-

Based on the historical price momentum, there is a high possibility that Solana’s price could soar by 25% to the $160 level.

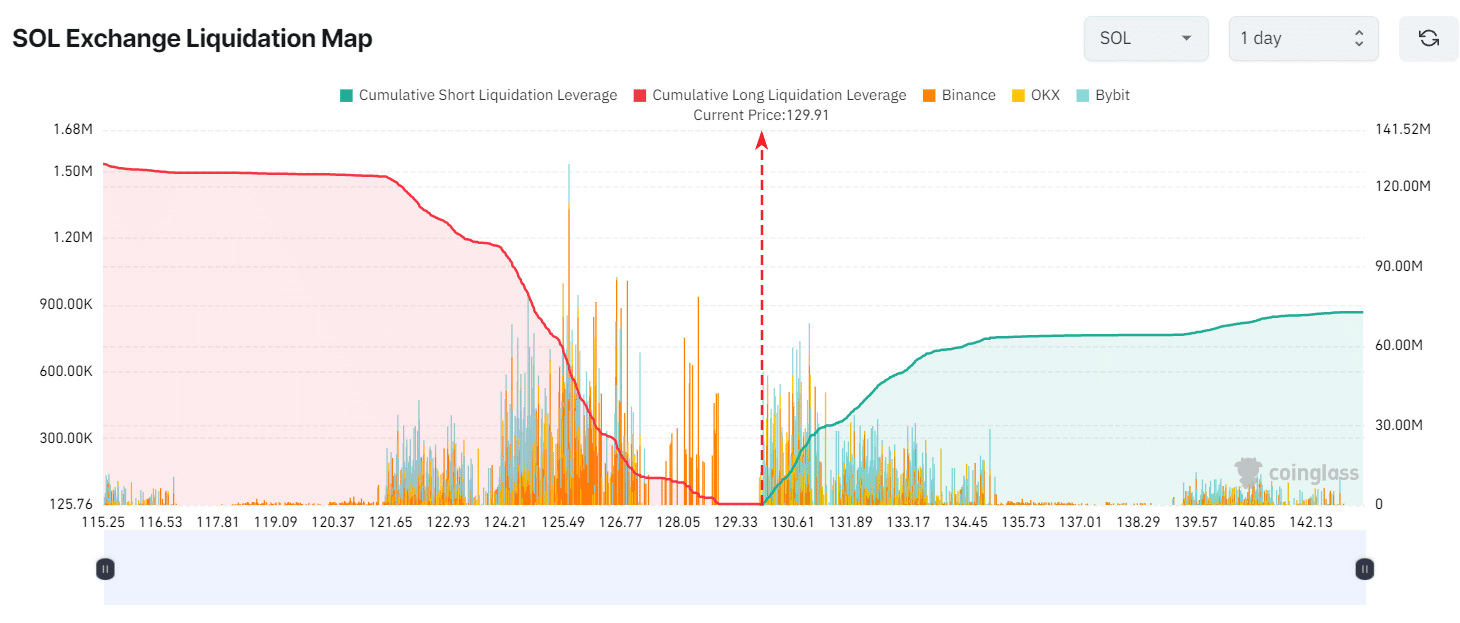

$25 million worth of short positions will be liquidated if SOL hits the $131 level.

As a seasoned researcher with years of experience navigating the ever-evolving crypto market, I find Solana’s current technical setup quite intriguing. The bullish divergence in the RSI, coupled with the rising open interest and bullish Long/Short ratio, paints an optimistic picture for SOL.

Despite the pessimistic mood in the crypto market, Solana (SOL) seems primed for a significant surge based on its bullish price trends and robust on-chain statistics. Over the past few days, while most cryptocurrencies have seen a substantial drop, SOL has been building strength around a critical support level of approximately $125.

