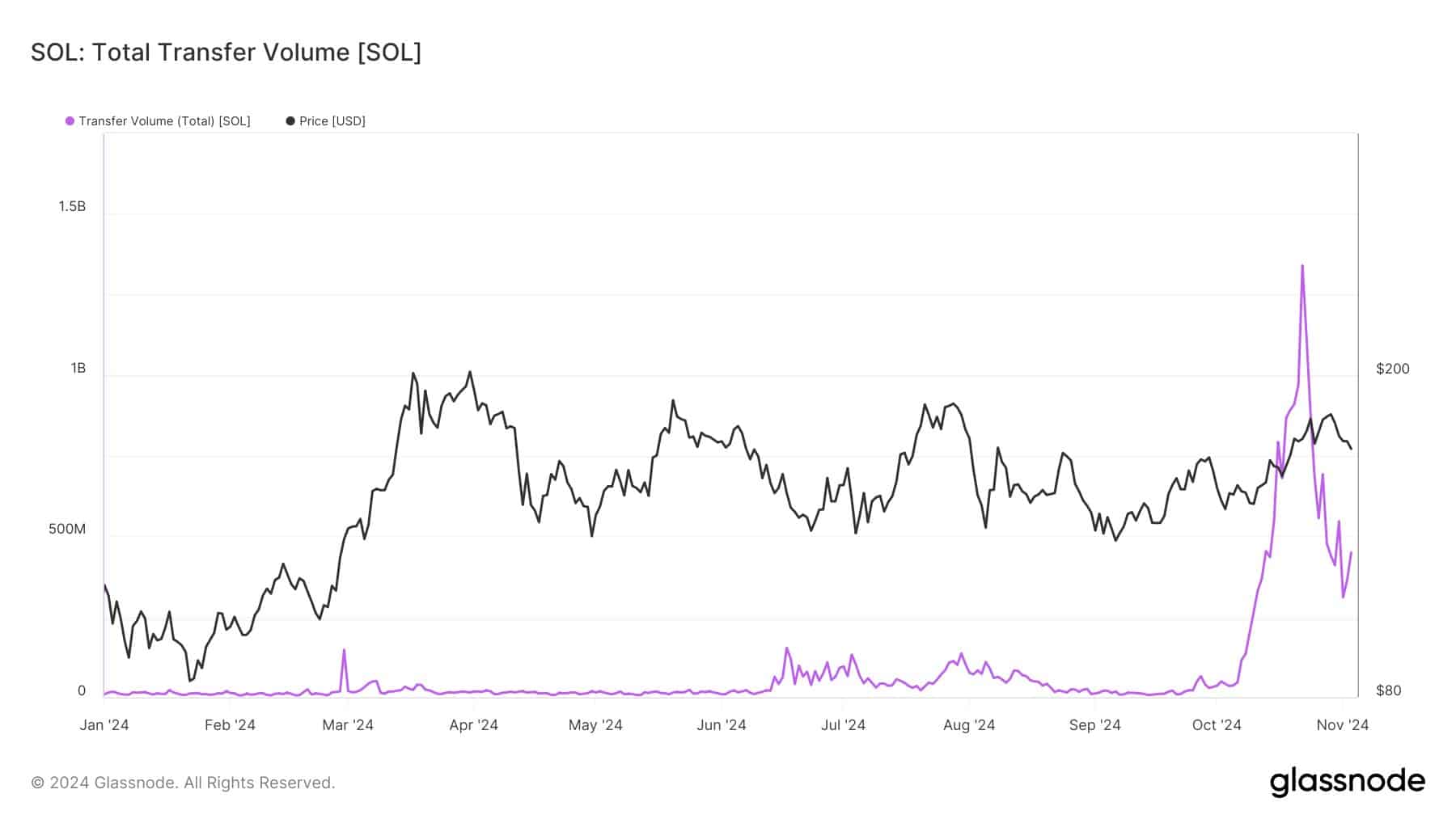

- SOL sees massive spike in on-chain volume.

