-

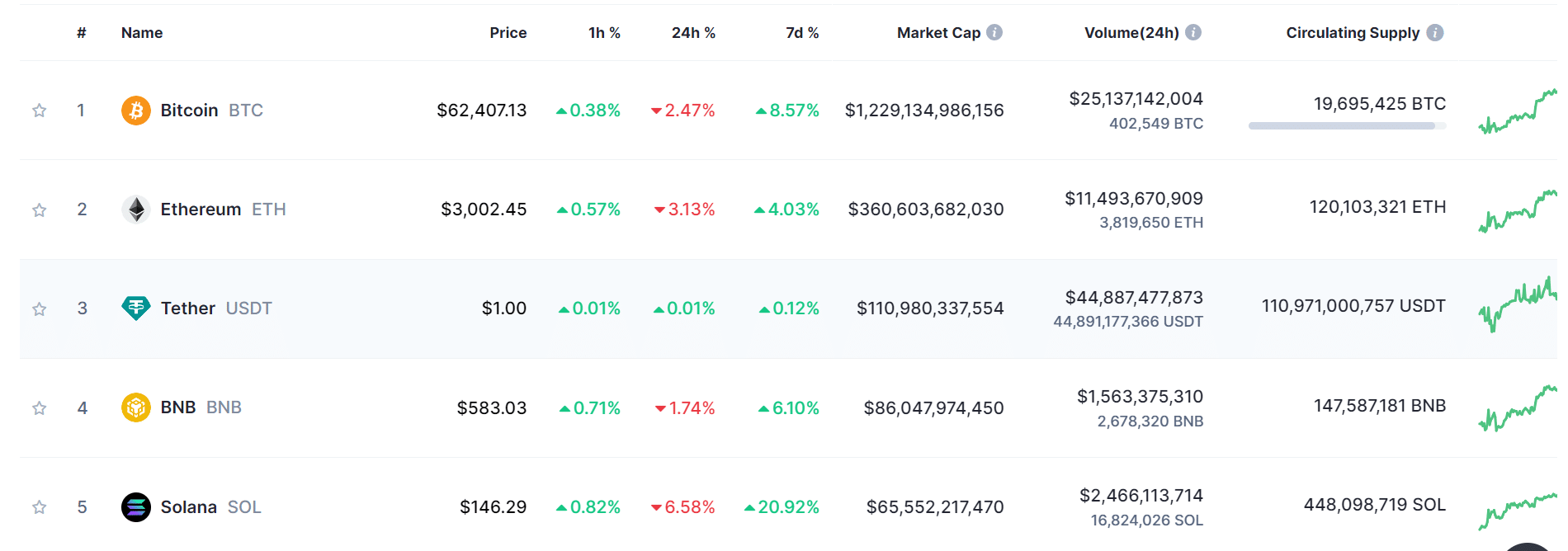

SOL showed the highest seven-day increase.

Its price has lost momentum in the last 24 hours.

As a researcher, I find Solana’s price trends intriguing. While it experienced the most significant decline among the top five cryptocurrencies in the last 24 hours, its seven-day increase was remarkable.

Based on recent evaluations, Solana (SOL) underwent the most significant drop among the leading five cryptocurrencies within the past 24 hours.

In spite of this disappointment, the data showed that it experienced the most significant increase among the leading five assets during the previous week.

Can we identify any key performance indicators pointing towards Solana’s potential to maintain its current price trend and break through its resistance level?

Solana sees mixed price trends

Based on current data from CoinMarketCap, Solana has seen the largest decrease among the leading five cryptocurrencies over the past 24 hours.

During this timeframe, the value of SOL decreased by more than 6%. Nevertheless, its market value remained substantial at approximately $65.5 billion, ranking it as the fifth largest cryptocurrency in terms of market capitalization.

I’ve analyzed the market trends over the last week, and it appears that SOL has been primed to deliver the most significant price growth among all assets under consideration.

