-

Solana reached a major milestone as the top DEX by volume, with meme tokens leading buys.

A new trend in SOL memes could further strengthen their dominance.

As a seasoned crypto investor with a knack for spotting trends and a penchant for memecoins, I’ve witnessed the meteoric rise of Solana [SOL] firsthand. The latest surge in SOL’s price and its emergence as the top DEX by volume is nothing short of impressive. The fact that meme tokens are driving this growth is a testament to the power of community and the resilience of the crypto market.

During the beginning of the second week of September, Solana (SOL) experienced a 8% jump, currently trading at approximately $135 per token. This rise may be attributed to an uptick in prominent holder positions for various meme tokens, boosted by its robust community of memecoin enthusiasts.

It’s worth noting that three well-known meme coins have caught the eye of big investors recently. Could this trend indicate a possible surge in prices for SOL as well?

Solana leads the way in DEX volume

Recently, Solana has surpassed its rivals, taking the top spot as the blockchain with the highest volume in decentralized exchanges.

In the first part of this year, Solana surpassed both BNB and Base, and currently maintains a significant lead with approximately 378% more volume, totaling $3.2 million against Base’s $670K. What’s more, Solana is the sole blockchain platform that has a Decentralized Exchange (DEX) trader count higher than one million.

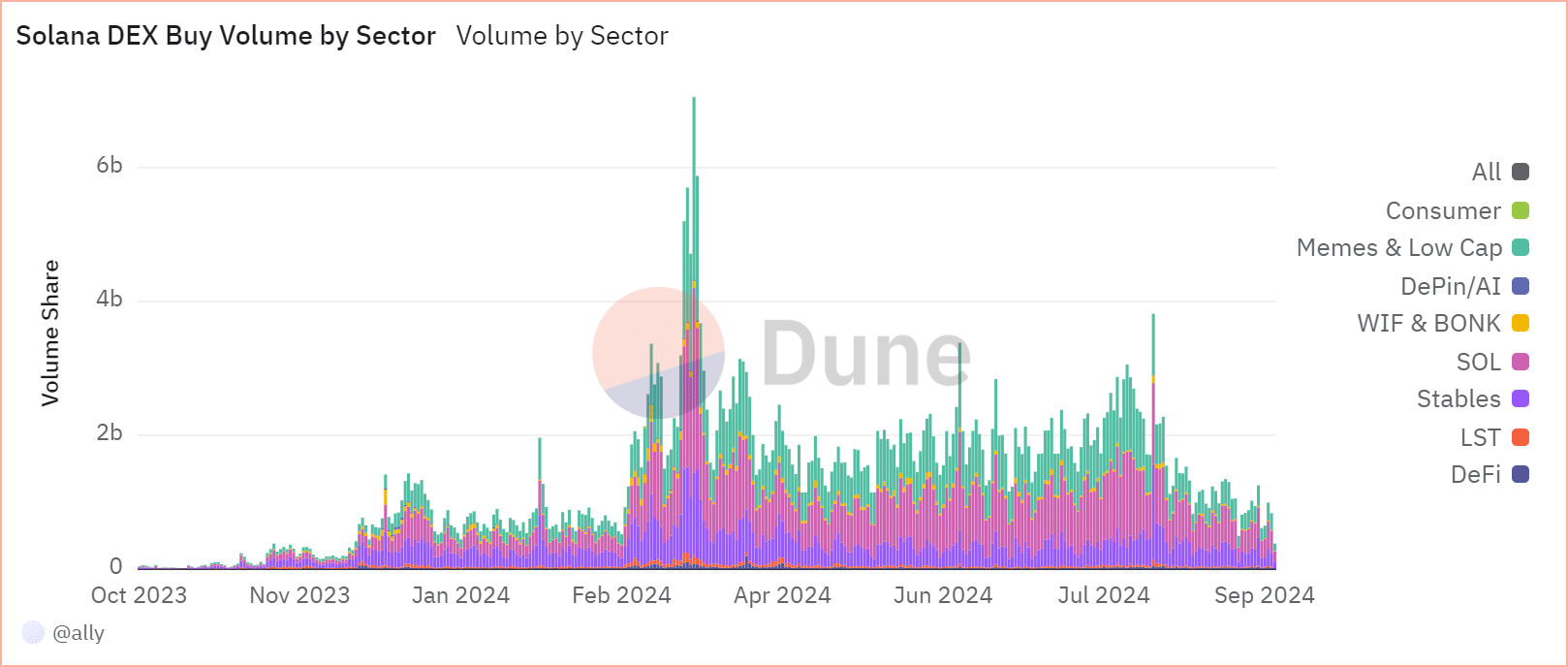

As shown on the accompanying graph, there’s been a significant increase in the purchase volume of memes and low-cap tokens, reaching an impressive $2 billion around mid-March. Notably, this spike occurred during a bull run that propelled SOL prices beyond the $200 level.

Source : Dune

Since that time, the purchase volume has decreased by around 94%, down to $110 million. However, the influence or supremacy of these tokens remains unchanged.

