- Solana consolidated in a rising wedge pattern below the $200 level.

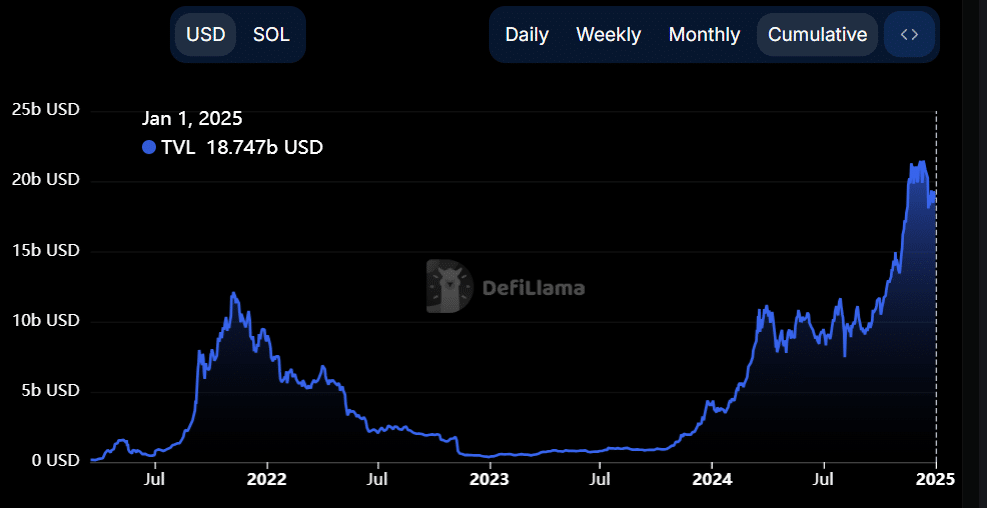

- SOL’s TVL including Staking, Borrows, and Liquid Staking hits $20 Billion.

As a researcher with years of experience in cryptocurrency markets, I have witnessed numerous price patterns and trends that ultimately led to significant gains or losses for investors. The current situation with Solana (SOL) is particularly intriguing, considering the strong financial ecosystem it has built over the past year.

The rising wedge pattern below the $200 resistance level presents an opportunity for a potential reversal to the upside during bullish markets, but I’ve learned not to underestimate the power of psychological price levels like this one. The consistent holding of the ascending support line and the formation within this wedge suggest a strong undercurrent of bullishness, yet Solana’s struggle around $200 indicates that this level is critical for future momentum.

Should SOL break above this resistance, I believe it could trigger a significant rally targeting the next resistance levels at $236 and possibly extending above $400 in Q1 of 2025. However, if Solana fails to surpass $200, we might see a pullback to lower support levels around $180.

On the flip side, Solana’s Total Value Locked (TVL) hitting an all-time high of $20 billion and its robust participation in staking, borrowing, and liquid staking indicate a strong financial ecosystem. The network’s high volume, daily fees collected, and active addresses underscore potential price appreciation.

However, I can’t help but think about the recent controversy surrounding Pumpdotfun and their offloading of SOL tokens, which has impacted investor trust and caused some wallet holders to question the project’s long-term potential. As a researcher, I always remind myself that the crypto market is unpredictable, and even meme coin launches may not guarantee success.

So, as we watch these levels closely for signs of either continuation or reversal in trend, let’s not forget to keep our sense of humor intact. After all, they say that investing in cryptocurrencies is like a game of snakes and ladders – sometimes you climb up fast, but other times you slide down just as quickly!

The price of Solana’s [SOL] coin has dropped by over 1.5%, now sitting at approximately $191. This decrease in price has been accompanied by a drop in trading volume, which is currently around $2 billion – a 16% reduction compared to previous levels, as reported by CoinMarketCap.

The graph demonstrates an emerging ‘rising wedge’ formation under the $200 barrier, a pattern typically seen as a precursor for a possible price increase in bullish market conditions.

Regardless, the upward trendline has persistently been reinforced, indicating robustness since prices formed higher bottoms, hinting at a bullish momentum beneath the surface.

