-

SOL’s extended price consolidation could set it up for a massive rally.

Several institutions plan to set up a shop on the network.

As a seasoned researcher who has witnessed the crypto market’s rollercoaster ride over the years, I find Solana [SOL] to be one of the most intriguing projects currently in the space. Its impressive recovery from the FTX implosion to a staggering 2000% gain is nothing short of remarkable.

During the recent market period, Solana [SOL] stood out as one of the exceptional performers. It climbed from a low of $8 following the FTX collapse to reach a peak of $210 in March 2024. This represents an impressive return of over 2000%.

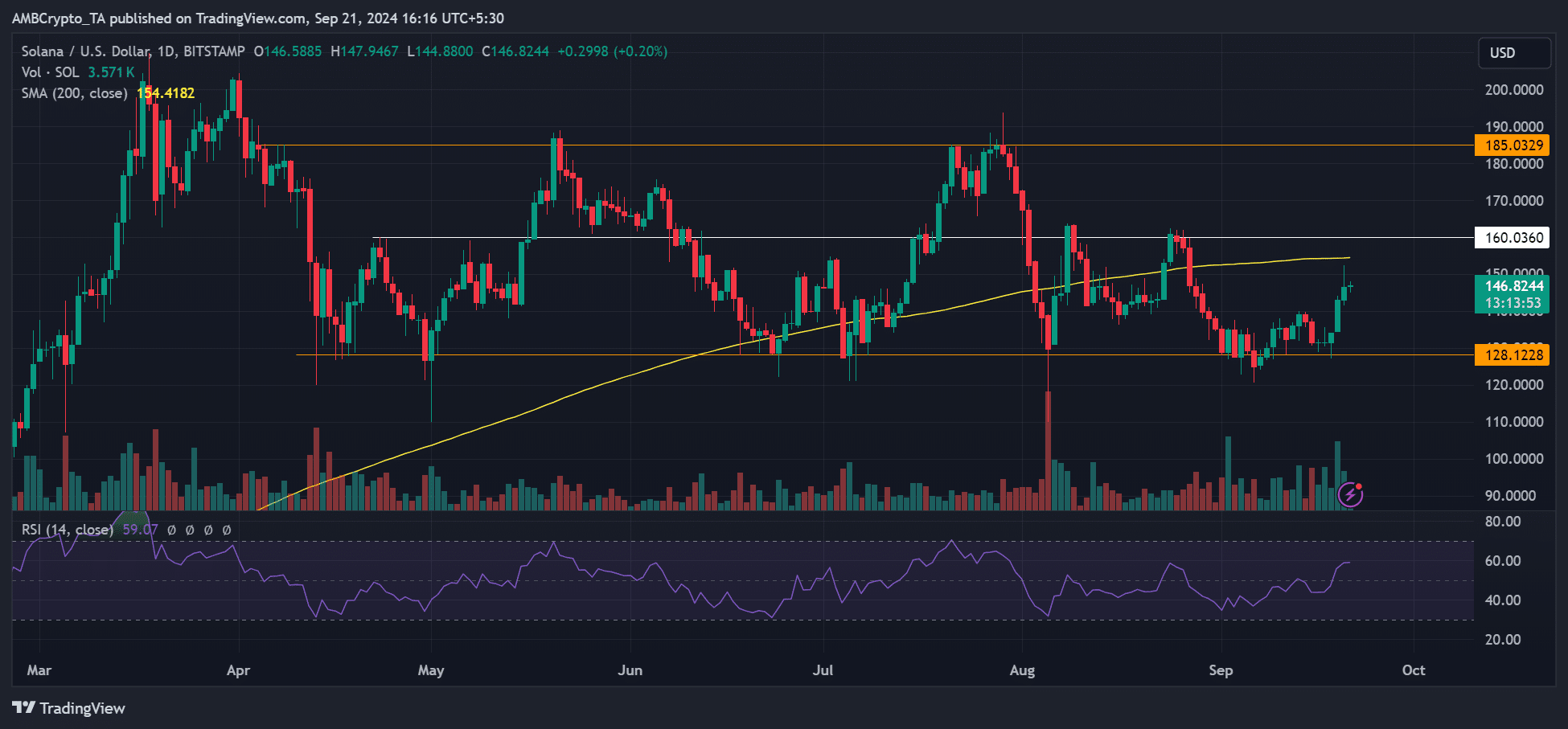

However, market headwinds in Q2/Q3 set the altcoin to consolidate above $120.

As per the observations made by well-known chart analyst Peter Brandt, the six-month price stabilization of SOL presented an excellent opportunity for a future price increase. He pointed out this setup specifically.

It appears that the price of SOL and its USD value found strong support at around $120. If this holds, it might form a rectangular pattern with potential for a significant upward movement.

If it does, breaking free from a square-shaped path often results in gains that mirror the channel’s height. In theory, this suggests a potential increase towards approximately $280.

Will BreakPoint aid SOL price?

Just as anticipated, the Solana BreakPoint gathering generated significant announcements and institutional interest towards this innovative layer 1 blockchain alternative.

