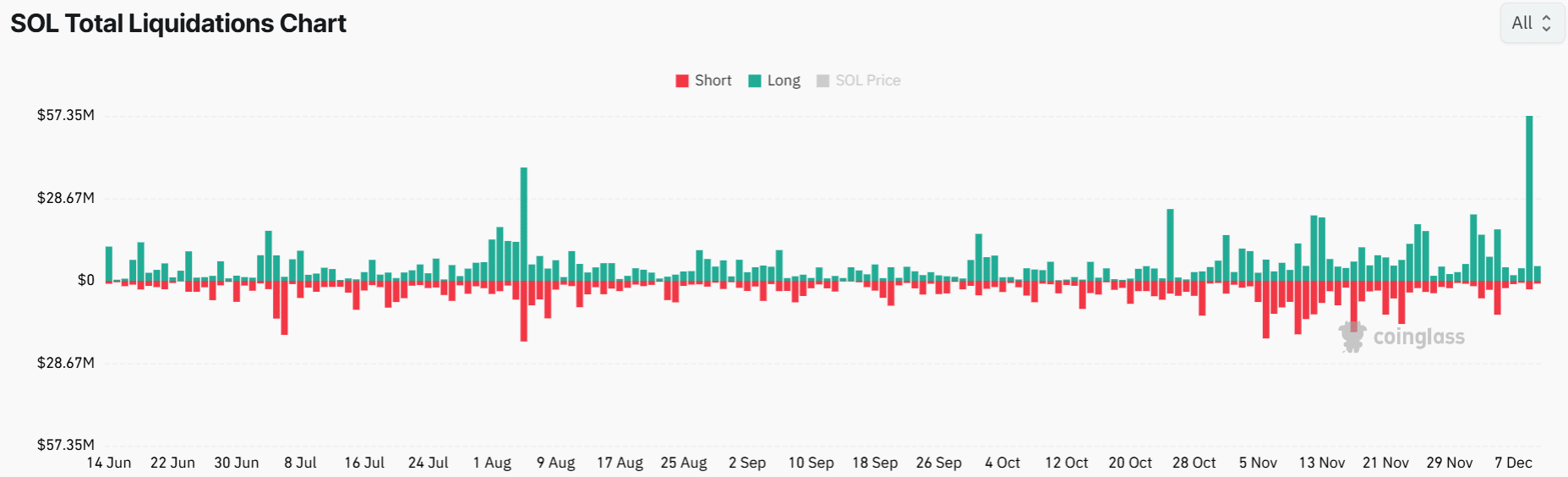

- Solana long liquidations soared to $57 million on 10th December, causing a rise in selling activity.

