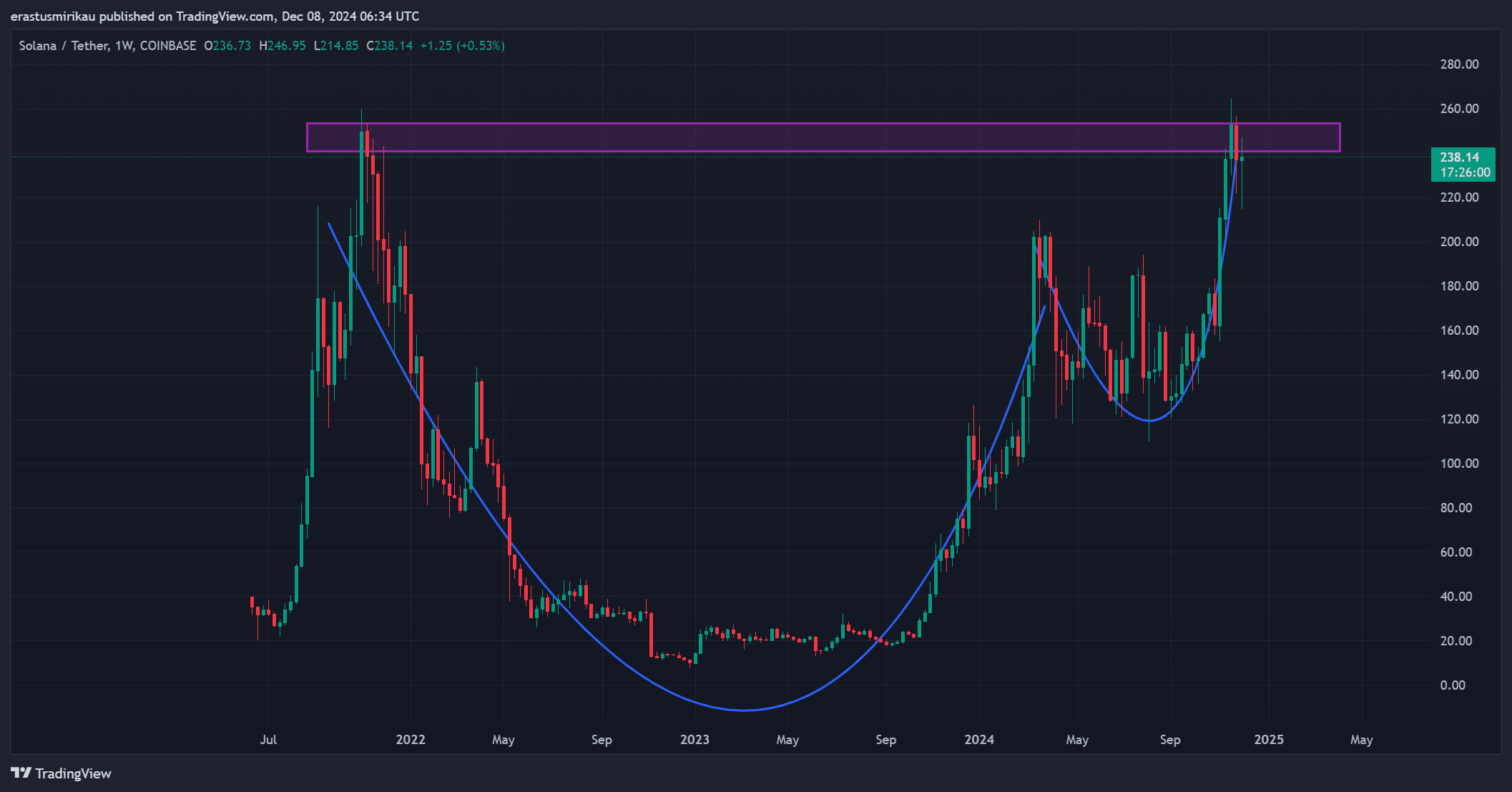

- Solana formed a bullish cup and handle pattern, testing a crucial supply zone.

- Strong technical indicators and social dominance suggested a higher likelihood of a bullish breakout.

As a seasoned researcher with years of experience in the cryptocurrency market, I can confidently say that Solana [SOL] is poised for a potential breakout. The bullish cup and handle pattern on its weekly chart is reminiscent of a finely crafted teapot ready to spill its contents – in this case, a surge in price.

On the weekly chart, Solana (SOL) is constructing a robust setup that resembles a traditional cup and handle pattern, implying a possible breakout could occur. Currently, SOL is priced at $238.32, marking a 1.08% increase in the last 24 hours.

