- Solana’ rapid appreciation against Ethereum reflects a significant price action shift.

- Now, ETH’s long-term outlook needs reassessment to restore its former dominance.

As a seasoned analyst who has witnessed numerous bull and bear markets in the crypto world, I find it intriguing to observe the shift in momentum between Solana [SOL] and Ethereum [ETH]. The rapid appreciation of SOL against ETH is more than just a temporary price action shift; it seems to be the beginning of a larger trend that could reshape future market cycles.

It’s typical for the cryptocurrency market to have periods of volatility, but according to AMBCrypto’s latest analysis, it seems that the rise in Solana price [SOL] might not just be a temporary spike, but rather the start of a significant trend that could influence future market patterns.

It seems that Solana’s recent growth compared to Ethereum might not be just a temporary trend, but could instead become a consistent pattern. This potential persistence could challenge Ethereum’s long-held lead in the blockchain industry.

A recurring pattern

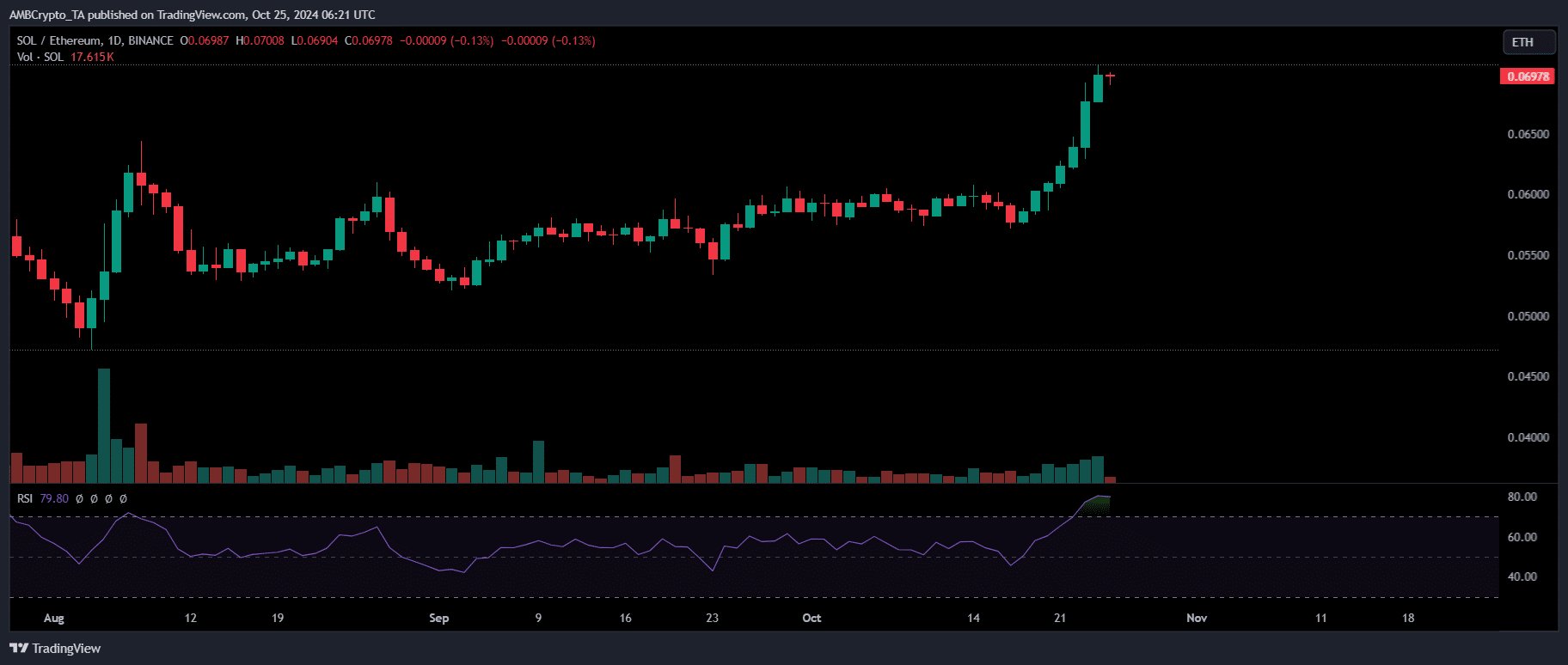

In August, the ratio comparing Solana (SOL) to Ethereum (ETH), or simply SOL/ETH, hit an unmatched peak of 0.06179. This means that there was a substantial increase in the value of Solana as compared to Ethereum during this period. This remarkable milestone occurred amidst a chaotic market event where approximately $500 billion worth of assets were sold off.

In the face of these obstacles, I observed an impressive surge in SOL’s value. Within a span of three days, it climbed an astonishing 48%, soaring from $110 to $163. On the other hand, ETH experienced a more gradual recovery, increasing by 15% during the same period, moving up from $2,157 to $2,463.

Source : TradingView

At present, the SOL/ETH exchange rate has hit a record high of 0.06987, aligning with a boisterous market climate, as Bitcoin soared to a new peak of $70,000.

