-

Indicators suggested that SOL looks almost certain to hit $334 for a start.

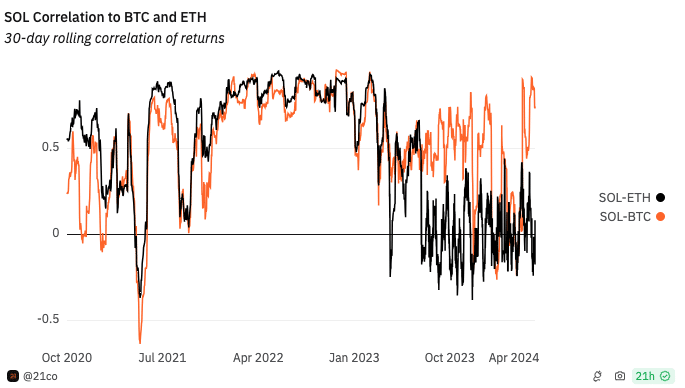

The token’s correlation with ETH was negative, but with BTC, it was strong.

As a researcher with experience in cryptocurrency analysis, I believe Solana (SOL) is showing some interesting indicators that suggest potential price growth. However, the recent underperformance of SOL’s price action has not deterred bulls from predicting significant gains in the future.

Over the past week, Solana’s [SOL] price had a hard time surging significantly, with the coin priced at $167.12 according to recent market data from CoinMarketCap.

As a crypto investor, I’d put it this way: The price level I saw on the 25th of May was roughly similar to what it is now. Looking at the Year-To-Date (YTD) growth, Solana (SOL) has surged by an impressive 52.63%. Yet, this pales in comparison to its remarkable gains in 2023.

Despite the lackluster performance of Solana’s price lately, many optimistic investors remain confident in its potential for significant growth. In fact, they believe the price could reach as high as $500 during this market cycle for those holding the cryptocurrency.

SOL needs Bitcoin, not ETH

This collection of data indicated that Solana would exceed its previous peak of $260 during the initial quarter of 2024. Nevertheless, it fell short of this mark with the closest approach being a price of $210 attained in March.

In examining Solana’s predicted price, AMBCrypto took a closer look from an on-chain standpoint. Initially, we considered the relationship between Solana’s price movement and that of Bitcoin (BTC). Following this, we assessed the correlation with Ethereum (ETH) as well.

As a data analyst, I’ve examined the price trends of Solana (SOL) and Bitcoin (BTC) based on information from Dune Analytics. The correlation coefficient between these two cryptocurrencies was calculated to be 0.83. This figure signifies that their price movements generally align, implying that when Bitcoin’s price rises, Solana’s tends to do the same and vice versa.

For ETH, the reading was 0.10, suggesting a divergence between both cryptocurrencies. As such, if SOL were to hit $500 in the near time, BTC would have to increase past its all-time high.

