- Solana’s next breakout could target $148.058 and $161.97

- Whale accumulation and liquidation data pointed to growing bullish sentiment

As a seasoned market analyst with years of experience under my belt, I see promising signs for Solana (SOL). Having closely monitored the whale accumulation and liquidation data, I believe we are on the brink of a significant breakout. If SOL can surmount its current resistance levels, we could be looking at potential targets of $148.058 and even $161.97 in the short term.

In the financial world, Solana (SOL) is creating quite a stir following its recovery from recent price dips. Traders are keeping a keen eye on it, wondering if SOL will manage to surpass its resistance thresholds, potentially sparking a strong upward trend.

Currently, Solana (SOL) is being transacted at $140.02, representing an increase of 2.60% over the past 24 hours. Its recent trading suggests a potential surge, though significant obstacles remain due to existing resistance levels.

Can SOL break through and surge higher?

The price of SOL seems to be entering a period of stability around $135.524. If this level is surpassed and sustained, it may trigger an upward trend, with potential future targets at $148.058. Furthermore, if the positive momentum persists, SOL could challenge its July high of $161.97.

Instead, there’s a possibility that SOL could test its lower support near $127.60, which might introduce temporary uncertainty for traders regarding short-term trades.

Whale activity – What are top holders signaling?

Analysis of on-chain data shows that entities with more than $5 million in stablecoins possess approximately 61.63% of the entire stablecoin supply. This significant rise in these large investors’ holdings points towards their faith in a possible price surge ahead.

As a result, significant entities are also moving into place, which could cause the price to increase significantly if Solana (SOL) manages to break through its resistance level.

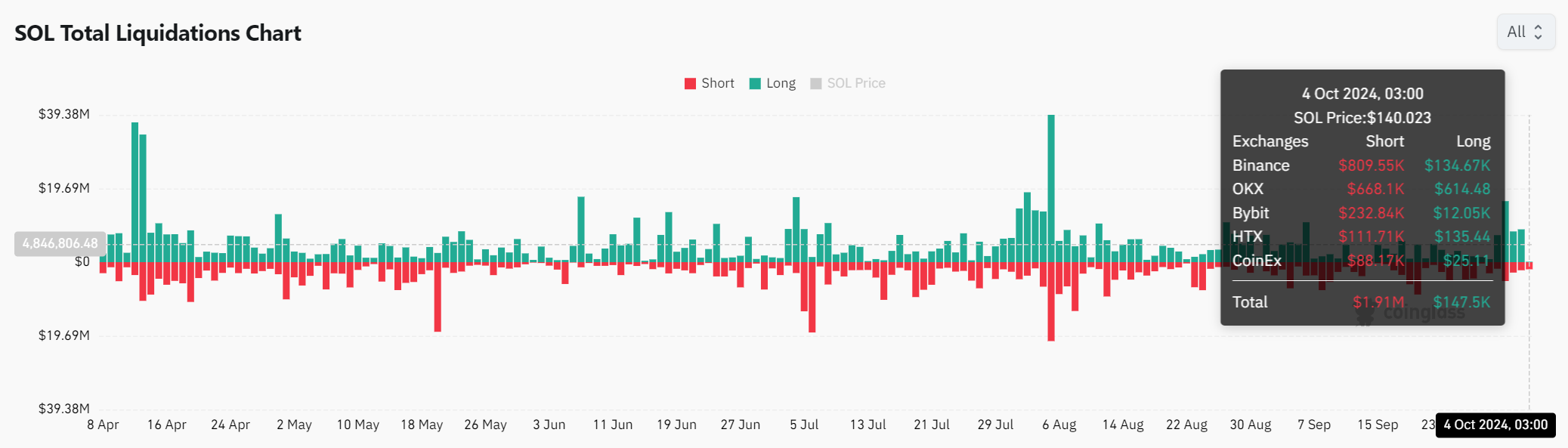

SOL liquidation data – Are shorts feeling the pressure?