Contrary to past cycles, Ethereum (ETH) hasn’t demonstrated any indications of a rebound. Instead, it’s been exhibiting lower lows each day with extended periods of red candlesticks, dropping from $2,700 to $2,400 within just four trading days.

On the other hand, the price of SOL remains consistent, surpassing the significant psychological level of $160 and trading at $174 as we speak, supported by a positive MACD crossover, which indicates a bullish trend.

During periods of heightened market volatility, I’ve observed a striking trend where investors tend to favor Solana (SOL) over Ethereum (ETH) when Bitcoin (BTC) encounters resistance. This pattern suggests a significant capital reallocation towards the Solana network during such times.

If the current pattern persists, it seems plausible that Solana’s increasing worth may challenge Ethereum’s supremacy. This might result in Solana becoming the go-to high-value asset for investors seeking risk reduction when Bitcoin experiences its peak moments.

Factors driving Solana upward

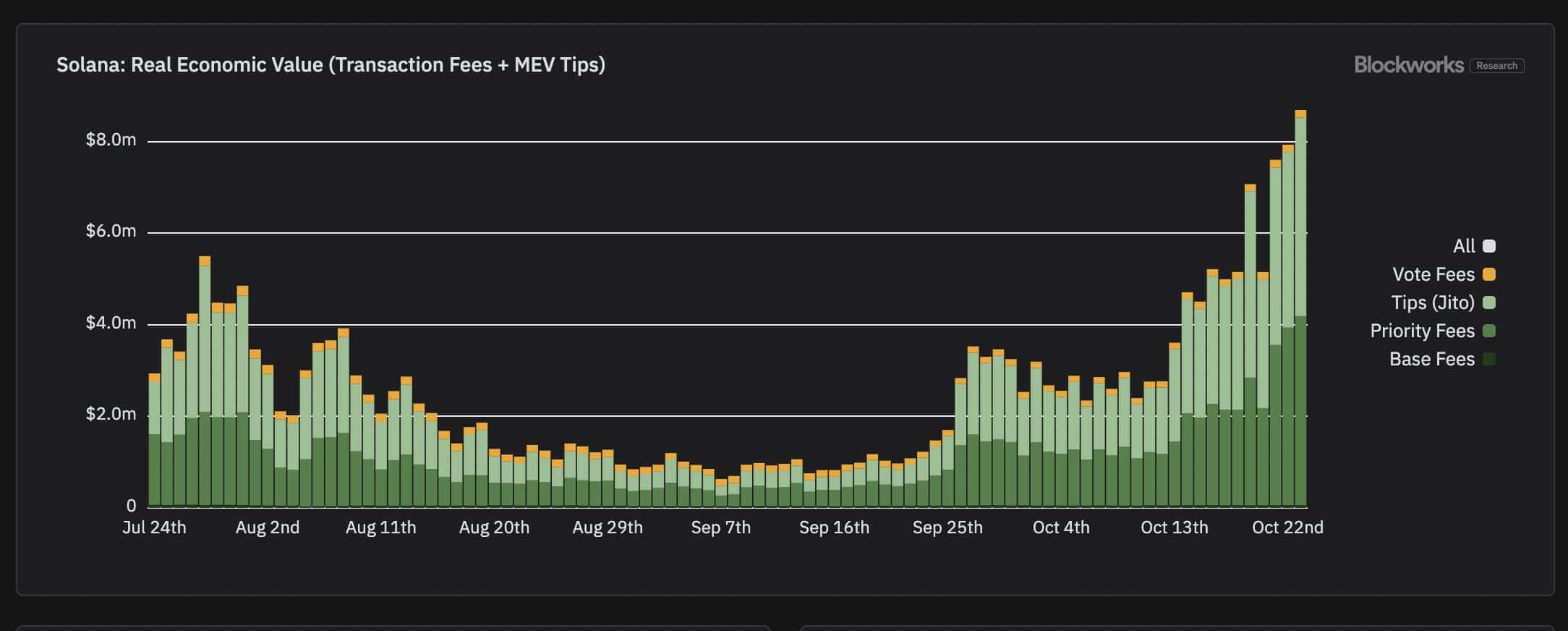

Initially, detractors argued that Solana’s affordable fees could lead to economic instability within the network. However, just under a year later, Solana has surpassed Ethereum not only in terms of transaction fees but also in miner extractable value (MEV) tips.

This change demonstrates that the movement of Solana’s price isn’t just a result of Bitcoin’s price swings; instead, it’s fueled by its strong internal structure.

Source : Blockworks

Moreover, Solana has drawn notable interest from the meme coin sector, as half of the top eight meme coins in terms of market capitalization currently operate on the Solana platform.

Notably, the AI-powered meme token known as Goatseus Maximum [GOAT] has seen almost a 100% increase in value over the past week. This rise has sparked interest among those holding Solana (SOL) to take advantage of the current memecoin trend and potentially boost their holdings.

