- Solana surpassed Ethereum in daily network fees and DEX trading volume.

- With a 300% price surge, SOL was positioning itself as a serious competitor to Ethereum.

As a seasoned analyst who has witnessed the ebb and flow of the crypto market for over a decade now, I must admit that Solana [SOL] has certainly caught my attention. Its meteoric rise and impressive performance in key metrics such as daily network fees and DEX volumes have positioned it squarely as a formidable challenger to Ethereum [ETH].

Currently standing as the fourth-biggest cryptocurrency by market value, Solana [SOL] is reshaping the storyline within the blockchain sector.

Making significant progress in crucial areas like daily transaction fees and decentralized exchange volumes, Solana is swiftly advancing, indicating a maturing ecosystem and increasing real-world usage. Originally a competitor, it now presents a strong rival to Ethereum [ETH], altering the competitive terrain of blockchain technology.

Solana vs. Ethereum

Over the past few months, Solana has made notable advancements, outperforming Ethereum in terms of daily transaction fees and decentralized exchange (DEX) trading volumes.

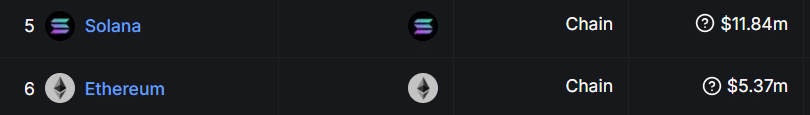

Based on information from DeFiLlama, Solana’s network fees amounted to approximately $11.8 million over a 24-hour period, which is almost twice the daily network fees generated by Ethereum at around $5.3 million.

In terms of decentralized exchanges (DEX), Solana has been equally remarkable. Over the past week, its 24-hour trading volume soared to a staggering $6.24 billion, significantly outshining Ethereum’s $850 million and exceeding the combined volumes of all Ethereum Layer-2 platforms.

This show was fueled by a strong increase of 300.56% in the value of SOL over the year so far, which has just surpassed $240. This underscores the growing popularity of the network and the positive sentiment towards it in the larger cryptocurrency market.

Expanding ecosystem and real-world adoption

The rapid expansion of SOL isn’t just reflected in market figures; it’s deeply rooted in tangible evidence. As per Ryan Watkins of Syncracy Capital, this blockchain’s development is based on solid data, not mere speculation.

Over the course of the last year, the fees associated with Solana’s protocol have escalated to an impressive $343 million, almost twice as much as Ethereum’s $178 million. This significant increase is a stark contrast to November of the previous year when Solana’s transaction fees accounted for only 1.36% of Ethereum’s. At present, they have reached a remarkable 80%.

Watkins highlighted that Solana was no longer viewed as a speculative network driven by technical advantages like speed and scalability. Instead, it is now a blockchain ecosystem with undeniable data to back its success.

Will Solana surpass Ethereum?

With Solana’s ecosystem steadily growing and its real-world usage increasing at a rapid pace, one can’t help but wonder: Could Solana potentially outshine Ethereum completely?

Although Solana boasts notable benefits such as affordability and capacity for high transaction volumes, Ethereum maintains its lead in terms of developer interest, backing from institutions, and the foundation of decentralized financial systems (DeFi).

Realistic or not, here’s SOL market cap in BTC’s terms

If Solana continues on its current path of growth, it may firmly establish itself as a serious competitor to Ethereum’s reign. The upcoming months should show us if Solana can keep up this pace, or if Ethereum, with its established advantages, will manage to preserve its lead.

Currently, SOL’s rise signifies a significant turning point in the market, demonstrating the ever-changing and competitive landscape within the realm of blockchain technology.

Read More

2024-11-21 16:07