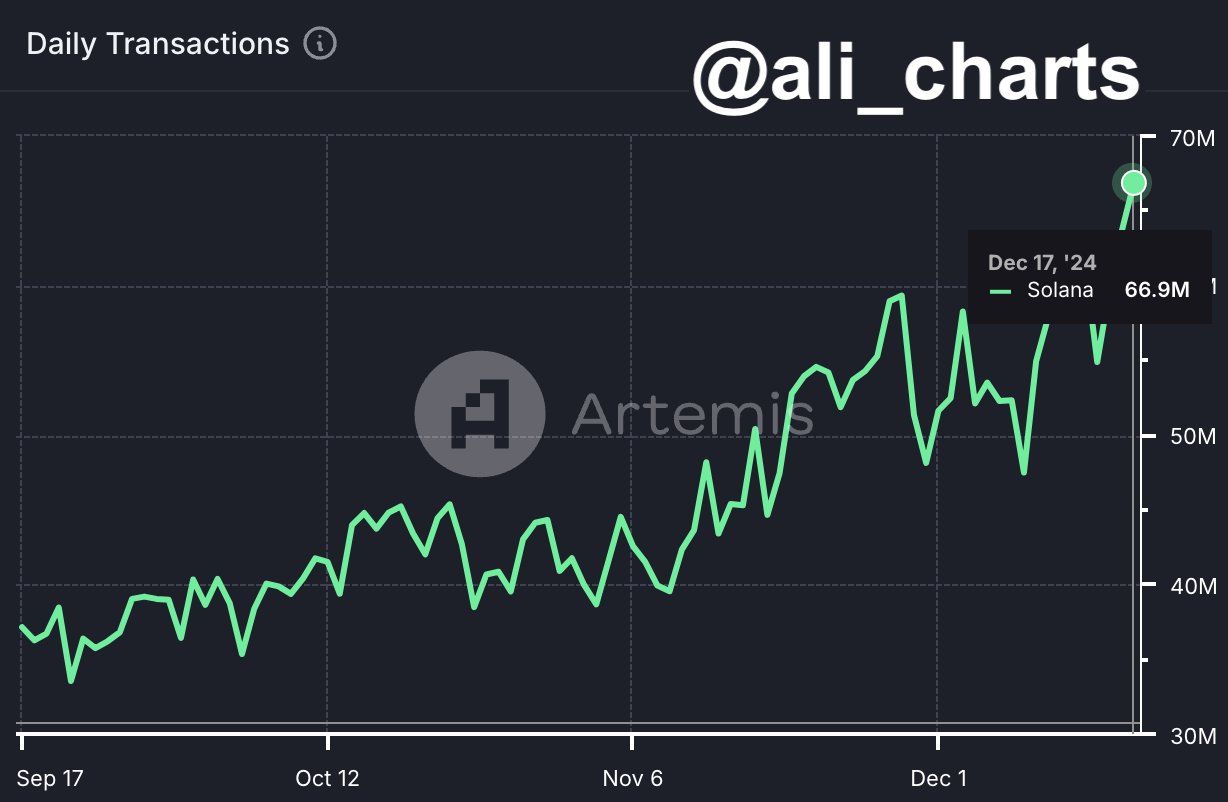

- Transaction activity on the SOL network surged over the past 24 hours, suggesting increased interest.

- Market sentiment in both the spot and derivatives markets is gradually shifting in favor of a bullish outlook.

As an analyst with over two decades of experience in the crypto market, I’ve seen my fair share of bull and bear runs. The recent surge in transaction activity on the SOL network and the shifting sentiment in both the spot and derivatives markets have piqued my interest.

