-

SOL, at press time, was trading with a slight uptick, but remained largely bearish

Sentiment fell into the negative zone due to its price decline

As a seasoned analyst with years of experience navigating the volatile cryptocurrency markets, I’ve seen more than a few rollercoasters in my time. And while Solana (SOL) has been on a bearish ride lately, it seems to me that there could be some twists and turns ahead.

Recently, the value of Solana (SOL) has noticeably dropped, falling away from important pricing thresholds. This price decrease has likewise impacted the derivatives market, as more and more traders are wagering on the coin’s continued price drop rather than an increase.

Conversely, the technical signals hinted at potential surprises for traders betting on a decrease in SOL‘s price, should its direction prove unanticipated instead.

Solana shows bearish trends

At present, Solana (SOL) is being traded around $139.37 on the daily chart. Interestingly, this price point aligns with the 0% Fibonacci retracement level, suggesting that SOL has reached a significant turning point in its price trend.

Additionally, the value of SOL consistently fell beneath both its longer-term and shorter-term average lines (represented by the blue and yellow lines). These levels acted as a barrier or resistance at approximately $149.29 and $153.87, respectively.

Upon closer examination of the technical indicators, it appears that Shiba Inu Coin (SOL) might be experiencing a downward trend as well. For example, its Relative Strength Index (RSI) stands at 41.43, suggesting low strength and nearing oversold conditions, which typically indicates sellers have been more active than buyers.

Moreover, the Moving Average Convergence Divergence (MACD) stood at -1.46, while the signal line was at -3.67. These indicators’ negative values underscored Sol’s ongoing downward trend, even though it briefly showed a slight upward movement.

Where can SOL go from here?

Based on the current negative signals, Solana (SOL) now encounters significant levels of potential support and resistance that could dictate its future direction in the price chart.

If the downward trend persists, we’ll likely encounter a notable support point at approximately $128.88, which represents a 23.6% Fibonacci retracement level. But if this support doesn’t manage to hold its ground, there’s a possibility that the price could drop to another key level, the 50.0% Fibonacci retracement level, around $116.79.

If Solana (SOL) holds steady or slightly increases around its current price of $128.88 or nearby, and the Relative Strength Index (RSI) starts to trend upward, it may indicate the onset of a recovery. In such a case, SOL could try to challenge its resistance levels again. Overcoming both the short-term and long-term moving averages, which are currently acting as resistance at around $149.29 and $153.87 respectively, would be essential for a bullish reversal.

Should SOL surpass its current moving averages, a noteworthy resistance level to keep an eye on will be the 61.8% Fibonacci retracement level at approximately $162.60. Overcoming this barrier might suggest increased bullish energy.

To ensure a complete bullish recovery, SOL needs to aim higher and surpass the 100% Fibonacci retracement level, currently around $185.51, marking a successful upward momentum.

Why did Solana fall?

It seems that the drop in Solana’s (SOL) value wasn’t caused by any particular issues within the Solana network itself. Instead, it appears to be a response to wider fluctuations in the overall cryptocurrency market.

Over the last seven days, the value of cryptocurrencies has dropped considerably, causing a massive erasure of wealth from the total market worth.

In the recent market downturn, major cryptocurrencies like Bitcoin and Ethereum experienced substantial drops in their values, and Solana was not immune to these effects either.

Traders take short SOL positions

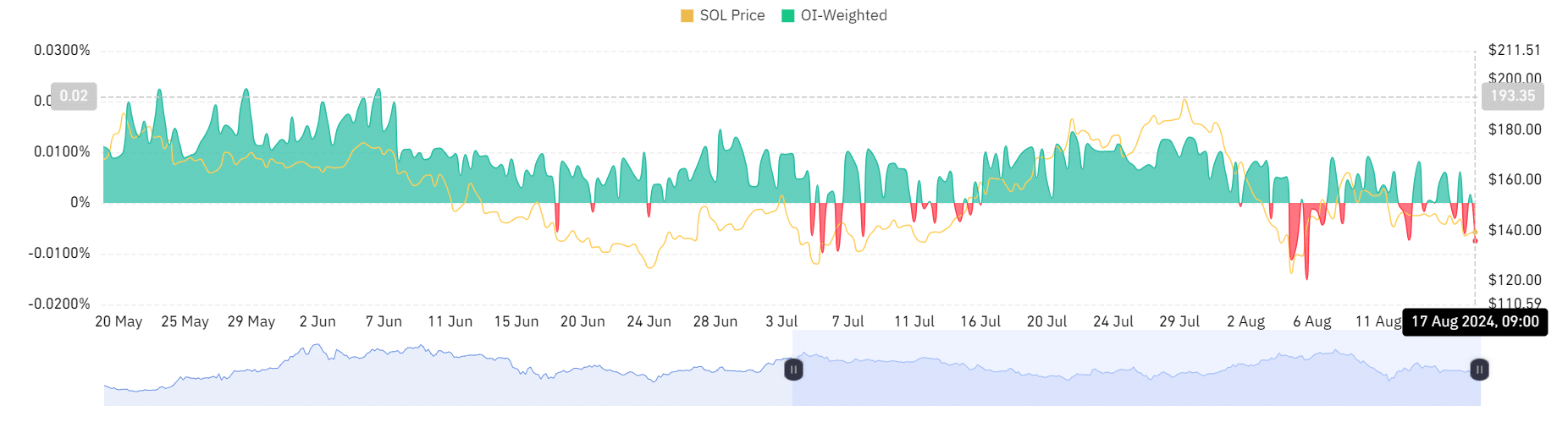

Ultimately, a study on Solana’s (SOL) funding rate using Coinglass showed that favorable opinions have been dwindling in the last couple of weeks.

previously, the market was mainly controlled by buyers, but the trading activity was rather low; currently, the funding rate is less than zero and stands around -0.0075%.

– Read Solana (SOL) Price Prediction 2024-25

The current low funding rate indicates that more sellers than buyers are active in the market, as an increasing number of traders anticipate a continued decrease in Solana’s (SOL) price. While this trend suggests pessimism, it also carries potential dangers.

If Solana’s price suddenly increases more than anticipated, investors who have taken short positions might experience large-scale liquidation. This sudden surge in buying could possibly lead to a swift correction or reversal in the market.

Read More

2024-08-17 21:12