-

SOL has surged by 9.11% over the past month.

Solana has flipped 200 EMA on daily and 4-hour timeframes, signaling potential upswing.

As a seasoned crypto investor with a knack for spotting trends and understanding market behavior, I find Solana’s recent performance intriguing. While it’s true that SOL has been stuck in a consolidation range between $140 and $160, the latest technical indicators are pointing towards an upswing.

After reaching a peak of $193, Solana’s [SOL] progression hasn’t managed to sustain an uptrend and regain higher prices. Consequently, it’s been trapped in a price range that fluctuates between approximately $140 and $160.

This indicates that, after falling below $160, the negative sentiment (bears) has been stronger than the positive one (bulls), causing the prices to remain within this price range.

Currently, Solana (SOL) is being traded for approximately $146. This represents an increase of 9.11% over the past month, as SOL has also seen some moderate growth in its weekly and daily performance charts as well.

Despite the recent gains, SOL remains 43.9% below its ATH of $259 recorded in 2021.

Despite SOL‘s difficulty in surpassing $160 so far, the latest market movements spark hope and stimulate discussions among analysts. One such analyst is Coin Signals, who predict a possible rise based on the 200 Exponential Moving Average (EMA).

Solana flips 200 EMA

According to Coin Signals’ assessment, Solana (SOL) appears to have surpassed its 200 Exponential Moving Average (EMA) on both daily and 4-hour charts. This price development suggests that the cryptocurrency has breached the symmetrical triangle it was previously contained within.

In simpler terms, if the altcoin surges past its upper boundary line (trendline), it suggests the beginning of a rising trend. This implies that the altcoin might experience more price increases in its graph.

What SOL’s charts suggest

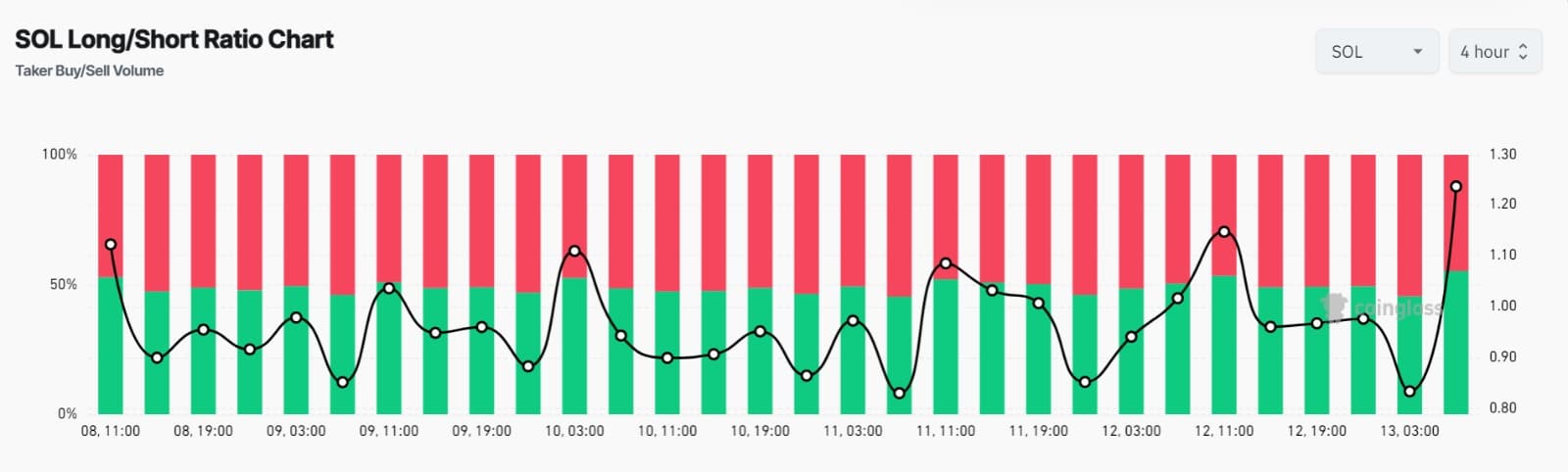

At the moment’s check, the long/short ratio for Solana on a 4-hour scale was 1.2, suggesting that I, along with other investors, are predominantly leaning towards long positions in the market. This indicates an increased confidence among traders that the price will trend upwards rather than downwards.

