-

Solana outperformed Ethereum in terms of DEX volumes.

The price performance of both SOL and ETH tokens were positive over the last 24 hours.

As an experienced analyst, I have closely observed the cryptocurrency market and the dynamics between Solana (SOL) and Ethereum (ETH). Based on recent data and trends, it’s clear that Solana is making significant strides in outpacing Ethereum in certain areas.

Solana [SOL] and Ethereum [ETH] have been one of the top cryptocurrency networks in the space.

As a seasoned market analyst, I’ve observed Ethereum’s impressive hold on several domains, but recent advancements hint at Solana potentially surpassing Ethereum in the near future.

Solana shows promise

As a researcher analyzing decentralized exchange (DEX) trading data from DefiLlama, I discovered an intriguing development: Solana outpaced Ethereum with an impressive daily trading volume of approximately $1.148 billion. In comparison, Ethereum recorded a volume of around $745 million.

This change signifies a new leading position in the Decentralized Exchange (DEX) marketplace, potentially indicating a rising trend toward Solana’s quicker transaction processing times and reduced costs.

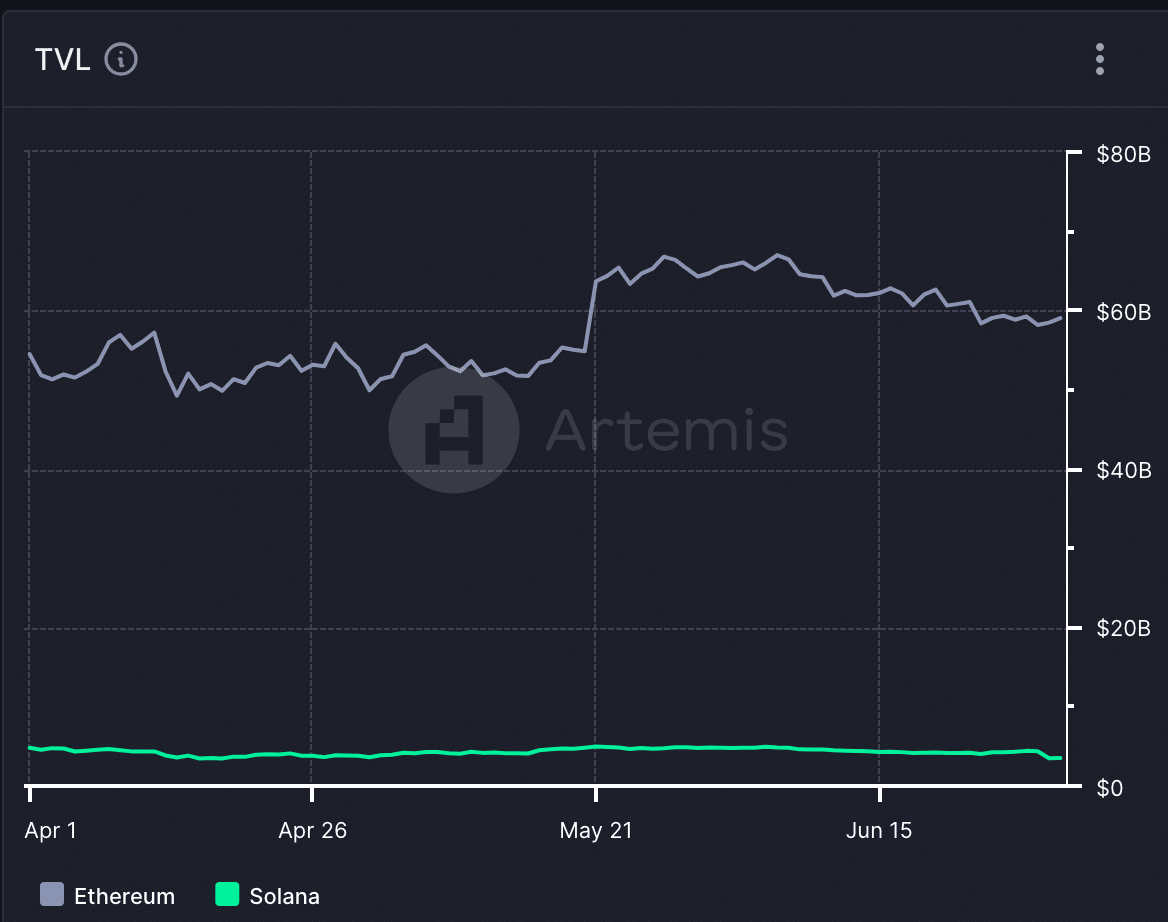

Noting the current lead of Ethereum in terms of total value locked (TVL) in Decentralized Finance (DeFi), it’s important to acknowledge the impressive performance of Solana in DEX (Decentralized Exchange) volume. This growth could potentially catapult Solana to greater heights within the DeFi ecosystem.

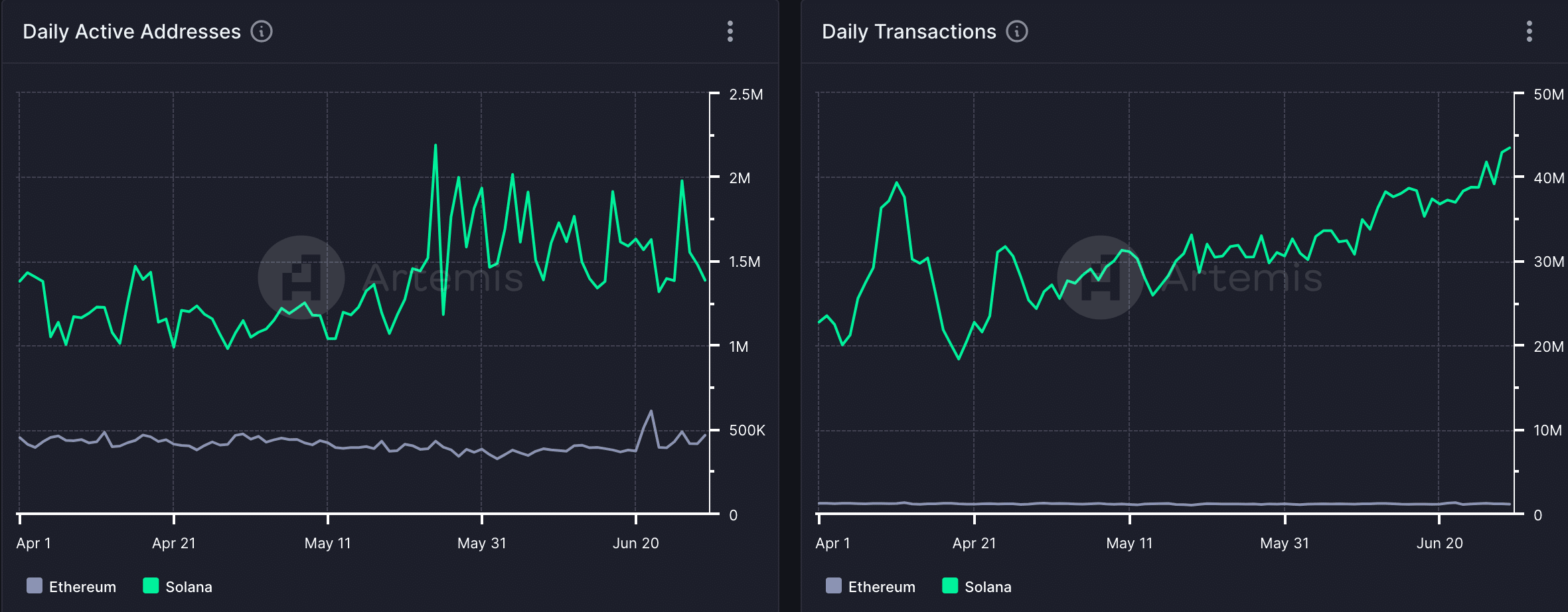

Despite having a smaller total value locked (TVL) compared to Ethereum, Solana surpassed Ethereum in overall network activity.

At present, approximately 1.4 million unique addresses are in use daily on the Solana network, while Ethereum hosts around 644,000 daily active addresses.

