- Solana’s social dominance hit record levels amid its whale distribution phase

- At press time, its technical setup suggested strong resistance at $205 with significant liquidation events

As a seasoned crypto investor who has weathered through several bull and bear markets, I find Solana’s current market position quite intriguing. The altcoin’s record-breaking social dominance and strategic whale distribution phase are reminiscent of the early days of Bitcoin, which often signals significant price action ahead.

Currently, Solana’s (SOL) community is experiencing unprecedented social interaction, which signifies a notable change in market trends.

Interestingly, the latest findings by Santiment show that the altcoin is currently trending second on social media platforms – an indication of increased investor attention and possible future price fluctuations.

Solana market structure and whale behavior

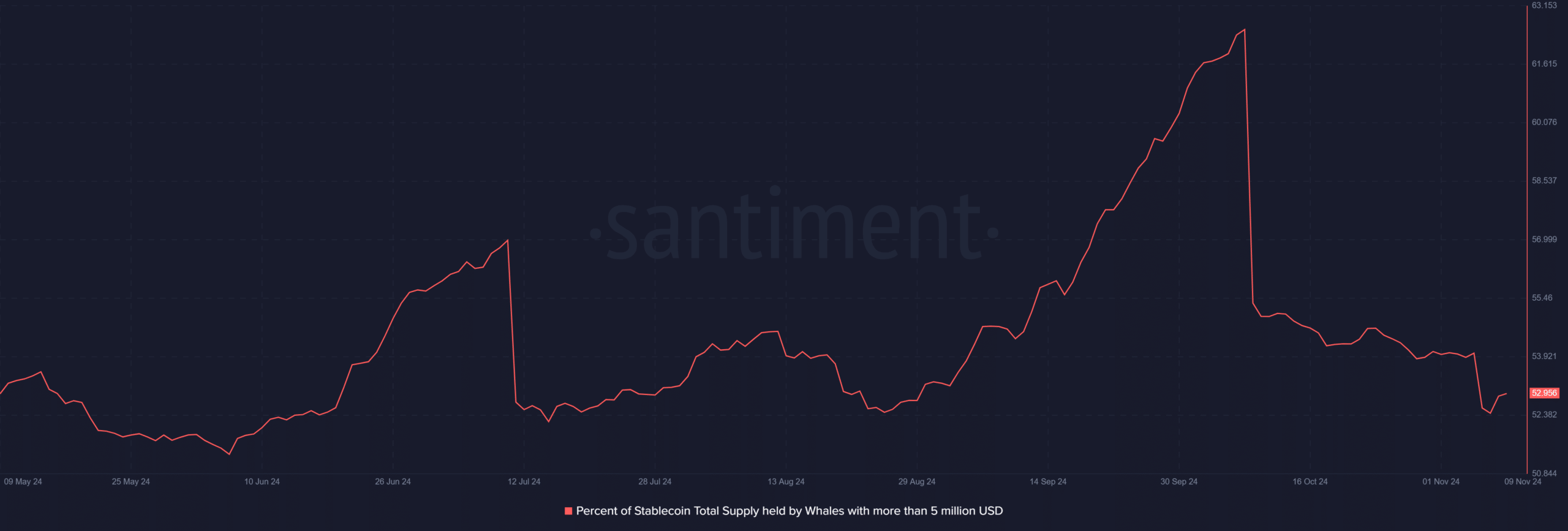

Additionally, it’s worth noting that changes in SOL’s whale holdings also shed light on some intriguing market trends. In other words, the significant decrease in the size of positions held by major SOL investors since their peak on October 8th offers insights into the market’s behavior.

During this stage of SOL’s distribution, it didn’t indicate weakness but instead aligned with increased market involvement and a surge in retail demand.

