-

Solana could see a couple of days of choppy trading.

The bullish Bitcoin move could lead SOL past the nearby resistance.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. Currently, Solana [SOL] seems poised for a short-term correction, but the long-term outlook remains promising.

Over the last 24 hours, Solana [SOL] surpassed a significant barrier, yet it remains below a sturdy barrier for potential advancement.

As a crypto investor, I noticed that the technical indicators were exhibiting robust bullish signs, yet the trading volume remained relatively low, even with consistent buying pressure.

As a researcher, I’m excited to share my findings on network robustness between Solana and Ethereum. It appears that Solana’s network metrics exhibit greater resilience compared to Ethereum. If this trend continues, it could potentially lead to significant market capitalization growth for Solana in the upcoming months. This is an exciting development for long-term investors!

Solana price prediction: Caution in the short-term

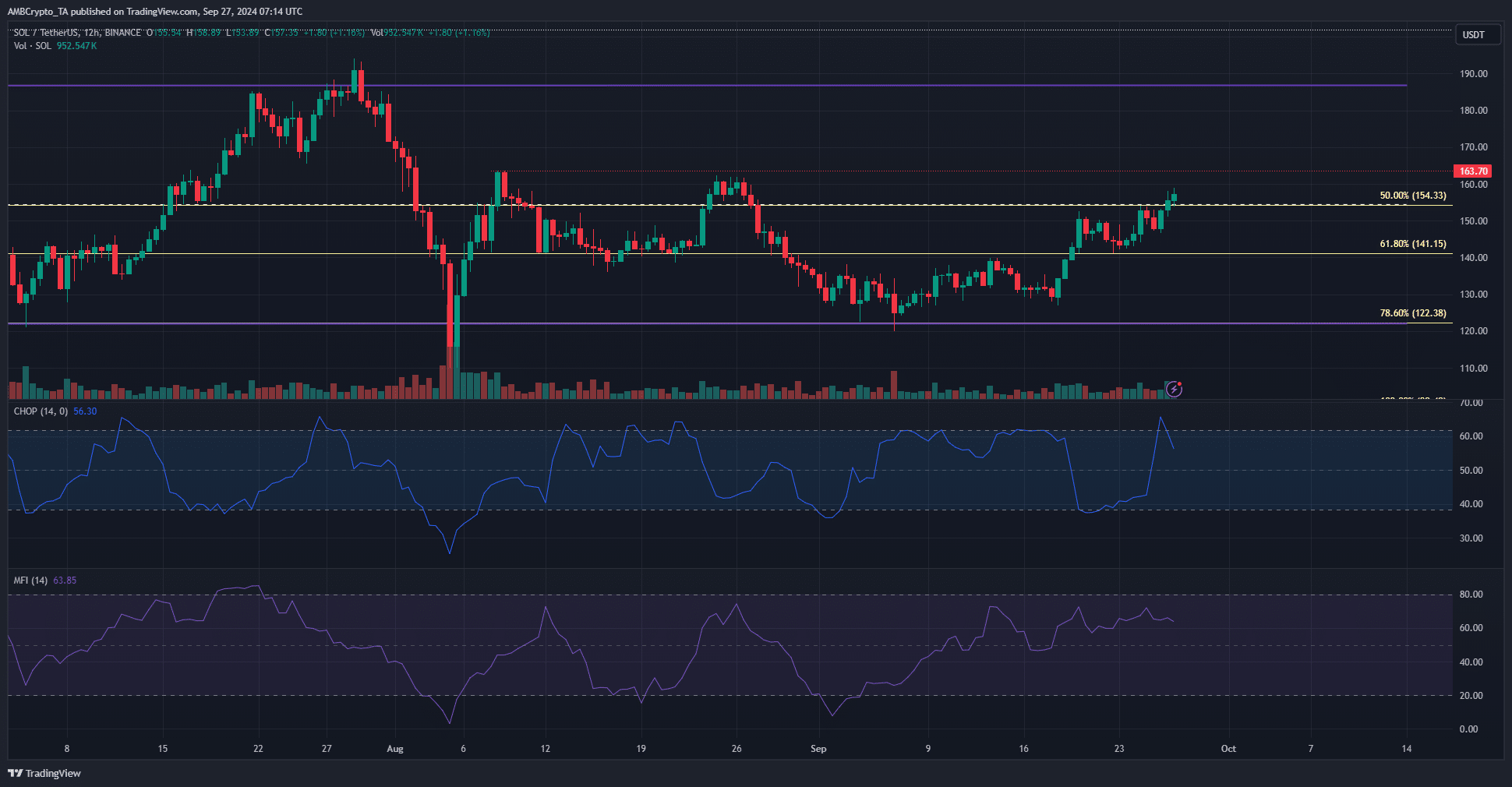

Previously mentioned, the significant level of $154 was crucial due to two reasons: firstly, it represented the middle point of the long-term price range, and secondly, it corresponded to the 50% point of the price recovery that occurred during the SOL surge in March.

Over the past three months, this level has been broken on three occasions. However, the two earlier surges were stopped by the $162 resistance barrier.

