-

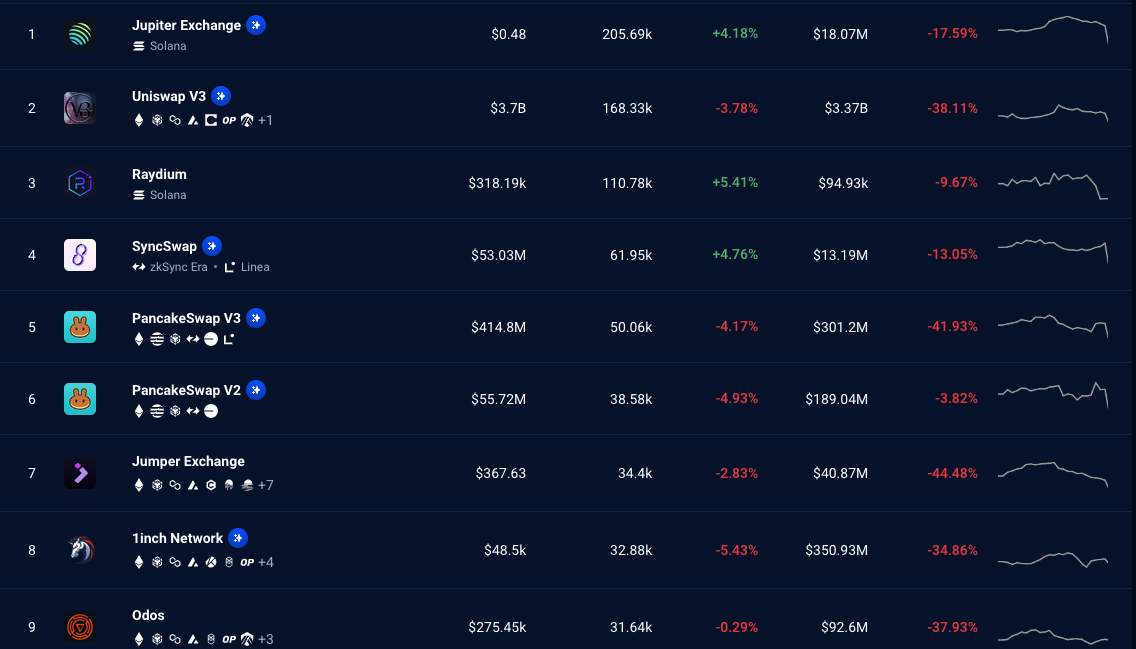

Activity on Jupiter, Solana’s biggest DEX, trumped Ethereum-based Uniswap’s numbers

