-

Funds attracted inflows despite SOL’s bearish price action.

The prospect of improving network health might have driven investors towards SOL.

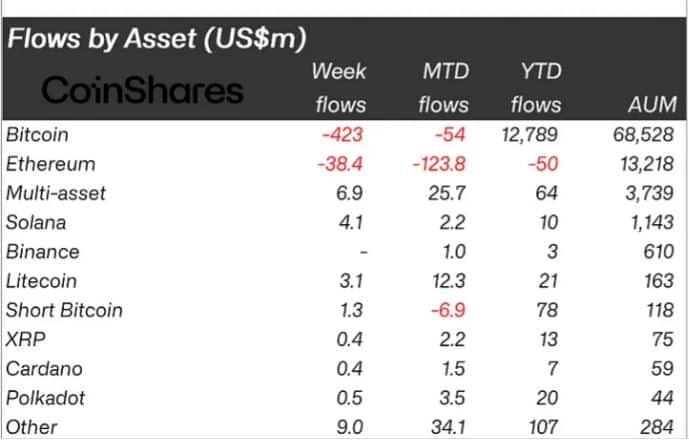

As a researcher with experience in the cryptocurrency market, I find it intriguing that Solana [SOL] attracted inflows despite its bearish price action last week. The latest report by CoinShares revealed that Solana-based crypto products saw more than $4 million in inflows, a sharp turnaround from the net outflows of $300,000 recorded in the previous week.

Last week, there was robust interest in digital investment funds linked to Solana [SOL], with investors showing renewed enthusiasm for this fifth-largest cryptocurrency.

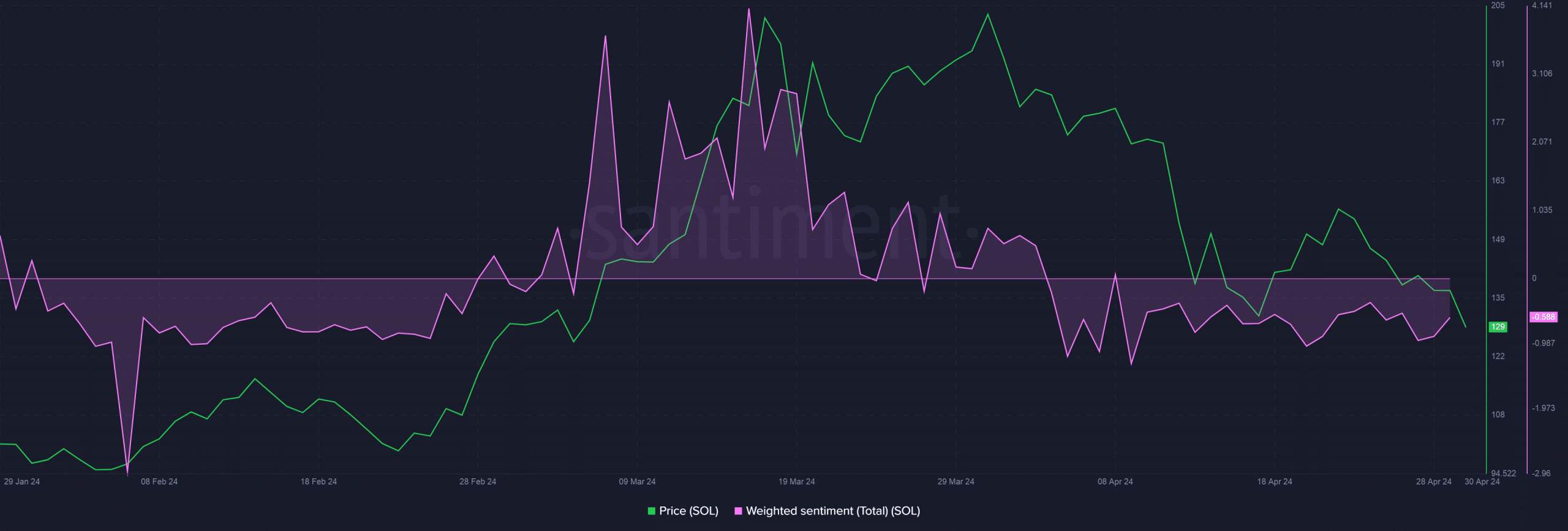

Solana sees a shift in sentiment

Based on the most recent findings from cryptocurrency asset manager CoinShares, Solana’s crypto products drew in over $4 million in investments during the previous week.

This was a sharp turnaround from the $300,000 in net outflows recorded in the week prior.

Recently, a significant amount of new funds flowed in, despite the fact that major assets such as Bitcoin (BTC) and Ethereum (ETH) experienced substantial outflows, to the tune of $423 million for Bitcoin and $38 million for Ethereum.