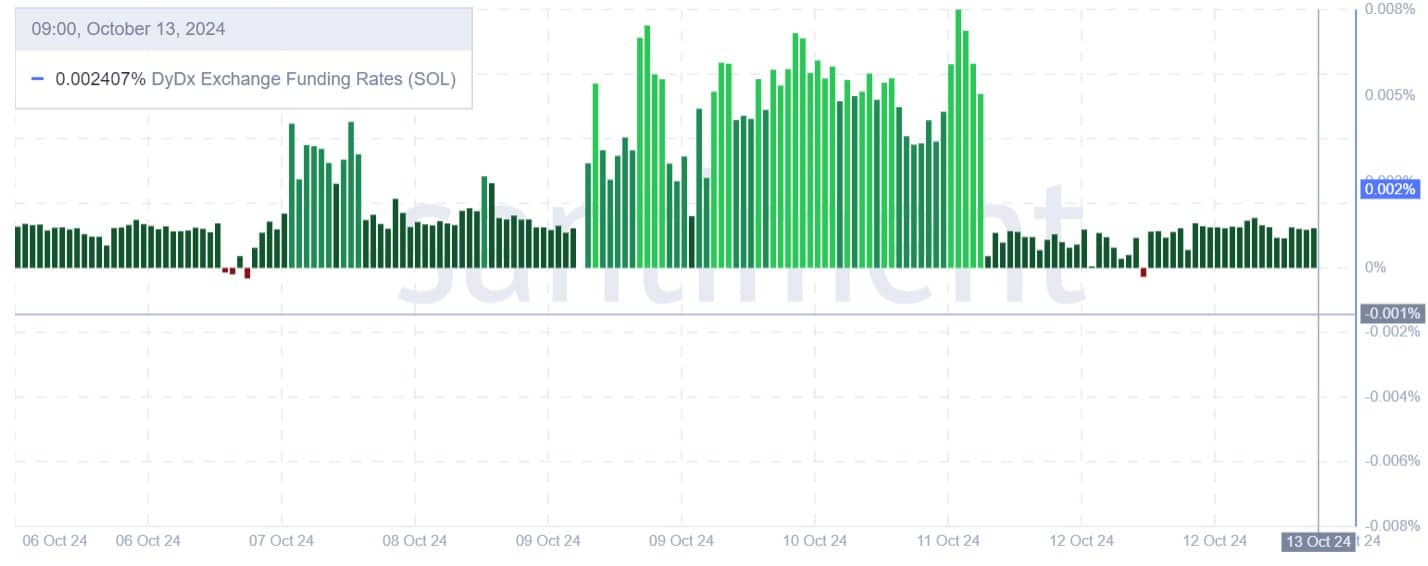

During the last week, the demand for long positions was strengthened by a favorable Dydx Exchange Funding Rate. Essentially, this means that long investors are currently paying short investors a higher fee when the market experiences a dip, in order to keep their positions intact.

Such market behavior also indicates that investors are confident with the altcoin’s future gains.

Over the last week, there’s been an upward trend in the value associated with Solana’s USD-denominated open interest across exchanges. This figure, known as open interest, increased significantly from a bottom of $649 million to reach $712 million.

This indicates that investors kept creating new opportunities, assuming there would be more profits ahead.

Read Solana’s [SOL] Price Prediction 2024–2025

From my perspective as a crypto investor, although Solana (SOL) hasn’t been able to surpass the $140 and $160 price ranges recently, there’s an evident uptick in optimistic market sentiments surrounding this altcoin.

Under these circumstances, Solana might continue to rise. If it manages to surge beyond its current resistance at around $160, we can expect it to reach approximately $170.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-14 07:03