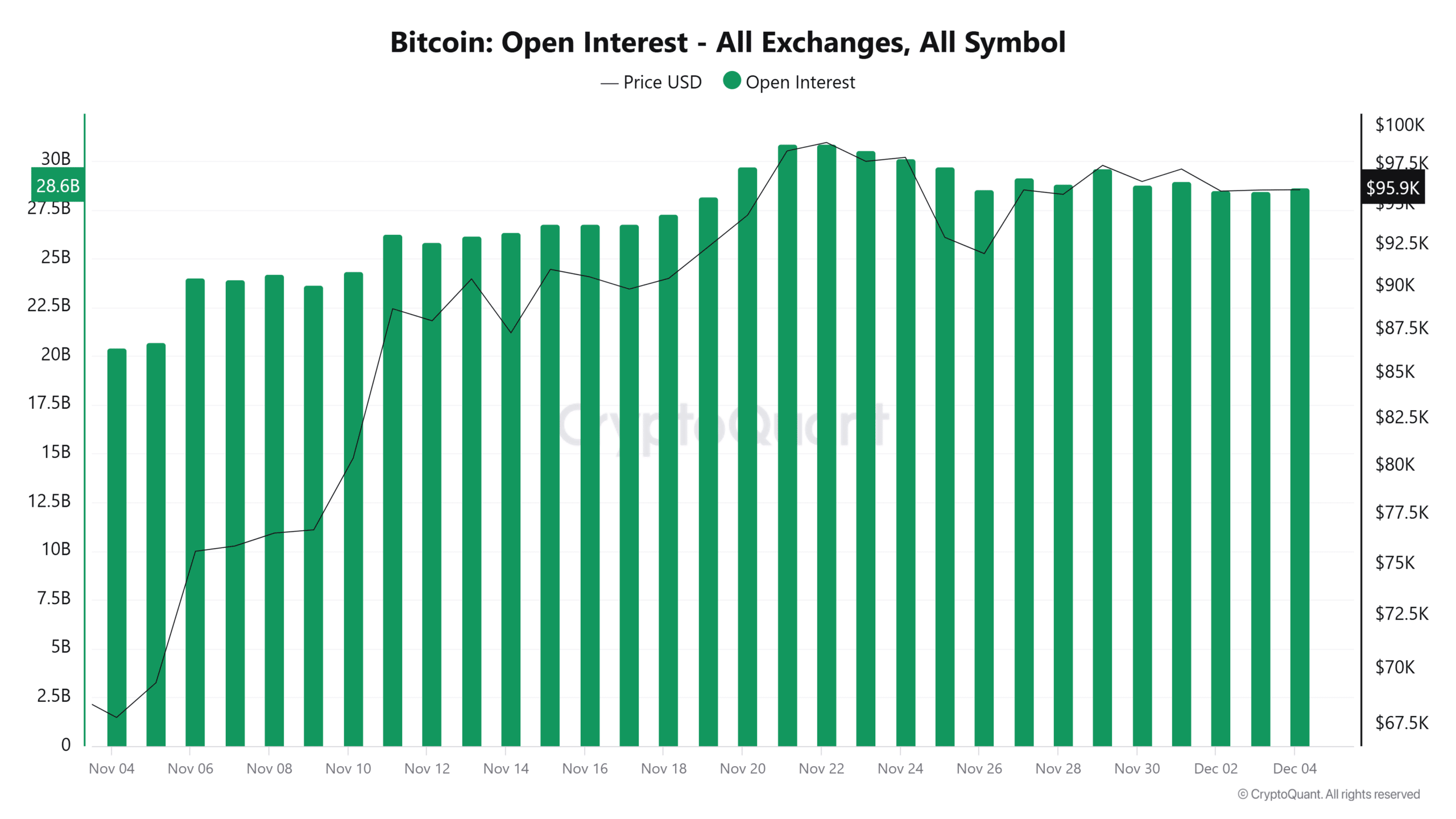

- Solana’s Open Interest hit an all-time high in November.

- SOL surged over 10% in two days, yet bearish pressure from shorts dominates with a 52% share.

As a seasoned crypto investor with battle scars from countless market cycles, I find myself intrigued by Solana’s [SOL] latest moves. The Open Interest hitting an all-time high is always music to my ears as it suggests heightened trading activity and potential for significant price swings.

The global trading community is increasingly drawn towards the rapidly expanding derivatives market associated with Solana’s [SOL], reflecting a growing interest. The Open Interest (OI) in this market has skyrocketed to unparalleled heights, as the struggle between bullish and bearish investors becomes more intense.