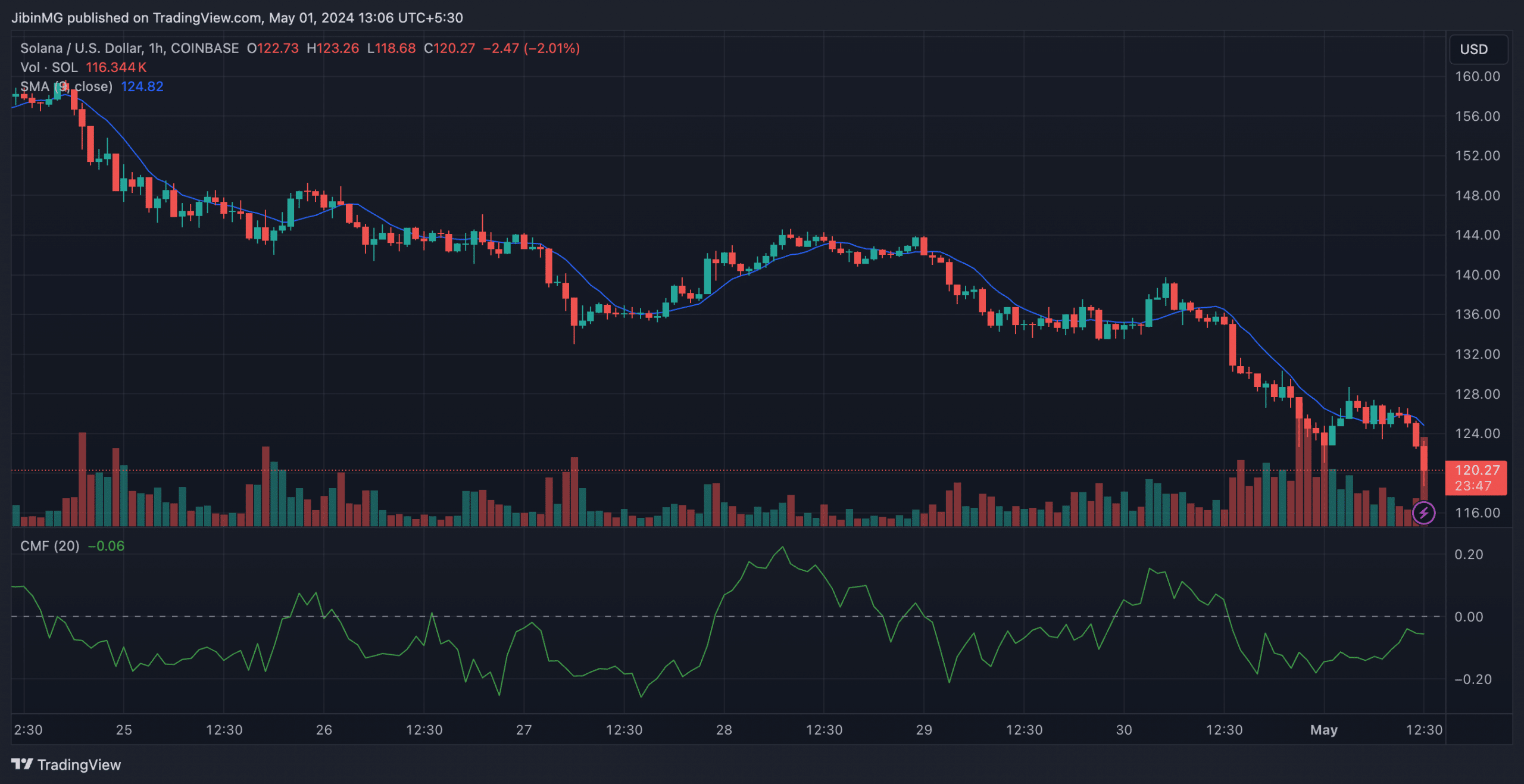

It’s intriguing that the appetite for Solana-linked funds increased despite a week-long bearish trend that caused cryptocurrency prices to drop by around 16%. According to AMBCrypto, this information was gathered using CoinMarketCap data. At the current moment, Solana’s price has decreased by more than 10% in the previous 24 hours as per chart data.

The decrease in prices led to a modest reduction in the total managed assets, going from $1.15 billion to $1.14 billion compared to the previous week.

Was this the reason?

Although it’s challenging to identify exactly what’s driving investors towards Solana assets, the prospect of less network congestion might be a plausible explanation.

Solana’s development team has been consistently releasing updates to address transaction mishaps and network overload, two problems that have fueled uncertainty and negativity (FUD) surrounding the cryptocurrency.

The most recent version to undergo testing is v1.18.12. At present, it is being verified in our test environment.

As a researcher studying the Solana blockchain, I have observed the community’s anticipation that recent enhancements would effectively address the long-standing issues. These problems arose primarily from the surge in meme coin trading, which pushed the network to its utmost capacity and strained its resources.

Read Solana’s [SOL] Price Prediction 2024-25

The latest blow

Bitcoin’s slide under the $60,000 mark has continued to affect Solana’s price chart, causing a 10% decrease within the last 24 hours for this altcoin.

The most recent decline seemed integrated into the larger market downturn, driven by underwhelming debuts of new cryptocurrency ETFs on the Hong Kong exchange.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-05-01 11:03