As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by the ongoing battle between Solana (SOL) and Ethereum (ETH).

The rivalry between Solana (SOL) and Ethereum (ETH) is growing stronger, especially in terms of transaction costs, with Solana experiencing significant growth.

New findings show that Solana’s transaction fees have exceeded those of Ethereum on a daily basis, indicating an increase in network usage.

However, despite this spike in Solana’s fees and total value locked (TVL) growth, Ethereum remains the dominant blockchain in terms of overall market value and locked assets.

Solana’s fee surge outpaces Ethereum

Over the last week, Solana has seen a notable increase in transaction fees. According to DefiLlama’s recent assessment, Solana and its decentralized applications (DApps) currently surpass Ethereum in terms of daily fee transactions.

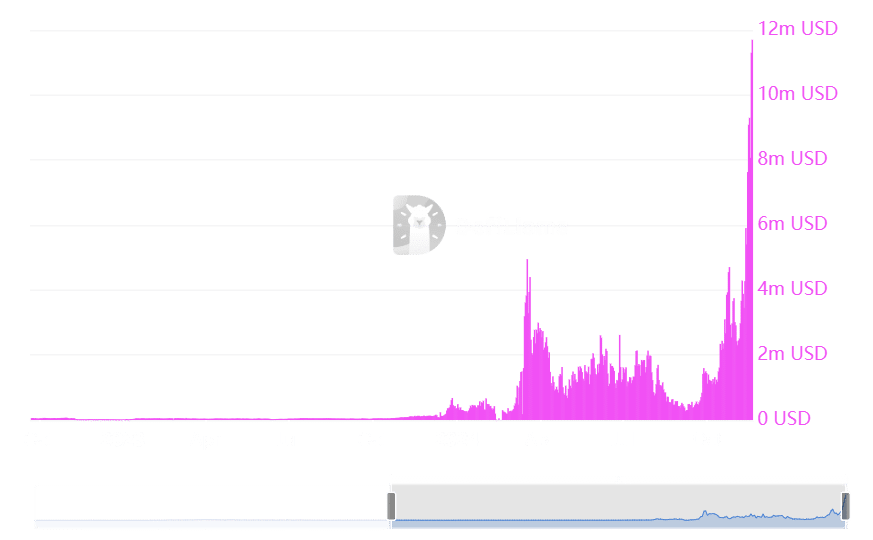

In simpler terms, Raydium, a significant app within the Solana network, earned approximately $12 million in charges, placing it as the second-most profitable platform in terms of fees during that timeframe.

On its own, the Solana platform collected around $11.3 million in transaction fees. Additionally, another decentralized application on Solana named Jito contributed nearly $11 million to the overall fee income.

Compared to others, Ethereum collected approximately $6 million per day in transaction fees, making Solana the leader in this category. Over the last week, Ethereum’s fee pattern has remained relatively unchanged, demonstrating a steady state of consistency.

Contrarily, Solana has experienced numerous surges in transaction fees, peaking at an unprecedented $11.7 million on the 19th of November. This extraordinary activity underscores Solana’s increasing popularity and utilization within its network.

Ethereum retains leadership in TVL

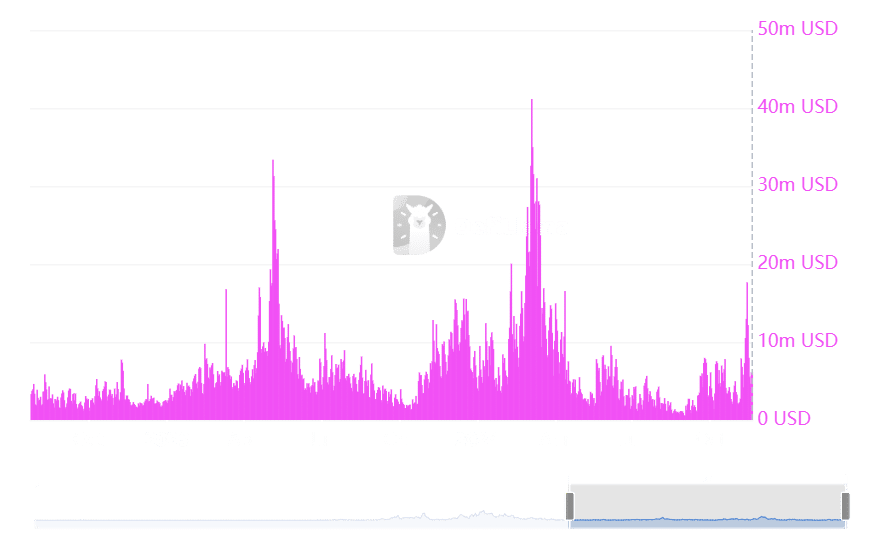

Although Solana has made strides in reducing transaction fees, Ethereum remains ahead in terms of Total Value Locked, which is a significant indicator in the world of Decentralized Finance (DeFi).

In the past few days, Solana’s Total Value Locked (TVL) has surged noticeably, now standing at approximately $8.4 billion. This substantial increase signifies a robust comeback for Solana, moving it closer to the peak levels it attained in 2022.

Nonetheless, it’s worth noting that Ethereum holds the top spot in terms of Total Value Locked (TVL), boasting an impressive $60 billion tied up within its system. This amount represents over half of the entire Decentralized Finance (DeFi) market’s TVL, which amounts to approximately $110.5 billion.

Price movements reflect broader trends

Currently, Solana is approximately valued at around $244, marking a 1% rise. Notably, the $200 price point has served as a robust base, contributing significantly to its recent positive trajectory.

Realistic or not, here’s SOL market cap in BTC’s terms

In contrast, Ethereum currently trades slightly over $3,000, experiencing a minor drop of about 2%. However, it’s holding strong in this price bracket, and there are signs that a new level of support could establish itself near the $2,900 mark.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-19 18:15