A fresh blog post has unveiled a significant amount of Solana (SOL) tokens, around 150,000 SOL, that were recently staked in a new wallet. This accumulation took place over the last three days and is estimated to be worth approximately $26 million.

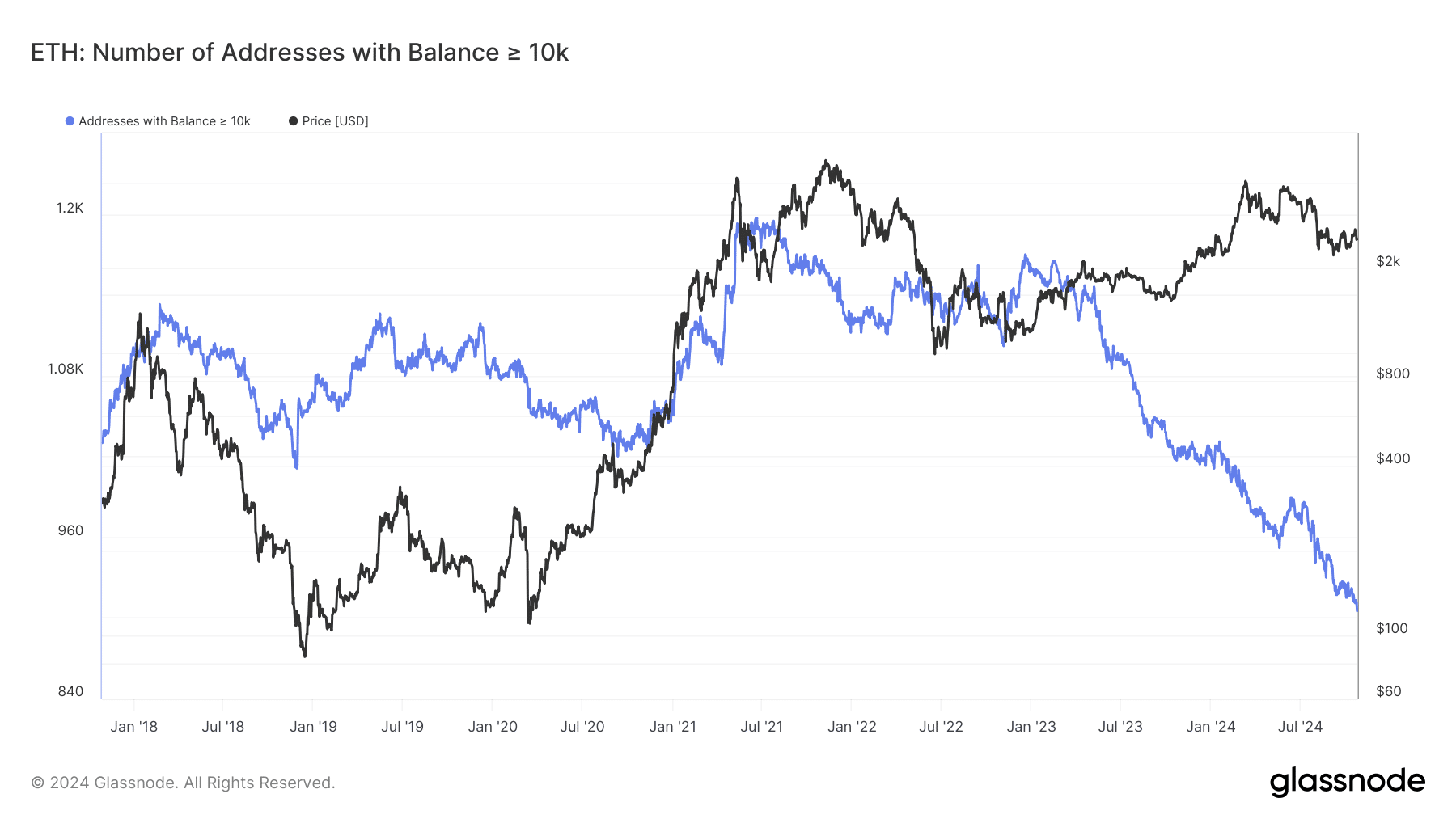

ETH fundamentals are under pressure

The basic factors that previously made Ethereum stand out among other alternative cryptocurrencies are currently facing strain, since the number of wallets containing over 10,000 ETH has dropped to its lowest point in seven years.

Source : Glassnode

Absolutely, it’s time for a fresh look at Ethereum’s future outlook due to the dwindling trust among investors. To regain its prominent standing, Ethereum needs to tackle these issues head-on.

Read Ethereum’s [ETH] Price Prediction 2024–2025

If it doesn’t, problems like scalability challenges, expensive transaction costs, and competition from rising platforms like Solana might cause a shift in the altcoin pecking order, potentially limiting Ethereum’s capacity to capitalize on market transitions.

At the moment, Ethereum stands at approximately $2,464. Over the past week, this value has decreased by about 6%, and as a result, its total market capitalization has dropped by roughly 4%.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-25 17:15