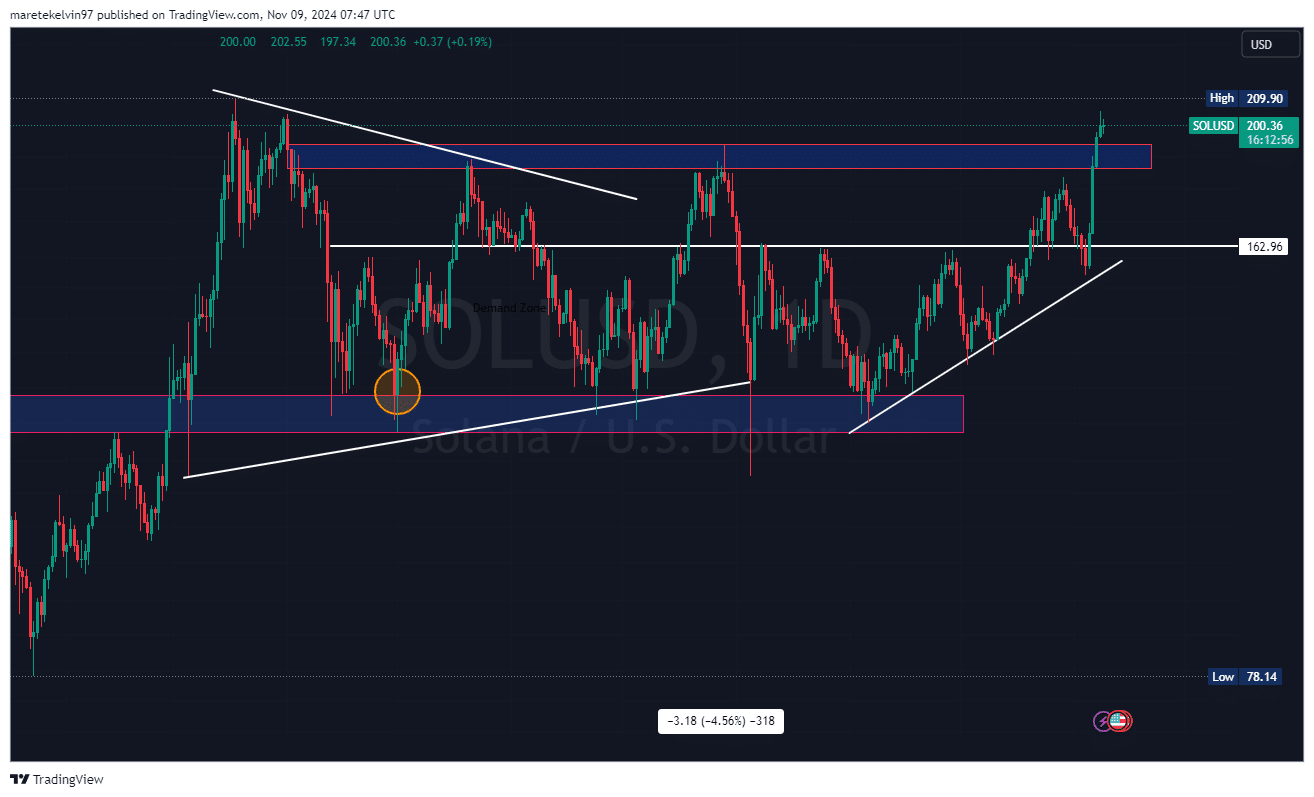

Furthermore, the daily chart displayed a strong bullish pattern, where the $205 level seems to be the last hurdle before further gains.

