- The mid-range support’s failure was a heavy blow for the bulls.

- A move toward the $122 range low is possible, but the $140 level could also hold the sellers off.

As a seasoned researcher with years of experience under my belt, I have seen countless market swings and learned to navigate them with patience and a keen eye for detail. The recent failure of Solana’s mid-range support was indeed a heavy blow for the bulls, sending ripples throughout the cryptocurrency market.

As a crypto investor, I find myself once more in a position where Solana [SOL] has dipped below the $150 mark, and the obstacles on the bearish side seem insurmountable. However, there’s an anticipation that surpassing the $160 resistance could lead us to the range highs at $190. Interestingly, sentiment shifted bullish just last week, so I remain hopeful for a potential upward momentum.

This did not last.

Bitcoin‘s (BTC) upward momentum hit a roadblock at the $62,500 barrier, indicating a rejection by bulls. This setback in the cryptocurrency leader was mirrored by Solana, suggesting that there might be further downward movement ahead.

The Solana mid-range support was decisively breached

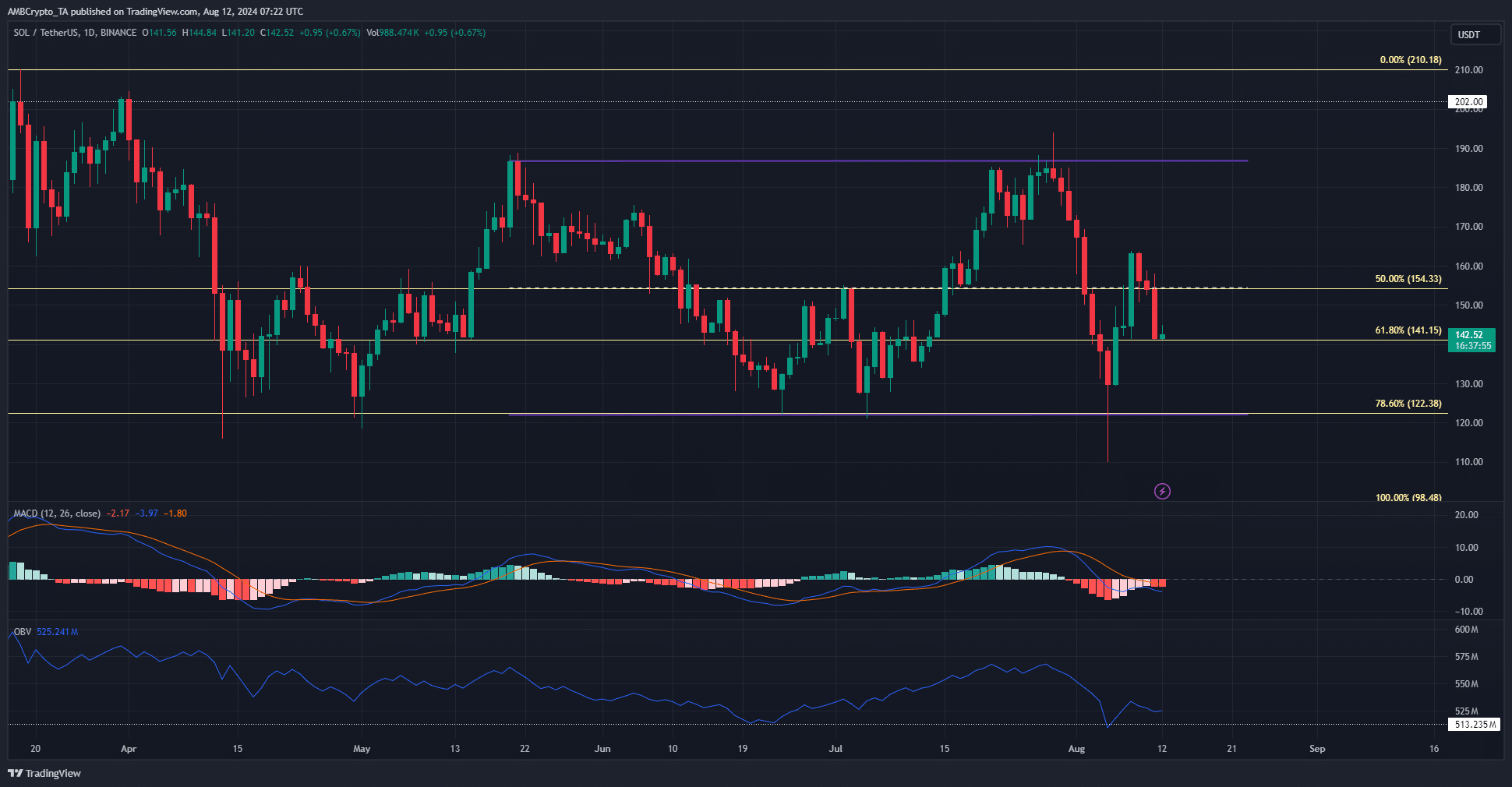

Over the past three months, Solana’s price fluctuated between a low of around $122 and a high of approximately $186. The middle point at about $154 aligns with the 50% Fibonacci retracement level, derived from the upward trend seen in February and March.

