-

SOL has depreciated by 16.17% over the last 7 days

Analysts expecting further downside, citing a strong HTF bear pennant

As someone who has navigated through numerous crypto market cycles and experienced the highs and lows of digital assets, I must say that the current trajectory of Solana (SOL) is concerning, to put it mildly. Over the past week, we’ve seen SOL depreciate by a whopping 16.17%, and analysts are expecting further downside due to a strong HTF bear pennant.

Currently, Solana (SOL), ranked fifth in cryptocurrency market capitalization, has experienced significant declines over the last week. At present, it is being traded at approximately $132.11. This downturn is reflected in a 4.02% decrease on daily price charts.

Over the past week, the altcoin has been on a strong downward trajectory. On the weekly charts, SOL declined by 16.17% after a long month of depreciation.

In the turbulent month of August, SOL experienced a significant loss, amounting to more than 21%. Additionally, the challenging market circumstances have significantly affected both SOL’s trading volume and market capitalization. This was most clearly demonstrated by a decrease in its trading volume by approximately 52.6%, dropping down to $1.08 billion.

In simpler terms, these market circumstances are leading experts to anticipate a continued drop. To illustrate, renowned crypto analyst Crypto-Scient hypothesizes that since Solana (SOL) has been at the conclusion of a six-month-long bearish pennant formation, the altcoin could be primed for further downward movement.

What does market sentiment say?

Over the past six months, I’ve observed a persistent bear pennant formation in my analysis. This pattern, which I believe indicates a longer-term bearish market sentiment, has been holding steady.

In this particular case, that can be supplemented by SOL’s weekly and monthly charts too.

Significantly, if a cryptocurrency’s pattern indicates such, it often implies that its price may further decrease following a phase of stabilization or consolidation.

Over the next 4-6 weeks, it’s expected that SOL could stabilize in a narrow price band. After this phase of stability, there should be a breakout.

If the cryptocurrency breaks out from its current pennant pattern towards the downside, it would likely continue the ongoing downward trend. The extent of this crypto’s fall in such a situation would be determined by the height of the ‘flagpole’ observed on the price charts.

What do the price charts say?

Beyond interpreting the graphs of the altcoin, it’s equally crucial to evaluate Solana using various other factors as well.

Initially, the total amount held in open positions for Solana on each exchange has decreased from $857 million to $646 million during the last seven days.

This could suggest that investors might be choosing to end their investments in SOL rather than starting new ones. This feeling also hints at a low level of investor faith in the future movement of SOL’s price, leading some to consider selling to prevent potential further losses.