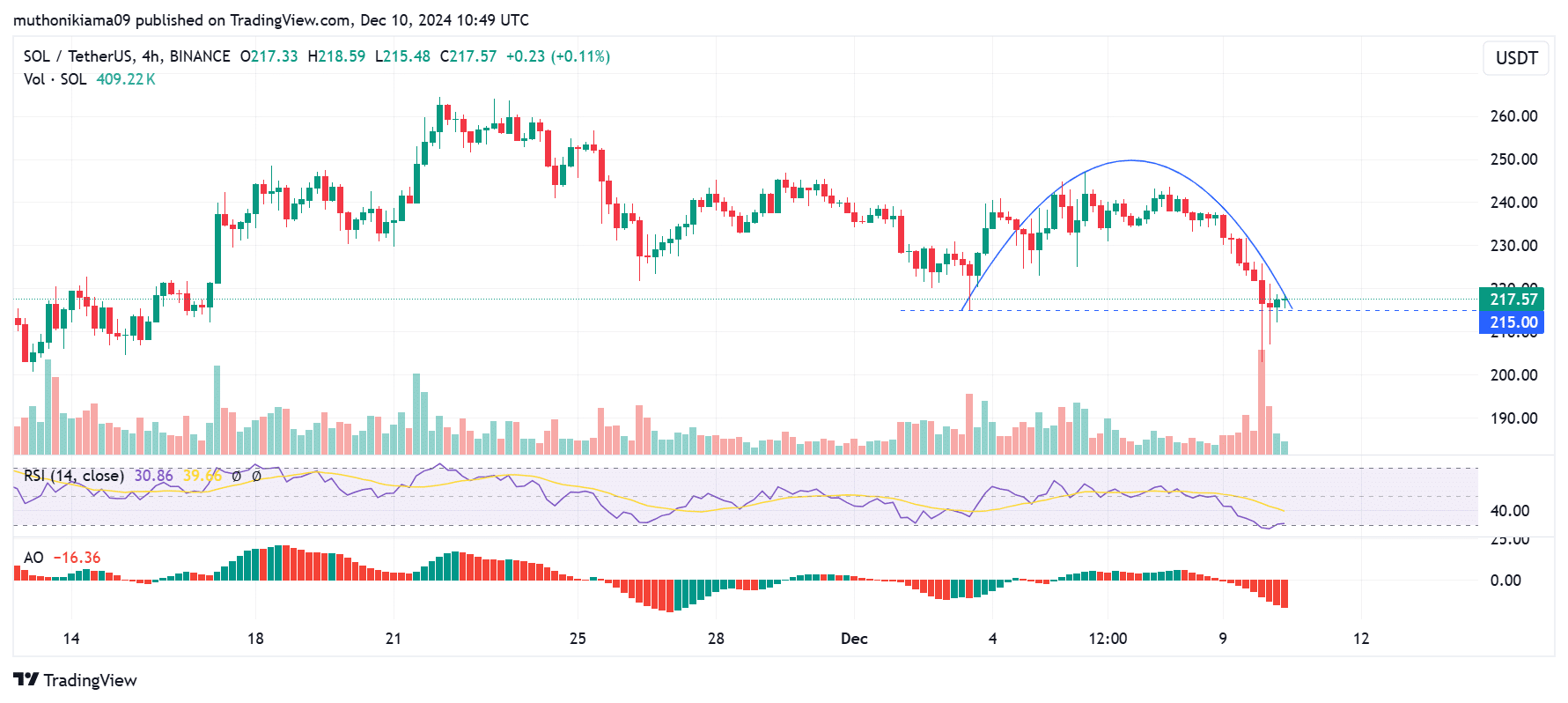

- A rounded top pattern on Solana’s four-hour chart suggests a bearish continuation.

As an analyst with over two decades of experience in the financial markets, I must say that the current state of Solana (SOL) is a classic reminder of the old adage “what goes up must come down.” The massive long liquidations and the formation of a rounded top pattern on SOL’s four-hour chart are clear signs of bearish sentiment.

In simpler terms, Solana (SOL) has experienced a decline of about 5.39% over the past day, currently trading at approximately $217. This marks the first time in three weeks that its total market value has dipped below $100 billion. The bearish trend sweeping across the crypto market seems to have affected Solana as well.

Over the past day, we’ve seen increased market turbulence due to a significant rise in liquidations within the derivatives sector. This has resulted in substantial losses for Solana’s bullish investors.

Solana long liquidations hit record highs

As a crypto investor, I noticed some intriguing data from Coinglass on the 10th of December. It appeared that the total liquidations for leveraged long positions on Solana amounted to a staggering $57 million. This figure represented the highest volume of SOL long liquidations in more than five months, underscoring the significant market activity surrounding this digital asset.

Prolonged periods of liquidation often boost selling actions, leading to a decrease in Solana’s value. Yet, this chain reaction of liquidations could potentially clear out excessive leverage associated with Solana, paving the way for its potential recovery.