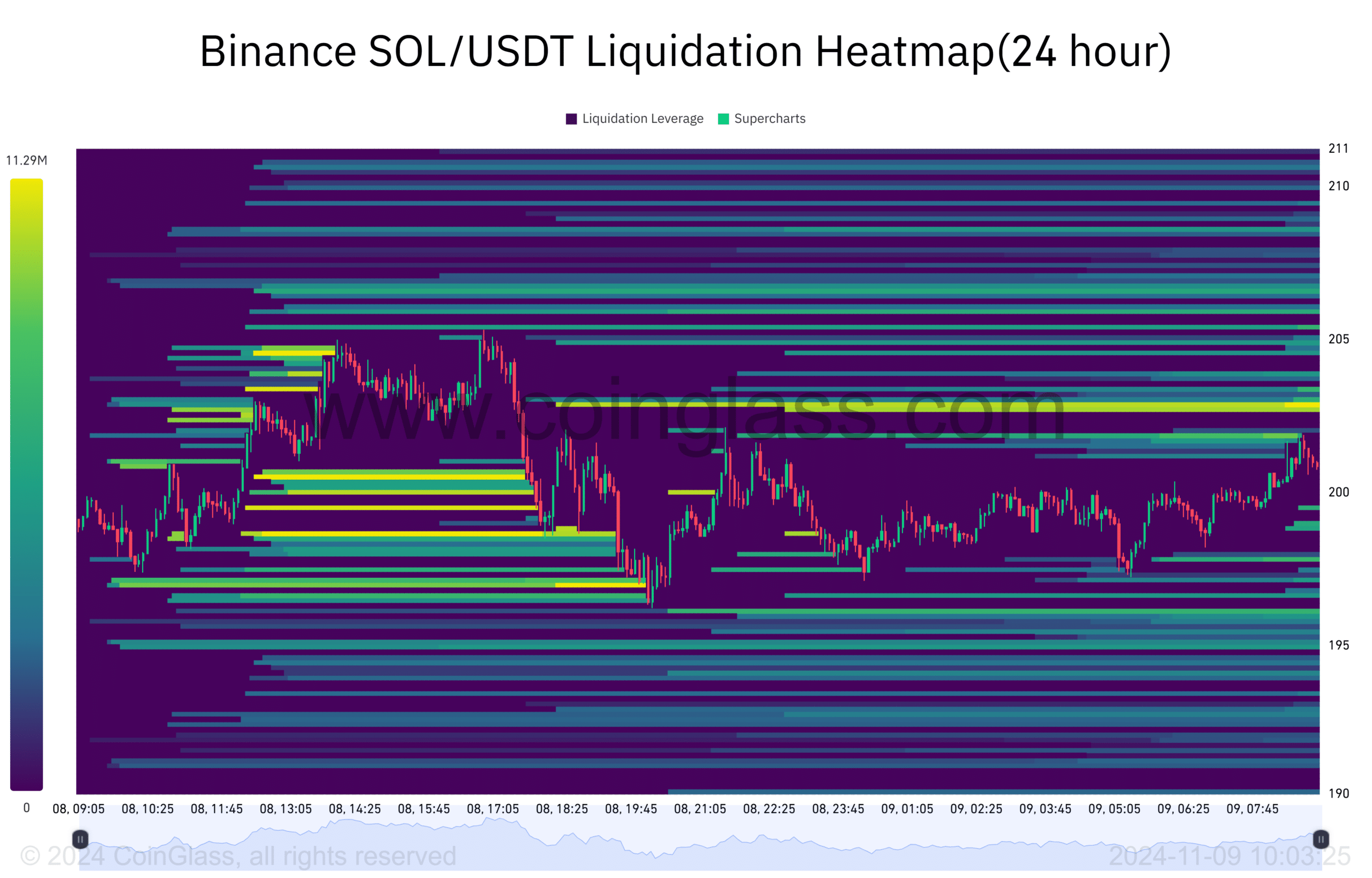

In simpler terms, this technical pattern, along with a liquidation heatmap suggesting more than $12 million in possible sell-offs between $203 and $205, indicates a crucial price area. This area might trigger a strong upward market trend, potentially leading to a substantial bullish surge.