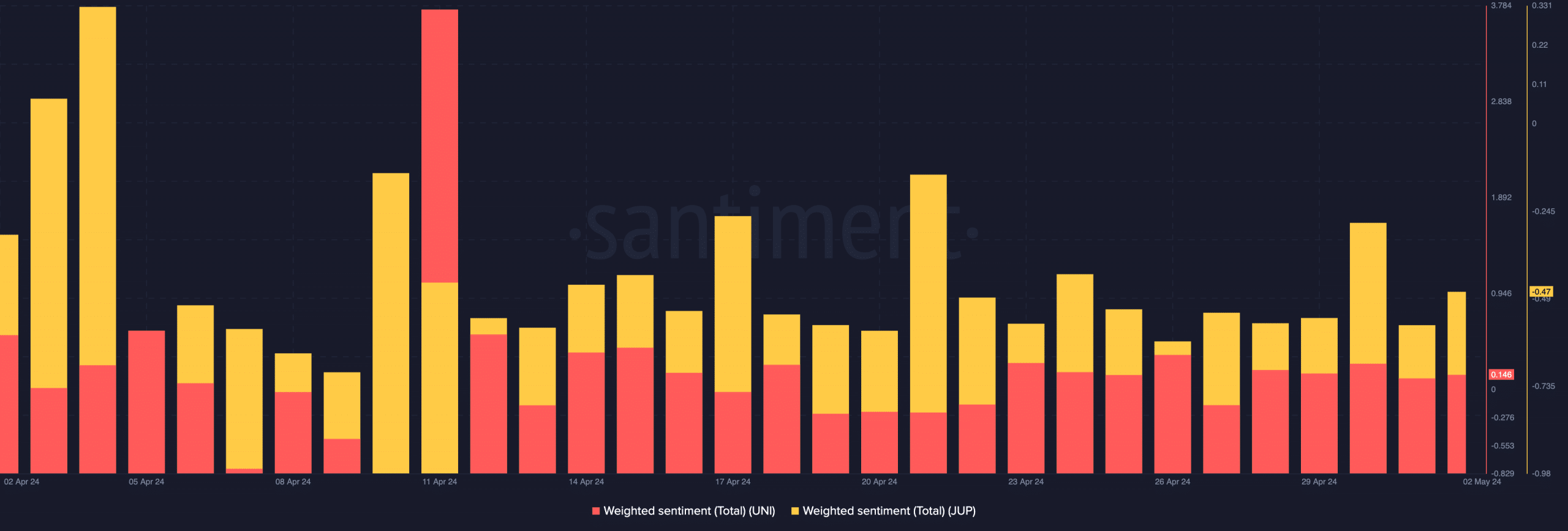

ETH’s volume remained higher than SOL’s, while JUP and UNI sentiment differed

As an analyst with a background in blockchain technology and experience observing market trends, I find it fascinating to see how Solana’s DEX, Jupiter, has surpassed Ethereum’s Uniswap in terms of unique active wallets (UAWs). This shift is a significant development that speaks volumes about the competition between these two major blockchain networks.

As an analyst, I’ve observed an intriguing development in the decentralized exchange (DEX) landscape: Jupiter, which runs on the Solana blockchain, has surpassed Uniswap in terms of unique active wallets (UAWs). This revelation came to light after examining data provided by DappRadar.

As a crypto investor, I’ve observed that at the current moment, there were more than 205,000 Universal Automated Workers (UAWs) traded on Jupiter decentralized exchanges. In contrast, Uniswap, which operates on Ethereum [ETH], saw a lower volume with approximately 169,000 tokens transacted.

How did this happen?

As a crypto investor, I keep an eye on User Active Wallets (UAW) as a key performance indicator. When this metric experiences growth, it signifies an uptick in user engagement with the network or applications. Conversely, a decline indicates decreasing interest or activity from users.

Observed in the following chart, Jupiter’s active wallets experienced an increase within the past 24 hours, contrasting Uniswap’s decrease. However, this trend goes beyond just these specific Decentralized Exchanges (DEXs). Instead, it reflects the growing rivalry between Solana and Ethereum.

In contrast to Ethereum’s historical dominance, Solana has emerged as the go-to blockchain for many popular meme tokens in this current cycle. The reasons behind this shift are noteworthy.

As a crypto investor, I’ve noticed that while some projects have emerged on Vitalik Buterin’s developed blockchain, none have been able to rival Solana in terms of growth. For instance, memecoins like dogewifhAT (WIF), Bonk (BONK), and Popcat (POPCAT) have seen remarkable expansion on the Solana network. In contrast, it seems that only PEPE has made a significant appearance from the other blockchain.

Aside from the appearance of new tokens, another influential factor has been transaction fees. It was discovered that the affordable fees provided by Solana have contributed significantly to keeping traders engaged. Despite Ethereum’s reduced fees compared to earlier times, it still falls far short of Solana’s fee levels.

Simply put, the DEX takeover happened as a result of a combination of these factors.

