- Solana has capitalized on Bitcoin’s pullback, pulling ahead of Ethereum.

- With momentum shifting, can ETH make a comeback?

As a seasoned crypto investor with a decade of market experience under my belt, I’ve witnessed the rise and fall of numerous altcoins. The current trend shows Solana [SOL] outpacing Ethereum [ETH] in this bull cycle, and it’s not just about market cap.

Labeled informally as the “Ethereum Alternative,” Solana (SOL) has shown remarkable strength during the current bull run. It has acquired this nickname not only due to its market capitalization, but also by frequently appearing among the top performers in terms of weekly gains while Ethereum (ETH) remains stationary.

During this phase, Solana (SOL) is prospering as Bitcoin (BTC) reaches significant mental barriers, drawing in investors aiming to move their funds to reduce risk – a benefit that Ethereum (ETH) previously possessed.

SOL is taking lead over ETH

Even though Ethereum (ETH) currently dominates the market with a whopping $300 billion valuation compared to Solana’s (SOL) $81 billion, recent trends suggest that SOL’s value has grown by more than 5%, whereas ETH has experienced a dip of approximately 3%.

It’s quite remarkable that this trend aligns with Bitcoin’s recent spike towards almost $70,000, which represents an impressive 16.67% increase over the past ten days.

In most cases, a heated market tends to draw funds towards large-cap alternative cryptocurrencies, as cautious investors look for opportunities to reallocate their gains by investing in less risky assets.

After Bitcoin hit its peak prices, Ethereum often saw substantial growth. But in contrast to past trends, Solana appears to be leading the charge in this particular cycle.

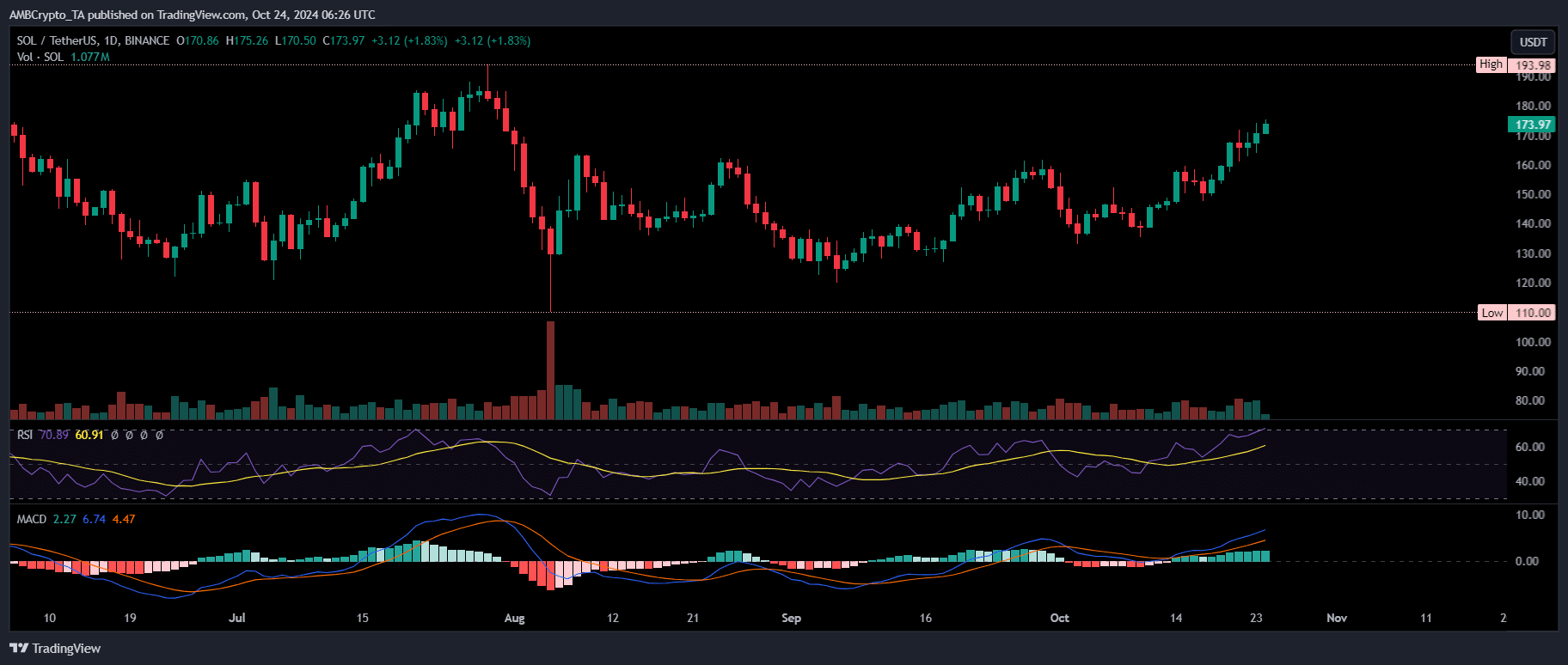

Source : TradingView

Four days ago, observing Bitcoin’s struggle to break through its four-month-old downtrend, Solana surprisingly recorded a daily increase of 4%, which was the highest growth rate in the past week. This significant spike might indicate a pivotal shift for Solana.

