-

SOL has declined by 15.83% over the last 30 days

Analysts believe a rebound may be incoming based on 3 previous breakpoint cycles

As a seasoned crypto investor with over a decade of experience in this ever-evolving market, I’ve learned to navigate the rollercoaster ride that is Solana [SOL]. After witnessing its meteoric rise in 2023, I must admit, I was caught off guard by the subsequent decline this year. However, I find myself intrigued by the analysis of Ali Martinez and his prediction of an upcoming rebound.

In 2024, Solana (SOL), currently the fifth largest cryptocurrency by market value, has experienced significant price fluctuations. Following a consistent growth phase in 2023, often referred to as the ‘ETH rival,’ Solana has struggled to keep its positive trajectory this year.

The change in investor attitudes towards this cryptocurrency has led to a drop of approximately 40% in its value as shown on the graphs, down from its all-time high (ATH) of $209 that it reached in March.

Currently, Solana (SOL) is being exchanged for approximately $130.13, following a decrease of 5.95% in its value during the last seven days. This persistent drop indicates increasing uncertainty among investors.

Despite the scale of this downside though, analysts like Ali Martinez are expecting an upcoming rebound.

What do the market sentiments suggest?

Based on the analysis of a well-known cryptocurrency expert, it’s possible that SOL could experience an upward trend in the near future. This prediction is primarily based on SOL’s historical pattern. Martinez suggests that the TD sequential indicator points to a significant buy signal on SOL’s daily charts. Furthermore, he refers to the three preceding cycles before Solana’s Breakpoint, noting that each cycle from 2021 to 2023 has been followed by a rise in price.

His observations on X stated,

As a researcher, I’ve noticed an interesting pattern regarding Solana (SOL). Historically, two weeks leading up to the Solana Breakpoint conference has often been a period of price growth for SOL. In the past years, this surge has been significant. For instance, in 2021, we saw a remarkable increase of 35%, followed by another 35% boost in 2022. Last year was even more impressive with a price jump of 60%. Now, with just 16 days left until the 2024 Solana Breakpoint event, I find myself intrigued about what this year’s trend might bring.

Based on this analysis, SOL’s price might start an uptrend pretty soon.

In simpler terms, just like how a light signals an end, the TD Sequential Indicator marked the conclusion of a particular market trend by observing its behavior. Essentially, this indicator is likely to show a ‘buy’ signal shortly, hinting at a possible upturn following a downtrend, similar to a green light indicating go ahead.

What do the charts say?

While an analysis based on previous cycles might be compelling, what do SOL’s charts say?