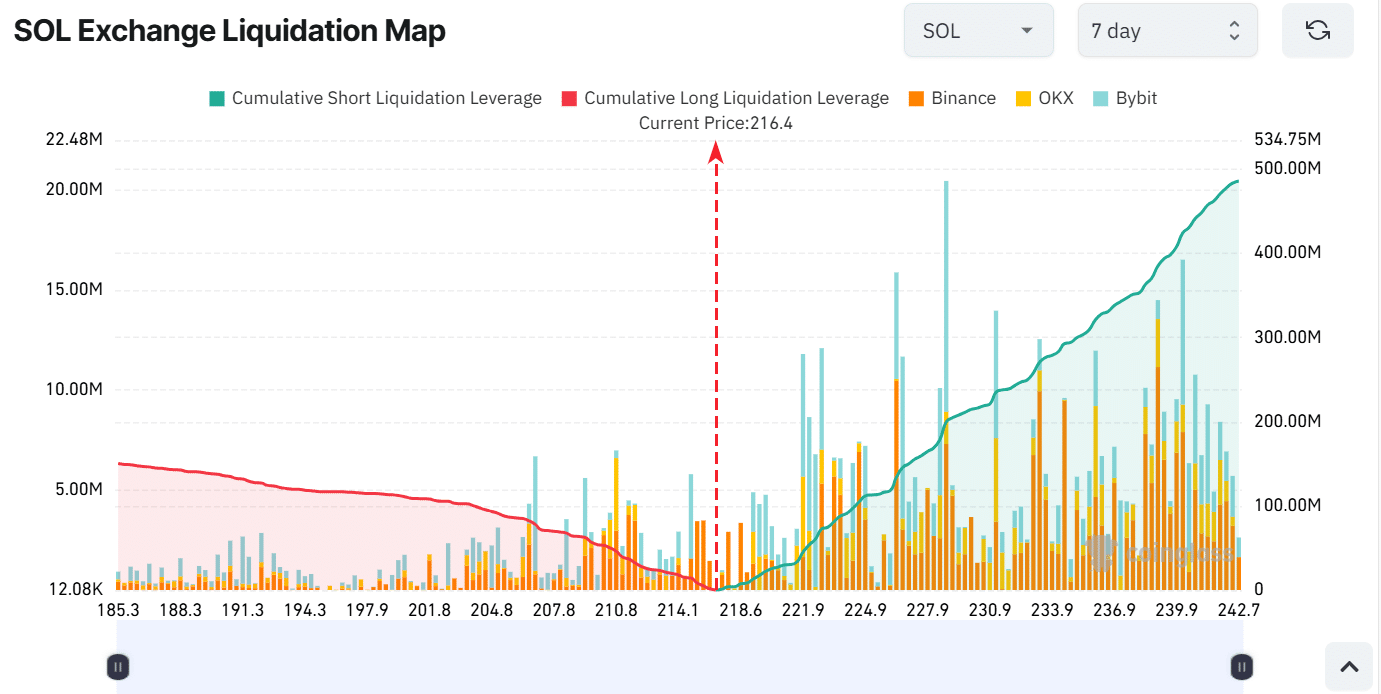

From my perspective as an analyst, it’s worth noting that there are other liquidation clusters under the present price point. Should Solana continue to struggle against the prevailing bearish tendencies, and the price reaches these thresholds, it might precipitate additional downward pressure on the market.

Rounded top shows a bearish trend

On its lower chart, Solana appears to have developed a rounded top formation, indicating that the bears might be dominating the market. This rounded top’s neckline is around $215, a price level that Solana has frequently approached.

Should Solana not sustain this current support and decline, there’s a potential for its price to fall as low as $183 from the current $200, possibly leading to additional long position closures.

The Relative Strength Index (RSI) for SOL currently stands at 30, indicating it might be overbought and due for a correction. However, even though this could potentially lead to some gains, a consistent upward trend will occur only when the RSI line surpasses its signal line.

The Awesome Oscillator (AO) underscores the continuing downward trend of SOL by displaying red bars in its histogram, indicating a strong bearish momentum.

Will SOL drop further?

The downward signals suggest that Solana (SOL) may experience further drops unless there’s a change in the buying attitude among investors.

Read Solana’s [SOL] Price Prediction 2024–2025

Keep an eye on a potential price dip beneath the base of the rounding top pattern at approximately $215. This might intensify the downward trend. Furthermore, if the price falls below $200, it may lead to significant distress for buyers because of possible forced selling of long positions.

On Coinglass, Solana’s liquidation chart indicates a substantial number of long positions with high leverage when SOL dips below $200. Forced closure of these positions might lead to additional price drops.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-12-10 21:44