- Altcoin’s price respected the 4-month range formation once again

- A short-term price dip can be anticipated

As a seasoned analyst with over two decades of market observation under my belt, I’ve seen more than a few market cycles come and go. The current Solana [SOL] situation reminds me of a rollercoaster ride – exciting, unpredictable, and filled with twists and turns.

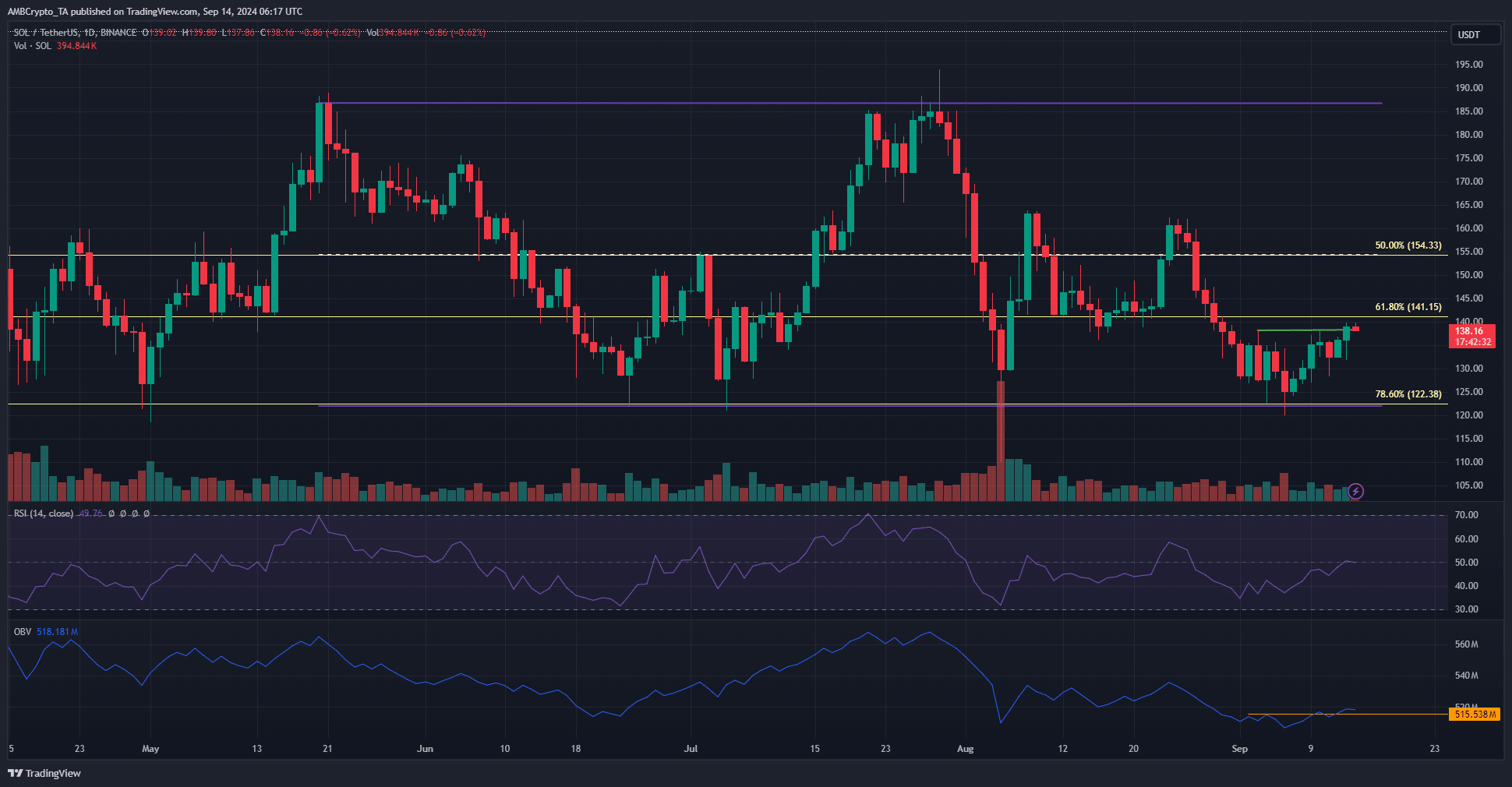

On its daily chart, Solana (SOL) showed a strong pattern break, suggesting a potential price increase. However, the optimism among Solana bulls following Bitcoin‘s (BTC) recent surge over the past week isn’t fully supported by technical analysis indicators at the moment.

Beginning the first week of September, SOL experienced a decline of approximately 13.13% from its peak at $138.13, reaching $120 on Friday, September 6th. However, since that date, it has rebounded by nearly 15%, effectively regaining all the losses it incurred during the previous week.