Social metrics and volume analysis

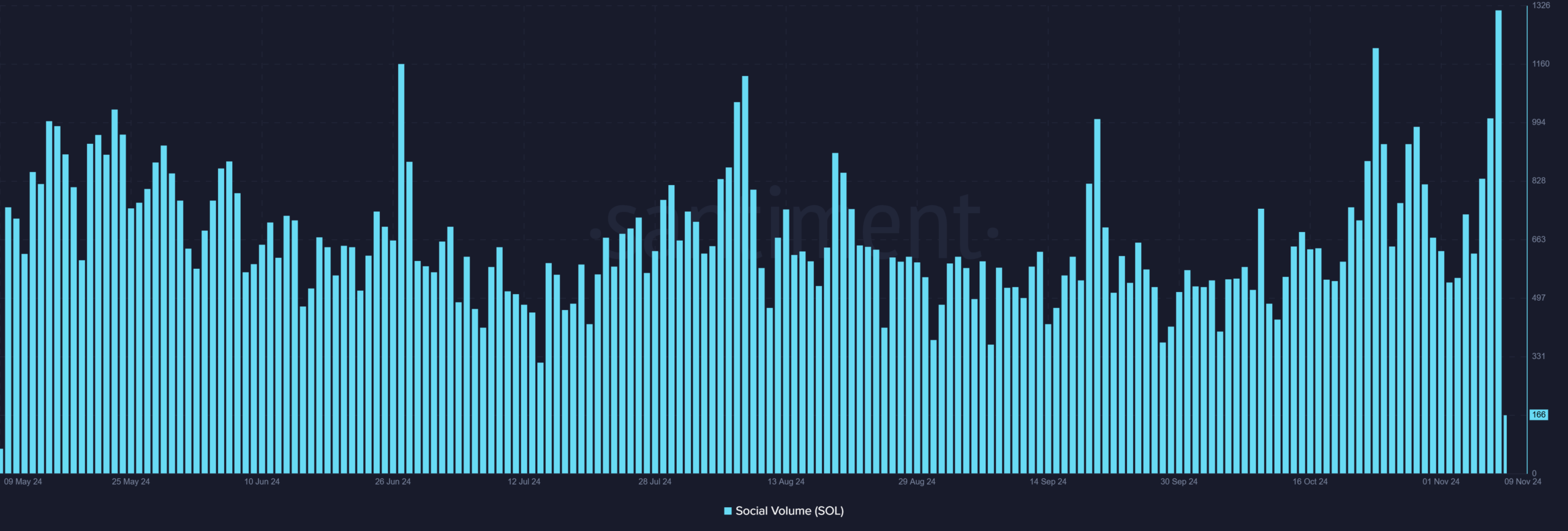

Additionally, it’s noteworthy that the relationship between social activity and price fluctuations told a persuasive story.

Solana’s social interaction indicators reached unprecedented peaks, potentially signaling significant shifts in the value of alternative coins within the market.

The recent increase in its social media activity appears distinct from past peaks as it exhibits steady progression instead of abrupt surges. This sustained growth could encourage investors to invest more in this altcoin, boosting their confidence.

Technical outlook and market sentiment

Ultimately, at the current moment, Solana’s market structure suggests a robust upward trendline support at approximately $156. This could potentially serve as a sturdy base for an upcoming bullish price increase.

The liquidation heatmap’s data also revealed a concentrated zone of positions, one that could fuel a breakout if the $205 resistance is breached.

What’s next for Solana?

Even though some social signals and technological signs suggested a possibly optimistic outlook, the market continues to be influenced by larger cryptocurrency movements. The dispersal of large investor holdings leads to a broader distribution of ownership, which may lessen the effect of a single entity on the market.

Consequently, the combination of strong social interaction, well-planned whale distribution, and evident technical milestones creates a distinctive market configuration.

As a researcher, I’m exploring whether this particular combination could propel Solana to unprecedented peaks. The key factors seem to be preserving our current trajectory and effectively transitioning the $205 level from a resistance point to a support one.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-11-09 19:03