-

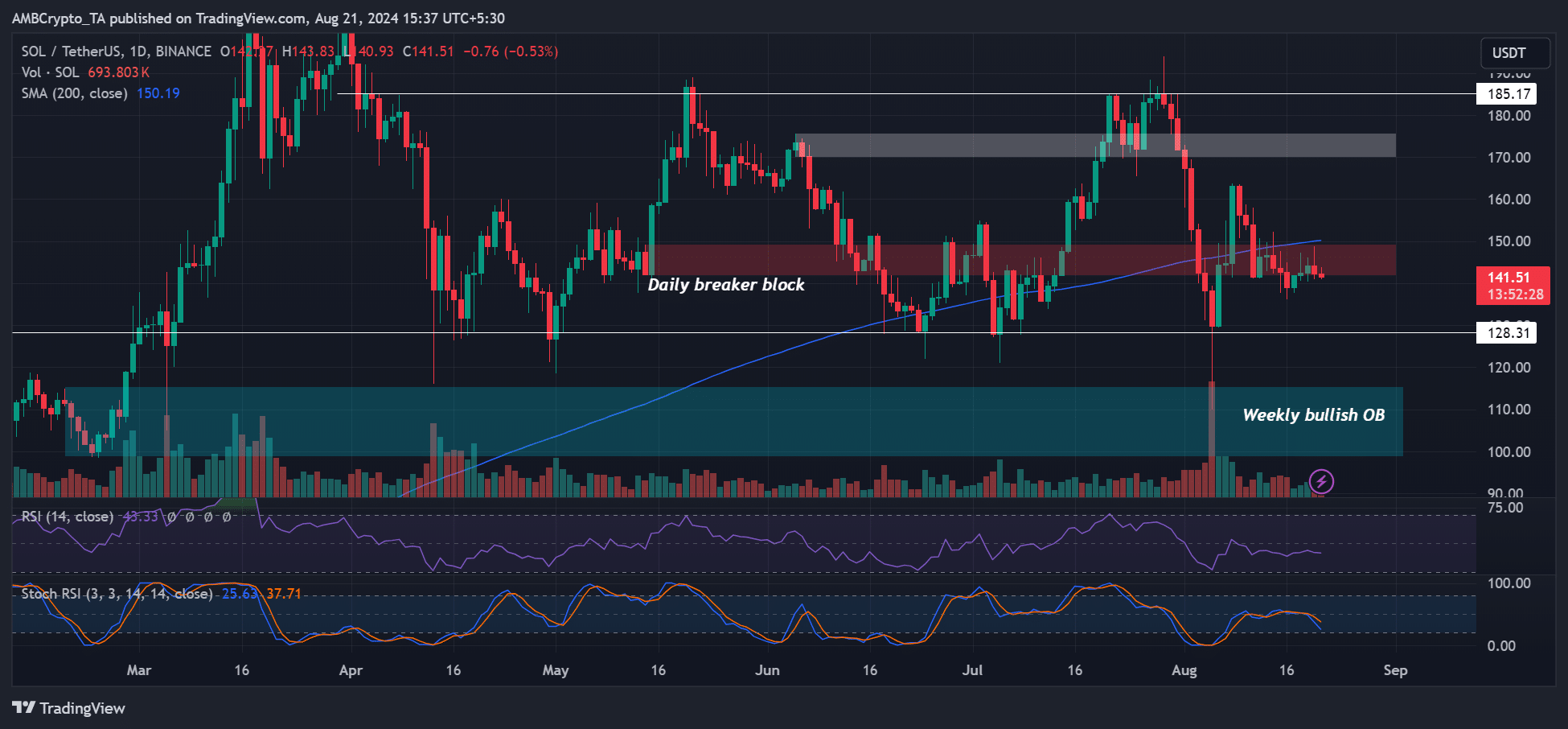

SOL has been consolidating below the 200-day Moving Average.

Whales have placed nearly $3.5M sell orders for SOL at $150 at the time of writing.

As a seasoned researcher with years of experience in the cryptosphere, I find myself constantly intrigued by the ebb and flow of digital assets. The current state of Solana (SOL) has piqued my interest, given its struggles below the 200-day Simple Moving Average (SMA).

Following the potential bear trap noticed in early August, the price of Solana’s [SOL] has stayed surprisingly steady. Despite numerous attempts, it hasn’t managed to surge past $150 and has instead been accumulating beneath this mark for more than a week.

The altcoin has remained bearish on the price charts, with the recent withdrawal of U.S. spot SOL ETF filings further denting sentiment.

