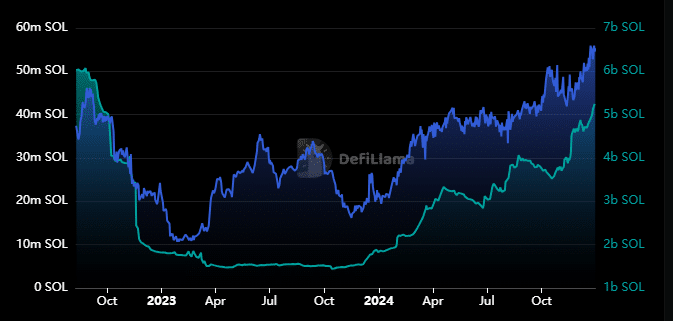

- Solana stablecoin marketcap jumps back above $5 billion, imitating the global stablecoin situation.

- SOL bears pullback, paving the way for slight weekly recovery.

As a seasoned analyst with years of experience in the cryptocurrency market, I’ve witnessed numerous trends and fluctuations that have shaped the industry as we know it today. The recent surge in Solana’s stablecoin marketcap to above $5 billion is not just another data point on the chart for me, but rather a testament to the resilience and adaptability of the Solana network in the face of adversity.

In my early days as an analyst, I remember when Solana was still a relatively unknown player in the blockchain space. Its impressive growth over the years has been nothing short of remarkable, with its stablecoin count, user base, and transaction volume all skyrocketing. This latest milestone, achieved amidst the global surge in stablecoin marketcap to over $200 billion for the first time ever, is a clear indication that Solana is not just keeping pace with the competition, but setting the bar higher.

The network’s Total Value Locked (TVL) also reached new highs during this period, peaking above $55 billion last week. This growth in liquidity and accessibility to the Solana WEB3 ecosystem has been a boon for investors and developers alike, providing more opportunities for innovation and collaboration within the network.

However, while I’m optimistic about Solana’s potential for continued growth in 2025, it’s worth noting that both its TVL and stablecoin marketcap ended the year below their historic all-time highs achieved in 2022. This could suggest that there is still room for growth, especially as more investors gain confidence in the network and its native coin, SOL.

Solana’s native coin, SOL, also posted a net positive weekly gain of 11.39%, which might indicate that the bears are starting to cool off after weeks of sell pressure. This could be a sign that profit-taking has run its course and that we may see some recovery in the coming weeks.

All in all, I believe Solana is poised for greatness in 2025, provided it can continue to attract developers and investors with its growing liquidity and user base. But as they say, even the best laid plans of mice and men often go awry, so let’s see what the new year brings!

And on a lighter note, I always like to remind myself that in this wild world of crypto, the market can be like a rollercoaster – it’s always best to hang on tight and enjoy the ride!

Last week, Solana [SOL] emerged as the leading blockchain with the most significant growth in stablecoins. This is an intriguing achievement for the network; however, one might wonder about its implications as we approach 2025.

Over the past week, which was the final week of 2024, approximately $424.87 million was added to Solana’s stablecoin. This made Solana the leader in terms of growth for stablecoins over the previous seven days.

This was mostly USDT and USDC stablecoins.

2024 saw Solana rank highly among performing blockchains across various aspects, such as user expansion, transaction volume, and the number of stablecoins. Particularly noteworthy is its stablecoin count, which plays a crucial role in providing liquidity as demand increases.

This development occurs as the global stablecoin market capitalization exceeds $200 million for the first time ever, marking a significant increase recently.

On December 29th, 2024, Solana’s stablecoin market capitalization reached an all-time high of $5.24 billion, which was the highest point for that year. The last time Solana’s stablecoin market capitalization was this substantial was back in September.

2024 saw remarkable growth for Solana’s stablecoin market capitalization, as it surpassed a significant milestone of $1.83 billion towards the end of the year. The network started the year with a stablecoin market cap of this amount.

The showcase aligned well with the network’s Total Value Locked (TVL), thereby underscoring increased liquidity and easier access to the Solana Web3 ecosystem.

During the previous week, the total value locked (TVL) on Solana surpassed $55 billion, reaching a brand-new record for 2025. This spike in TVL and the growth of stablecoin market capitalization can be attributed to the impressive network expansion and increased demand that Solana experienced in 2025.

As I analyze the current trends, it appears that we’re not likely to surpass the all-time highs of 2022 for these key growth indicators by the end of this year.

2025 might see significant expansion for Solana, given its current increase in liquidity and investor trust, suggesting potential for further development.

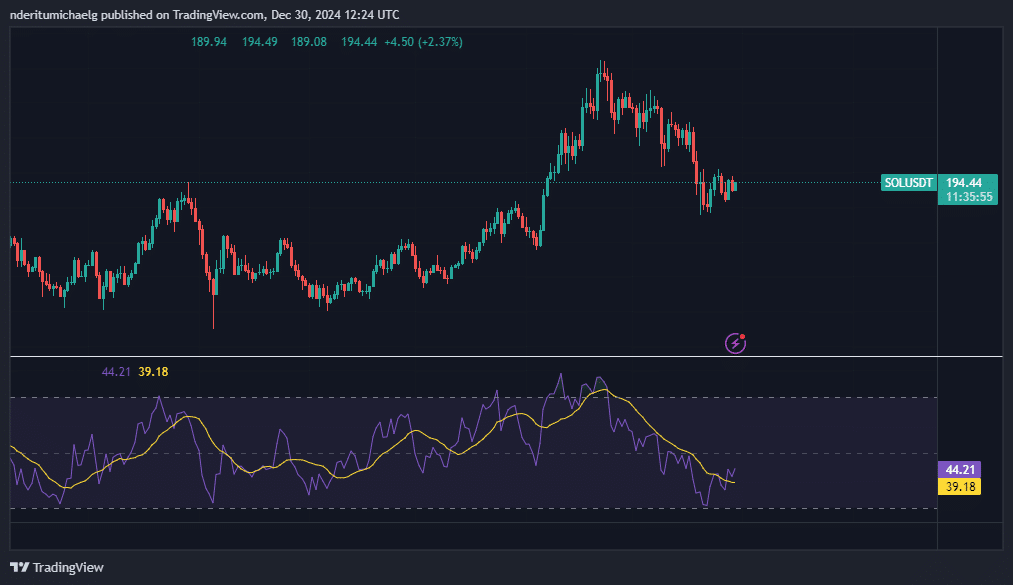

SOL price action

Discussing confidence levels, it seems that the native coin of Solana has been receiving a boost of optimistic sentiment, as evidenced by its positive weekly returns.

Last week, SOL saw a substantial increase of 11.39%, ending the week with a value of $194 per unit. At the moment of reporting, this was a 26% reduction compared to its highest point in November.

As a researcher, I’ve observed an intriguing pattern in SOL’s recent price movements. It appears that the intense selling pressure experienced over the past month might be subsiding, potentially indicating that the bears are starting to lose momentum.

Read Solana’s [SOL] Price Prediction 2025–2026

Based on my years of experience in the financial markets, it appears that we might be witnessing a point where profit-taking has reached its peak and could now pave the way for some recovery. This is something I have seen time and again – market cycles often follow a predictable pattern, and when everyone seems to be cashing out, it could signal a potential shift towards growth. However, it’s always crucial to remember that past performance does not guarantee future results, so it’s essential to stay vigilant and adaptable in the ever-changing financial landscape.

Based on the increasing Total Value Locked (TVL) and market capitalization of Solana’s stablecoins, there are indications that Solana may become more active in 2025. Yet, it remains uncertain if this trend will influence the movement of SOL prices.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

2024-12-31 04:08