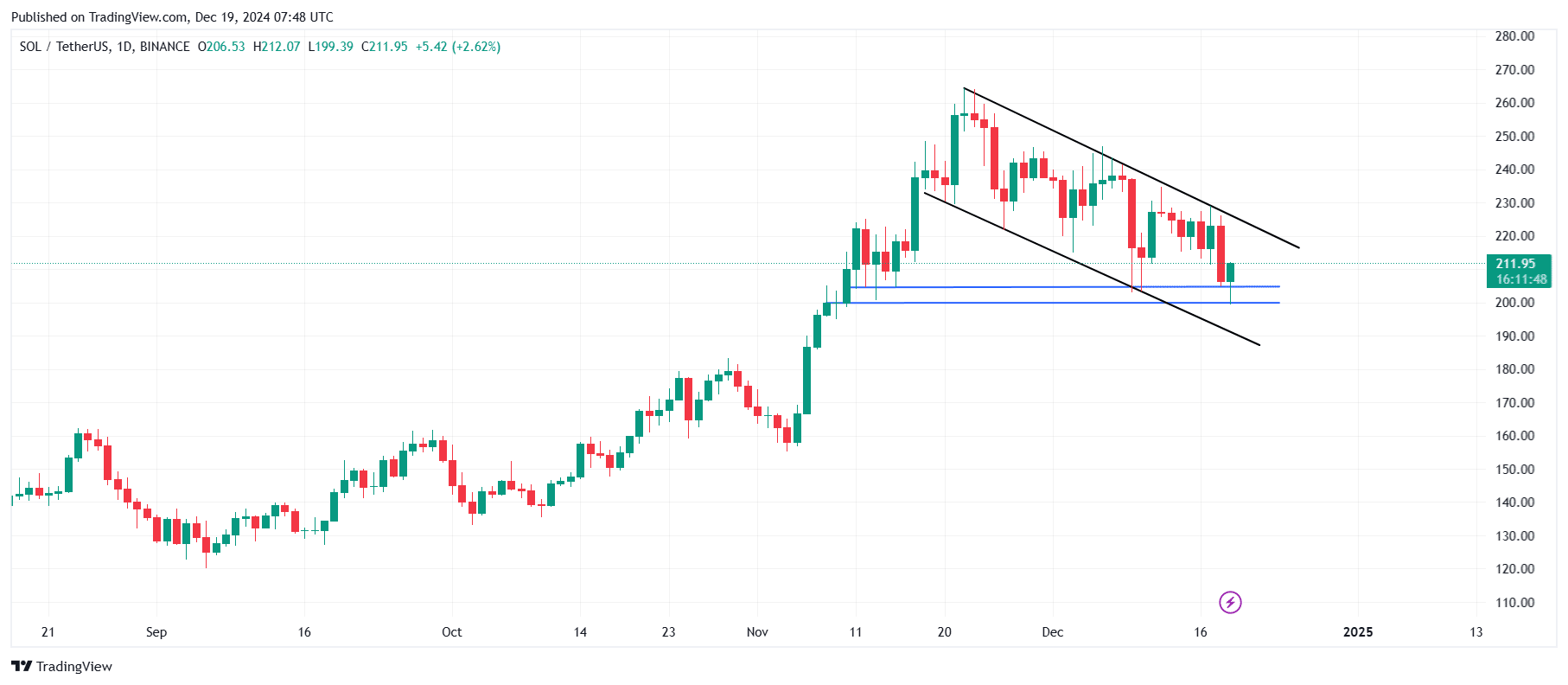

Solana (SOL) has faced some difficulties following its peak of $264.39. In the last month, it has experienced a decrease of approximately 13.20%, undoing its earlier advancements. At this moment, on the daily chart, the asset is seeing a decline of 2.93%, currently trading at $209.44.

From AMBCrypto’s analysis, it appears that high trading activity might be a sign of selling pressure. However, the general mood or sentiment seems to hint at a potential bullish turnaround.

Increased trading activity: What does it mean for SOL?

Based on Artemis’ findings, there has been a significant increase in daily transactions on the SOL network. The transaction count is now close to 67 million, a figure not observed in several months.

An increase in transaction frequency might indicate either a favorable or unfavorable trend for an asset, typically based on the direction of its price.

For SOL, a drop of 2.93% implies that the rise in transactions might be driven by sellers rather than buyers. Lately, it reached a fresh weekly bottom, currently being traded at $199.39.

