- Solana has breached an imbalance on the daily chart and could retest it as a support zone.

- The momentum and price action signaled bulls were in control of the market.

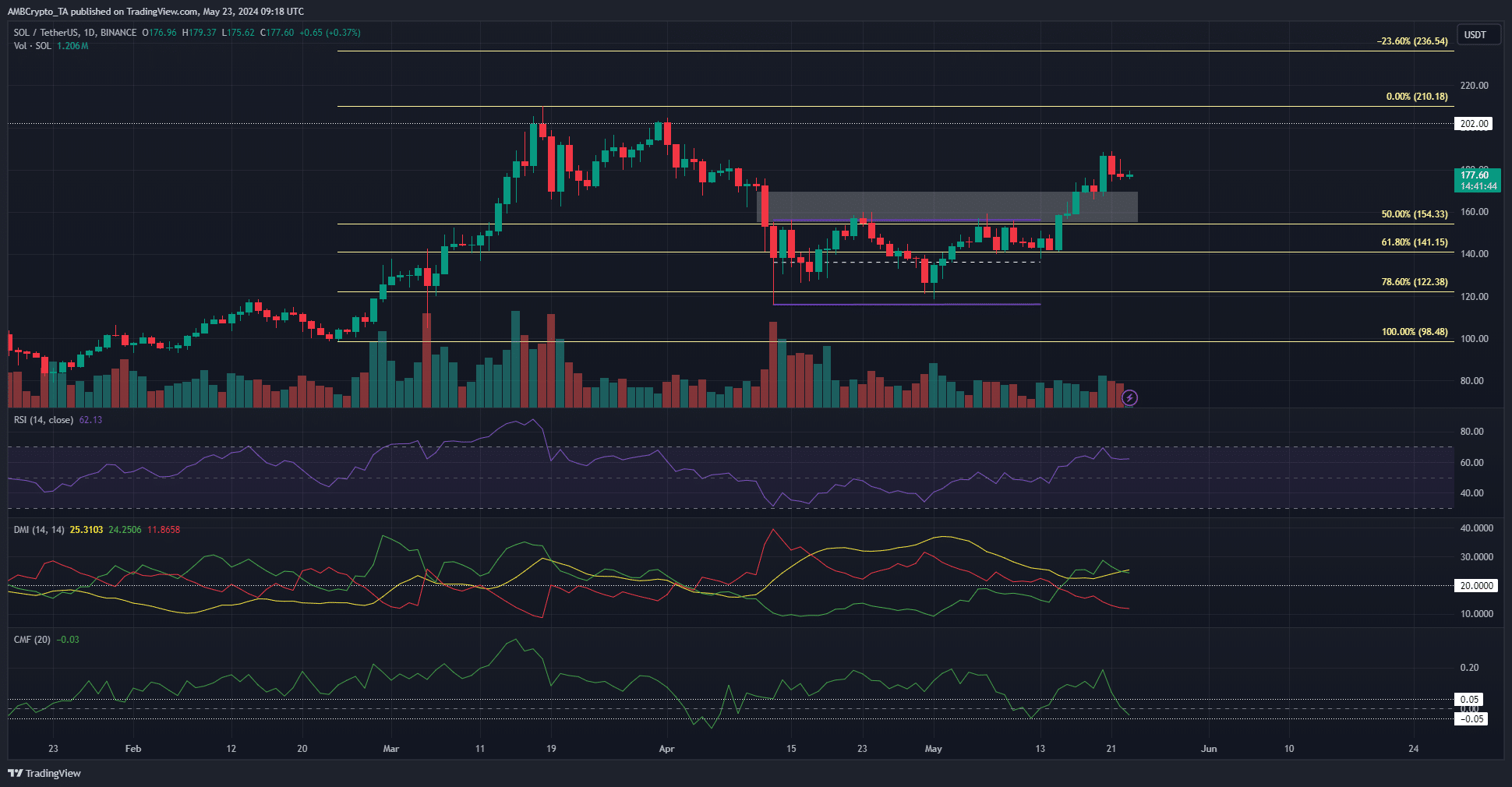

As an experienced technical analyst, I’ve closely observed Solana’s [SOL] price action and market trends. Based on my analysis, while SOL breached an imbalance on the daily chart and could potentially retest it as a support zone, the overall momentum and price action signaled that bulls were in control of the market.

At present, there’s a significant surge in non-fungible token (NFT) trading activity on the Solana [SOL] blockchain. According to recent findings from AMBCrypto, the NFT trading volume on Solana experienced a 30% increase within the last 24 hours prior to this writing. However, it’s essential to note that this short-term growth comes against the backdrop of a 57% decrease in comparison to the volume recorded in April.

As a crypto investor, I’ve been closely monitoring the technical analysis of this token, and based on the charts, I believe a price target of $200 is attainable. However, despite the bullish sentiment, I can’t help but notice some concerns arising from the volume indicators. They suggest that while there’s potential for a breakout, it might not be as straightforward as initially anticipated.

The incongruence of the volume indicators

Previously, AMBCrypto observed that the On-Balance Volume (OBV) hadn’t surpassed the local resistance in a price analysis, despite the price surge. The Fibonacci extension levels at $236 and $279 represent potential future targets. However, the absence of a strong bullish continuation could be an indication of waning strength.

