What Just Happened and Why Is Everyone Holding Their Breath? 🤦♂️

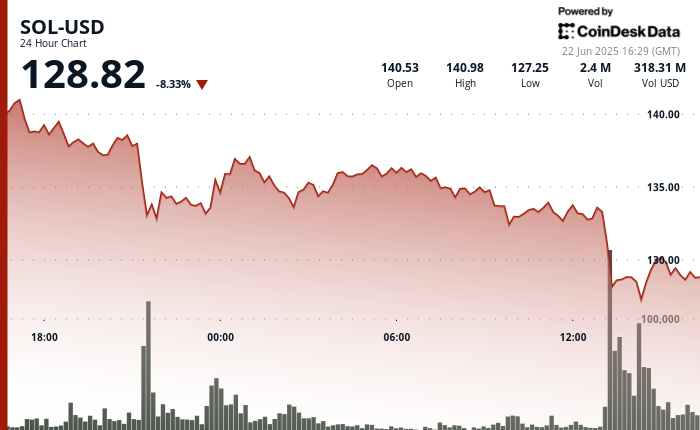

- SOL scraped its knees, tumbling 8.33%—now limping along at $128.82, and bruised at a low of $127.25.

- Panic hit peak velocity at precisely 13:00, as 4 million enthusiasts shouted “SELL!” at their screens.

- The $120–$125 region is now being watched as support, and possibly as a pillow fort for nervous traders.

Solana (not a tropical island, but sometimes just as volatile) is currently trading at $128.82, after a majestic swan dive of 8.33% over twenty-four hours. Analysts suggest this drop is linked to geopolitical turmoil—also known as “Why can’t global superpowers just get along?” The token’s journey from $140.39 to $127.25 was especially dramatic at 13:00, when trading volume leapt above 4 million, presumably from traders trying to break the sound barrier with their selling speed.

The market squall came hot on the heels of reports that U.S. military actions targeted Iranian nuclear sites—because the world clearly needed more drama. Risk aversion swept crypto, because if you can’t trust global stability, you can always panic!

Now, some traders clutch pearls about the Strait of Hormuz—a place nobody’s been since geography class—potentially being closed. If that happens, oil prices could rocket to the moon (no NFT attached), inflation might roar, Fed rate cut fantasies would dissolve, and traders would keep refreshing their charts to feel something. Should the geopolitical pot get an extra stir, altcoins—like SOL—could face more sell-offs, because, historically, when the world goes to pieces, bitcoin gets all the attention.

Meanwhile, SOL bravely slipped below such technical landmarks as the 200-day moving average (think: security blanket at $149.54). Despite heroic reversal attempts, SOL spent most of the session rolling downhill and yelling for help. Bears, being natural party-crashers, had indicators flashing WARNING, and technical types began watching the $120–$125 area for signs of a native support tribe.

Technical Analysis (aka The Bit Where We Pretend to Know the Future) 🧐

- SOL managed a lovely fall of 8.1% ($140.39 to $129.02 for the mathematically inclined)—an $11.37 drop that left even gravity impressed.

- The range? From $141.14 to $126.85. That’s a 10.2% mood swing fit for a daytime soap opera.

- Peak plummet: At 13:00, SOL nosedived from $133.58 to $128.82. Volume? 4.03 million and probably some trader tears.

- Descending channel spotted, full of lower highs, lower lows, and hope in freefall.

- $133.80 formed resistance, blocking rebounds like a bouncer at a particularly exclusive nightclub.

- $127.43 stepped in as initial support, followed closely by $128.90 which offered the market a comfy, if nervous, futon.

- From 15:25 to 15:27, another bout of selling pushed price below $129.30, because clearly, we needed more drama.

- As the session wound down, SOL shuffled between $130.42 and $128.85, weighed down by “consistent sell pressure” (and possibly existential dread).

- Every attempt at recovery near $130.05 was swatted away faster than an optimistic moth at a bug zapper.

- Lastly, a swarm of sellers appeared at $130.20, reinforcing the short-term bear mood and reminding bulls there’s no easy escape from gravity—or sarcasm.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2025-06-22 22:00