Currently, the cost is being put to the test at a crucial support level. If it manages to break through successfully, this could lead to a substantial surge in prices.

Market participants are keenly waiting to find out if Solana (SOL) can continue its upward trend and surpass the current resistance level.

Is SOL on the verge of a breakout?

On Solana’s weekly chart, you can see a typical “cup and handle” configuration, which is generally considered a bullish sign indicating a possible price increase. As the price approaches a significant supply area, it encounters a key resistance level.

Moving beyond this area is probably going to attract more purchasers, causing Solana (SOL) to increase. But if it’s turned down, we could see a retreat follow.

Therefore, traders will closely observe SOL’s movement here to determine the next price trend.

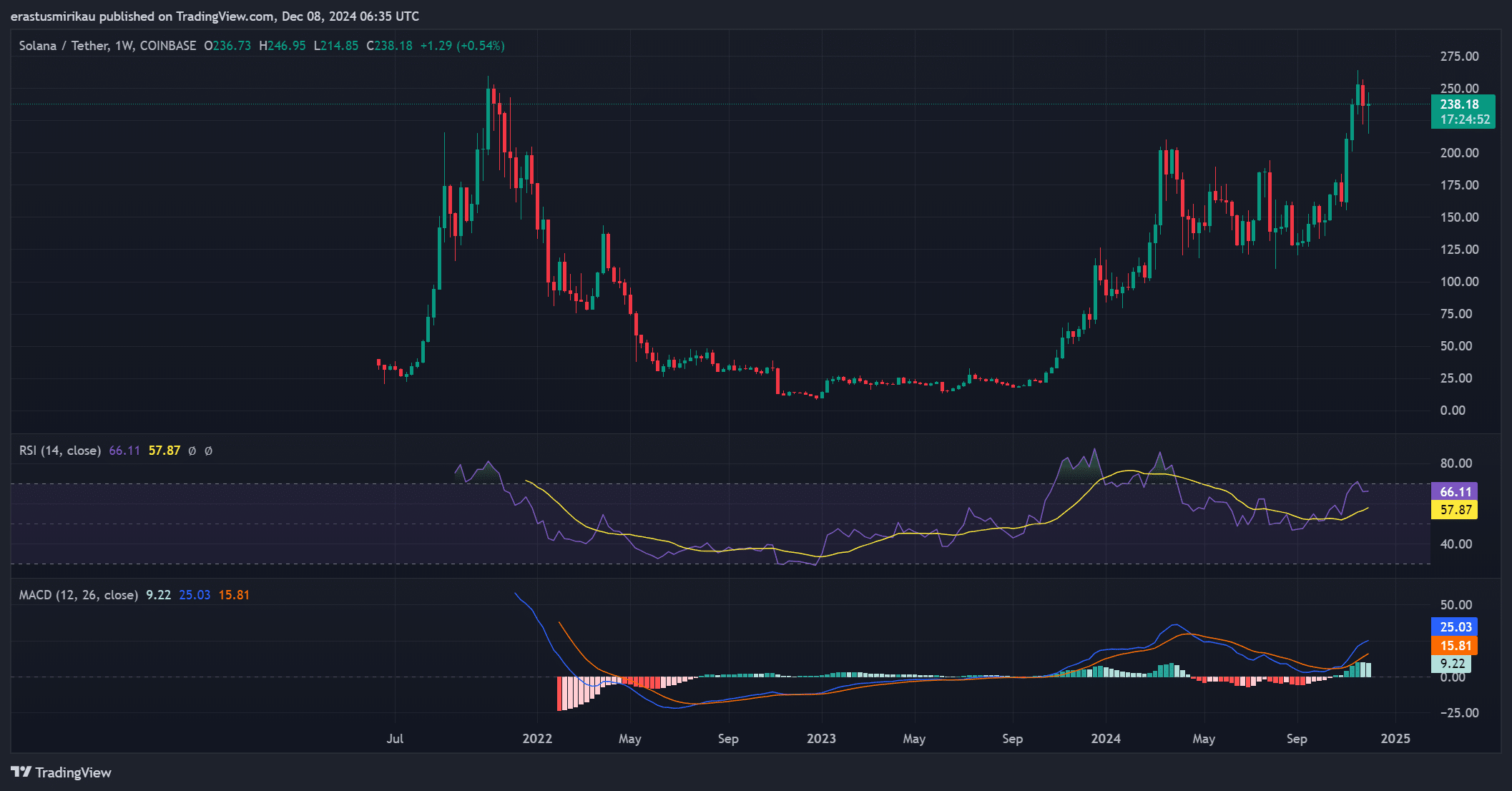

What do the technical indicators say?