When it comes to handling day-to-day transactions, Solana outperforms Ethereum substantially. As of now, approximately 42.9 million transactions are being processed on Solana’s network, whereas Ethereum sees around 1.1 million transactions.

Looking at the finer details

Despite surpassing Ethereum in terms of overall activity on its network, it’s crucial to acknowledge that the contribution of Layer-2 solutions has not been factored into this assessment.

L2 platforms such as Arbitrum (ARB) and Optimism (OP) serve as scalability solutions for Ethereum by handling transactions away from the primary network while maintaining Ethereum’s security protocols.

Activity on these L2s translates to interest in the Ethereum ecosystem as a whole.

However, Solana’s impressive numbers raise questions about long-term sustainability.

The heavy trading activity could be fueled in part by investors engaging in speculation or meme coin trends, which might not result in substantial value growth over the long term.

It’s essential to examine whether this activity contributes to creating robust Decentralized Finance (DeFi) applications and drawing in established projects.

In addition, Solana’s design offers quicker processing times and more affordable costs. However, it has drawn critique due to previous issues with network congestion and downtimes.

Should persistent outages on the Solana network persist, they could significantly influence public perception towards the network and potentially dissuade some users from utilizing the protocol.

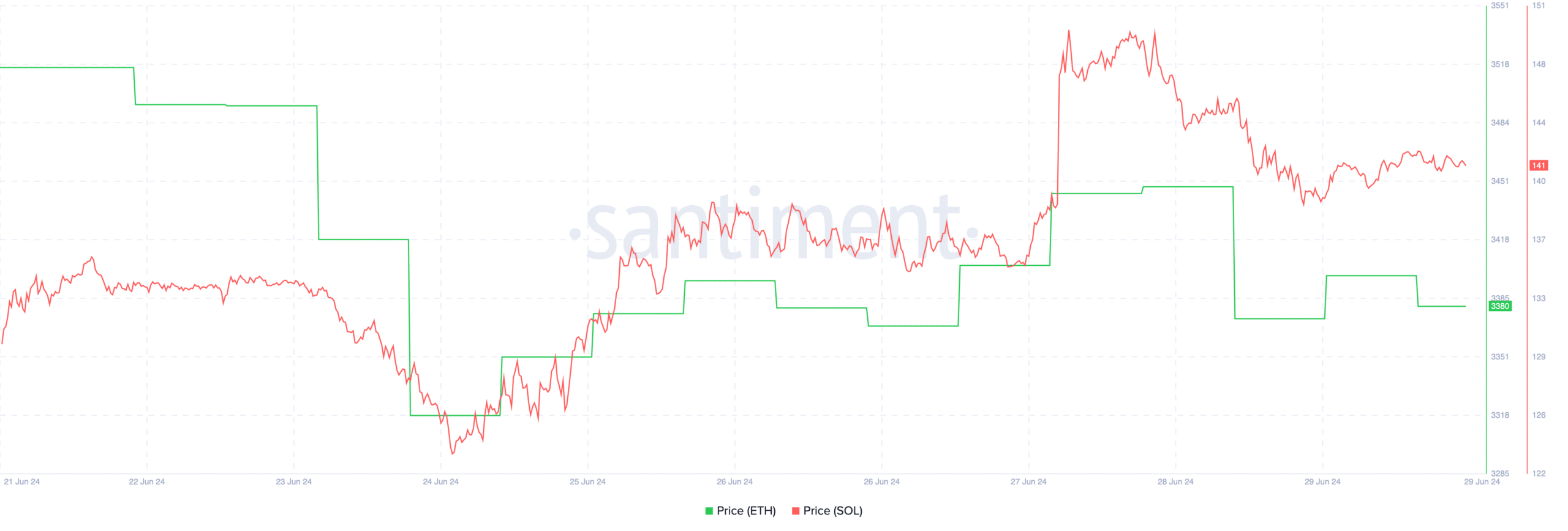

As of when this article was published, the prices of Solana’s SOL token and Ethereum’s ETH token had gained from the surging optimism in the cryptocurrency market within the previous 24 hours, recording growths of 6.6% and 3.4%, respectively.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-01 14:19