Simply put, memecoins serve as a protective measure for SOL by counterbalancing the fluctuation of Bitcoin‘s value, thereby drawing in both seasoned and novice investors.

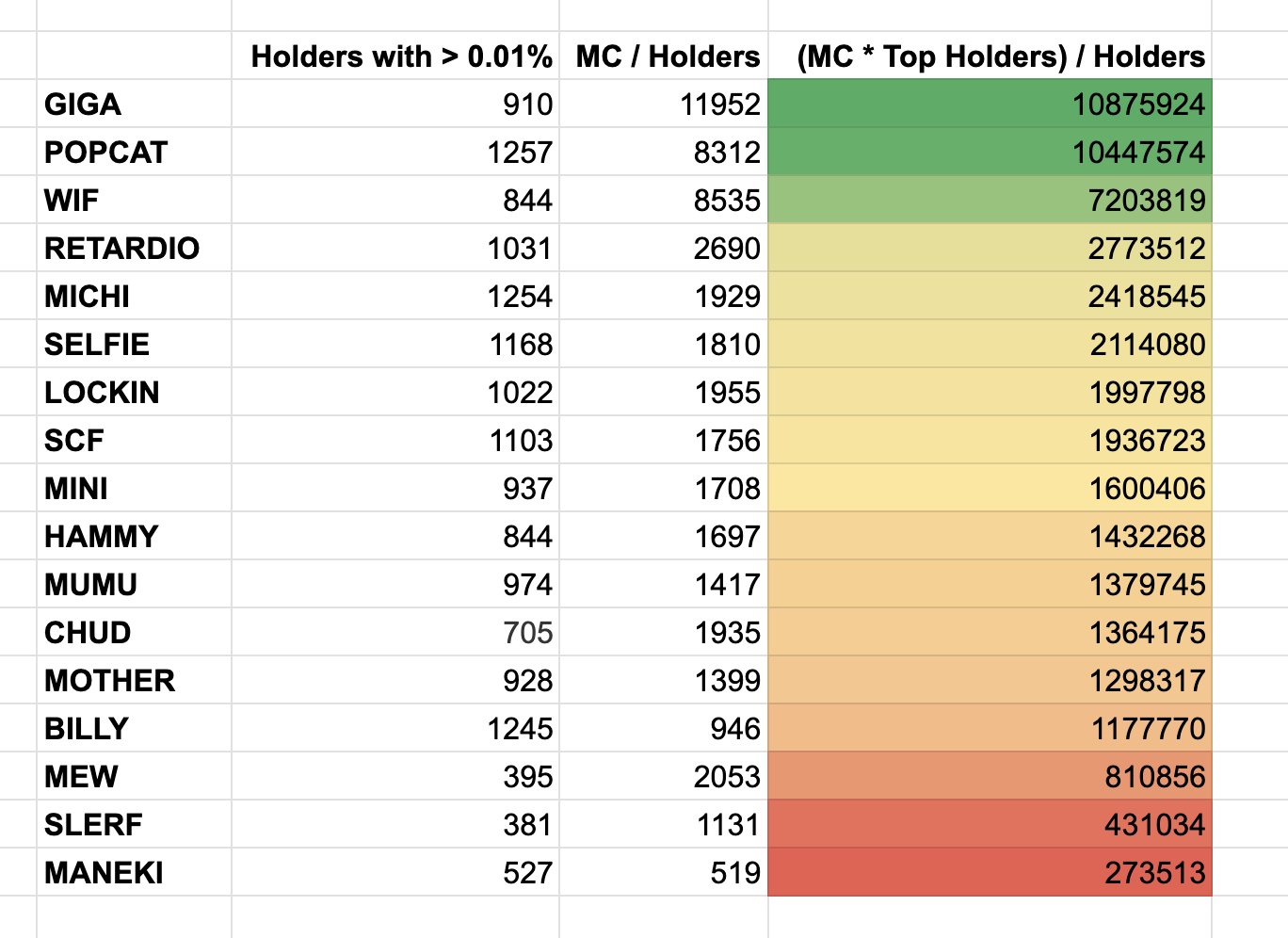

In the meantime, it’s worth noting that a significant analyst has pointed out an intriguing development: the popular use of Solana-based memecoins seems to be boosting decentralization among top holders.

In simpler terms, it’s observed that a fairer distribution of notable meme tokens is occurring, where each major token holder possesses approximately 0.1% of the entire supply. The intriguing aspect is – How does this trend benefit Solana (SOL)?