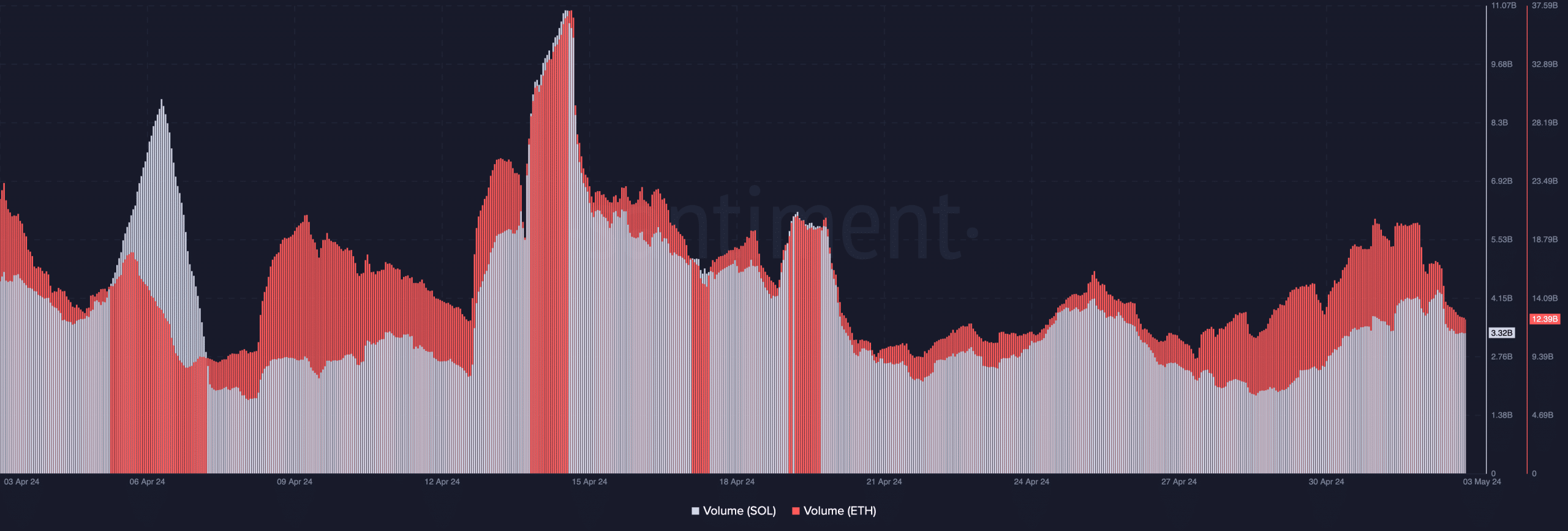

Despite this, the data from the blockchain shows that Ethereum’s trading activity remains more substantial compared to Solana’s.

ETH, UNI, overtake SOL, JUP on some fronts

As of the latest news update, Solana’s trading volume amounted to $3.32 billion. In contrast, Ethereum reported a volume of $12.39 billion. However, when it comes to price increases, Solana outpaced Ethereum.

Currently, the price of SOL is being traded at $139.03, representing a substantial increase of 537.65% over the past 365 days. In contrast, during the same timeframe, ETH experienced a more modest appreciation of 61.10%.

If the current level of performance for SOL is maintained in the upcoming months, there’s a possibility that it may surpass Ethereum (ETH) during this market cycle. Nevertheless, it’s essential to keep in mind that the decentralized exchanges (DEXs) listed here also have their own native tokens.

Jupiter’s symbol on financial markets is “JUP.” In comparison, Uniswap’s token, UNI, has gained more popularity due to its earlier introduction. At present, the price of JUP is $1.02, marking a significant 75.53% increase in value over the past 90 days.

I’ve noticed that UNI’s price reached $7.08 after experiencing a significant increase of 14.54% in a short time frame. However, despite this bullish price action, my sentiment analysis tool for the Solana-based JUP token indicates a negative weight.

As a market analyst, I’ve observed that the price of UNI, which is built on the Ethereum blockchain, has been trending upwards recently. This suggests a bullish attitude among investors towards UNI compared to JUP, whose price has not shown the same level of growth. However, it’s essential to note that positive sentiment alone may not be enough to impact prices significantly. If JUP continues to outperform UNI in terms of market performance, its momentum could potentially overshadow UNI’s potential gains.

Realistic or not, here’s SOL’s market cap in ETH terms

The competition between Ethereum and Solana may persist indefinitely. Consequently, it is advisable for stakeholders to remain informed about the latest advancements occurring on each of these blockchain platforms.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-03 22:16