Various entities such as Franklin Templeton (asset managers) and Securitize (tokenization service providers) are intending to establish their presence within the Solana network.

Furthermore, it’s said that Citi, a prominent banking institution, is investigating its potential for tokenization and digital transactions using the Solana platform.

Additionally, Solana’s infrastructure is set for a significant update, with the Firedancer, its secondary validator client, now live on the test network and expected to move to the Mainnet shortly.

Firedancer is ready to boost its transaction speed significantly, moving from the current 3000 transactions per second to a whopping 1 million transactions per second on the Solana network.

Beyond improved processing, this adjustment would also increase the network’s decentralization by minimizing a potential single point of failure reliant on a sole validator node.

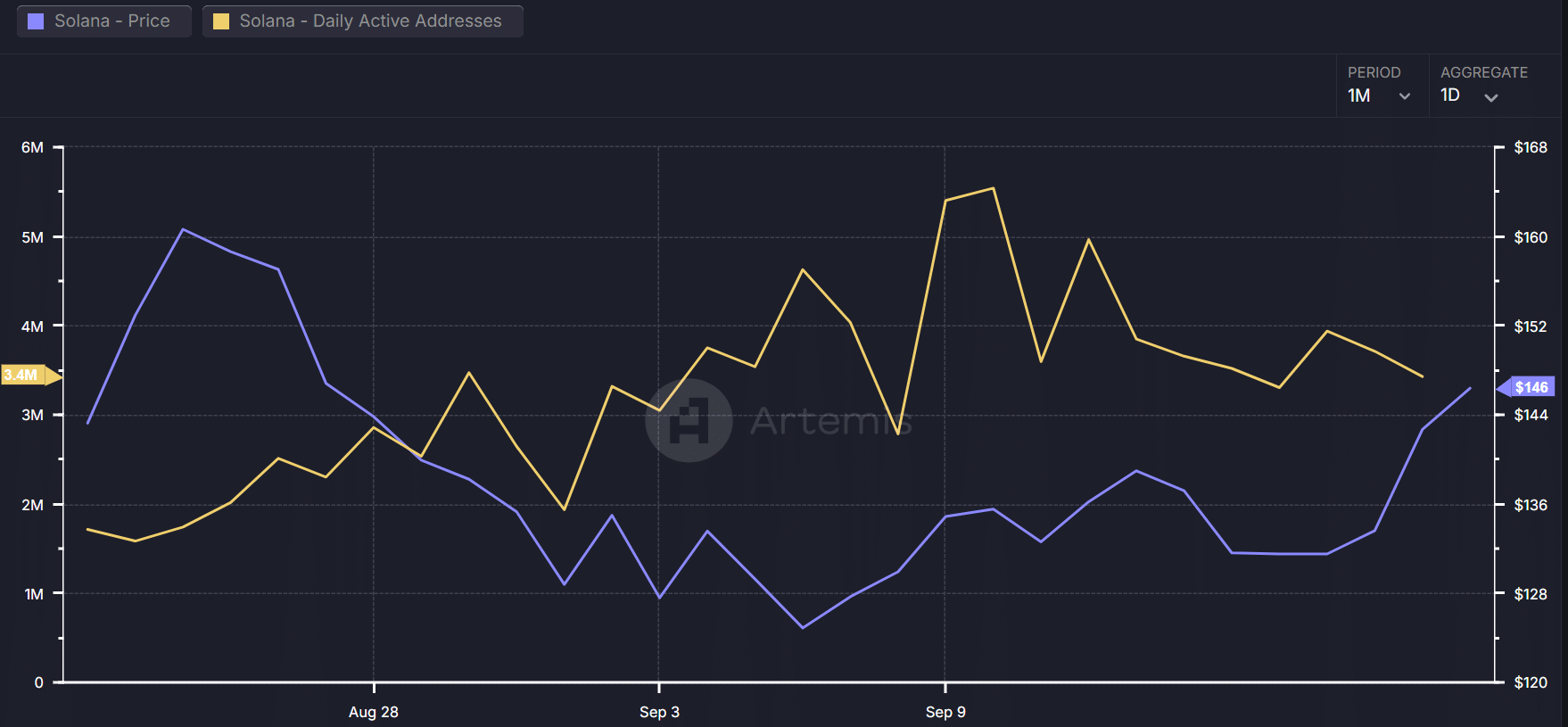

Nevertheless, the expansion of the network appeared to slow down significantly following an impressive surge in late August, which can be seen from the trend of daily active addresses.

From under 2 million in August, the figure skyrocketed to more than 5 million on September 10th, only to decrease later on.

In simpler terms, a significant surge beyond $150 for this altcoin might be postponed temporarily due to its current positioning near the 200-day Moving Average. Although it experienced an increase of approximately 14% from its base at $128, it has halted just above $154, which is close to a key moving average level.

Should it reclaim the 200-day MA, $160 and $180 could be next bullish targets in the short-term.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-22 03:03