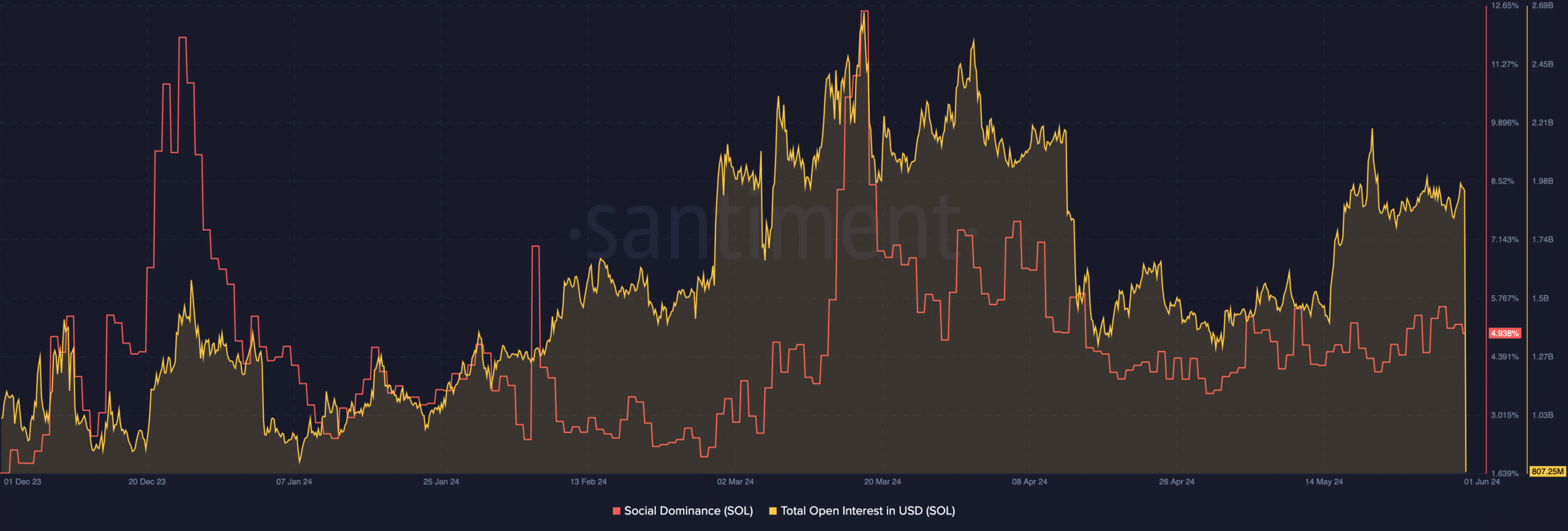

One method AMBCrypto employed to analyze the significance of a token was by examining its social dominance. Social dominance signifies the proportionate amount of conversation surrounding a particular token relative to other cryptocurrencies ranking among the top 100.

Has a good entry surfaced?

As a Solana investor, I’ve been keeping an eye on social dominance metrics provided by Santiment. Recently, I noticed that Solana’s social dominance stood at 4.938%. This figure appears lower when compared to the peak levels observed in March.

In historical terms, a low social standing for a particular token might represent a worthwhile investment chance. The reason being, when dialogue about the token lessens, it typically hasn’t reached a peak in demand yet.

From my perspective as an analyst, purchasing Solana (SOL) between the prices of $161 and $168 might be an optimal entry point, considering the potential for another rally. This view is bolstered by the Open Interest (OI) data.

The OI, or Open Interest, of a token fluctuates depending on the overall market positioning. A rise in OI indicates that investors are buying more contracts associated with the token than they’re closing. Consequently, funds are being allocated to these contracts.

Alternatively, a reduction in open interest indicates that liquidity is being withdrawn from the market. The open interest for SOL stood at $807.25 million as of the latest update.

Regarding the price drop, Solana approaching the $161 support level suggests a potential further decline. Yet, it doesn’t mean that increased open contracts won’t resurface once more.

As a crypto investor, if Solana’s open interest (OI) surpasses $2 billion once more, as it did a few months ago, I believe we could witness a potential price increase of up to 100%. Consequently, the token’s target price might reach approximately $334 within the following months.

Data says “enough buying power”

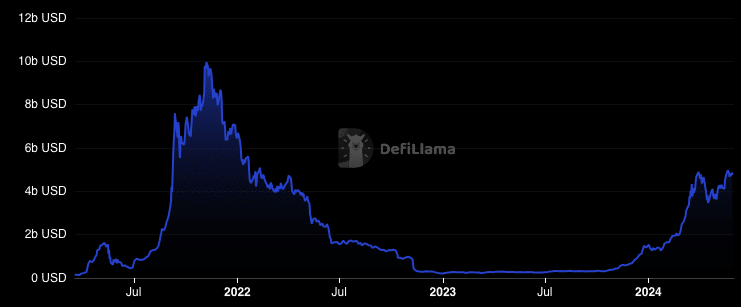

Apart from the mentioned indicators, AMBCrypto examined Solana’s Total Value Locked (TVL) as well. This metric signifies the amount of assets that market players have locked or staked within a specific protocol, indicating a decrease in available capital.

As an analyst, I would interpret an uptick in the metric as a sign of a thriving network and heightened confidence among participants in the project’s potential for profitable returns. Conversely, a decline suggests that more assets are being withdrawn from the network.

According to DeFiLlama’s latest figures, Solana’s total value locked (TVL) stood at approximately $4.8 billion. Marking a notable surge of 20.27% within the past month. However, the last week has shown some volatility as there were reports of SOL tokens being unstaked.

Despite the recent decrease in total value locked (TVL), the chain’s TVL has the potential to reach $8 billion given the heightened activity on the network compared to other projects.

As a crypto investor in Solana (SOL), I’m excitedly observing potential developments that could significantly boost the demand for SOL. Should certain events unfold, the price of SOL might reach or even surpass the $500 mark due to increased interest and adoption. Moreover, intriguing data from Dune reveals a steady expansion in the circulating supply of stablecoins on Solana’s network.

Realistic or not, here’s SOL’s market cap in ETH terms

Stablecoins like USDT, USDC, and the recently added PYUSD have been contributing to this hike.

As an analyst, I would interpret this observation as follows: My analysis indicates that the surge in transactions on the Solana blockchain signifies that holders of addresses on the network possessed sufficient purchasing power to drive up the value of SOL.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-06-01 16:08