Mid-range resistance as the take-profit target

The span of the purple-highlighted price band stretched from approximately $122 to $187. Its middle point is around $154.33. Notably, this is the fourth time since June that the prices have dipped back to these lower range limits.

As an analyst, I noticed an uptrend in the market structure, accompanied by increased buying volume, as indicated by the On-Balance Volume (OBV) surpassing last week’s highs. Additionally, the Relative Strength Index (RSI) was about to cross above the neutral 50 level. These indicators suggest a potential significant rally for Solana (SOL), offering promising signs for further growth.

Looking ahead, a potential goal for Bitcoin’s price could be around the $154 mid-level mark, though this might be optimistic given the possible obstacles at the $61k-$62k resistance area. If Bitcoin encounters rejection in this region, it may pull down not only itself but also altcoins like Solana (SOL).

Get ready to buy the next dip

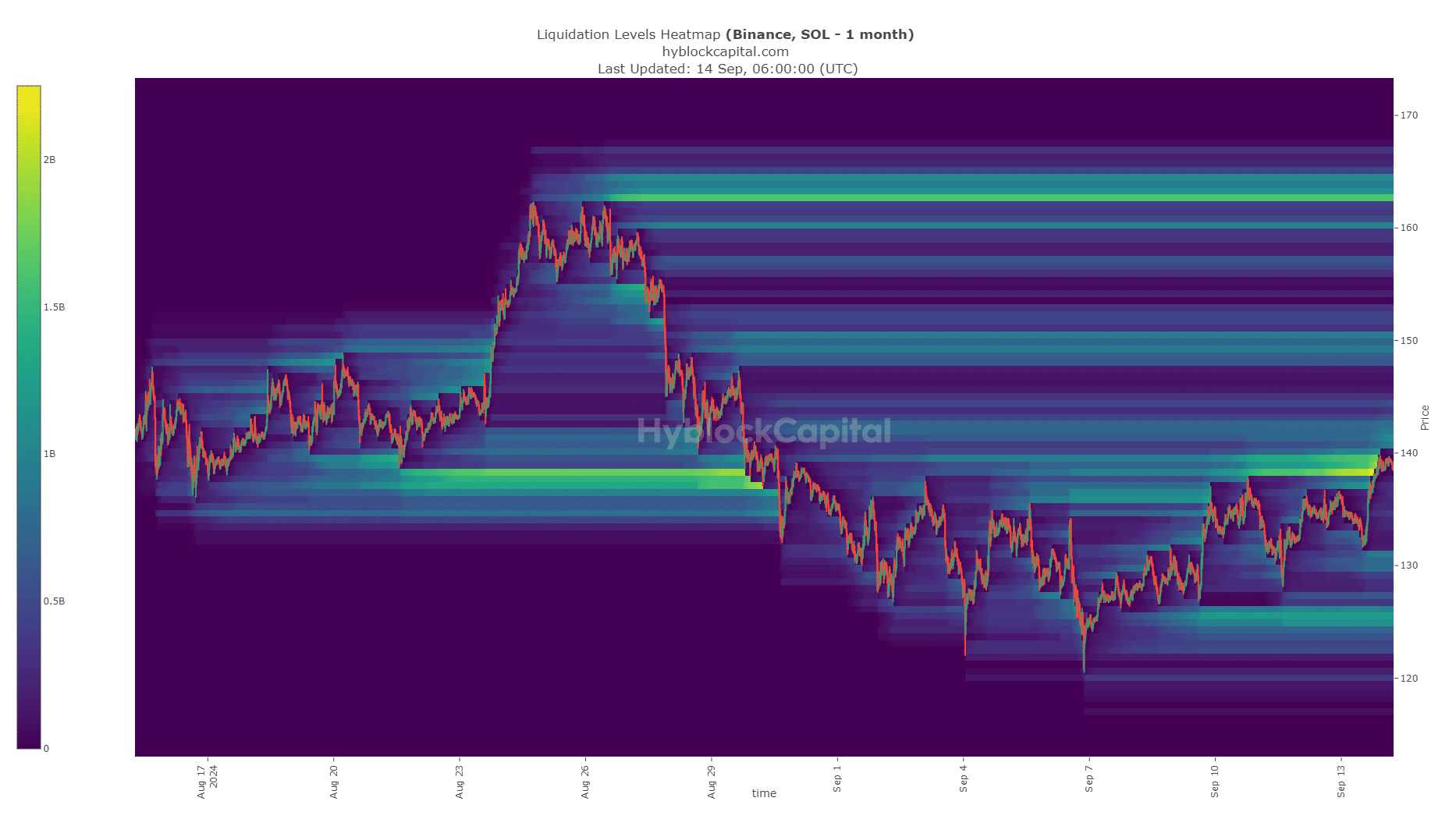

During the latest price surge, the range between $138 and $140 was quickly emptied out, indicating a significant area of market activity. Potential future points of focus could be at $142 and $150, yet it’s possible that Solana might not immediately reach these levels. Instead, a temporary price drop seems plausible before further advancement.