Given that it’s one of the top darlings of this market cycle, what’s next for the altcoin?

SOL struggles below 200-day SMA

On the day-to-day graph, the price of SOL experienced significant short-term selling pressure around the $150 mark. It’s worth noting that the 200-day Simple Moving Average and a daily resistance barrier (indicated in red) coincided at the $150 level.

Put differently, the $150 was a crucial supply zone in the short-term.

Indeed, the value of SOL has consistently fallen beneath the significant confluence point for more than a week. As a result, the price level of $150 has proven crucial for realizing profits, particularly for long-term investors who have yet to realize their potential profits.

Put differently, sellers had market leverage on SOL at the time of writing.

Based on the RSI (Relative Strength Index) moving sideways below its usual levels, it’s clear that the supply side has an advantage due to the lack of significant demand, as suggested by the horizontal trend.

SOL: A short-seller’s paradise?

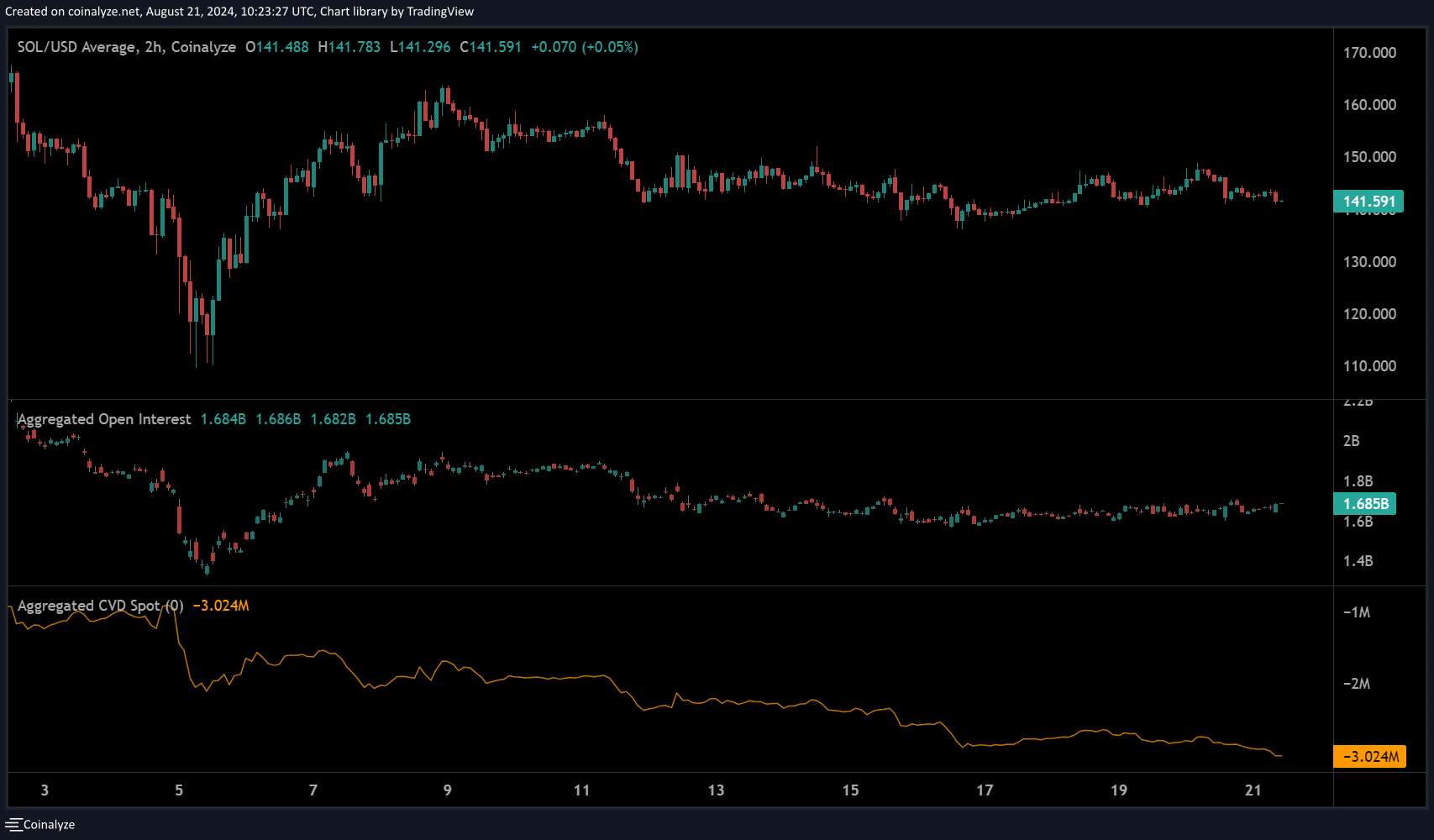

In August, the CVD (short for Cumulative Volume Delta) – a measure that follows the difference between trading volumes on various exchanges for buying and selling – experienced a decrease.