Based on technical analysis, the positive trend seems to be reinforced. The Relative Strength Index (RSI) stood at approximately 66.11, suggesting robust buying activity, yet there’s still a bit of leeway before it becomes excessively overbought.

Additionally, the MACD sat at 9.22, reinforcing SOL’s upward trend.

Positive signs indicated that a strong exit from the supply area could enhance these technical tools, drawing in additional traders to take long positions.

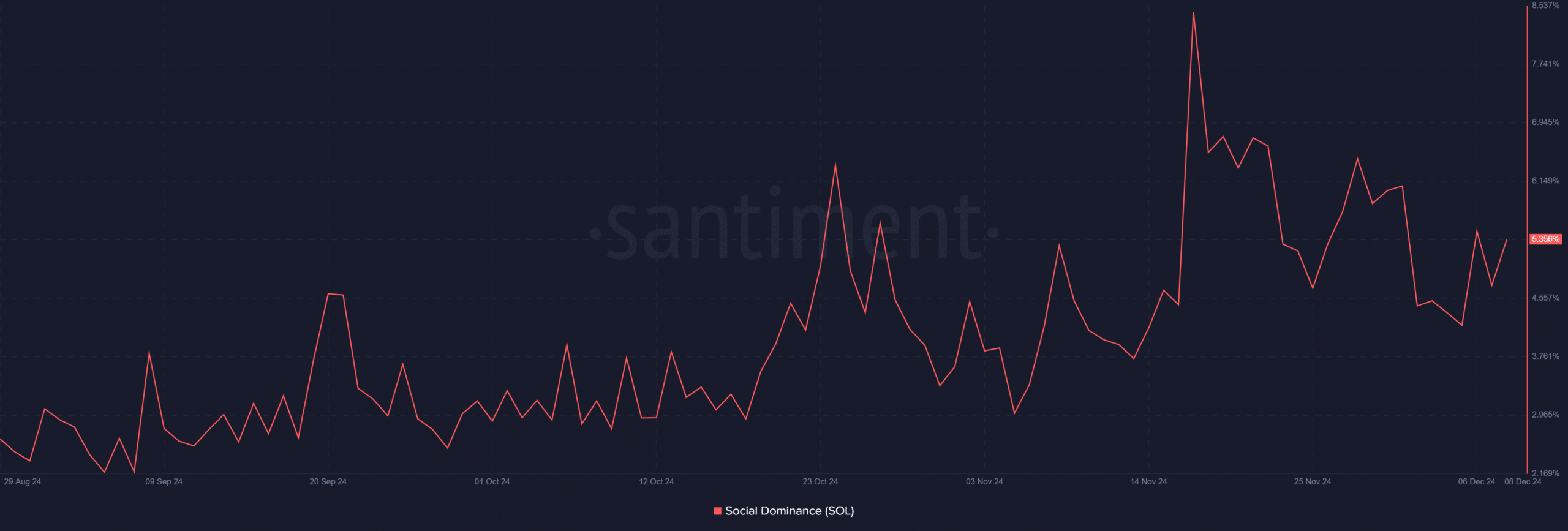

Why is Social Dominance gaining traction?

In a single day, the social influence of SOL increased significantly, going from 4.73% to 5.36%. This surge seems to be driven by heightened user interaction and curiosity on various social media sites.

Such attention often correlates with higher market participation and price momentum.

Consequently, a greater level of Social Dominance might lead to an increase in traders joining the market, potentially adding even more impetus to Solana’s (SOL) upward trend.