On the following day, Bitcoin saw a 2% decrease, setting the recent peak at $70K. This dip was echoed by Ethereum, which dropped almost 3%, furthering its downward trend.

Instead, it’s worth noting that those who believe in Solana (SOL) have successfully avoided a comparable dip. In reality, SOL has experienced a spike in value since overcoming the $160 resistance barrier, reaching this level for the first time on its fourth try after three earlier unsuccessful attempts.

At present, Solana (SOL) is priced at $173. Given that the Relative Strength Index (RSI) suggests an overbought condition, it might be time for a price correction. Over the last fortnight, about 83% of its price movement has been upward, which could potentially indicate a shift in trend direction towards a downturn.

Could this shift investor attention back to ETH?

A trend reversal could be near, but watch out for this

Previously, a report from AMBCrypto pointed out that the recent retreat of ETH could be a deliberate action by traders to eliminate less confident investors.

This dip might pave the way for a sudden price surge, drawing in fresh investors and motivating large investors (whales) to carry on buying – possibly pushing Ethereum prices beyond $2,700.

In contrast, the resurgence of Ethereum (ETH) during this cycle seems linked to Solana (SOL). Although ETH might experience a temporary turnaround near its support levels, breaking through requires keeping a close eye on Solana’s performance across different indicators.

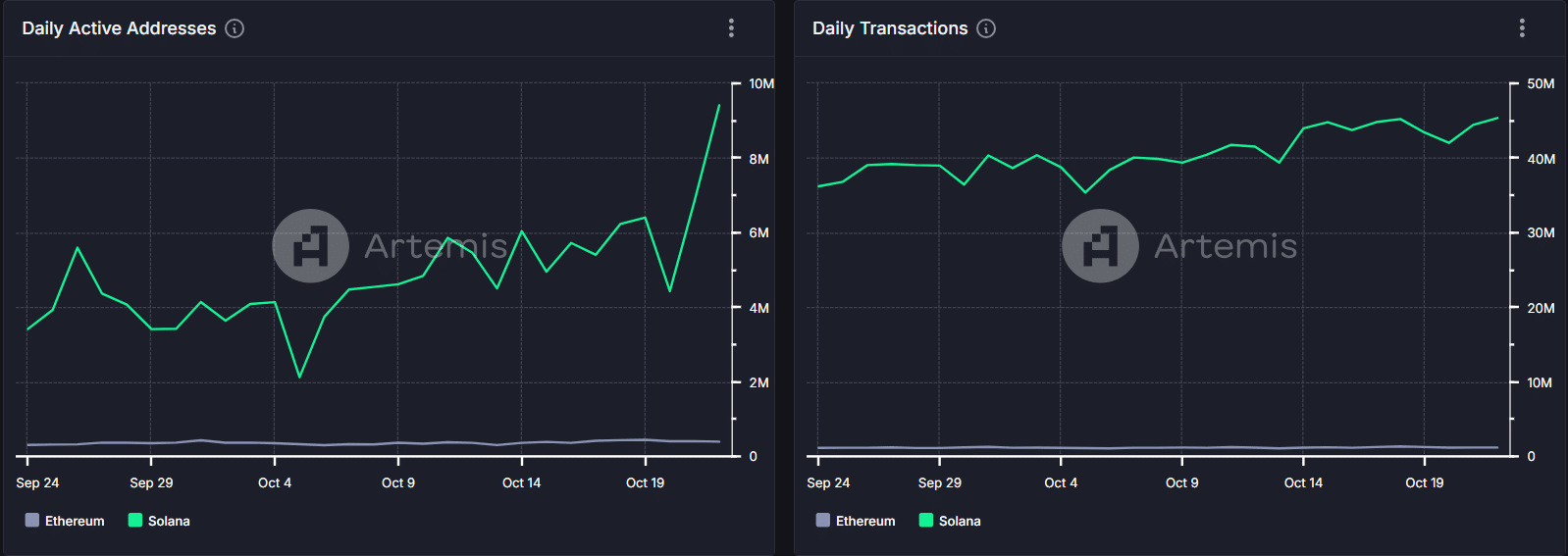

Source : Artemis Terminal

Over the past month, the number of daily active addresses on Solana has significantly spiked by 175%, compared to Ethereum which has experienced a more moderate rise in the double digits.

It’s not a mere chance that we’re seeing this surge in action. Solana has deliberately set itself up to surpass Ethereum by utilizing its superior transaction speed and affordability, making it quicker and less expensive to process transactions.

As a researcher, I can confidently say that thus far, the strategy we’ve employed has proven to be fruitful. Solana (SOL) has skillfully leveraged the escalating costs of Ethereum (ETH), thereby gaining considerable traction during this cycle and capturing substantial attention from Bitcoin (BTC) investors as well.

Read Solana’s [SOL] Price Prediction 2024–2025

Essentially, Solana (SOL) seems to have a more promising future compared to Ethereum (ETH), positioning itself as the top choice among alternative coins for the long term.

Although reducing SOL’s value might take it down to around $170, it still has the potential to surpass Ethereum (ETH), possibly paving its own way towards reaching a level above Ethereum’s projected $2,700 mark.

Read More

2024-10-24 16:08