-

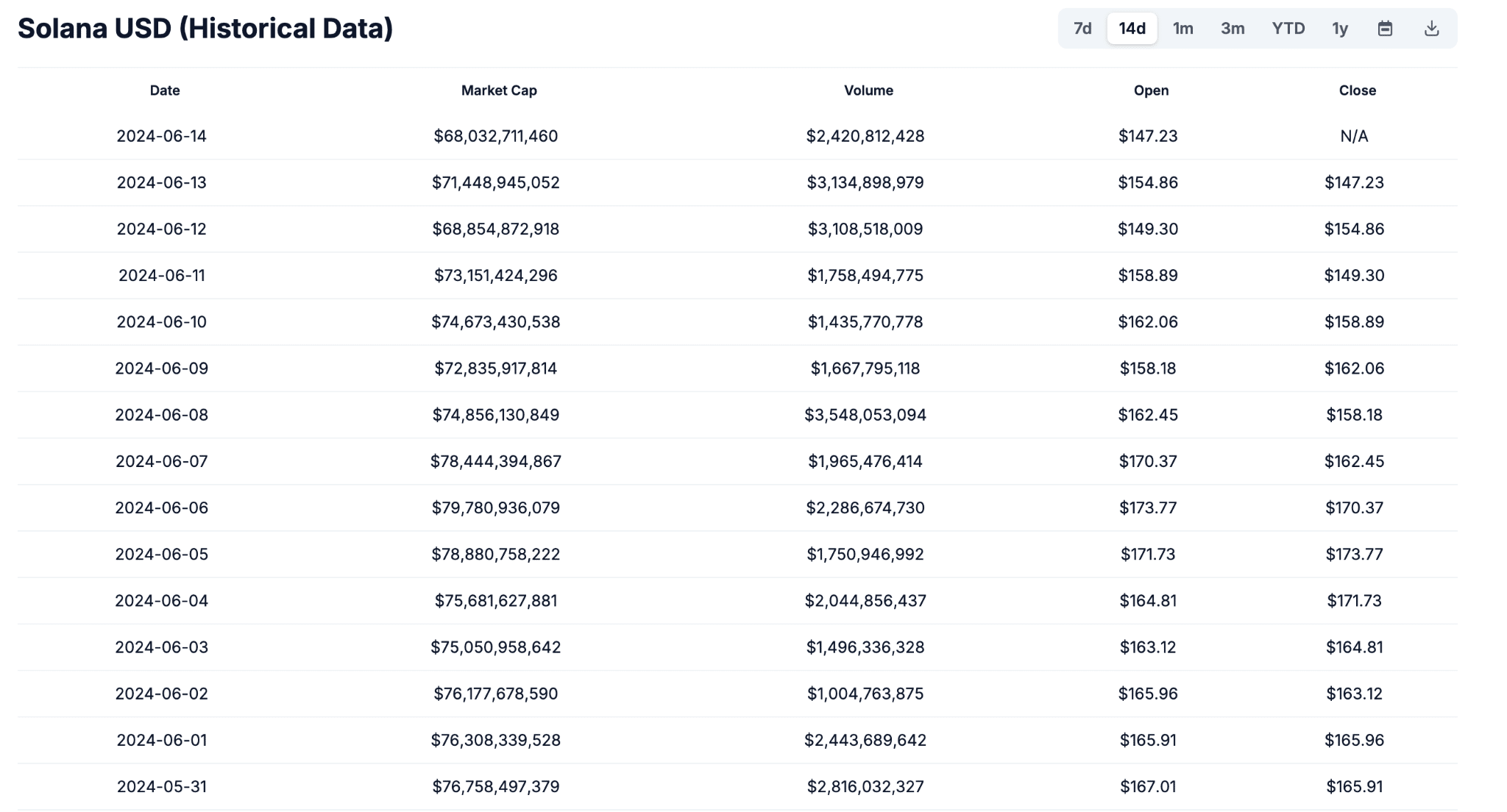

SOL has stabilized around $147, showing signs of consolidation despite a downturn.