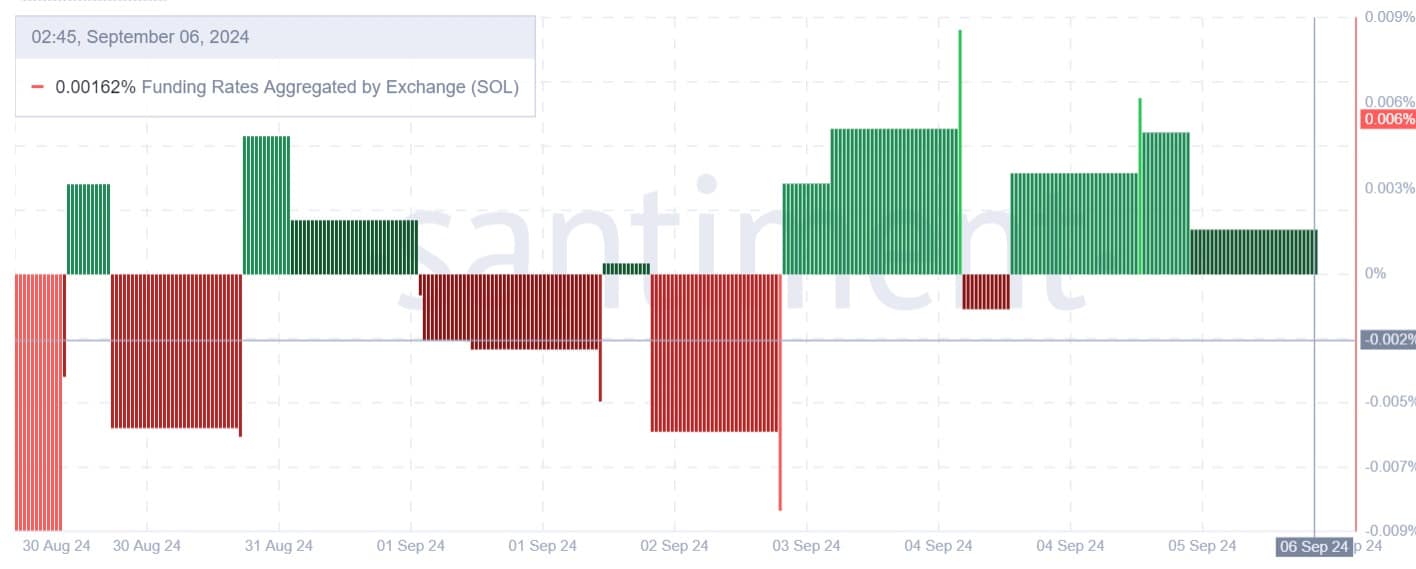

Initially, the accumulated funding rate of Solana across exchanges has stayed optimistic for the past three consecutive days. Despite a drop in its price over this timeframe, investors seem to be expressing faith in the future trajectory of this altcoin.

Consequently, those who have taken long positions are effectively compensating short positions by offering them payment to maintain their stance. Essentially, these traders are wagering that prices will increase, which is why they’re ready to pay a premium for their positions. This can be understood as an indication of optimism or bullish sentiment.

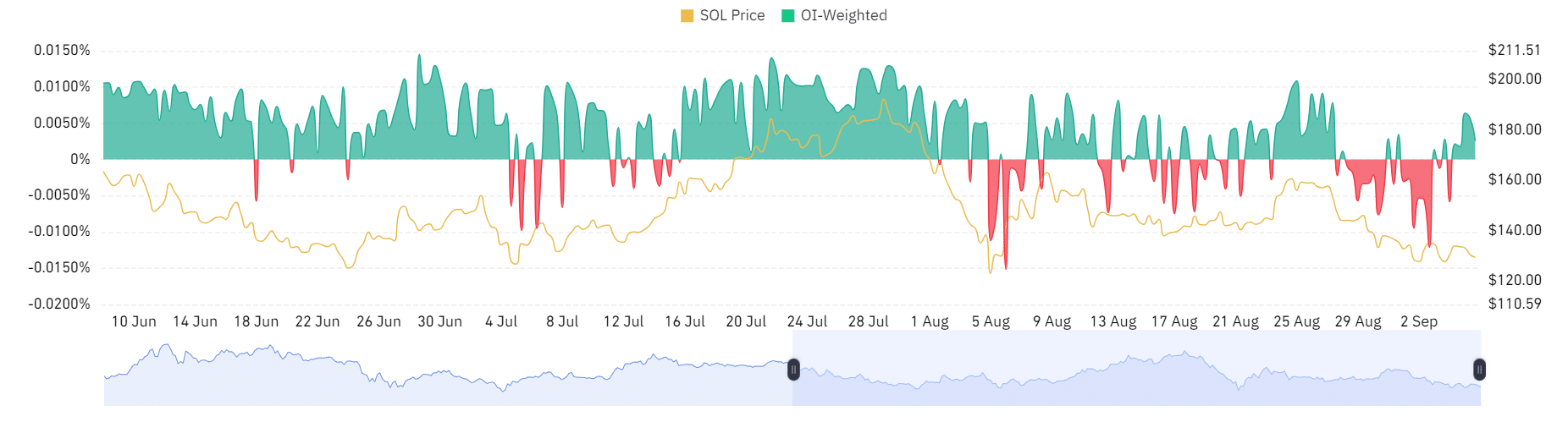

Moreover, the Open Interest on each exchange increased by approximately 7.59% during the last week, climbing from a minimum of $614 million to $661 million. This suggests an uptick in buying behavior as investors established new positions and maintained existing ones, contributing to a favorable market atmosphere.

In summary, between September 3rd and September 6th, 2024, the OI-weighted funding rate has persistently been positive. This indicates a growing interest in holding long positions, which could be interpreted as a reflection of investor confidence in the altcoin market.

If Martinez’s analysis proves accurate and there’s a favorable market opinion, it’s possible that SOL could experience a temporary increase, reaching around $142.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-07 06:15