As a seasoned trader with years of experience under my belt, I can say that those levels were still significant, as the 78.6% level aligned perfectly with the range lows. The inability of buyers to hold the mid-range support over the weekend underscored the short-term bearish outlook once again. It’s a reminder that markets don’t rest on weekends and can present unexpected shifts, especially when crucial levels are at play.

Prices on the OBV rebounded from their June minimums, suggesting a degree of optimism among buyers. Yet, the Moving Average Convergence Divergence (MACD) exhibited a bearish pattern by crossing over and dipping below the neutral point. The overall momentum was decidedly bearish, and the buying interest wasn’t sufficient to counter it effectively.

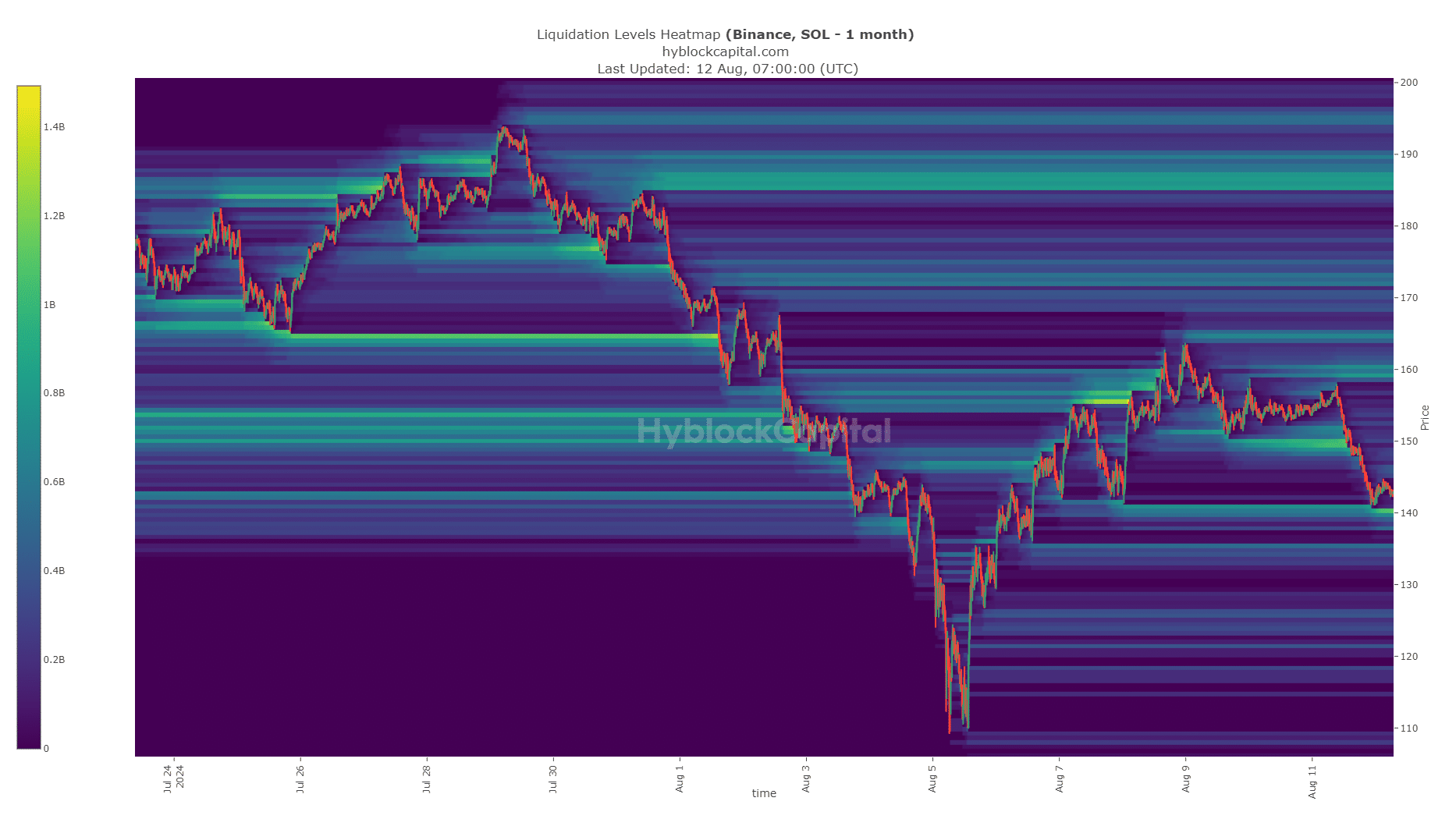

Could the $140 liquidity pocket reverse the bearish tides?

In simpler terms, AMBCrypto noted a significant amount of available funds around the price point of $140. This could potentially pull prices down further. Yet, on the 7th of August, there was also an indication of a quick bullish change in trend at that same level.

Is your portfolio green? Check the Solana Profit Calculator

Investors should stay cautious as a potentially repetitive situation may unfold. Given the reduced interest and negative market trend, Solana might slide beneath $140, reaching approximately $130, or even dipping further towards its lower price range.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-08-13 01:11