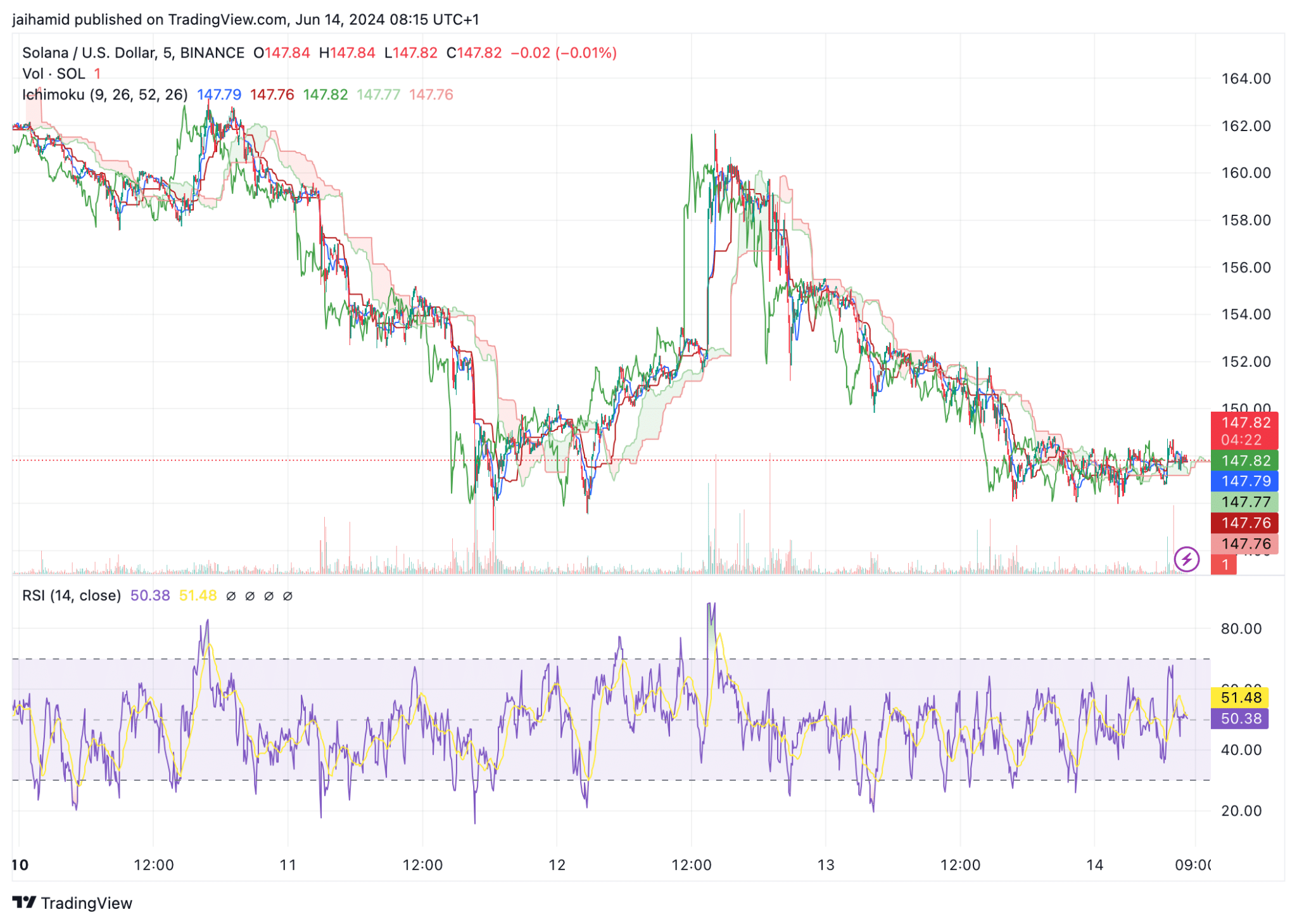

Bearish patterns in the Ichimoku Cloud signal continued bearish sentiment.

As a researcher with extensive experience in analyzing cryptocurrency markets, I believe Solana (SOL) is currently experiencing consolidation despite the downturn. The price stabilization around $147 is a promising sign, but the Ichimoku Cloud’s bearish pattern indicates continued bearish sentiment.

During this current market cycle, Solana (SOL) has emerged as the leading contender in terms of price gains and network expansion.