Consequently, the drop in SOL’s value has placed it within a significant area of support on its weekly graph, a region known for robust buyer activity. This reinforcement might spark an upcoming price surge.

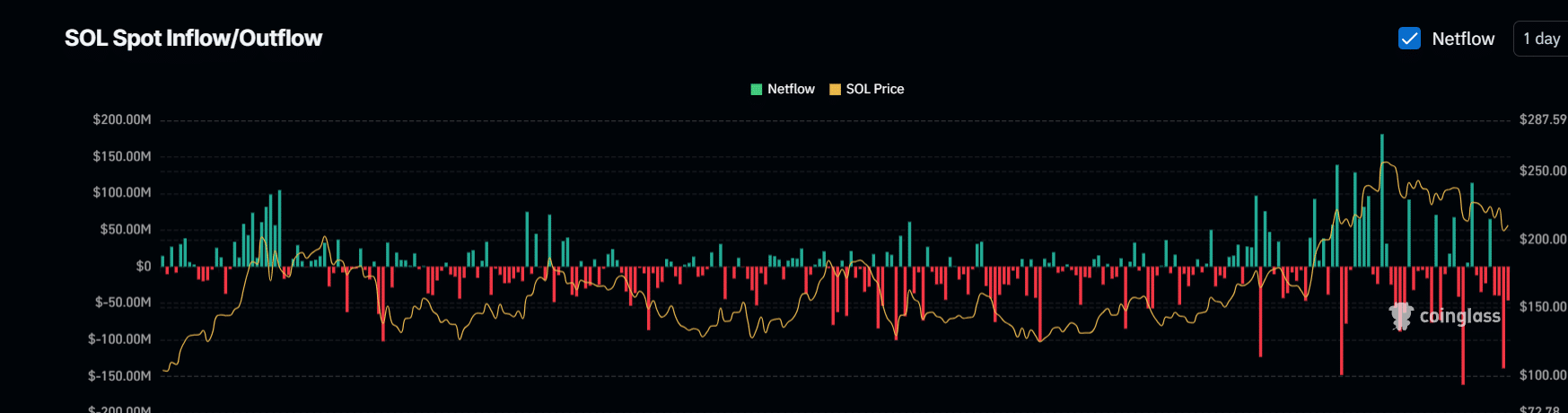

SOL outflows surge as spot conviction changes

A significant amount of Solana (SOL) being withdrawn from exchanges indicates that individual traders might be transferring their holdings to personal wallets, suggesting a possible long-term investment intent, even in the face of the current market slump.

Generally speaking, under these circumstances, it’s common for traders to add more assets to exchanges. But the ongoing trend of withdrawals suggests a strong optimism among traders, potentially indicating a bullish market.

Currently, the Exchange Netflow shows a significant outflow of Solana (SOL), amounting to approximately $264 million over the past 96 hours. In the last day, around $46.26 million worth of SOL has been taken off exchanges, adding to the market’s resilience by preventing an additional price drop.

As a researcher, I’ve observed that the market’s funding rate persists positively at 0.0057%. This suggests that long bullish traders are consistently paying a recurring fee to keep the equilibrium between the spot and futures market prices in check.

Should the ongoing increase in withdrawals and favorable funding rates persist, Solana (SOL) might be headed towards fresh record-breaking prices.

Long liquidations set the stage for a bullish shift

Over the last day, there’s been a significant wave of selling off in the market, leading to a loss of around $21.35 million. This happens when the value of an asset decreases instead of increasing as predicted by long-term investors (long traders), causing substantial losses.

On the lower time scales, there’s a noticeable transition taking place, indicating that traders’ attitudes might be changing, becoming less pessimistic.

Over the last 4 hours, I’ve seen a significant difference in liquidations: short liquidations have surpassed $936,150 while long liquidations are below $150,000. This imbalance suggests that traders are becoming more optimistic about the asset’s future direction, potentially indicating an upward trend.

Furthermore, during the same timeframe, Open Interest has risen by 0.62%, reaching a total of $3.52 billion. This growth suggests a bullish trend, since most of the outstanding derivative contracts indicate a preference for an increase in price.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-19 15:03