As a researcher examining market trends, I was astounded to discover an exceptional increase of more than 20% for that particular asset within the given timeframe. This surge outpaced the performances of other leading investments.

If Solana continues to trend upwards, it has the potential to outperform the other top five cryptocurrencies and surpass its current resistance levels.

Solana trends below the moving average

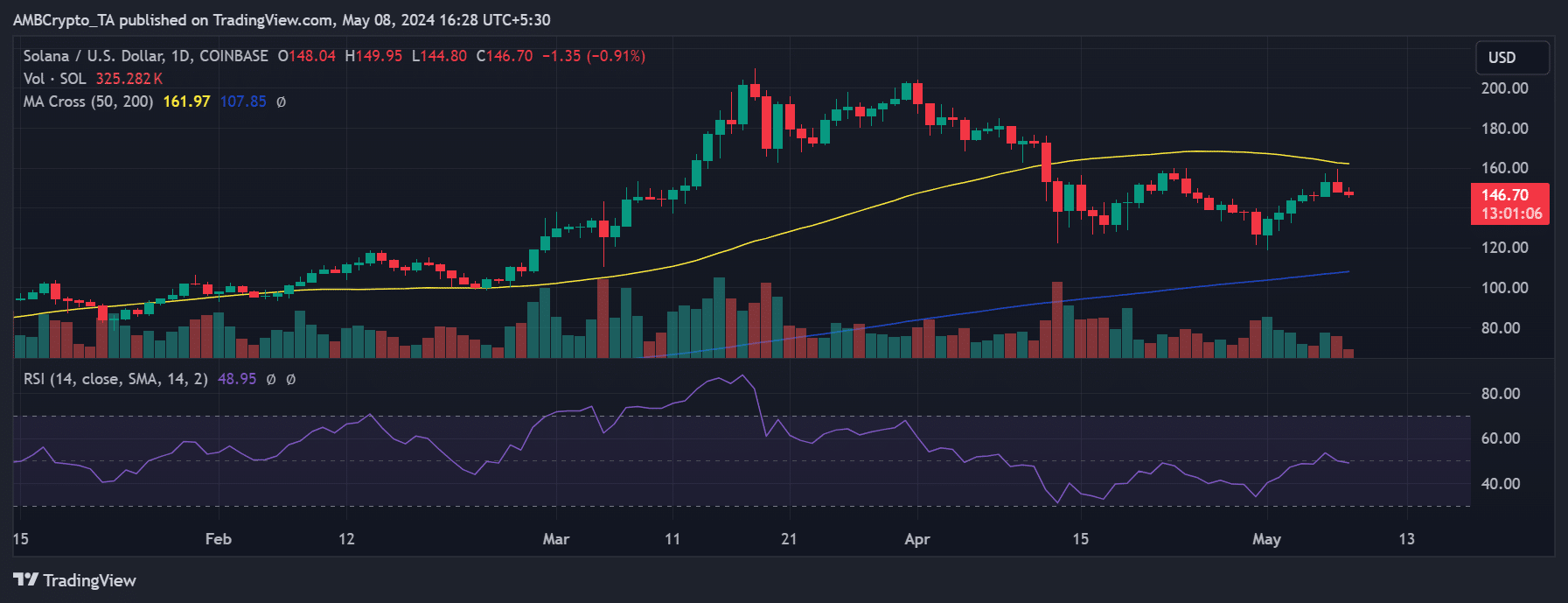

As a Solana investor, I’ve enjoyed a successful run with prices rising from roughly $134 to above $150 due to a series of consistent uptrends. However, on the 7th of May, there was a surprising shift in the market direction, causing a downturn that impacted my Solana holdings negatively.

Analyzing the intraday price chart, I found that it dipped by more than 3%. Consequently, the price fell approximately to the level of $148.

The interruption of this decline halted its progression towards surpassing its print deadline threshold, a level it had almost reached with consecutive upward trends.