As a crypto investor, I’ve noticed that Solana’s (SOL) price has experienced some fluctuations lately, but it seems to have found a footing around the $147 mark. However, this is well below its peak price from last month.

Over the last several weeks, the price of SOL has remained relatively unchanged within a particular range. However, the trading volume for SOL has persistently increased, indicating that traders continue to be highly engaged in buying and selling activities.

Despite the Ichimoko Cloud indication on Solana’s price chart showing a bearish sign, the trend appears challenging for bullish forces as the cloud mostly hovers above the trading activity throughout the displayed timeframe.

As an analyst, I observe that the Kijun-Sen line (blue line) sits above the current price action. This situation underscores the prevailing bearish sentiment among traders. Despite several attempts by the price to surge above this crucial level, it consistently fails or quickly retreats below it following brief breakouts. This persistent resistance to upward price movement emphasizes the market’s reluctance towards significant bullish momentum.

From June 12th onwards, the price of Solana has exhibited sideways motion with minimal variations, hovering around the $147 level. This suggests that the cryptocurrency is currently in a period of consolidation.

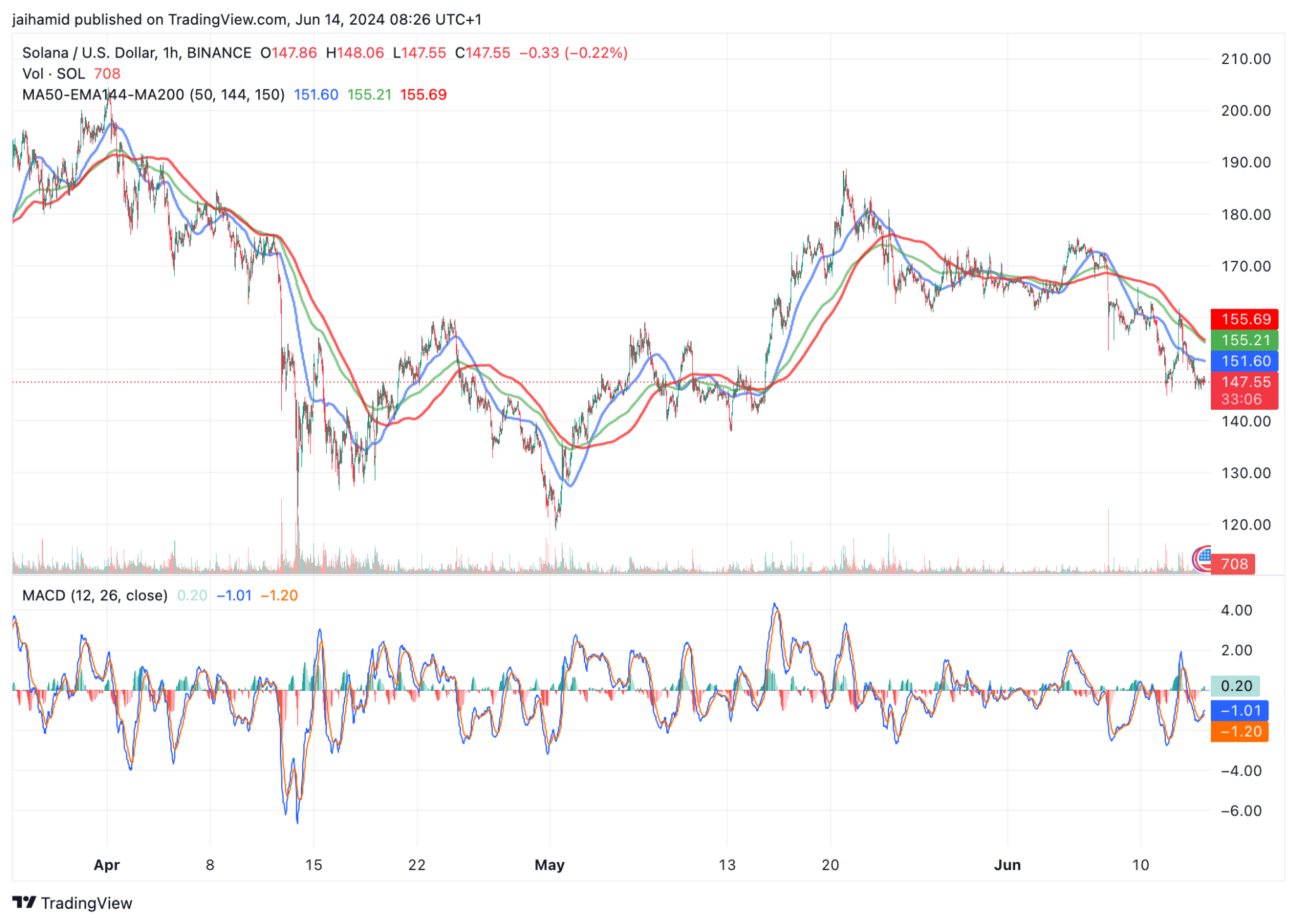

From April to early May, SOL displayed noticeable price fluctuations, marked by notable highs and lows. The value swung close to the Exponential Moving Average (EMA) of 144, hinting at a degree of uncertainty among traders.

After May, I’ve noticed a definite downward trend in crypto prices. The value has remained persistently below all three moving averages, indicating a dominant bearish attitude in the market.

The fact that the price remains persistently underneath the MA200 line (represented by the red line) adds credence to the pessimistic long-term view. Additionally, the MACD is hovering around the zero line without displaying substantial momentum for either the bullish or bearish forces.

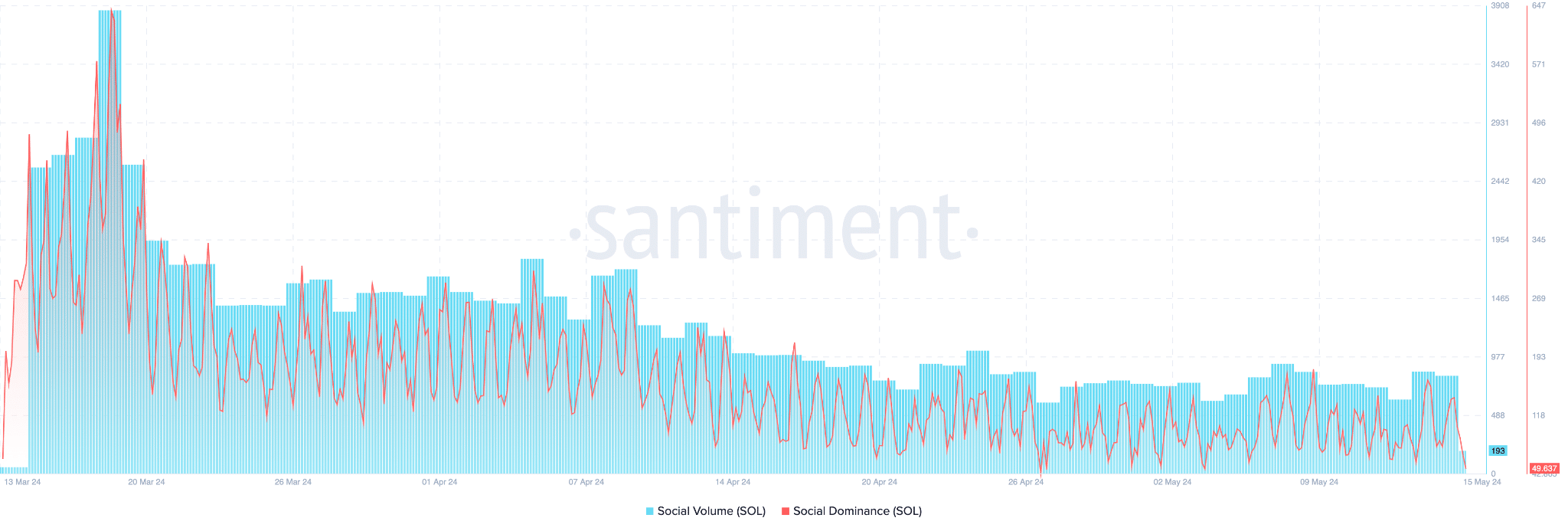

Additionally, the level of social activity and influence of Solana in crypto community discussions on social media platforms has decreased significantly.

Also, the Fear & Greed Index sits comfortably on ‘fear.’

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

2024-06-14 17:12