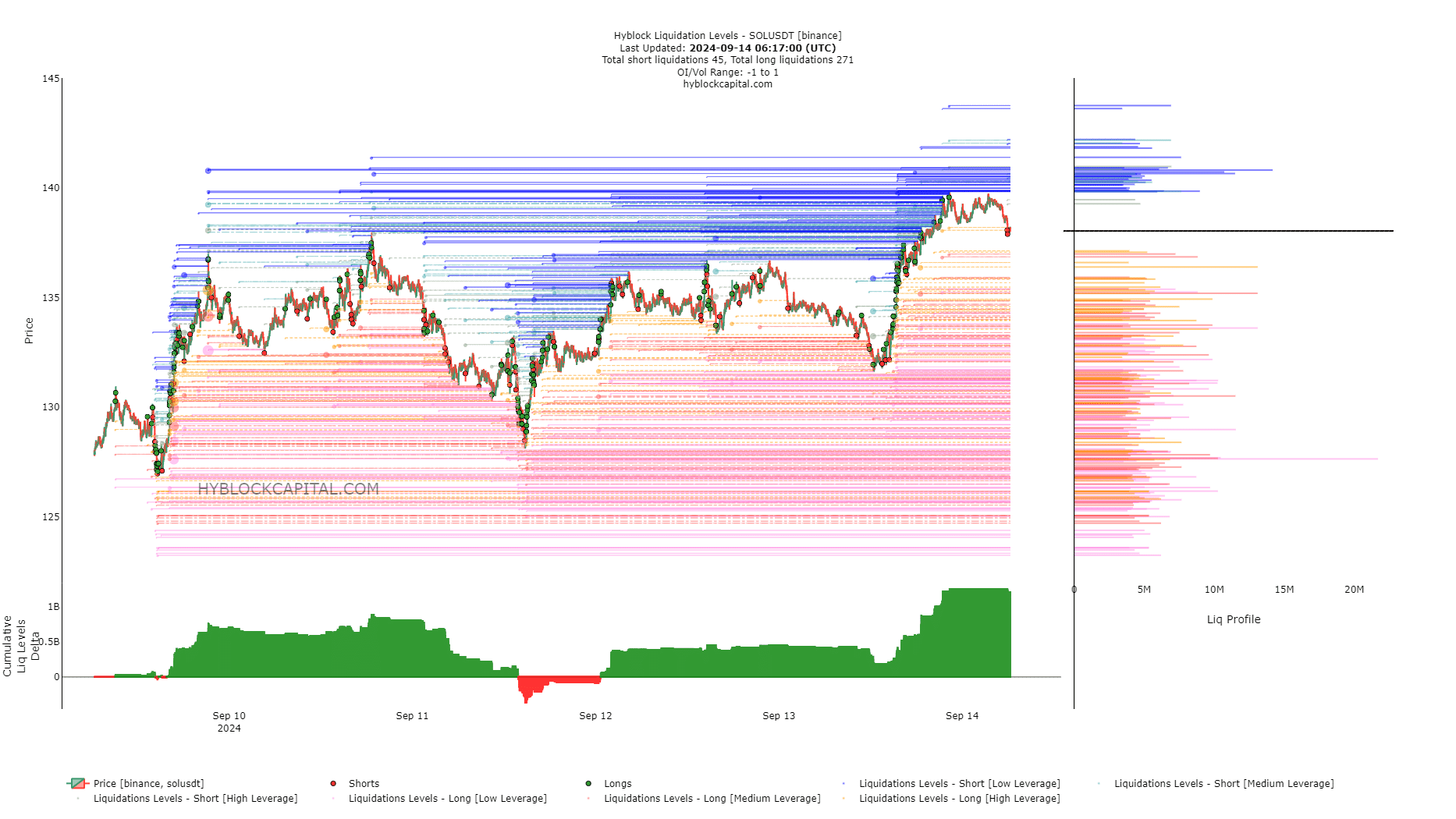

This situation occurred due to an immediate-term bias towards buying (bullish) in the liquidation levels. Currently, the total liquidation level difference (delta) is significantly positive, indicating a significant imbalance towards long positions. Typically, this situation leads to a price adjustment in the opposite direction in order to gather liquidity.

Read Solana’s [SOL] Price Prediction 2024-25

As a researcher, I discovered through my analysis that the short-term targets lay at approximately $133 and $135, as indicated by the liquidation levels chart from AMBCrypto. A potential revisit to this zone could offer a buying opportunity; however, it’s crucial to wait for signs of a bounce on lower timeframes before making a move.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-14 16:07