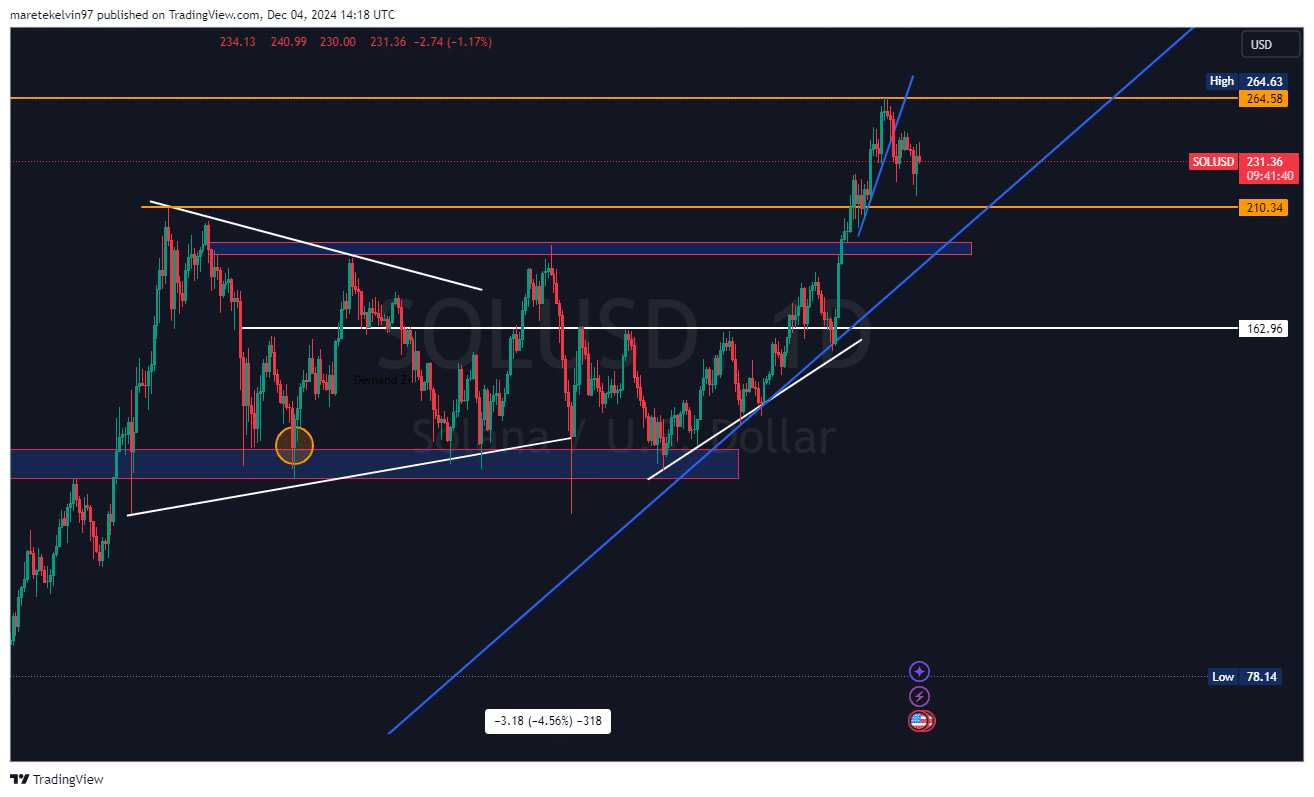

Following its abrupt rebound from a crucial resistance point, we’re left wondering if Solana can maintain this upward trajectory and reach $264, or if pessimistic market feelings might cause it to pull back instead.

Open interest signals high market activity

As a crypto investor, I’ve noticed an impressive spike in the derivatives market of Solana last November, reaching unprecedented open interest heights. Such a rise suggests a surge in trading activities, potentially hinting at substantial price fluctuations ahead.

Additionally, the rise in OI reflects growing trader confidence in Solana’s market movements.

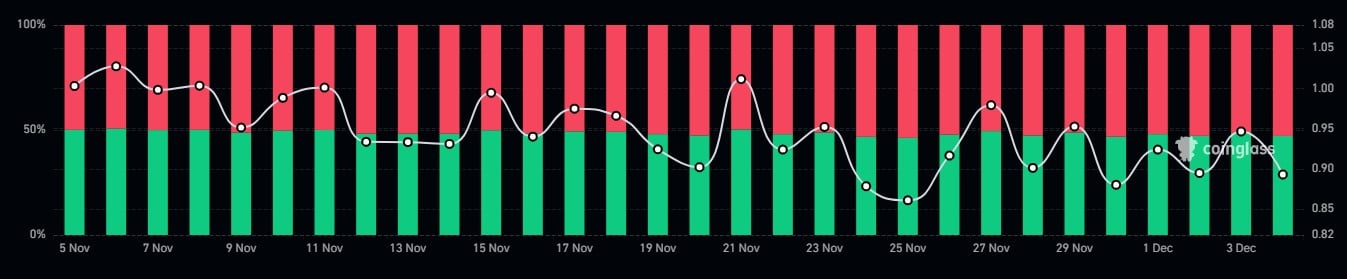

Funding rate hints at market sentiment

Despite the rally, SOL’s funding rates tell a different story. The chart showed periods of both positive and negative funding rates, indicating that uncertainty persists.

At present, there are more negative funding rates compared to positive ones, which might lead to a significant shift in prices as traders reposition themselves according to market conditions.

SOL shorts dominate despite recovery

As I compose this text, the Long/Short Ratio for SOL is 0.89, which suggests a predominant bearish trend. A significant 52% of the market is currently in short positions, suggesting doubts about the continuation of bullish momentum.

Nevertheless, the swift 10% recovery of SOL within just 48 hours seems to dispel any lingering doubts, indicating that buyers are actively entering the market at strategic points.

SOL’s strong recovery from the key support level

Initially, Solana experienced a sudden turnaround at a significant support area, leading to a rapid surge in price. This trend goes against the general expectation of a sell-off, indicating substantial confidence among buyers.

Maintaining the current pace might lead SOL to surpass significant and technical hurdles near $240, potentially paving the way for further growth towards approximately $264.

Read Solana’s [SOL] Price Prediction 2024–2025

The combination of OI and dominant short positions creates a setup for increased volatility.

If purchasing activity persists and short sellers start closing their positions, there might be an upward trend approaching $264.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-12-05 13:11