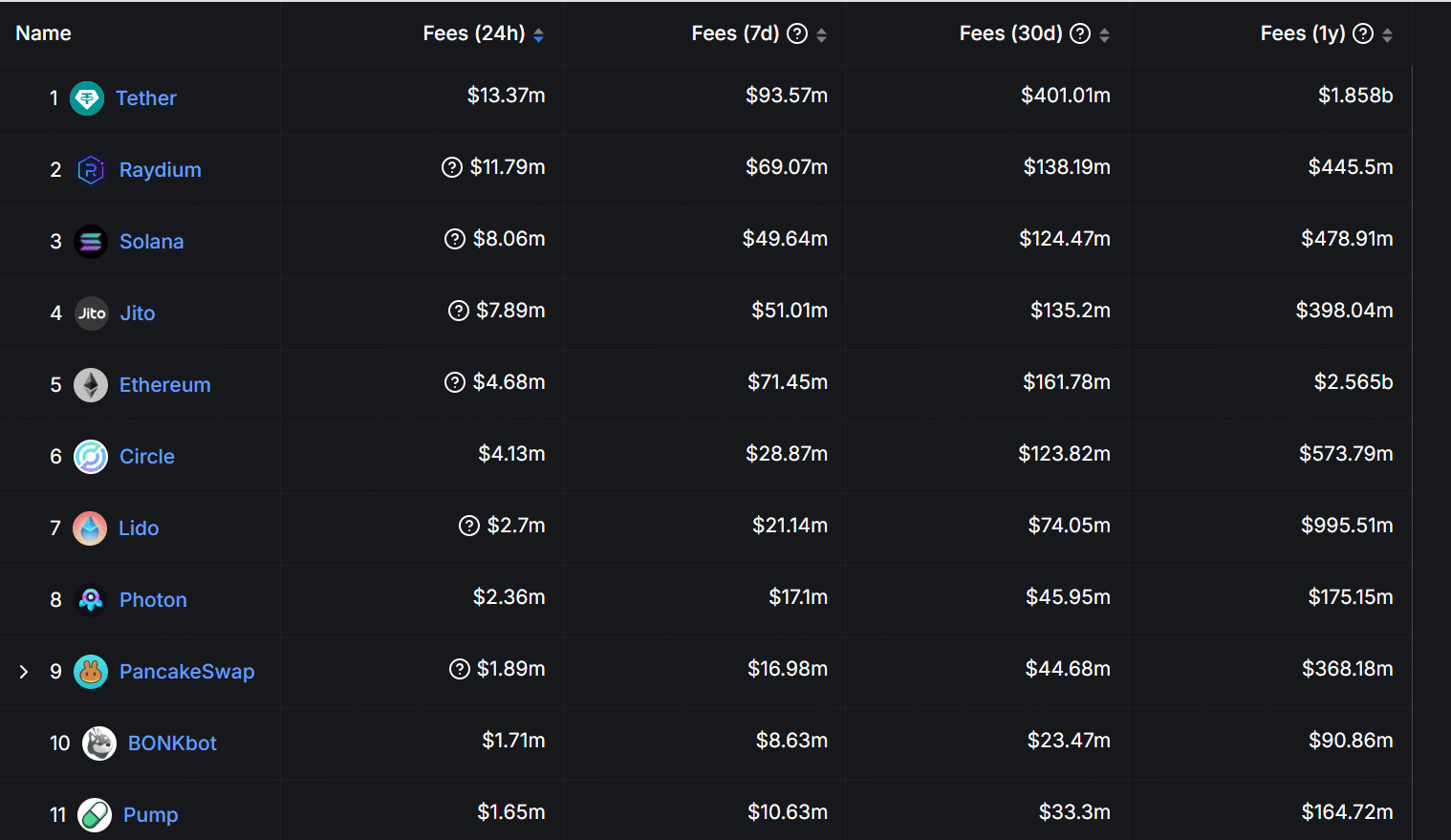

- Solana DApps featured prominently in the top fee rankings.

