- Solana’s market had a bearish bias on the daily timeframe, but might sustain its long-term bullish outlook

- Defense of a Fib level, combined with the liquidity hunts, implied an uptrend might be initiated again

As a seasoned crypto investor with experience in analyzing market trends and reading into technical indicators, I believe Solana’s [SOL] daily timeframe showed bearish signs but held its long-term bullish outlook. The defense of the Fib level at $135, combined with the liquidity hunts, implied an uptrend might be initiated once again.

Over the past week, Solana’s price decreased by 2.56%. Based on CoinMarketCap data, this placed Solana as the third-performing coin among the top ten in the market, excluding stablecoins. The optimistic outlook for SOL may stem from anticipation of a potential ETF approval and its potential growth following the U.S election results.

As an analyst, I’ve noticed a compelling point being made: Solana (SOL) stands out among altcoins with its relative strength. The majority of altcoins have suffered significant losses, often exceeding ten percent. In contrast, Solana has shown resilience. A recent report brought to light that Solana handles a substantial number of daily transactions compared to Ethereum (ETH).

Fibonacci levels have been resilient

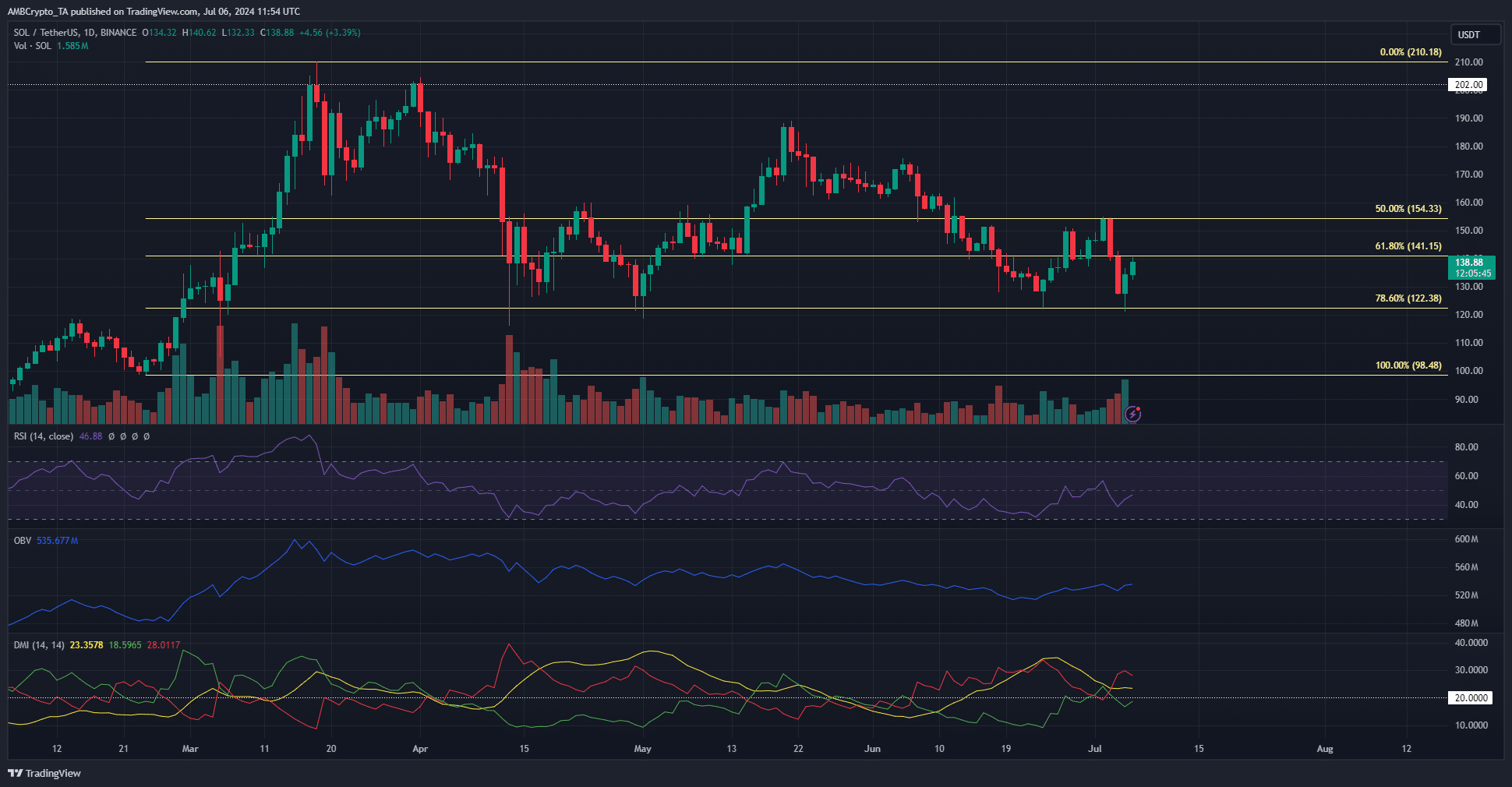

In February and March, the price of an asset surged from $98.48 to $210.18. Subsequently, Fibonacci retracement levels (indicated by the yellow lines) were drawn based on this price movement. Notably, the 78.6% level was tested for the fourth time since mid-April and successfully held.

