-

Bulls re-entered near the 200-day EMA as SOL reached an important price point on charts.

SOL’s funding rate declined but showed signs of improvement.

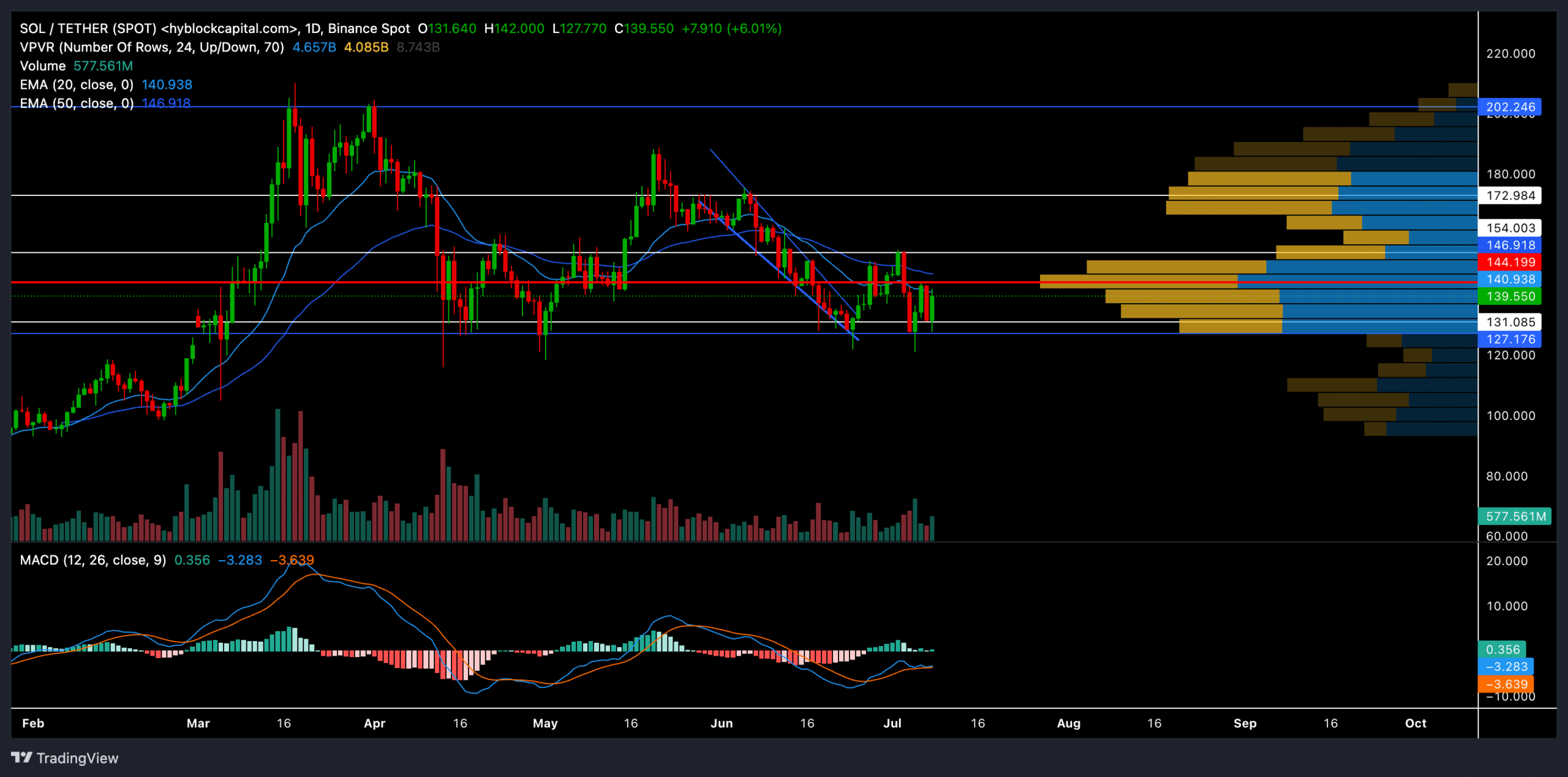

As an experienced analyst, I’ve closely monitored Solana’s [SOL] price action and chart patterns over the past few months. Based on my observation, SOL’s reversal from the $202 resistance mark in April paved the way for bears to re-enter the market. The altcoin has since then experienced significant bearish pressure, falling toward its 200-day EMA.

The price of Solana’s SOL coin dipping below the $202 resistance level in April initiated a resurgence for bears, leading to significant downward pressure on the token. At present, SOL is showing clear signs of bearish movement as it approaches its 200-day moving average.

Based on our earlier analysis in the SOL article, the heavily oversold state of SOL triggered a brief trend reversal as depicted on its price charts.

As a crypto investor, I’ve noticed that Solana’s (SOL) token price has approached a significant threshold once more. However, it’s important to note that the current market conditions aren’t yet oversold based on my analysis at the present moment. The coin was trading around $141 at the time of this observation.

Can SOL buyers reclaim their edge?

Pressure to sell has been present ever since SOL‘s unsuccessful attempt to surpass the $202 resistance point. Over the past three months, this cryptocurrency experienced a significant decline of approximately 37%, reaching a floor at around $127.

In the day-to-day price chart of Solana (SOL), there appeared a typical falling wedge pattern amidst the ongoing downtrend. The supportive price range of $127 to $131 significantly influenced a reversal, leading to a bullish breakout for the cryptocurrency.

After breaking through the $154 mark, the bulls attempted to revisit this level. Yet, the 20-day moving average and 50-day moving average served as obstacles for any potential price increase.

During the recent market decline, the price of SOL approached its 200-day moving average. Over the last week, this cryptocurrency, referred to as an altcoin, has encountered this significant resistance level for almost nine months.

It’s noteworthy that the cryptocurrency SOL last dipped beneath its 200-day moving average (EMA) back in January 2022. Throughout this downtrend, the price remained below this marker for approximately 1.5 years.

As a crypto investor, I’m observing that at the present moment, the 200 Exponential Moving Average (EMA) hovers around the $131 mark. Notably, this price point aligns with the previously established support zone of $127 to $131. This alignment suggests a promising near-term recovery outlook from this range.

Moving forward, SOL‘s price is expected to fluctuate between approximately $127 and $154. Consequently, traders have an opportunity to benefit from price reversals at these levels, whether as support or resistance. A break above $154 could lead buyers back towards the $172 mark for another test.

Any price movement approaching the $127-$131 support zone could potentially lead to a prolonged decrease in Solana’s (SOL) value, possibly resulting in excessively pessimistic market sentiments.

When I penned this down, the MACD indicator maintained a bearish stance. The MACD lines for SOL have yet to surpass the zero line, indicating that its squeeze period would persist for the following days.

Read Solana’s [SOL] Price Prediction 2024-25

Funding rates declined

Based on information from Coinglass, the funding rates for Solana (SOL) have dropped below zero on all trading platforms during the past few hours. This downward trend suggests a bearish outlook. Nevertheless, positive adjustments to this figure could assist SOL in recovering short-term energy and potentially regaining momentum.

In the end, keeping tabs on Bitcoin‘s price trends and public perception is essential for making a knowledgeable purchase.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-07-09 09:12