Despite the breach of a six-week resistance level, the trading volume remained relatively stable. The Chaikin Money Flow (CMF) dipped to around -0.05, indicating minimal net buying or selling pressure in the Solana (SOL) market at that moment, with a CMF reading of -0.03 at the press time.

This was worrying because ideally a breakout should be accompanied by increased buying pressure.

Based on current market conditions, it’s possible that the price of SOL may dip below the $160 threshold once more. However, this was an unlikely scenario at the time of press due to positive momentum indicators and the overall upward trend in price action. The Directional Movement Index (DMI) supported this optimistic outlook, with both the +DI and ADX lines sitting above the 20 mark.

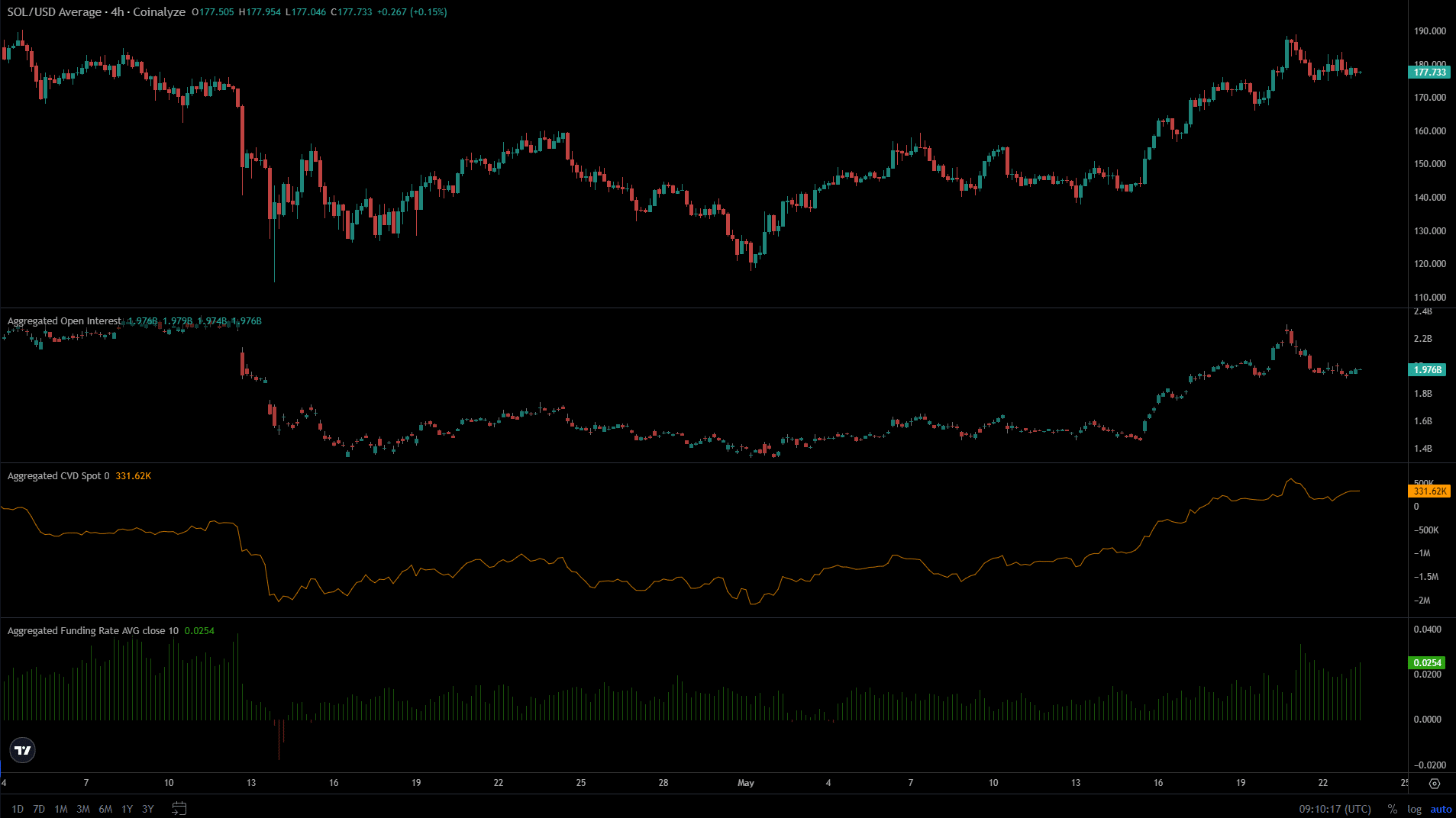

Spot demand was another reason why Solana is expected to continue its rally

The volume indicators OBV and CMF caused traders to hesitate, but the significant levels of spot CVD and Open Interest suggested strong bullish sentiment among market players. The Open Interest surged during the breakout, signaling a rise in bullish wagers.

Is your portfolio green? Check the Solana Profit Calculator

As a researcher, I’ve observed a noticeable improvement in the funding rate, which indicates a rising number of traders choosing to hold long positions. This trend is a clear reflection of the growing demand underlying the market rally. Furthermore, the persistent uptrend in the spot Contracts for Difference (CVDs) serves as an unmistakable sign of genuine appetite from traders.

As a crypto investor, I believe that should the price reach the $160 support level again, it’s highly probable that buyers will step in to protect this zone, leading to a continuation of the upward trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-23 20:07