Since March, the OBV (On-Balance Volume) indicator has been gradually moving downward, while the daily RSI (Relative Strength Index) has persisted below the 50-neutral mark since early June. These signals indicated that selling pressure and bearish momentum have been in control.

The DMI indicator exhibited a significant decrease in advance-decline progression. Specifically, the ADX line, represented by the yellow trace, and the -DI line, denoted by the red one, were both above the 20 threshold.

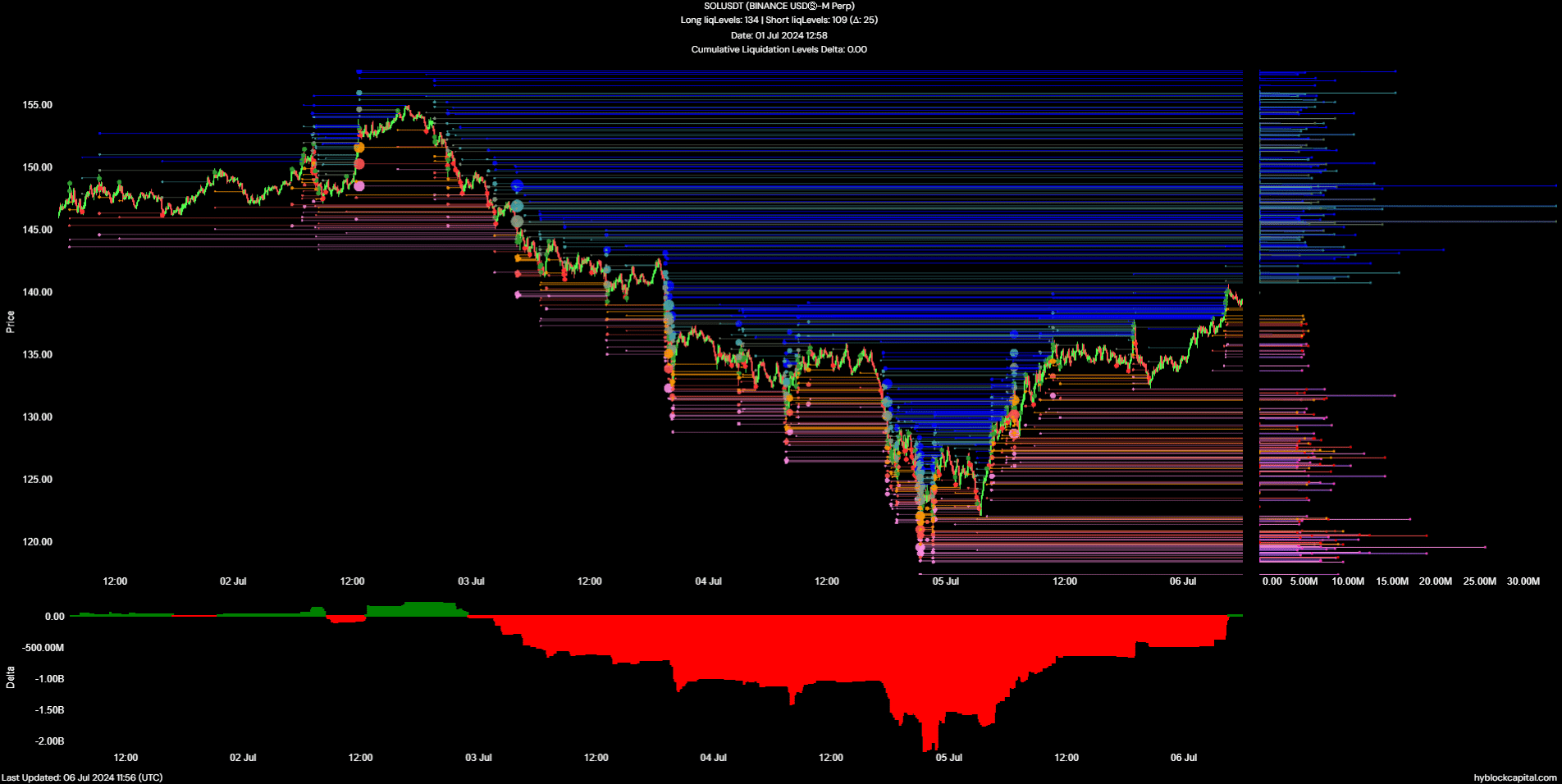

In the last week of June, CVD’s recovery from cardiovascular disease began to take shape. However, this progress was reversed during the recent market sell-off. Open Interest, which had shown some signs of improvement, took a hit as well. The past few hours have seen a modest rebound in both price and Open Interest among speculators – an indication that they are hesitant to make long positions but not completely disinterested.

In simpler terms, small-scale short sales were suddenly closed a few hours prior to the publication deadline, revealing $6.34 million worth of positions being liquidated at $137. This indicated that the short squeeze had been effective in the shorter timeframes, and the next potential resistance area was around $140-$143.