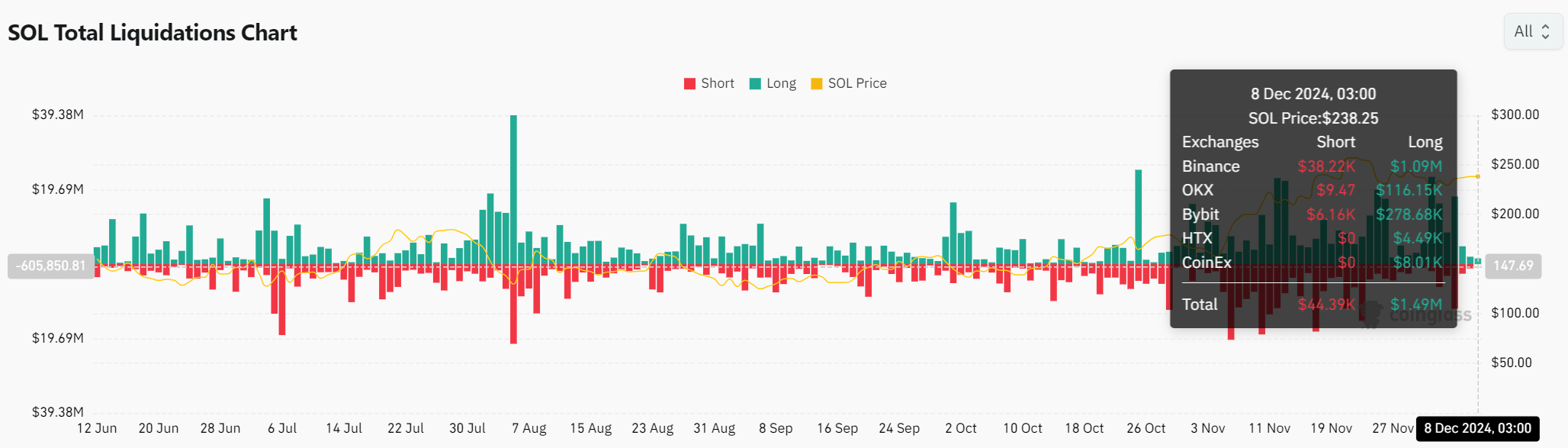

How do liquidations impact SOL’s momentum?

The data on liquidation shows a substantial bullish confidence among traders regarding SOL, with a significant amount of short positions being closed at $44,390 and long positions closed at $1,490,000.

A large number of long liquidations suggests that numerous traders are optimistic about the growth trend of SOL.

As a result, these liquidations suggest that SOL might exceed its supply area and continue moving upwards in a bullish trend.

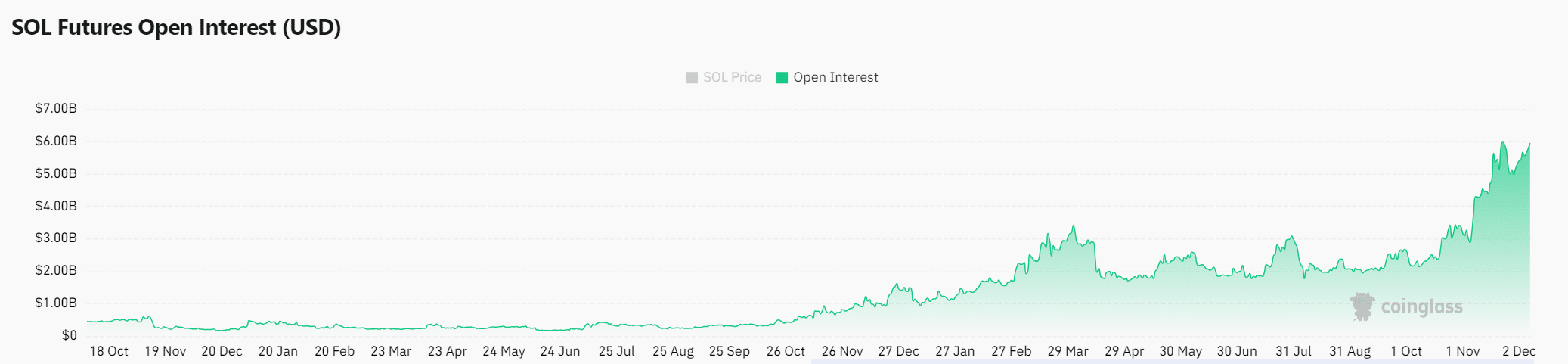

What does Open Interest reveal about SOL’s future?

The amount of money being invested in Solana futures contracts noticeably rose, as the Open Interest jumped by 4.04% to a total of $6.02 billion. This substantial influx indicates increased capital flow towards Solana futures.

A larger Open Interest suggests that an increased number of traders are making substantial investments. This can contribute to price consistency and bolster the upward momentum (bullish trend). Consequently, it increases the likelihood of a powerful surge past the supply area, potentially leading to a successful breakout.

Read Solana’s [SOL] Price Prediction 2024–2025

On the verge of a significant surge, Solana’s price action shows signs of a bullish trend as it forms a ‘cup and handle’ pattern over its weekly chart, suggesting potential price increase in the coming days.

Consequently, it seems plausible that SOL will surpass its resistance level, continuing its bullish trend and potentially leading to a prolonged period of price increase.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-08 16:08