According to AMBCrypto’s examination, the yellow line representing the short moving average served as a barrier to price advancement around the $162 mark.

If Solana manages to exceed its current level, there’s a possibility that it may challenge the $200 mark once more, as this price point has been tested by the cryptocurrency on two occasions in 2021. At present, the coin is priced around $146, representing a minimal decrease of almost 1%.

At the current moment, the market was exhibiting a modest downtrend, as indicated by a slight decrease in the Relative Strength Index (RSI), which had dipped just below the neutral threshold.

SOL metrics not strong enough

At present, according to AMBCrypto’s analysis on Coinglass, Solana’s Open Interest has experienced a slight increase, amounting to approximately $1.86 billion.

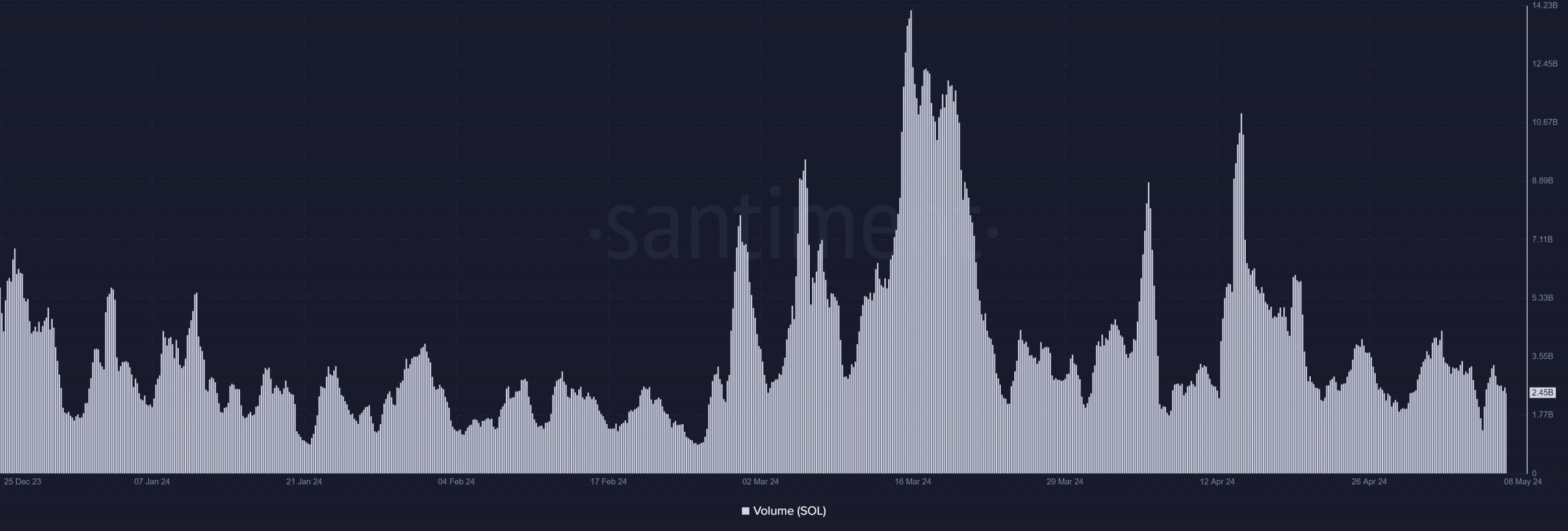

The inflow of funds into Solana has seen a modest uptick over the past 24 hours. Yet, to cause a notable influence on the SOL price, a larger influx of volume is needed.

Read Solana’s [SOL] Price Prediction 2024-25

As a researcher, I discovered a noteworthy decrease in trading activity based on data from Santiment. Initially, the daily trading volume surpassed $3 billion by the market’s close on May 7th. However, by the time of the press release, it had shrunk to approximately $2.4 billion.

These metrics would need to show higher figures to see a potential uptrend in the SOL price.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-05-09 03:03