- Solana was accumulating bullish pressure after rejection at around the $122 support level.

- High circulating supply and active stake indicated strong network engagement.

As a crypto investor with some experience under my belt, I’m keeping a close eye on Solana (SOL) right now. Based on recent price action and fundamental analysis, I believe SOL is accumulating bullish pressure after being rejected at the $122 support level.

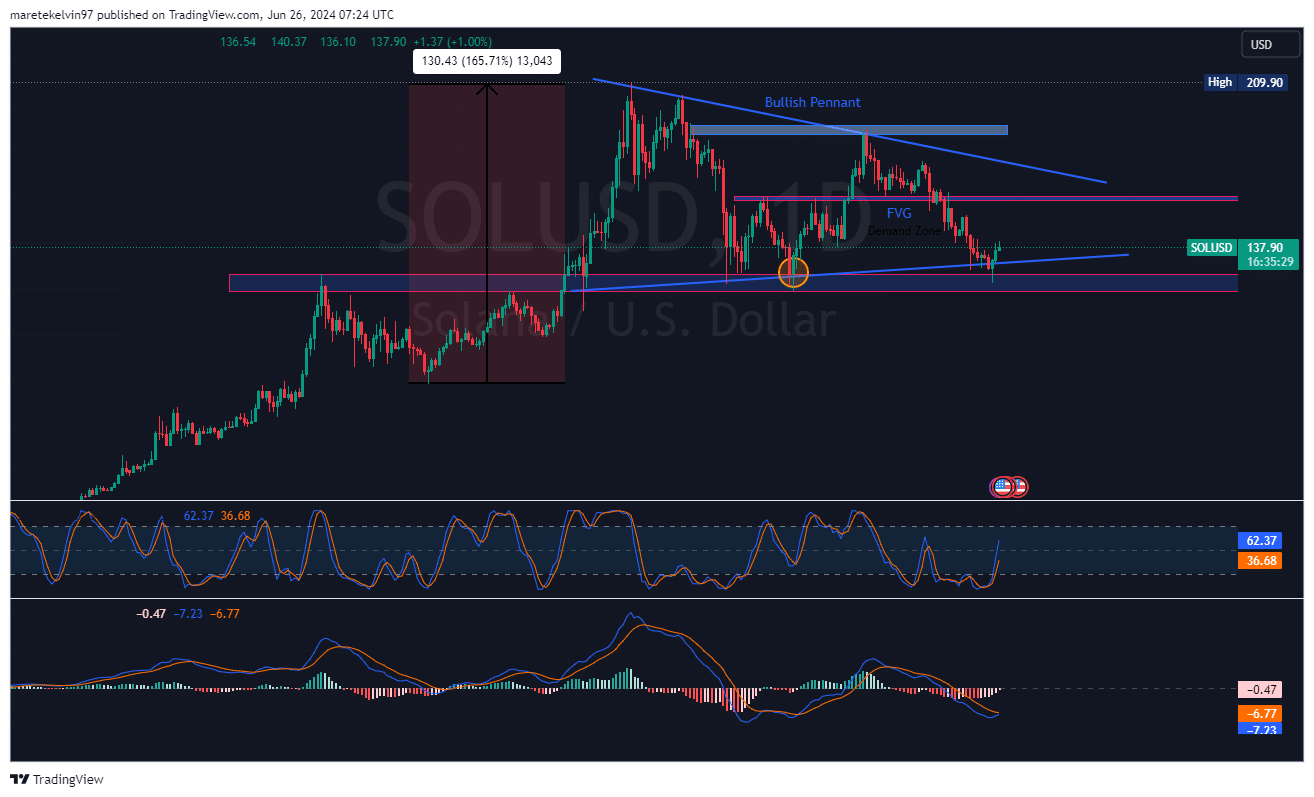

At present, Solana (SOL) was exhibiting a bullish pennant formation on the price chart. Over the past few days, there had been a significant drop in Solana’s value, with approximately a 35% decline since May 20th. However, the downward pressure was being held at bay by the strong support level of $122.

After being turned down, SOL experienced a significant increase of 10% over the past 48 hours. This trend suggests the ongoing accumulation of positive energy, pointing towards further growth.

At present, the cost of Solana (SOL) on CoinMarketCap is reported as $136.33, representing a 1.09% growth in the past day and a 1.26% rise during the last week. The market cap of SOL has expanded by 1.13%.

At the current moment, the MACD indicator signaled a weakening bearish trend based on its reading. It’s possible that this is a brief downturn preceding the continuation of the bullish trend.

