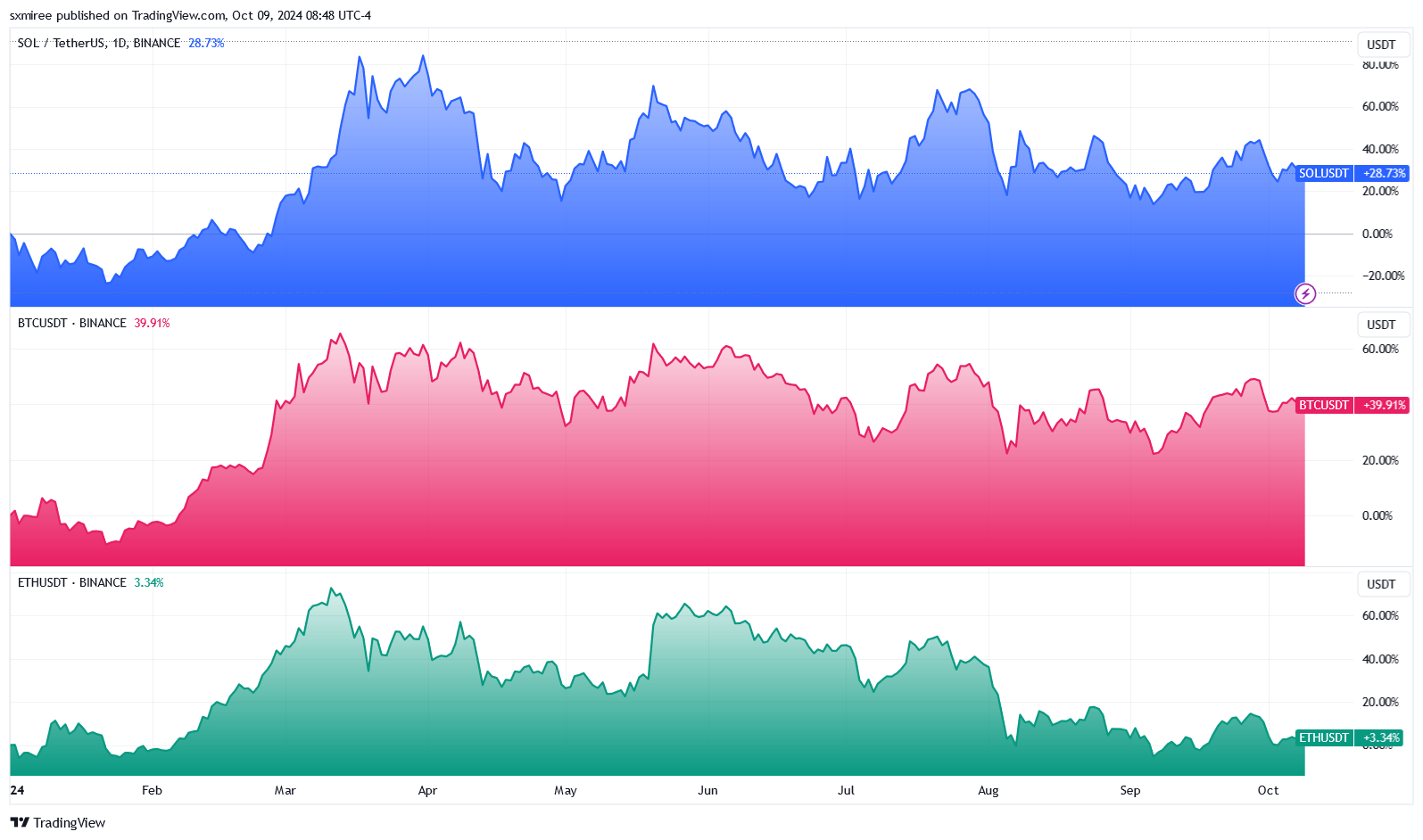

This year, Solana (SOL) has been one of the top-performing cryptocurrencies, initially trading at approximately $105. It subsequently surged to over $200 in March. Although it has experienced a slight decline since then, SOL is still 40% up for the year and may potentially see further increases during Q4.

This week, a report prepared by analysts at Standard Chartered identified SOL as a potential cryptocurrency that could prosper if Donald Trump, the Republican candidate, triumphs in the upcoming U.S. Presidential election in November.

According to the team headed by Geoffrey Kendrick, who specializes in digital assets research on a global scale, it is predicted that Solana will surpass both Bitcoin and Ethereum in terms of performance by the year 2025.

Based on this perspective, the report supports the possibility of a fivefold increase in the SOL price by the end of the coming year. Bank analysts highlighted a more advantageous regulatory climate as one of the main optimistic factors, attributing it to friendlier policies expected under the Trump administration.