Reduced monopoly mitigates risk

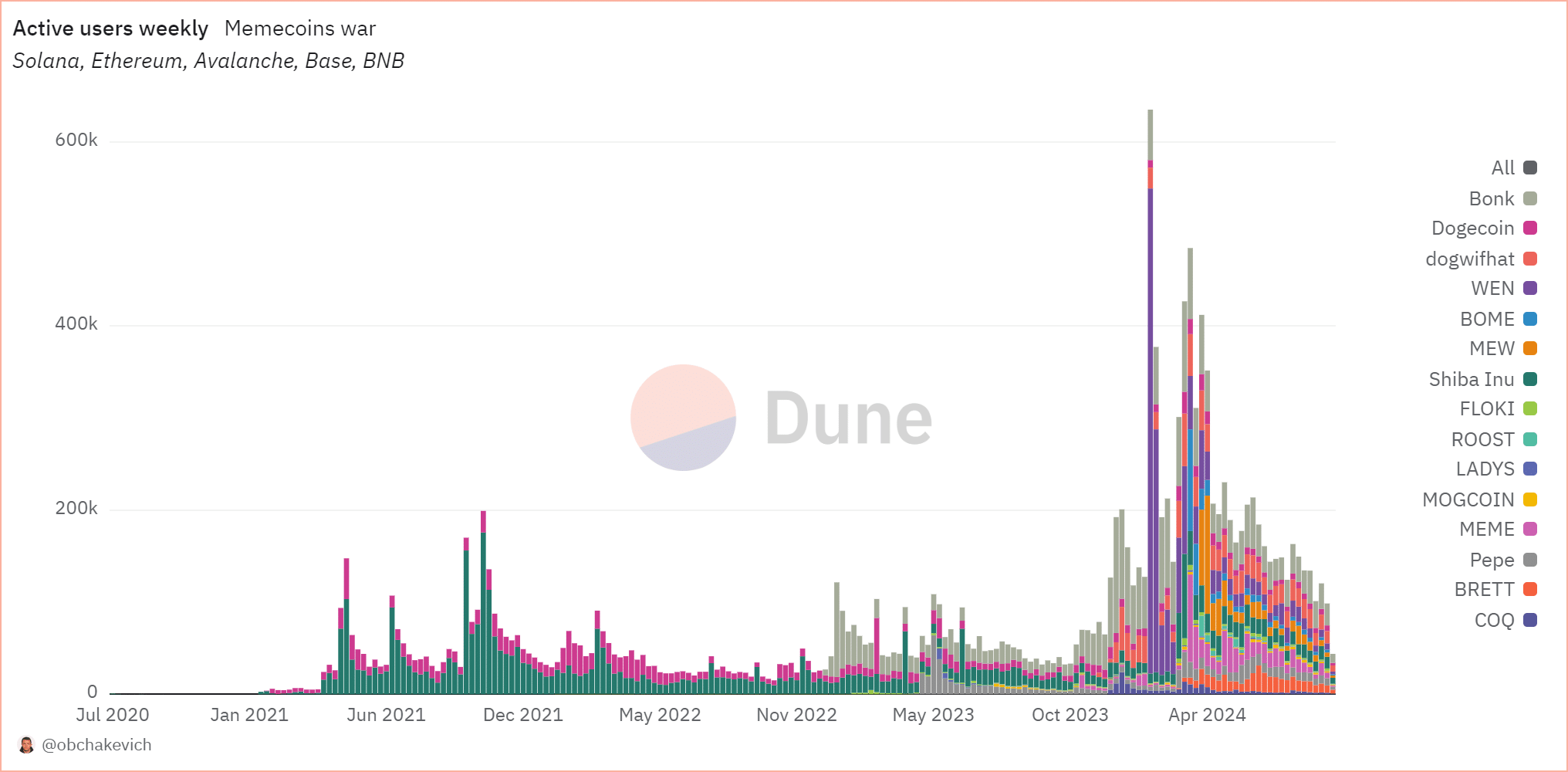

In contrast to last week’s dip, memecoins on the Solana network are consistently increasing, as demonstrated in the graph that follows, indicating resilience among dedicated investors (diamond hands).

Source : X

Between GIGA and POPCAT, the gap in the number of top holders is small, amounting to just about a 3% discrepancy, with GIGA boasting approximately 10.8 million holders and POPCAT not far behind at around 10.4 million.

Furthermore, spreading out large quantities of ownership helps decrease the risk of centralization, thus preventing a single entity from wielding excessive influence over the token’s price.

As a crypto investor, I’ve found that investing in projects with decentralized distributions tends to bring in a wider pool of participants, which in turn can boost the value of Solana (SOL).

Previously demonstrated, memecoins hold substantial impact over SOL. While some traders opt for them as affordable substitutes, others invest with lasting conviction.

Source : Dune

This notion is reinforced by the fact that those who own Solana meme coins view them as long-term ventures. Notably, BONK has been the most active coin on a weekly basis, while WIF comes in second.

Realistic or not, here’s SOL’s market cap in BTC’s terms

In a scenario where memecoins are unpredictable and have a significant following, decentralization in SOL (Solana) can minimize risks during economic slumps, particularly those caused by Bitcoin’s fluctuations.

In summary, if bears control the market direction, Solana (SOL) might encounter reduced risk from its memecoin section since prominent investors are less inclined to sell during turbulence, thus helping to stabilize the market volatility.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-12 19:04