- SOL was showing a positive trend for the first time in three days.

- LTHs have held despite the recent declines.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I find Solana’s current trajectory quite intriguing. The resilience shown by long-term holders and the consistent increase in network activity are strong indicators of a healthy ecosystem.

As an analyst, I’ve noticed a significant increase in long-term holder activity on Solana [SOL], based on the latest data from Glassnode. This surge suggests that investors are becoming more convinced about Solana, despite its current trading price hovering around $230.

With rising network activity and an escalating Total Value Locked (TVL) at approximately $9 billion, these patterns indicate a robust trajectory and promise for continuous expansion for this particular asset.

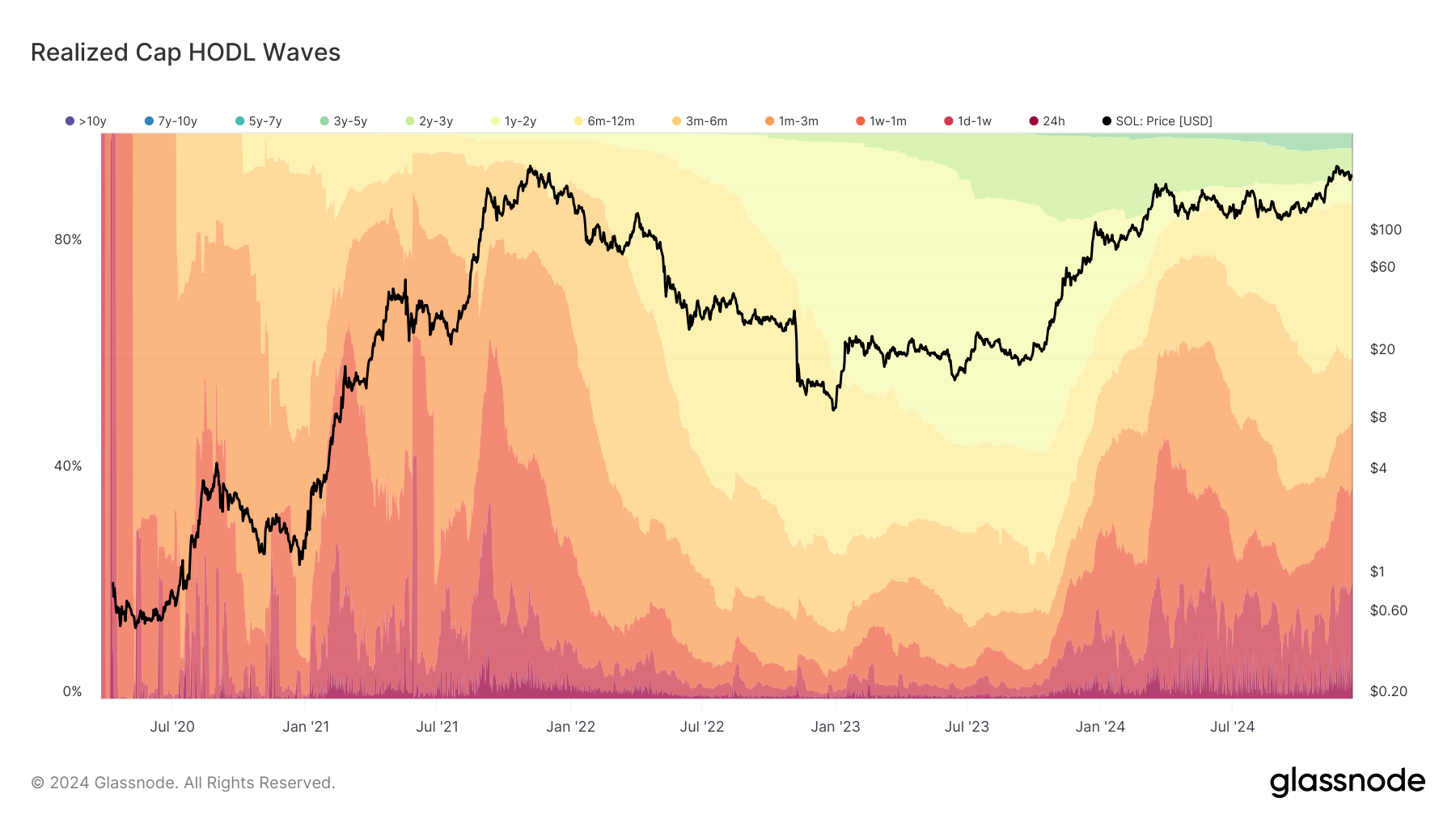

Analyzing Solana’s HODL waves

The surge in Solana’s price is backed by a high level of activity within its HODL waves, as indicated by Glassnode data. This data shows that about one-quarter (27%) of the entire supply is currently being held by investors who have purchased Solana during the 2024 rally, suggesting strong confidence and commitment among buyers.

