-

Investor shifted attention from SOL to memecoins.

Per a crypto hedge fund, SOL’s struggle could ease ahead of US elections.

As a seasoned researcher with years of experience in the crypto market, I find myself intrigued by the shifting tides of investor attention from Solana [SOL] to memecoins. While SOL’s struggle within the $160-$120 range is concerning, I share Quinn Thompson’s optimism about a potential strong breakout.

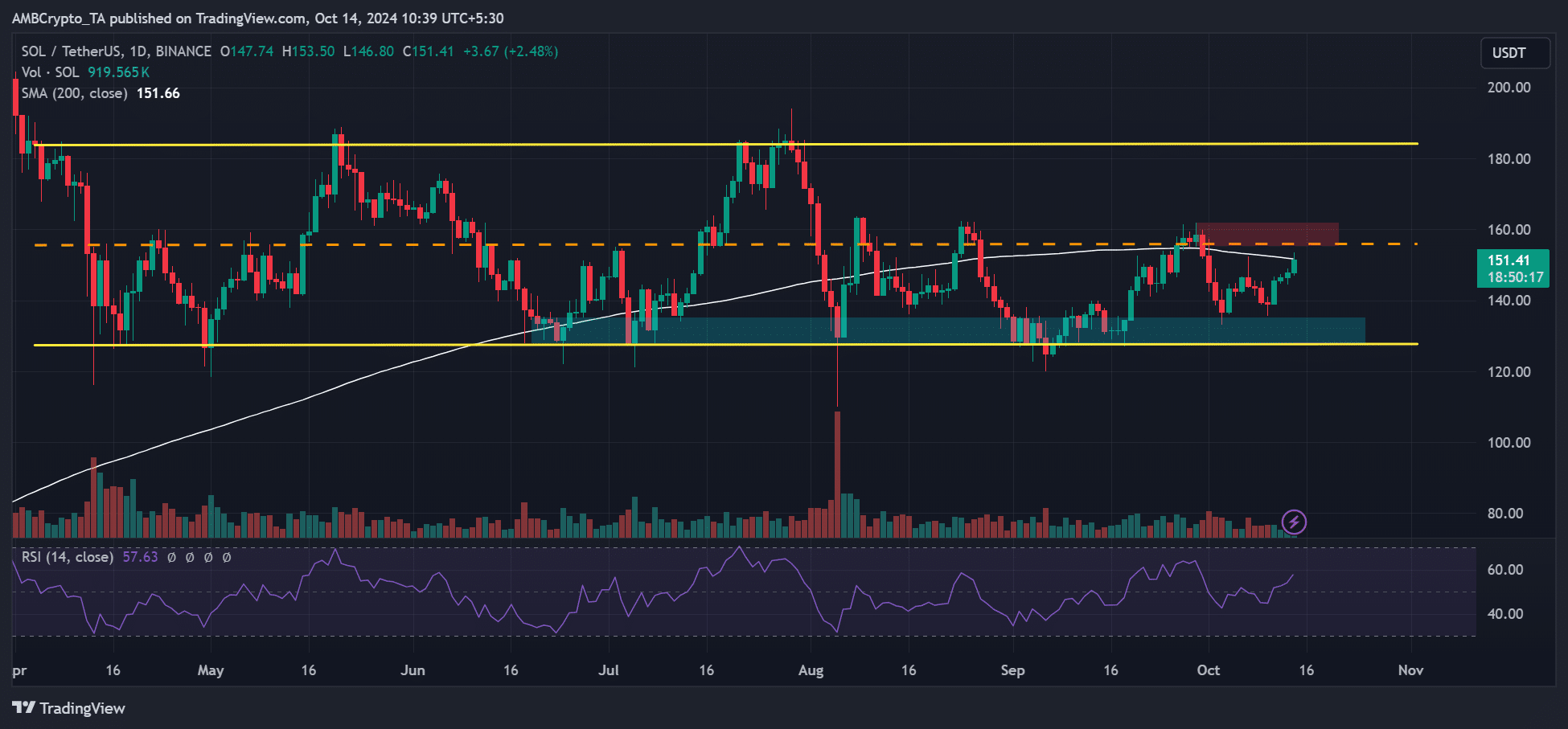

Since August, Solana [SOL] has been range-bound within the $160-$120 range.

On the other hand, Quinn Thompson, the creator of crypto hedge fund Lekker Capital, thinks it’s quite possible that a powerful surge might take place.

As a crypto investor, I’ve noticed that the buzz around Solana seems to have quieted down lately, with many native crypto enthusiasts shifting their attention towards the memecoin craze. (Thompson’s observation)

As a researcher delving into the dynamics of cryptocurrencies, I’ve observed an interesting trend: although the majority of memecoin activity occurs on Solana (SOL), this hasn’t significantly propelled the price of SOL due to a peculiarity. The conventional crypto-native capital, which usually invests in SOL or other alternatives, is instead opting for memes. This shift in investment strategy has resulted in the SOL token price remaining relatively stable amidst the bustling memecoin activity on its platform.