Despite the bank’s belief that cryptocurrencies will maintain their strength irrespective of the election results, the analysis indicated that Solana (SOL) is likely to lag behind Bitcoin (BTC) and Ethereum (ETH) in terms of spot market performance if Kamala Harris becomes the U.S. President.

Analysts believe these top cryptocurrencies will thrive, despite tighter regulations, thanks to their well-established foundations and widespread acceptance among institutions.

Fundamental analysis paints a mixed picture

As political events continue to unfold, they may significantly impact the direction of SOL‘s price. However, data from the blockchain itself doesn’t always back up a positive outlook for its price increase.

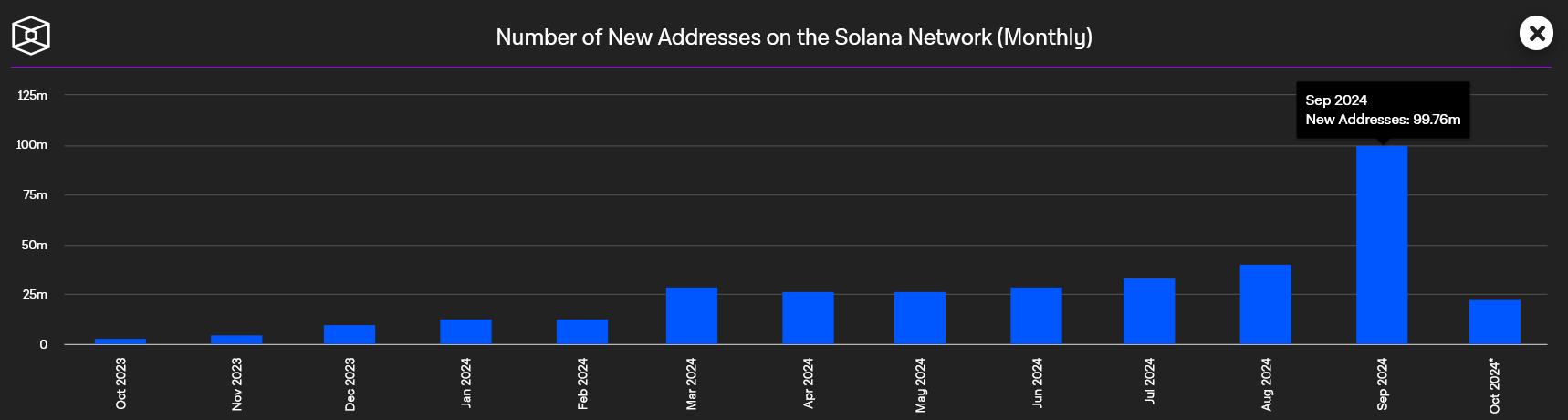

According to data from The Block’s Solana dashboard, the Solana network reached an all-time high in September by registering approximately 99.76 million new user accounts within a month.