Clues for the next major price trend from liquidation data

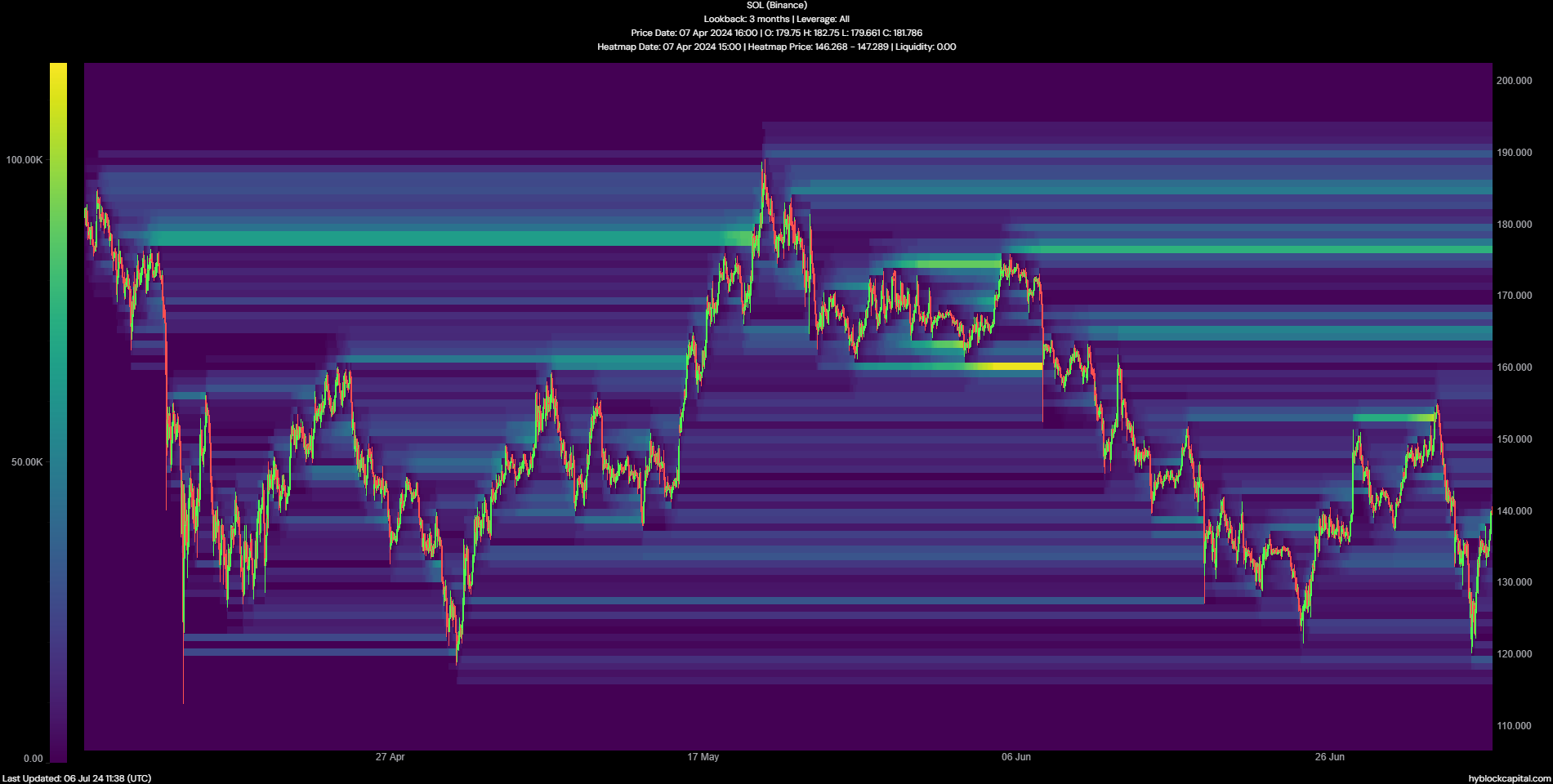

On July 2, Solana approached the liquidity group at a price of $152. Following this, its bullish trend unexpectedly shifted, reflecting how prices may contradict a trend in shorter timeframes and eliminate a liquidity pool before resuming the initial direction.

Ample pools of liquidity draw prices toward them. Notably, prices appeared to cluster around $164 and $175.

In the near future, the price rebound of Solana may have weakened. According to AMBCrypto’s assessment, the net difference in liquidation amounts was positive, indicating a higher number of long positions being closed compared to short ones.

Read Solana’s [SOL] Price Prediction 2024-25

As an analyst, I’ve been observing the market trends closely, and based on recent developments, I believe the short squeeze in Solana (SOL) might have come to an end. This realization strengthens my conviction that SOL could potentially pull back towards the $140-$143 zone’s southern boundary. In the grand scheme of things, it seems plausible for SOL to encounter resistance at this level and then consolidate around $135 for a few days.

Over the next few weeks, reaching $60,000 in Bitcoin (BTC) could instill confidence in buyers, potentially leading them to push the price upward toward $164 and $175.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-07-07 04:07