US elections potential impact

Thompson pointed out that if Trump’s chances of winning the U.S. elections rise, it might lead to a significant surge in Bitcoin [BTC], potentially raising the value of Solana (SOL) as well.

The momentum of Bitcoin (BTC) is expected to return, causing it to rise once more. This resurgence could have a significant domino effect on Solana (SOL), ultimately leading to its anticipated breakout point called SOLETH.

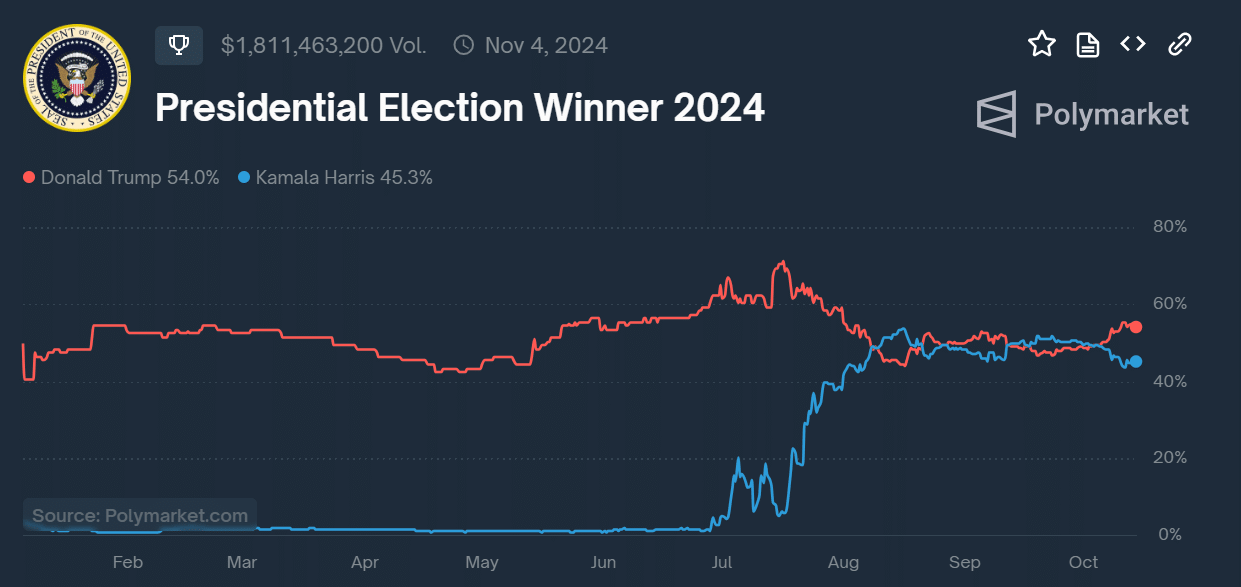

On the prediction site Polymarket, Trump has increasingly maintained a lead against Kamala in October. This reinforced Thompson’s bullish outlook on BTC and SOL. Currently, speculators priced a 54% chance of Trump’s win against Harris’ 45.3%.

Based on findings from Santiment, the optimism surrounding the altcoin reached its highest point in nine months. This trend suggests that investors are growing more confident about Solana’s potential for growth.

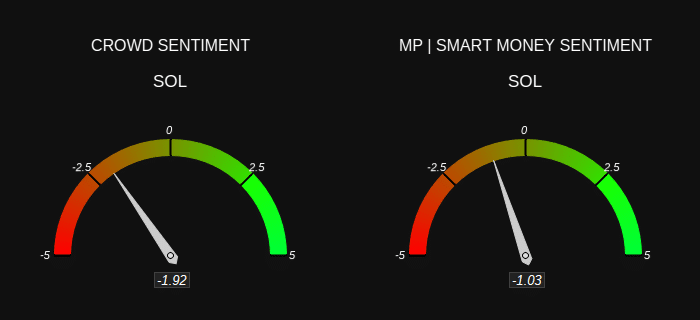

As a crypto investor, I noticed that while my personal sentiments about Solana (SOL) might have been positive, Market Prophit’s data on the aggregated sentiment analysis painted a slightly different picture. This suggests that the broader market perception could be more cautious than I initially thought.

As I write this, the overall sentiment among both individual investors and institutional ones appears to be quite bearish. This has led me to exercise more caution in the short term, since Solana’s (SOL) recovery is approaching critical resistance points.

As I analyze the current market situation, I’ve noticed that Solana (SOL) has recently recovered and touched its 200-day Moving Average at around $151. However, there’s another potential barrier ahead at the mid-range resistance level of approximately $160. For this recovery to continue and potentially reach $180, SOL needs to successfully overcome the resistance at $160 first.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

2024-10-14 12:07