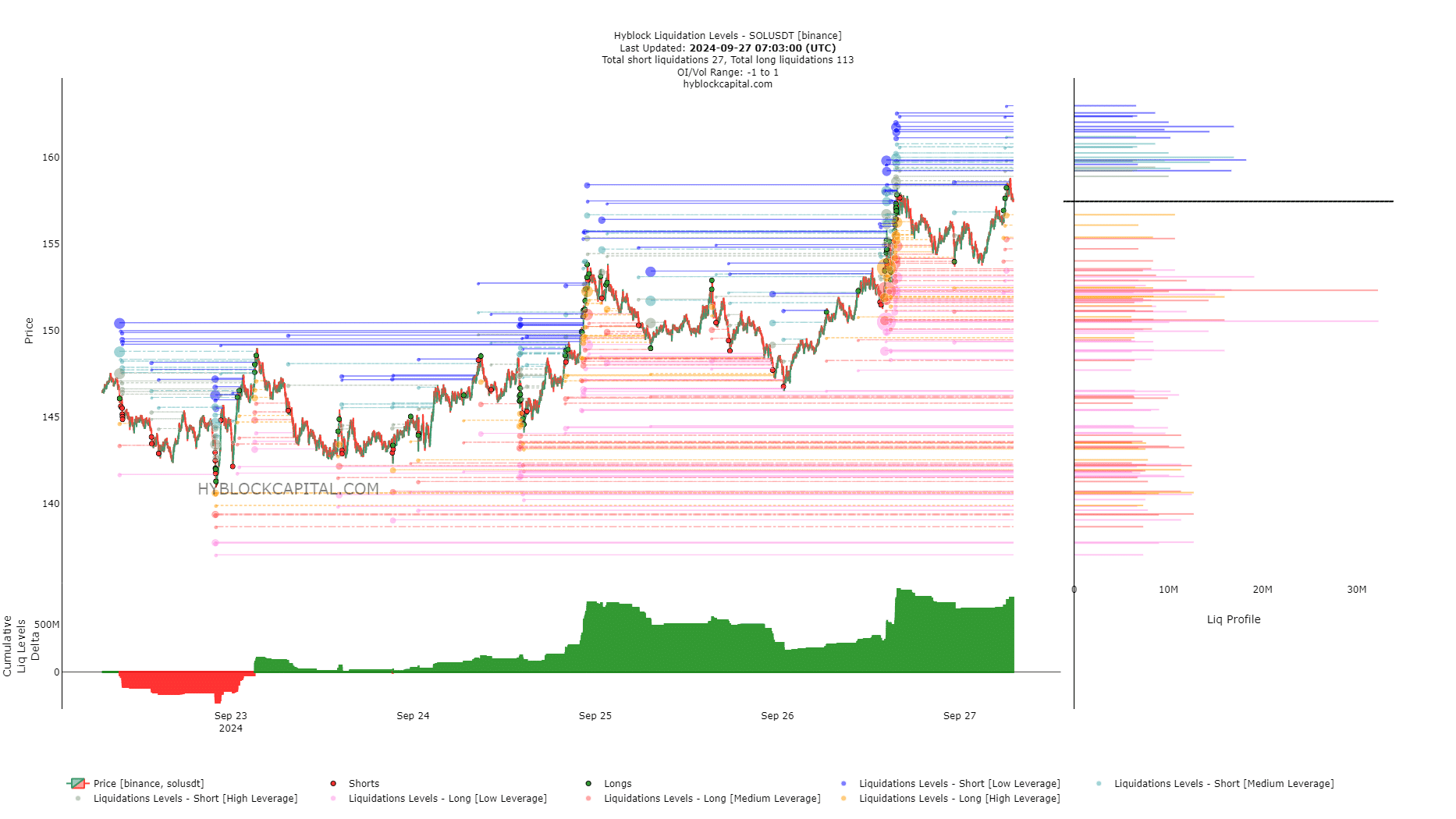

As someone who has been trading for over two decades and seen multiple market cycles, I believe there might be a potential risk of this move experiencing a similar outcome. With my past experiences, I’ve noticed that large liquidity pools around specific price levels can quickly disappear before a bearish reversal occurs. This pattern is something I’ve witnessed many times in the market, and it seems to be repeating itself with the current $162-$165 zone.

The momentum was bullish, but the MFI was unable to climb past 72 even though the price made new local highs. This could be an early warning of a price reversal.

Over the last three days, the choppiness index surged beyond 61.8, signifying turmoil for Solana as it failed to exceed the $154 mark. However, the index has started to decrease, suggesting that despite this drop, a substantial trend was not yet underway according to the indicator.

Buying was slow but consistent

The Open Interest remained near the month’s highs to indicate increased activity in the futures market. It is generally indicative of bullish short-term sentiment.

Last month’s September low point seems to have marked a pause for the ongoing decline in prices, with the market gradually ascending over the last week. The persistent sluggishness in demand might suggest that the price surge surpassing $162 may not occur swiftly.

Read Solana’s [SOL] Price Prediction 2024-25

In simpler terms, the overall liquidity level increase is causing a slight drop in price, similar to what we saw on Thursday. If this trend continues, potential support levels could be at $155 or even $152.

If the Solana price consistently falls below $146, it indicates a temporary bearish trend. However, the long-term forecast for Solana’s price remains optimistic when considering larger timeframes like the weekly one.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-27 16:07