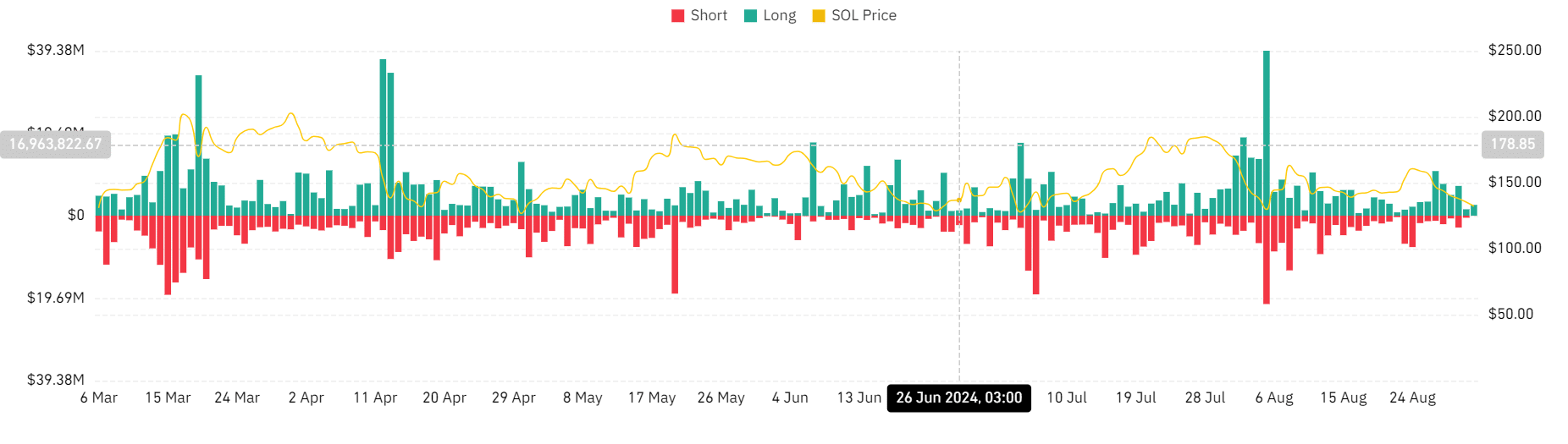

Additionally, SOL’s long-position liquidations have remained high over the past 7 days.

As I write this, the total value of positions where investors have bet on the price rising stands at approximately $2.57 million, whereas the value of positions where they have bet on the price falling is only about $28.9k. In other words, due to market conditions, those who wagered that the price would increase are being compelled to exit their investments.

In this situation, it suggests that the market is experiencing a downtrend, and those holding long positions seem hesitant to pay the higher price – another indication of pessimism.

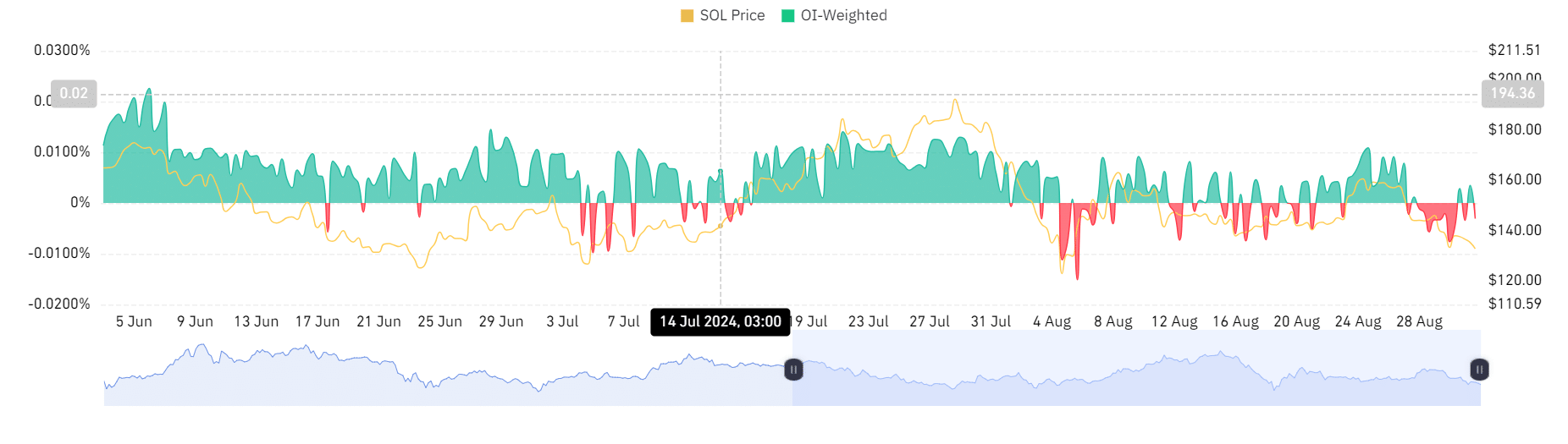

Lastly, the OI-adjusted funding rate showed a decrease, standing at -0.0031%. This suggests a decline in interest for long positions.

Currently, Solana (SOL) is experiencing a consistent drop. Should the current market trends persist, Solana could potentially decrease even more as predicted by chart analysis. This prediction suggests that SOL might dip below $110, moving towards the lower level of the flagpole.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-01 23:04