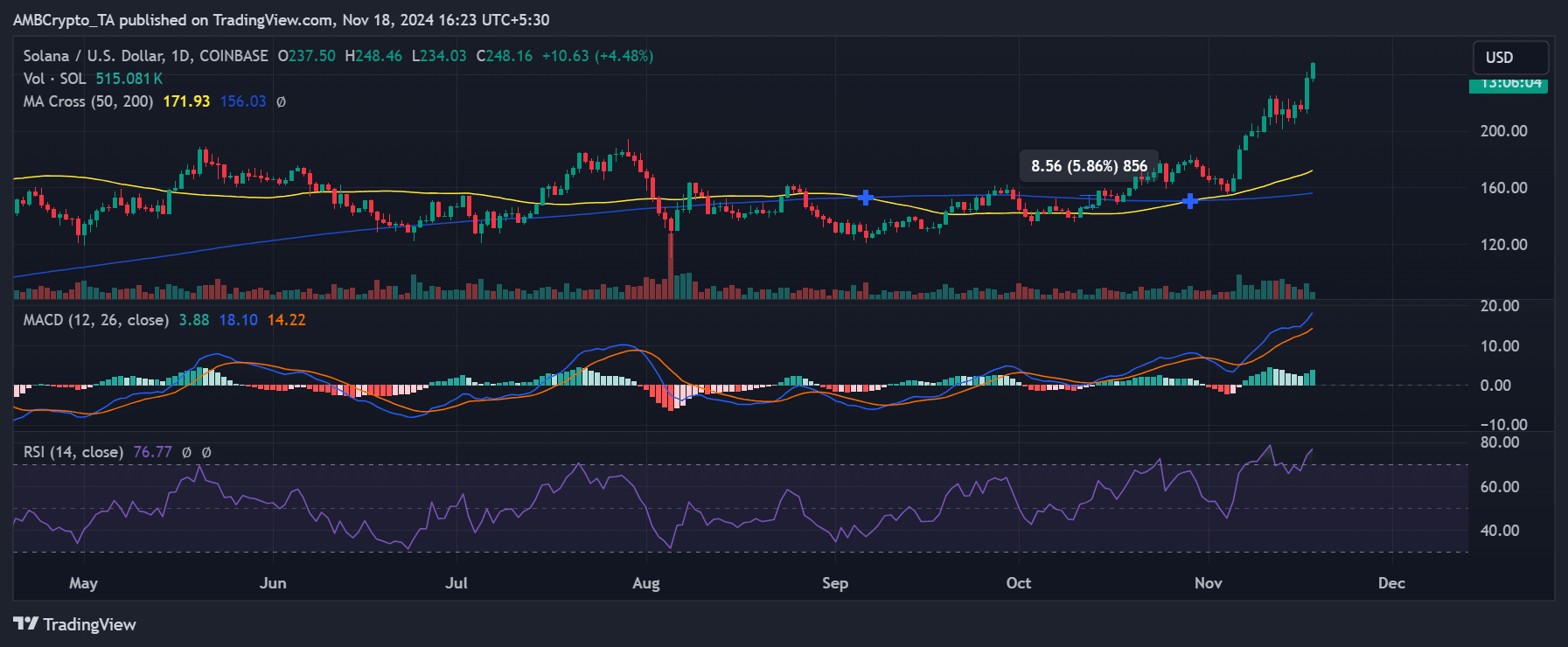

- SOL has continued to trend upward.

As a seasoned analyst with over two decades of experience in the dynamic world of digital assets, I must say that this recent surge in Solana memecoins has certainly caught my attention. The increased activity and fees generated by these dApps are reminiscent of the early days of Ethereum’s DeFi boom.

The increased activity that Solana [SOL] memecoins are seeing recently has impacted the ecosystem.

It appears that recent data indicates a rise in transaction fees for numerous distributed applications (dApps) within the system, and Solana (SOL) remains on an upward trajectory.

Soalana memecoins push fees on DApps

New information from DefiLlama indicates a significant increase in the fees collected by Solana’s decentralized apps.

Raydium, a well-known decentralized application (dApp) on the network, raked in more than 69 million dollars in fees during the last week. This places it as the second highest fee earner, trailing only behind Tether [USDT].

In terms of transaction fees, Solana claimed the number three position with approximately $49 million, and applications such as Jito and Photon also made it into the top ten.

Significantly, Pump.fun, a popular platform for numerous trending Solana memecoins, ranked 11th in terms of fee generation.

This rise corresponds well with the growing popularity of tokens like Peanut the Squirrel (PNUT) and Goatseus Maximus (GOAT), making it the most active memecoin on the Solana platform.

Currently, PNUT has a market value exceeding 1.6 billion dollars, whereas GOAT’s market valuation is 1.1 billion dollars.

Over the last 24 hours, I’ve noticed a remarkable surge in trading volume for both of these digital assets. This increase suggests a higher level of user interaction and transactional activity within their respective ecosystems, which is quite encouraging as a crypto investor.

Market cap of Solana memecoins surge

In the past day, the overall value of Solana’s meme-based cryptocurrencies has experienced significant growth, surging by over 10%. As a result, their combined market capitalization now exceeds $21.8 billion, as reported by CoinGecko.

Leading the crypto pack was Dogwhath (WIF), boasting a market capitalization exceeding $3.7 billion. Hot on its heels was Bonk (BONK) with a capitalization of around $2.8 billion, and PNUT taking the third spot.

These digital coins are not just leading the meme coin market, but they’ve also seen a rise in trade transactions, indicating growing curiosity and engagement among users.

As an analyst, I’ve noticed a significant increase in transaction volumes within the Solana ecosystem, which has resulted in a surge in fees. This underscores the substantial influence that memecoins have on our network.

SOL maintains strong upward momentum

At the moment of reporting, Solana’s native token, SOL, was on an uptrend, increasing by approximately 4.48%, and could be traded for around $248.16.

Today’s graph shows Solvent Overcoming Major Resistance Levels, boosted by an increase in trading activity surpassing the 515,000 mark.

Technical indicators affirmed the upward momentum.

In simpler terms, the Moving Average Convergence Divergence (MACD) consistently indicated a strong upward trend, while the Relative Strength Index (RSI) stood high at 76.77, suggesting the market was overbought. However, this high RSI value also supported a generally optimistic outlook in the market.

With the surge of popularity in meme coins sparking activity throughout the Solana system, it seems that SOL is set to experience additional growth, supported by a rise in transaction numbers and network expansion.

The combined impact of memecoins and bullish market conditions has solidified Solana’s uptrend.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-19 09:11