- Solana has a long-term bullish market structure.

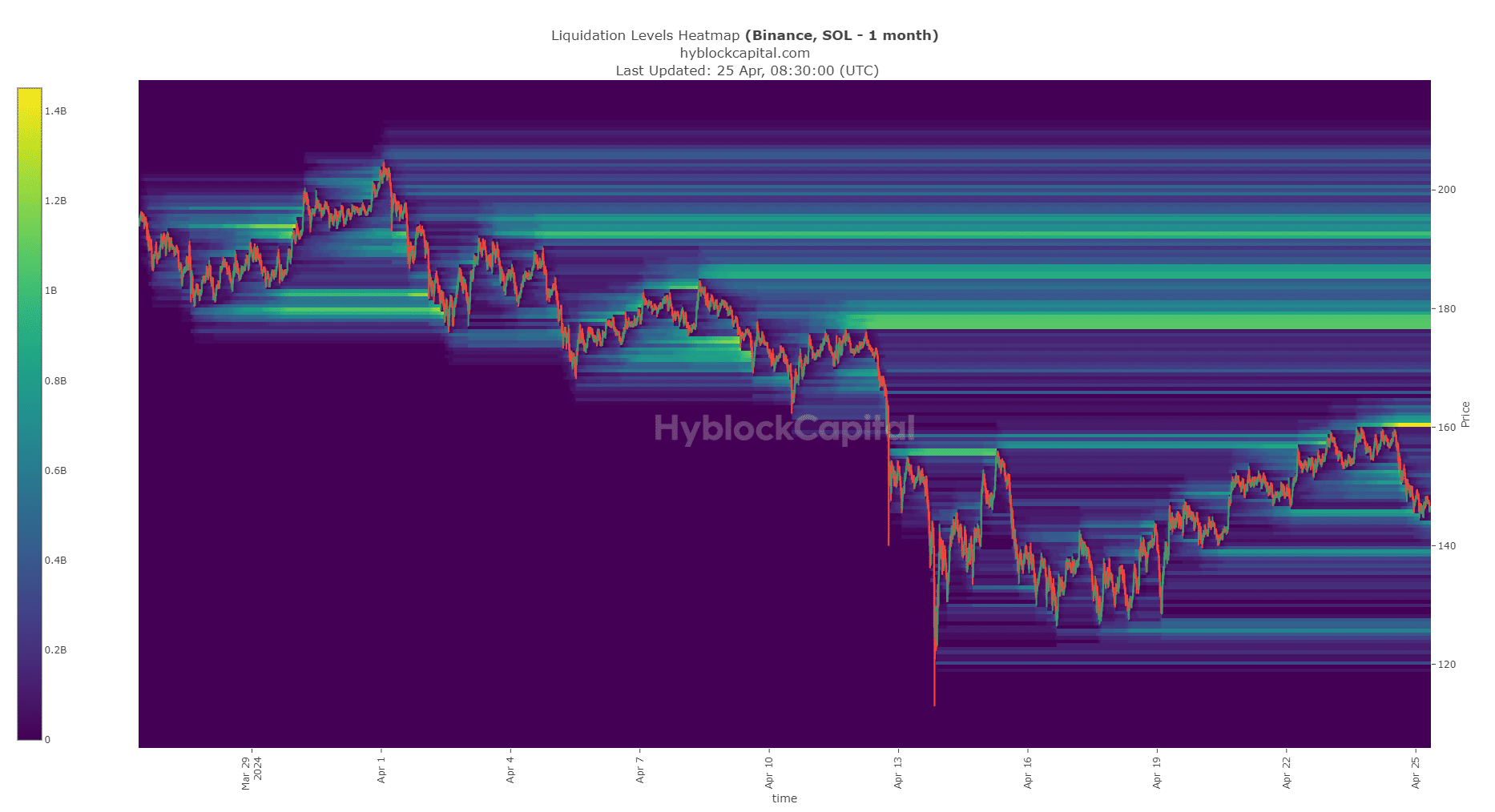

- The resistance overhead could be retested once again based on the findings from the liquidation heatmap.

As an observer with a background in cryptocurrency analysis, I find Solana’s current market structure intriguing. While its long-term bullish trend is evident from its consistent uptime and increasing revenue, the near-term outlook is bearish due to the resistance overhead at $160.

Last month, Solana (SOL) successfully resolved the problems that led to downtime and has since then ensured uninterrupted network operation in April. Despite this achievement, the cryptocurrency’s price performance left much to be desired, with a predominantly bearish sentiment among traders.

As a researcher examining the latest trends in the Non-Fungible Token (NFT) market, I’ve come across an intriguing observation from AMBCrypto. In the past week, the number of NFT transactions on Solana has surpassed those on Ethereum and Polygon.

The surge in Solana’s income grew by 33.3% as well, yet the hype surrounding memcoins began to dwindle. Consequently, this led to reduced transactions on decentralized exchanges and a decrease in total value locked (TVL).

