- Solana was rejected twice at the $190 resistance level.

- Metrics indicated mixed signals.

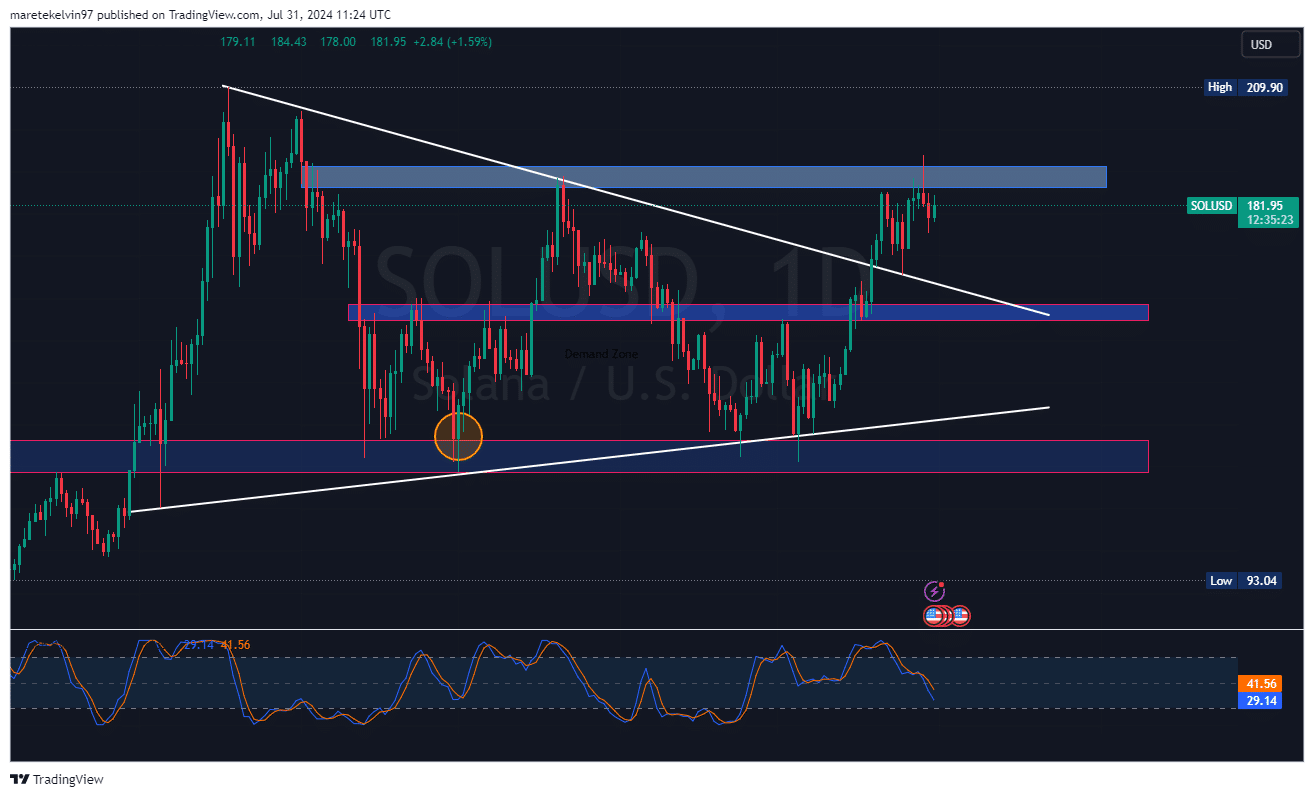

As a seasoned crypto investor with scars and victories etched into my trading journey, I find myself standing at a crossroads with Solana [SOL]. The $190 resistance level has proven to be an immovable fortress for SOL, rejecting it twice this week. This is not just a technical hurdle but also a psychological one, as the fear of another rejection looms large.

The digital currency Solana (SOL) is generating a lot of buzz within the cryptocurrency market. However, recent fluctuations near the $190 level have left traders feeling quite anxious.

190 dollars is seen as a significant hurdle for Solana. It hasn’t been able to surpass this level on two occasions this week. Could the third attempt prove fortunate for buyers aiming to create momentum?

Whenever the price approaches that particular zone, sellers tend to get more active, causing it to drop again. This level holds importance not just technically but psychologically too, as shown by repeated refusals, suggesting consistent resistance.

The $190 resistance level has proven to be a tough barrier.