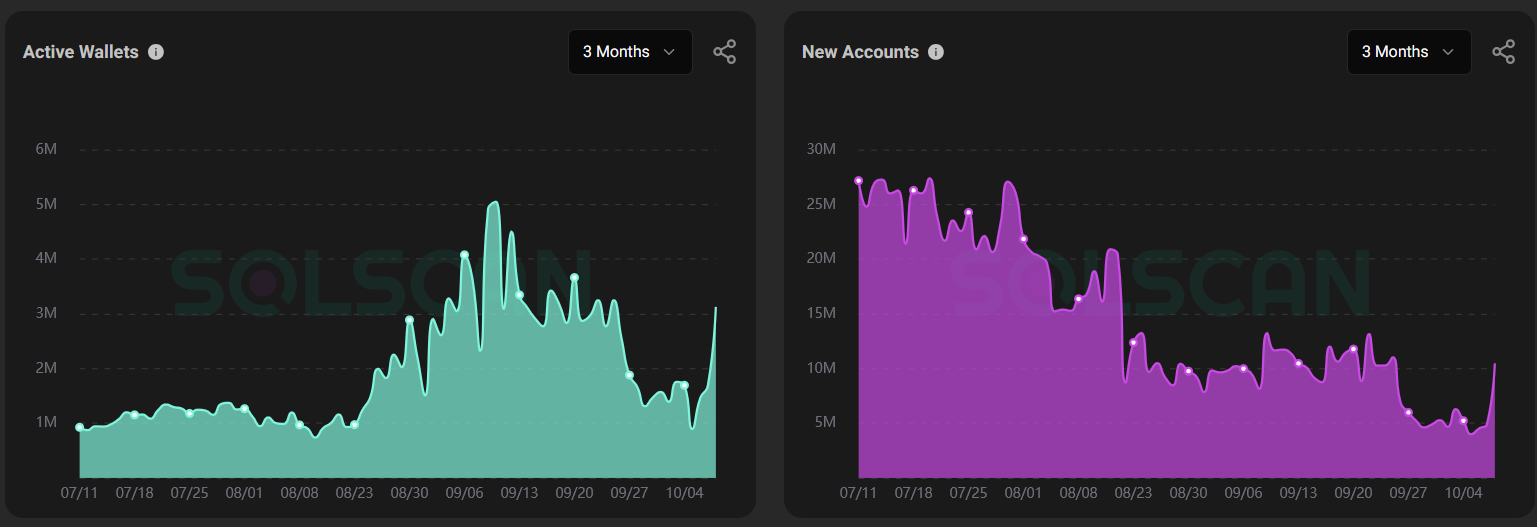

Conversely, based on information from Solscan Explorer, there’s been a decline in the number of active wallets over the past three weeks, reaching a peak of 5.047 million on September 10.

At the same time, new accounts have also been trending downward in the past two months.

The increasing reverse pattern observed among market players, suggesting a decrease in demand, provokes doubts regarding the long-term expansion of the recent increase in address usage.

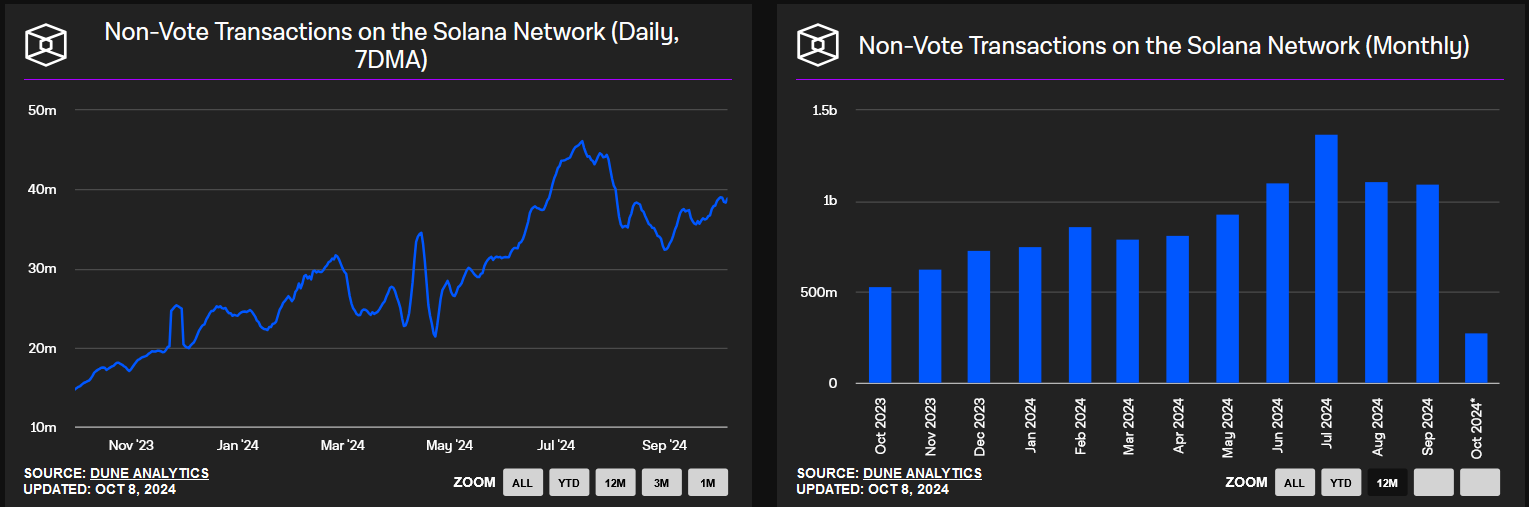

Conversely, the number of daily non-voting transactions on the Solana network has been decreasing since it peaked at 46.11 million on July 16. It’s worth mentioning that this figure has stayed below 40 million since August 4.

The reduction is also evident in the combined monthly transactions that don’t involve voting, which underscores a decrease in overall network usage, even though there has been an increase in active addresses.

Read Solana’s [SOL] Price Prediction 2024–2025

SOL/USDT technical analysis

Currently, Solana (SOL) is being traded at around $143, continuing its trend within a limited price fluctuation that has been observed between approximately $120 and $162 since August 5. On this date, the price dipped briefly to a level below $110.

Looking at the long-term SOL/USDT chart on TradingView, it appears this pair has been confined within an intriguing pennant structure for approximately nine months now. This flag formation hints that a substantial price swing might be imminent during the current quarter.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-10 11:04