- Solana outperformed Polygon and Tron in terms of transaction volume

- DEX volumes and TVL surged, while overall interest in Solana NFTs waned

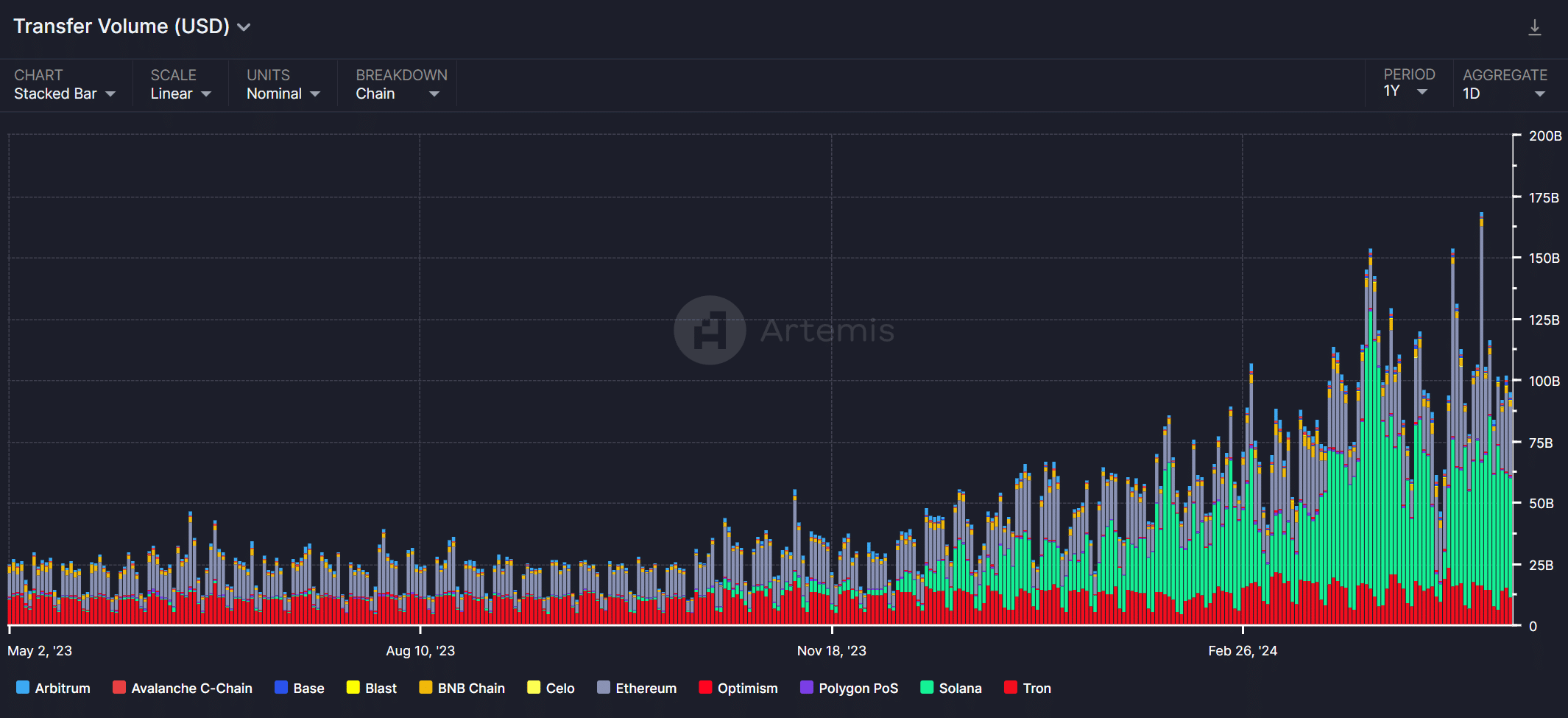

As a researcher with extensive experience in the crypto space, I have closely monitored the performance of various networks, including Solana [SOL], Polygon, and Tron. Based on recent data, it is evident that Solana outperformed its competitors in terms of transaction volume, with DEX volumes surging. However, there are areas where improvement is necessary for long-term sustainability.

As a researcher studying blockchain networks, I’ve noticed a recent decrease in activity and buzz surrounding the Solana (SOL) network. However, despite this dip, Solana has continued to surpass the performance of other networks like Polygon and Tron.

Artemis’s findings showed that Solana ranked first in transfer volume, trailing only Ethereum in this category based on the data.

DEX volumes on the rise

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing development in the case of Solana. While its overall activity has been noteworthy, what truly stands out is its success in the decentralized exchange (DEX) sector. In just the past few days, Solana’s DEX volumes have skyrocketed from $691 million to an impressive $1.2 billion. This significant increase in DEX volumes serves as a testament to the increasing popularity of Solana’s DEX platforms and hints at the emergence of a thriving ecosystem.

The boom in trading volume on Decentralized Exchanges (DEXs) running on the Solana network can mainly be explained by the widespread appeal of memecoins within this ecosystem. The affordable transaction fees offered by the Solana platform sparked a spike in memecoin creation and trade, resulting in increased DEX activity.

Due to these influencing factors, Solana performed commendably with regard to TVL (Total Value Locked), reaching an average of approximately $3.7 billion over the recent period.

It’s important to mention that despite the stable total value locked (TVL) in Solana, other platforms like Tron managed to surpass it in terms of performance.

As a researcher observing the Solana network, I’ve noticed that its activity levels and total value locked (TVL) have remained robust. However, the earnings generated from transactions on the network have been on a downward trend.

Over the past week, Solana’s revenue dropped significantly from $1.1 million to $381,000. In contrast, Tron maintained its strong performance in generating substantial revenue.

Despite the robust performance of the Solana network as a whole, there are aspects like Total Value Locked (TVL) and revenue that require significant enhancement for long-term viability.

Read Solana’s [SOL] Price Prediction 2024-25

NFT interest falls

One potential improvement for Solana could lie in its Non-Fungible Token (NFT) offerings. Lately, there’s been a significant decrease in demand for popular NFT collections.

Additionally, the average value of floors for Solana NFT collections, as well as the volume of NFT sales, have seen a decrease.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-05-03 14:15