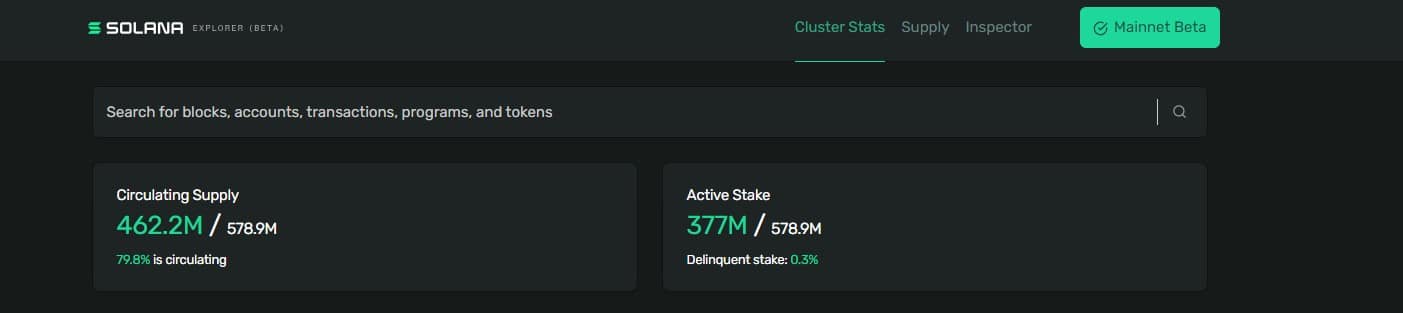

Circulating supply

Based on AMBCrypto’s examination of Solana’s figures, approximately 462.2 million SOL tokens are currently circulating. The total number of SOL tokens that can ever exist is 578.9 million.

As a crypto investor, I would interpret this to mean that approximately 79.8% of the total supply is currently in circulation and being used in various transactions within the marketplace. Such a sizable circulating supply signifies robust activity among users and investors alike, which can be considered a bullish indicator.

Approximately 65.1% of Solana’s total supply, which amounts to 377 million SOL, is currently being staked by investors. This significant figure underscores a strong level of trust and commitment from the investor community.

Reducing the amount of a cryptocurrency or token that is in circulation through staking can contribute to price consistency and possibly cause prices to rise due to scarcity.

The 0.3% past-due stake, which is inconsequential, highlights that almost all staked tokens play a crucial role in securing the network. This underscores Solana’s robustness and reliability.

Solana: What of investor confidence?

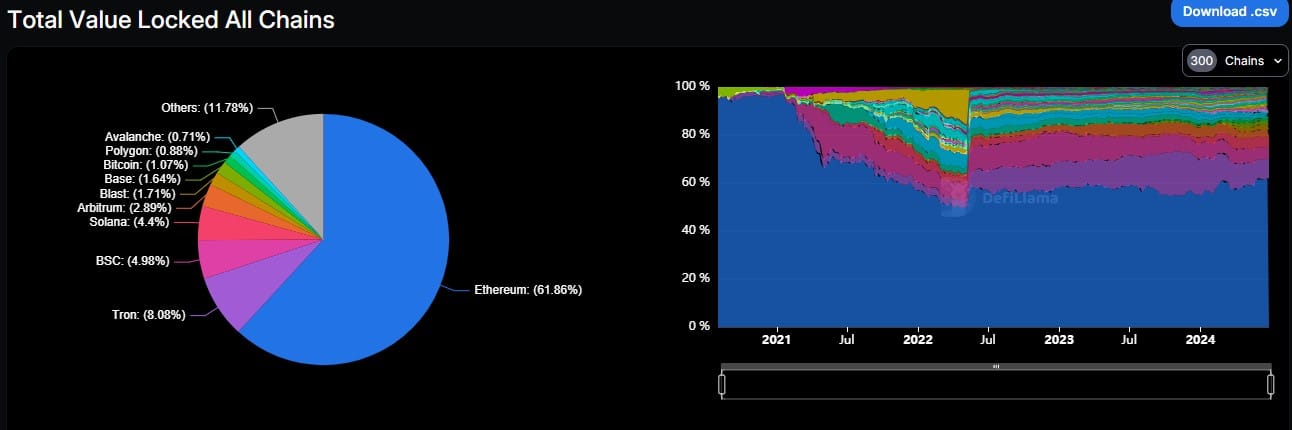

As a researcher, I delved deeper into Solana’s Total Volume Locked statistics, as reported by DefiLlama. It was noteworthy that Solana held a significant 4.4% share of the entire crypto market. This finding underscored the growing interest and confidence in Solana’s DeFi offerings from investors.

As an analyst, I’ve observed that even amidst market fluctuations, Solana has managed to maintain a consistent level of total volume locked in. This stability suggests a promising outlook for potential long-term investors.

Bullish continuation or imminent pullback?

As a crypto investor, I’ve noticed that Solana’s value is steadily building up bullish momentum. This optimistic trend seems to be supported by strong network fundamentals and positive market sentiment.

The high proportion of circulating supply being actively staked, reflecting robust network participation and belief, is a positive sign. Nevertheless, the MACD indicator suggests that a brief price decline may occur in the near term.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-26 16:08