What the metrics have in store

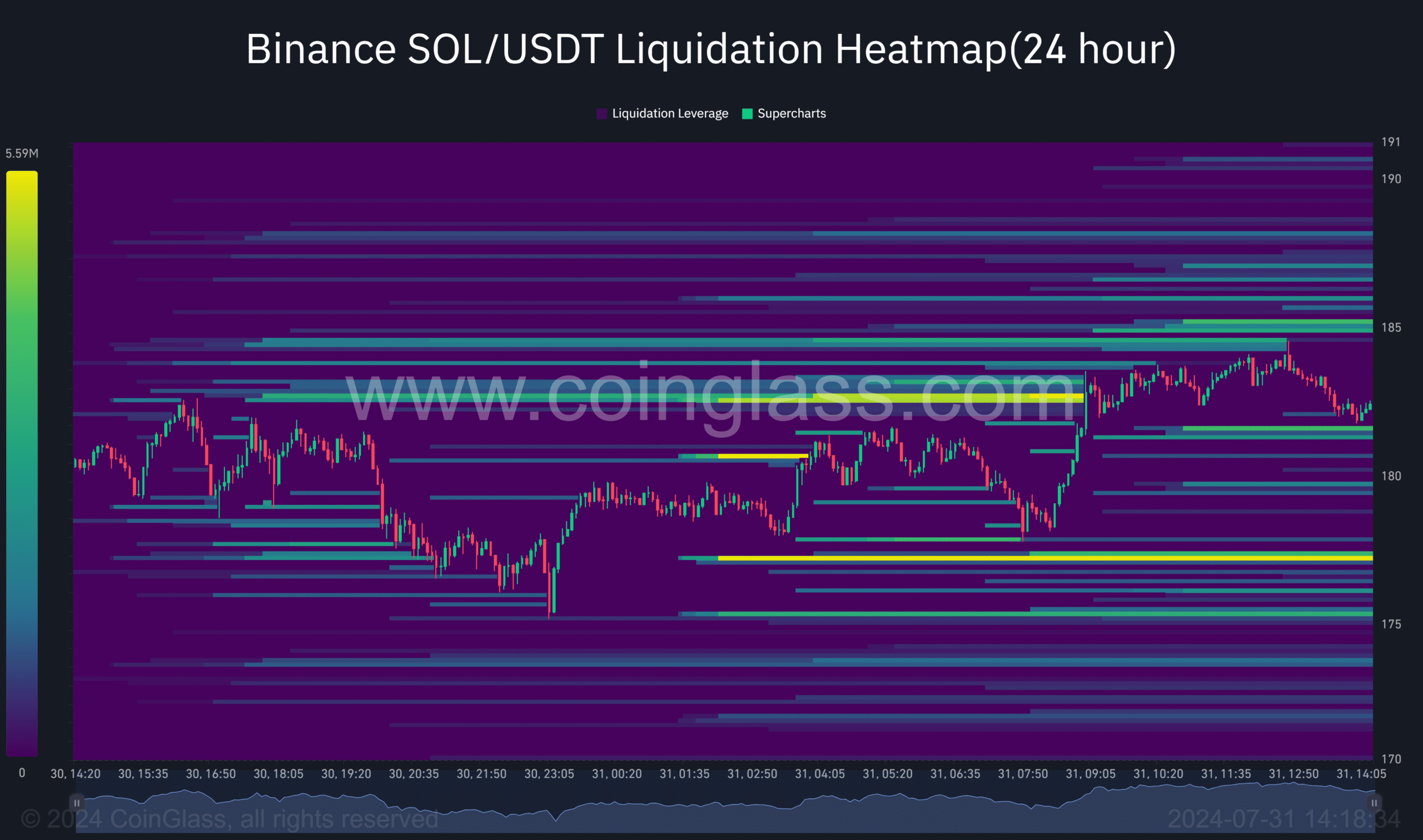

AMBCrypto analyzed Coinglass’ liquidation heatmap data.

Examining the data reveals significant opportunity for liquidation, approaching around $190, which might increase market volatility because it could trigger the closing of these positions.

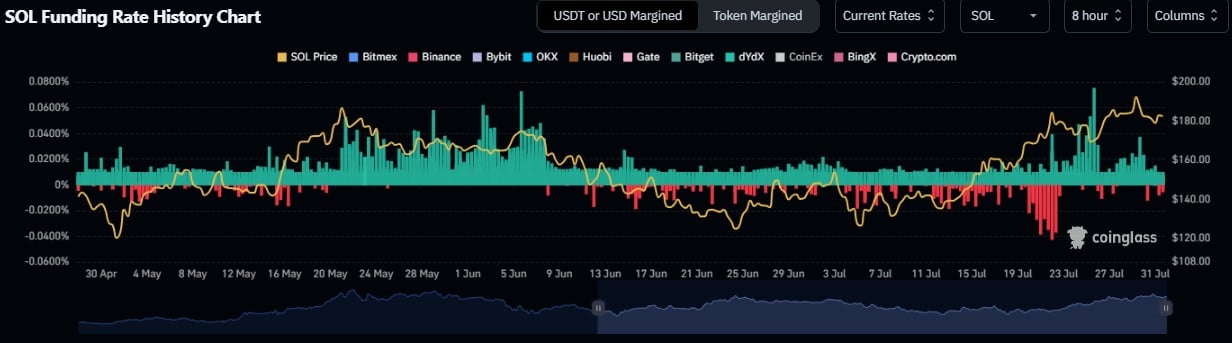

At the same time, the Funding Rate painted a mixture of sentiments in the market.

Although certain trading platforms exhibit favorable Lending Rates, other platforms show unfavorable ones, suggesting a sense of apprehension or doubt among Solana’s investor community.

In analyzing Solana’s price chart using data from Coinglass, AMBCrypto found a notable surge in the Long/Short ratio.

Based on my years of experience in trading and observing market trends, I believe that the recent movement in Solana suggests a shift towards bullish control in the short term. If the current momentum can successfully push through the resistance level, it could potentially change the overall tone of the market to a more optimistic one. However, as with any investment, caution is always advised and careful analysis should be conducted before making any decisions. My personal experience has taught me that markets can be unpredictable, so while I am encouraged by this development, I remain cautiously optimistic.

The path ahead for Solana

The crypto community waits eagerly as Solana nears the $190 resistance level for the third time.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Based on AMBCrypto’s assessment, there have been various signals in Solana that appear contradictory. However, a strong bullish energy was building up when this analysis was penned down.

As optimism grew among investors (bullish momentum), some conflicting signs from different markers might lead to an unpredictable final result.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-08-01 06:15