On the $200 mark, Solana has faced significant hurdles, suggesting this price point serves as a robust barrier. This suggests that if the price is to rise substantially in the future, it must first overcome this crucial resistance level.

If Solana manages to surpass its current resistance, it might spark a substantial upward trend, potentially reaching the next resistance points at around $236, and possibly even exceeding $400 by the first quarter of 2025.

However, failure to surpass $200 might result in a pullback to lower support levels around $180.

In the upcoming first quarter of the year, the development inside this wedge shape, along with trading activity and overall market mood, will serve as significant signs to predict Solana’s possible trend or direction.

Watch these levels closely for signs of either continuation or reversal in trend.

Solana’s Total Value Locked

In the year 2024, Solana demonstrated a robust financial infrastructure, as indicated by a record-breaking Total Value Locked (TVL) of $20 billion. This impressive figure underscores significant involvement in activities such as staking, lending, and liquid staking, suggesting a thriving community participation.

Stablecoins market cap reached $5.226 billion, reinforcing its liquidity framework.

Each day, we gathered a staggering $3.22 million in fees due to heavy network activity, with the total volume reaching an impressive $3.293 billion.

Boasting a constant trading volume of approximately 803 million dollars and 4.12 million active users, the network’s high level of activity suggests possible future price growth.

At the moment of reporting, Solana’s total value in the market was approximately $91.682 billion, and its coin was being traded at around $189.47. This current standing suggests that Solana could potentially see expansion up to 2025.

Pumpdofun’s monthly revenue

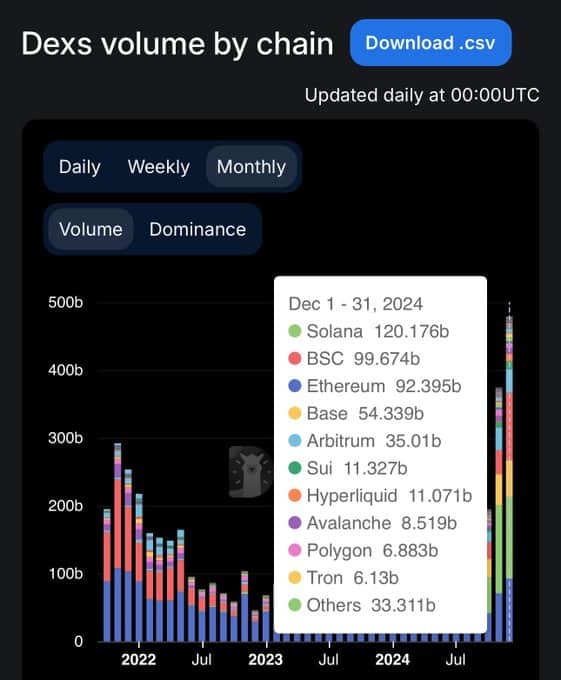

For the month of December 2024, Solana showed outstanding financial results, particularly in its decentralized exchange (DEX) trading volume and earnings from Pumpdotfun, surpassing a remarkable total of $80 million.

With a powerful surge, Solana has taken the lead, boasting a staggering $120 billion in Decentralized Exchange (DEX) trading volume and holding a 25% share of the market, thereby underscoring the expanding nature of its ecosystem.

In simple terms, both Bitcoin Standard Capital (BSC) and Ethereum [ETH] were very active, with trading volumes of approximately 99.674 billion for BSC and 92.395 billion for ETH. This shows a strong competition between these two entities within the cryptocurrency sector.

Read Solana’s [SOL] Price Prediction 2025–2026

Yet, Pumpdotfun encountered backlash due to the substantial transfer of SOL tokens, which raised concerns among investors as many wallet holders experienced limited rewards.

Or:

Pumpdotfun was met with criticism because they moved a large amount of SOL tokens out of their wallets, leading investors to question their trustworthiness since most wallet owners did not see substantial returns.

The fact that Solana is successfully drawing in users via meme coin launches hints at a possible upward price movement towards 2025, given it continues to dominate the market and addresses any lingering trust concerns.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-01-02 08:08