Solana technical analysis and upcoming levels

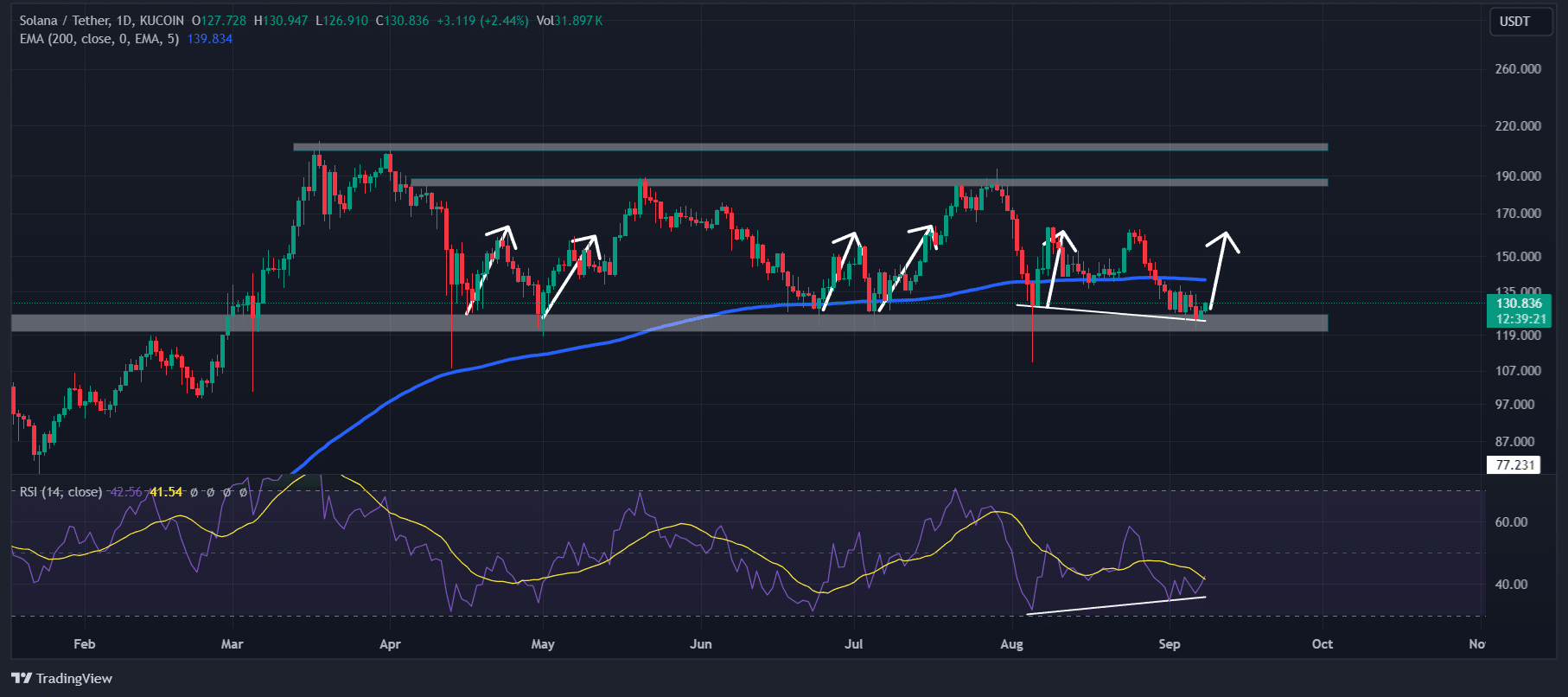

According to technical analysis by experts, Solana (SOL) appears optimistic right now. A bullish pattern called a divergence has emerged in its Relative Strength Index (RSI), suggesting that the coin might be on the verge of switching from a declining trend to an ascending one.

In this scenario, there’s a discrepancy arising when the price of the asset keeps hitting successively lower bottoms, but the technical indicator instead creates higher bottoms over the same timeframe.

Historically, when Solana (SOL) hits its present support point, it often sees a significant price increase. Given the current bullish market activity, it’s quite likely that the price of SOL could jump by approximately 25%, potentially reaching the $160 mark.

Bullish on-chain metrics

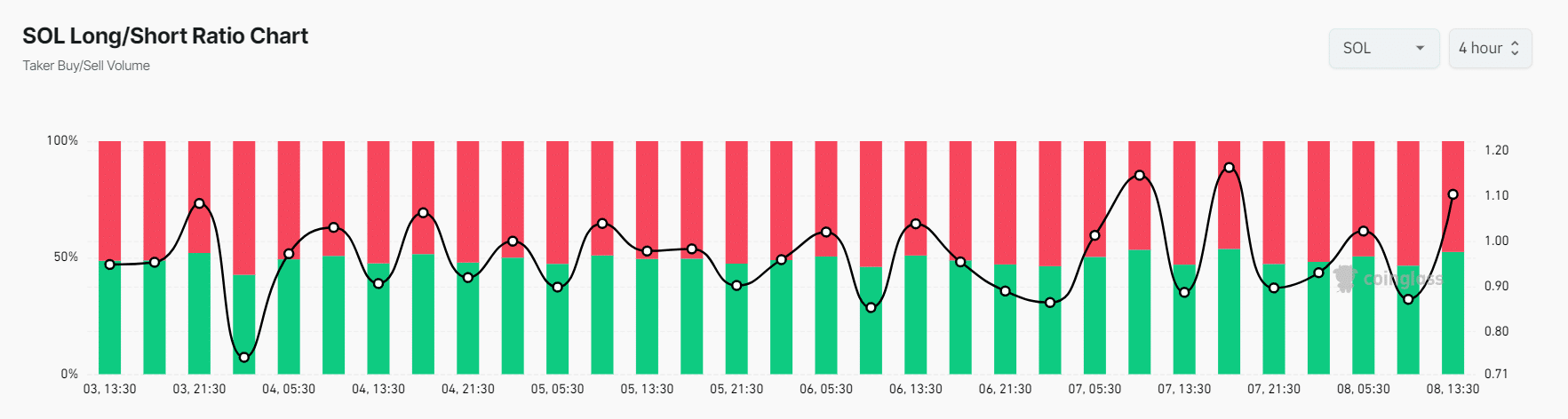

Based on the latest data from CoinGlass, their SOL Long/Short ratio chart suggests a predominantly positive market outlook. At present, the ratio is reported as 1.103, implying that traders are generally more hopeful (A ratio above 1 indicates bullishness).

Over the past day, SOL‘s open interest has grown by 3%, and this increase has been steady for the past three days.

A growing number of investors taking new positions, along with the Long/Short ratio being greater than 1, may indicate a promising time for purchasing assets. This pattern is frequently utilized by traders as they construct their long and short positions.

Currently, the key selling points for traders are approximately $125 and $131, with the former being the lower resistance and the latter the higher one. This is suggested by the CoinGlass data, indicating that traders may be carrying too much leverage at these price levels.

Should the bullish outlook of the trader not hold up and Solana’s (SOL) price falls to around $125.61, approximately $56 million in long positions may need to be closed out.

In other words, if the optimism continues and the price hits $131, around $25 million in short positions will have to be closed out.

Realistic or not, here’s SOL’s market cap in BTC’s terms

As a researcher examining current market trends, it seems that long positions held by bulls are prevailing and carry a significant likelihood of closing out short positions at present.

Currently, SOL is close to $130.40 per token and has seen a significant increase of more than 2.5% in the past day. However, during this timeframe, the trading volume decreased by approximately 65%, suggesting that fewer traders are participating due to the recent price decrease.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-09-09 09:11