This pattern indicates that investors are choosing to keep their investments instead of selling them at these prices, which can be seen as a positive sign for the network’s robustness.

Long-term holders are increasingly dominating the wealth within the Solana ecosystem, as they accumulate a larger portion with the price of SOL nearing the $230 mark, according to the HODL waves.

This information emphasizes the faith and positivity of investors, even amidst market ups and downs. An uptick in long-term holders usually means less pressure to sell, possibly indicating a path toward continuous price rise.

Solana price tests key resistance levels

Right now, Solana is being exchanged for approximately $226 following a peak at $227. The coin has been trading effortlessly above both its 50-day and 200-day Moving Averages, which suggests robust upward momentum in the market.

In simple terms, the Relative Strength Index (RSI) stood at 49.62, indicating that the market is currently in a balanced state and showing no clear indications of either overbuying or overselling at this moment.

The trend suggests that SOL is strengthening and preparing for a possible surge. If it manages to surpass the $230 resistance point, it may thrust the cryptocurrency towards new heights, with $250 being the next significant milestone.

Conversely, the $215 region is an essential region of potential support, reinforced by heightened purchasing activity during past market declines.

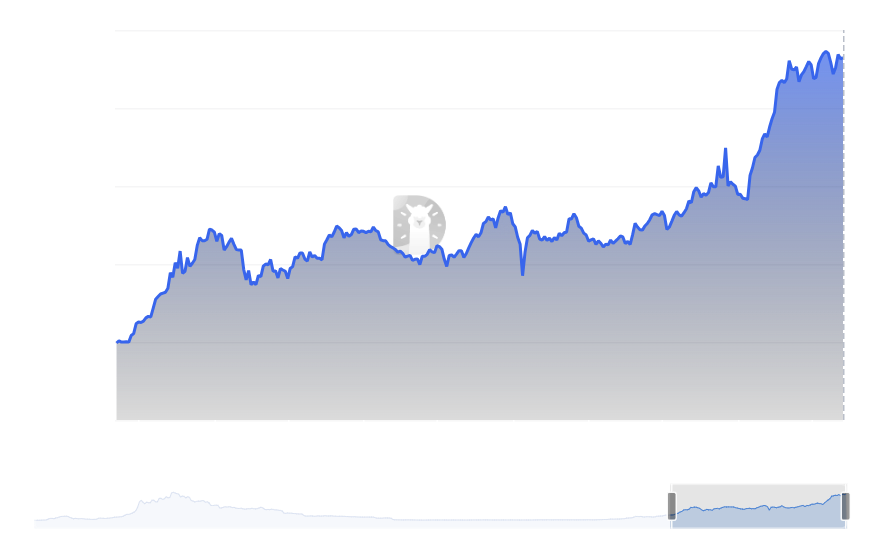

TVL correlation: Growing network activity

According to DeFiLlama’s data, the Total Value Locked (TVL) on the Solana network has soared close to $9 billion, indicating a substantial rise in network usage and activity.

The increase in Total Value Locked (TVL) indicates a surge in user interaction and growing trust among the Solana ecosystem users, particularly those involved in Decentralized Finance (DeFi).

The correlation between rising TVL and HODL waves suggests that long-term holders are not just holding SOL for speculative purposes but are actively utilizing it within the network.

Increased TVL often correlates with stronger price trends, which signifies greater utility.

What lies ahead for Solana?

The increasing number of long-term investors, substantial total value locked, and optimistic market behavior indicate a favorable future for this asset. The surge in long-term ownership implies less urge to sell, whereas the rising TVL hints at the network’s expanding popularity and usefulness.

As significant resistance points approach, Solana seems set to continue climbing, as long as the market stays advantageous. Keep an eye out for a surge past $230 to verify that its bullish trend is still in play.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-14 18:15