The fair value gap could present a significant challenge

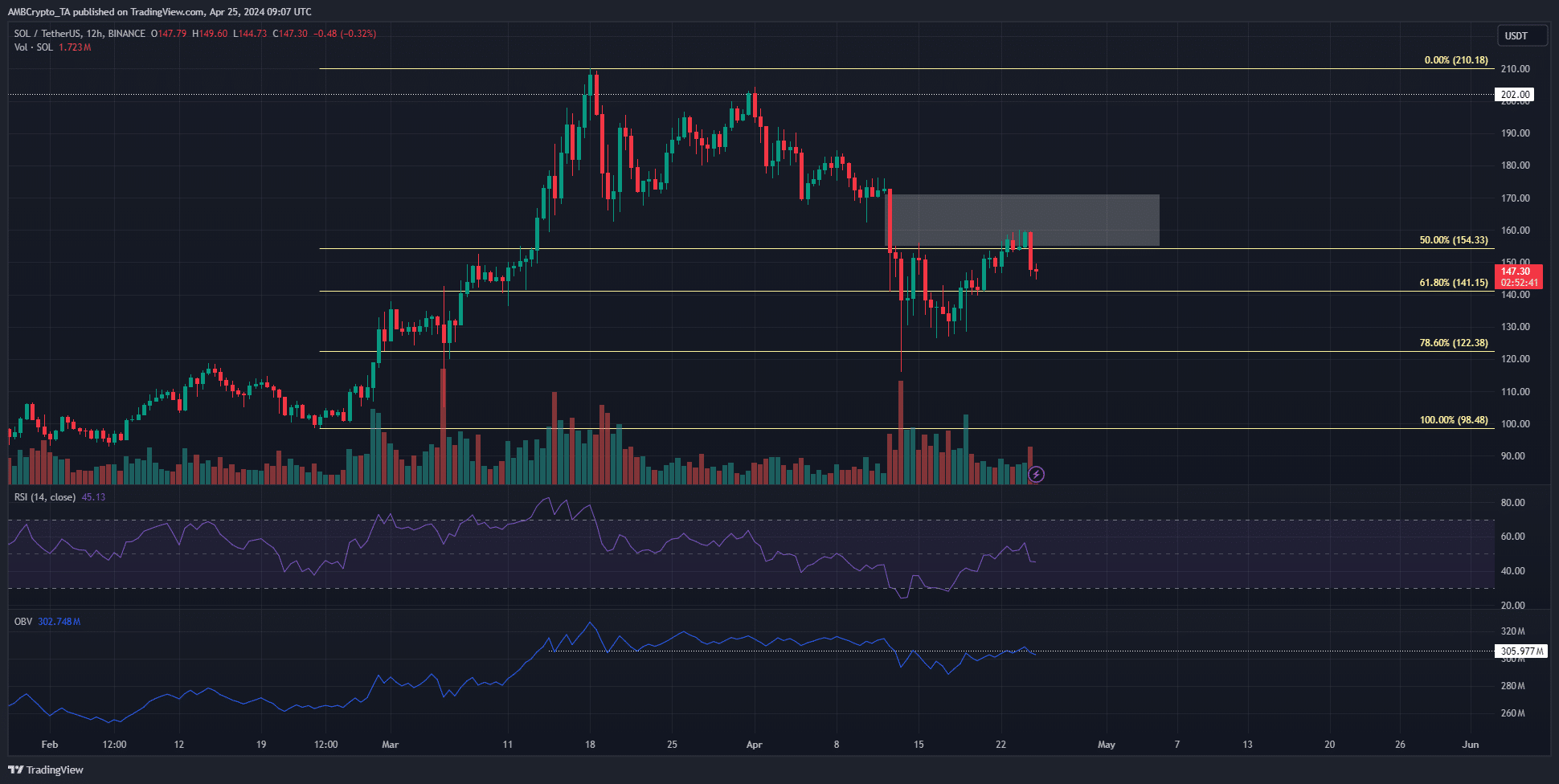

In the grand scheme of things, Solana’s long-term trajectory appeared optimistic following its surge in late February and early March. However, in the short term, the market sentiment leaned towards bearishness. This shift was a result of Solana forming a succession of lower peak and trough prices in April.

The RSI indicator showed a value of 45, which is lower than the neutral threshold of 50, for the majority of April. This prolonged period below 50 indicated a bearish trend in momentum. Additionally, the On-Balance Volume (OBV) displayed a downtrend and reached a resistance point at the current moment.

An extra noteworthy price difference, approximately $160, existed. In March, this area functioned as a source of support. However, presently it acts as a barrier to further price increases.

In the upcoming weeks, it’s probable that the market will revisit the Fibonacci retracement levels of $141.15 and $122.38 (depicted in pale yellow) before the bullish trend can be reversed.

The liquidity northward could see a quick reversal

In the short term, the liquidation heatmap indicated that the price range of $143 to $145 held a substantial amount of liquidity for Solana (SOL). Over the past few days, SOL experienced a downturn from $157 to $145 in order to access this available liquidity.

To the north, the $160 level had a large concentration of liquidation levels.

Is your portfolio green? Check the Solana Profit Calculator

Based on the available information, it’s plausible that Solana prices would be drawn towards a magnetically charged area in the near future. However, this pull may not last long as Solana seems unable to sustain an uptrend at present.

On the other hand, if the $165 level was surpassed, the $180 region would become the next target.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-04-26 02:15