Interestingly, recent liquidation data revealed $1.91M in short positions liquidated, compared to just $147.5K in longs. Therefore, short traders are increasingly cautious, possibly anticipating a bullish breakout. This imbalance in liquidations adds fuel to the upside potential.

As a researcher, observing the current market dynamics, I find myself anticipating that if this upward trend persists, the ongoing short liquidations could potentially propel Solana (SOL) higher, leading to heightened volatility in the immediate future.

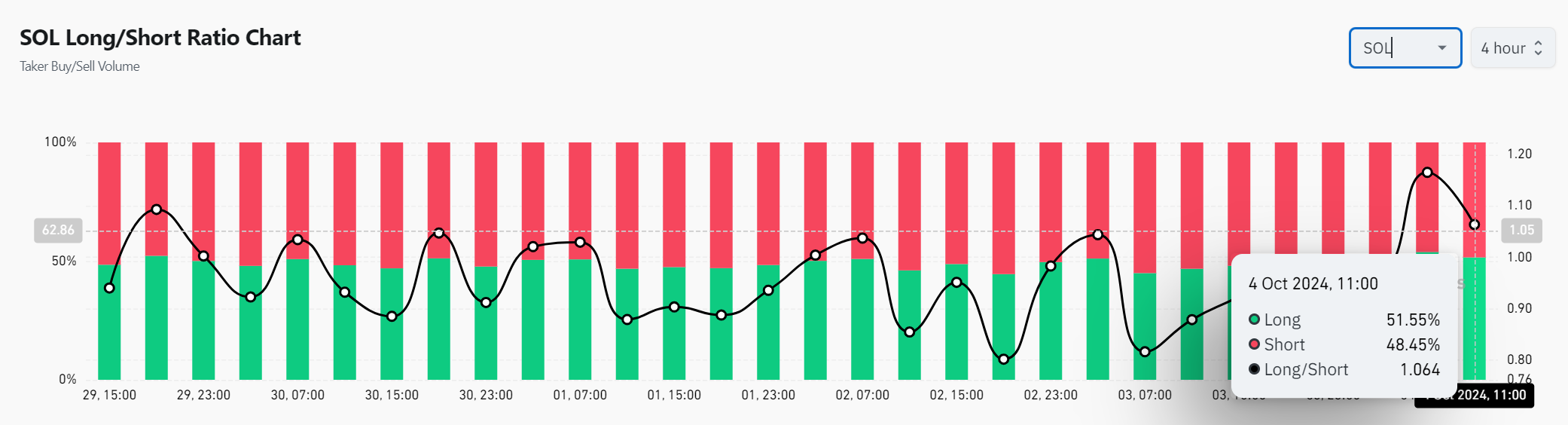

Long/short ratio – Who dominates the market?

As an analyst, I’m observing that as we speak, the long/short ratio for Solana leans more towards long positions at approximately 51.55%, indicating a rising bullish outlook among traders. Yet, it’s essential to note that a substantial 48.45% of traders are still holding short positions, suggesting that the market remains somewhat divided on its direction.

Therefore, it’s important to note that volatility is common in trading SOL, so it’s crucial for traders to closely monitor certain ratios. If long positions are prevailing, Solana (SOL) might experience substantial growth. However, sudden price changes in the opposite direction should also be prepared for.

Read Solana’s [SOL] Price Prediction 2024–2025

To summarize, it appears that Solana could be on the verge of a significant surge if certain factors continue to align positively. Whale actions, liquidations, and the long/short ratio all indicate a promising outlook; however, for this breakout to occur, the current resistance levels need to be surpassed. If Solana manages to breach these levels, $148.058 and $161.97 could serve as important future benchmarks for its price movement.

Consequently, traders ought to prepare themselves for a significant shift that might shape Solana’s path in the upcoming days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-10-05 11:35