The decrease in SOL‘s value suggests it has experienced significant selling pressure from traders, creating an ideal situation for those who engage in short selling.

Over this period, I’ve noticed that the Open Interest (OI) levels of SOL, my perspective as an analyst, have remained stable. This could imply that the interest or demand for the altcoin within derivative markets has been relatively static during the recent days.

This also means a neutral market sentiment; as such, SOL’s price could go in either direction.

As a crypto investor, I find myself closely watching Solana (SOL). Regaining $60K by Bitcoin [BTC] is essential if we want SOL to surpass the immediate resistance level at around $150 in the near future.

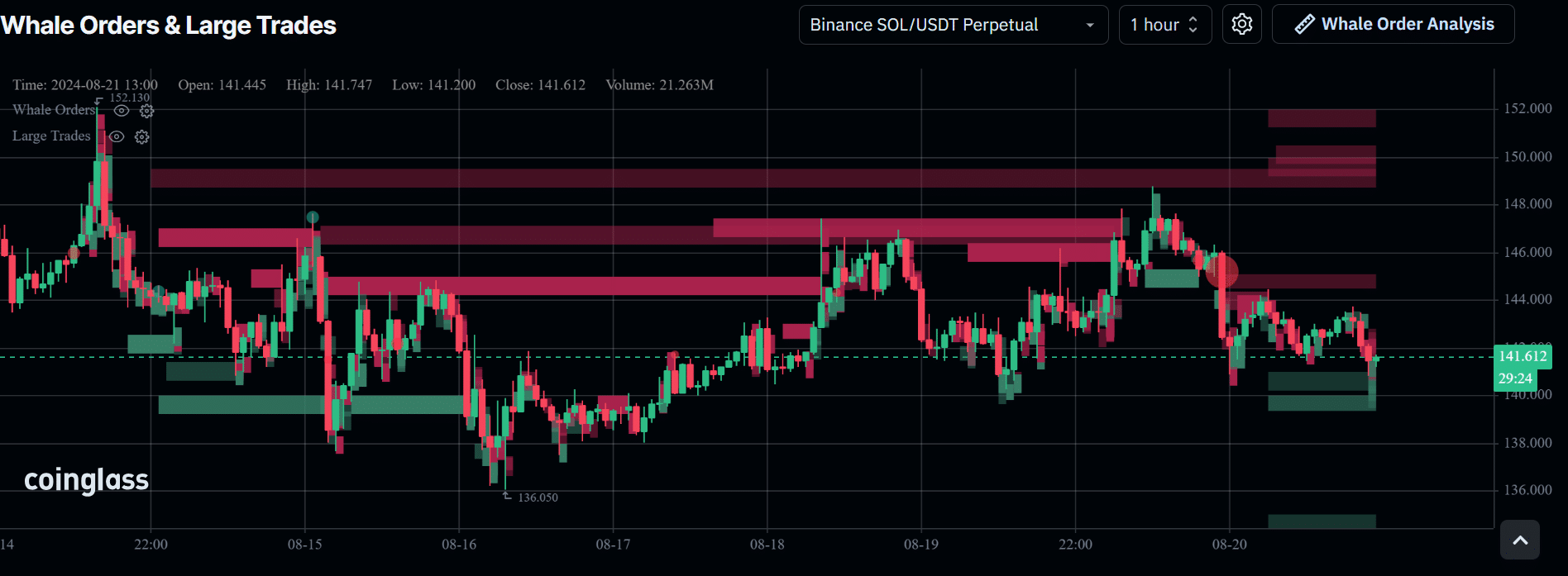

According to AMBCrypto’s assessment of Coinglass’s whale order examination, approximately $3.5 million worth of Solana (SOL) was put up for sale at a price of $150 within the past 24 hours, as indicated by the red-marked sale wall.

Read Solana’s [SOL] Price Prediction 2024-2025

Another sell order was placed at $152, reinforcing that the 200-day SMA was a massive supply zone.

As a crypto investor, I noticed a substantial buy order worth $1M for Solana (SOL) transacted at around the $139-$140 range. This indicates that SOL’s price may be confined within the range of $140 to $150 in the near future, giving us a potential short-term price outlook.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-08-22 03:04