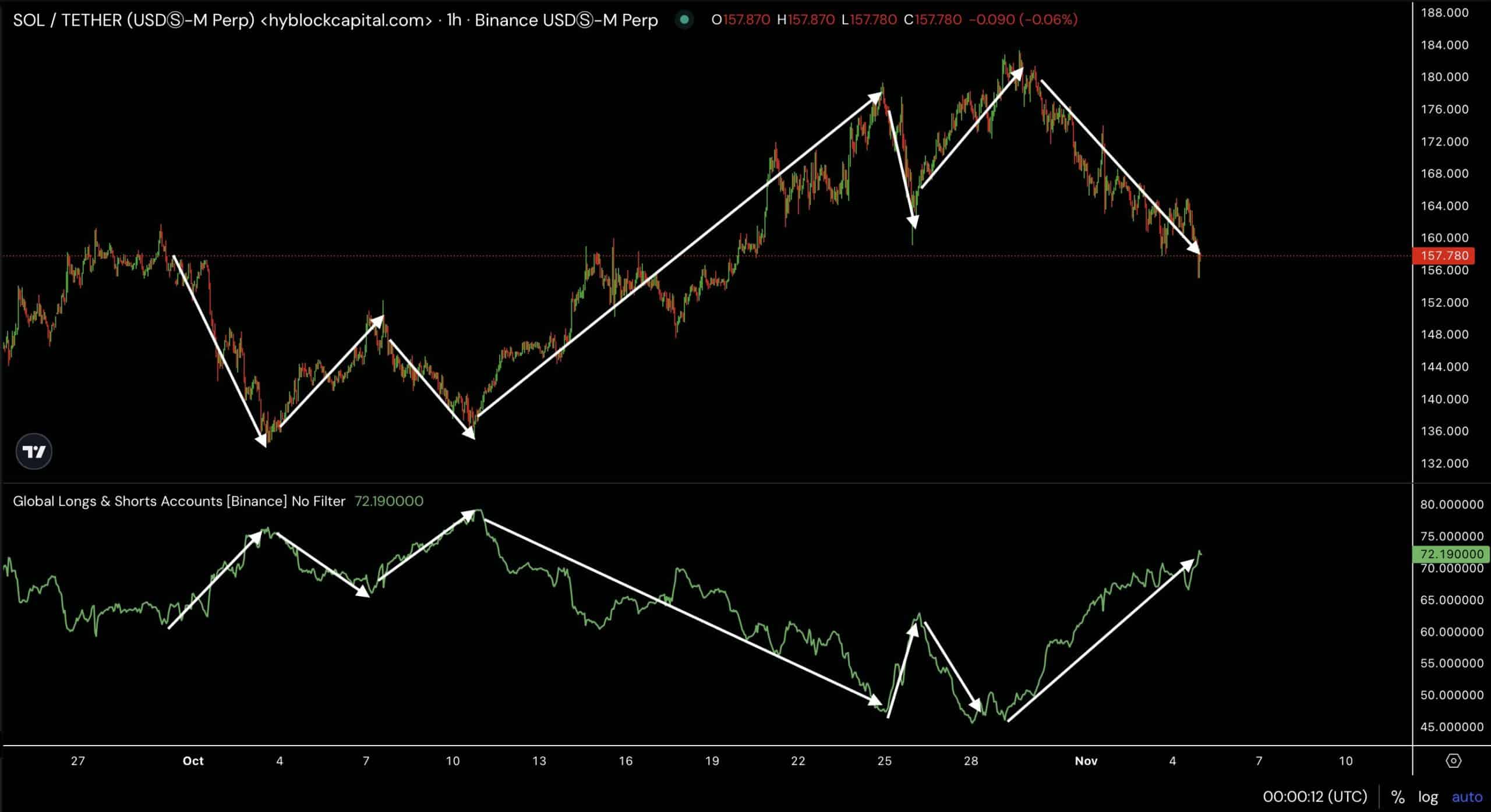

- Global long positions increased even as SOL’s price dipped.

As a seasoned crypto investor with a few battle scars from navigating the wild West of digital assets, I find myself intrigued by Solana’s [SOL] recent on-chain fireworks. The massive surge in transfer volume and the subsequent dip in price left me scratching my head like an old-timer trying to decipher hieroglyphics.

Over the past while, Solana (SOL) saw a substantial boost in daily transaction volume, hitting an astounding $224 billion. Remarkably, this amount almost tripled Solana’s total market capitalization, which was around $76 billion at the time.

This significant increase appeared to originate from a highly active wallet operating several different accounts. Experts suspect that this wallet might have been an automated trading bot, significantly boosting its actions starting from early October.

As a crypto investor, I’ve noticed that the heightened activity of this bot might have played a role in the recent surge of transaction fees across the network.

In stark contrast to the intense activity on the Solana blockchain, its price actually decreased instead of gaining from the spike in activity. The market observers kept a close eye as the value of SOL fell, indicating an unanticipated reaction to the significant data transfer.

Despite the decrease in prices, there was an increase in on-chain activity that left certain investors perplexed, as they had anticipated a more favorable response given the high trading volume.

Can SOL bounce as longs increase?

Despite a drop in Solana’s price, there was an increase in global long positions, suggesting a change in trader sentiment. This could mean that traders are predicting a reversal for SOL and are taking advantage of the dip by increasing their long positions.

Analyzing recent trends, it appears that a significant negative relationship exists between Solana’s Global Accounts Long percentage and its value. In simpler terms, as the Global Accounts Long percentage decreases, Solana’s price tends to increase, and vice versa.

The correlation matrix indicated a strong negative value of -0.89, suggesting that the price and the quantity of long accounts often tended to fluctuate in opposite manners.

Traders seemed to be capitalizing on the short-term drop in Solana’s price by placing wagers on its future price increase, indicating a strong faith among them that this decline was merely temporary and that Solana would regain its pace shortly.

While no immediate bounce back occurred, the rise in long positions hinted at future confidence.

When pondering about Solana’s upcoming market direction, a significant point of interest arises: will the price of SOL climb back over $200? The resolution to this query hinges upon various elements such as investor sentiment, blockchain activities, and overall crypto market movements.

If Solana continues to maintain the enthusiasm stirred by its high on-chain activity and efficiently utilize this activity, it’s quite possible that we might witness a recovery in its price.

Realistic or not, here’s SOL’s market cap in BTC’s terms

The growing enthusiasm among Solana’s community and traders indicates a potential resurgence in the value of SOL. Yet, the $200 level poses a substantial psychological hurdle.

The success of Solana in overcoming its challenges will largely hinge on the broader market trends, the level of institutional involvement, and the network’s capacity to effectively manage and leverage heightened activity.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-05 20:07