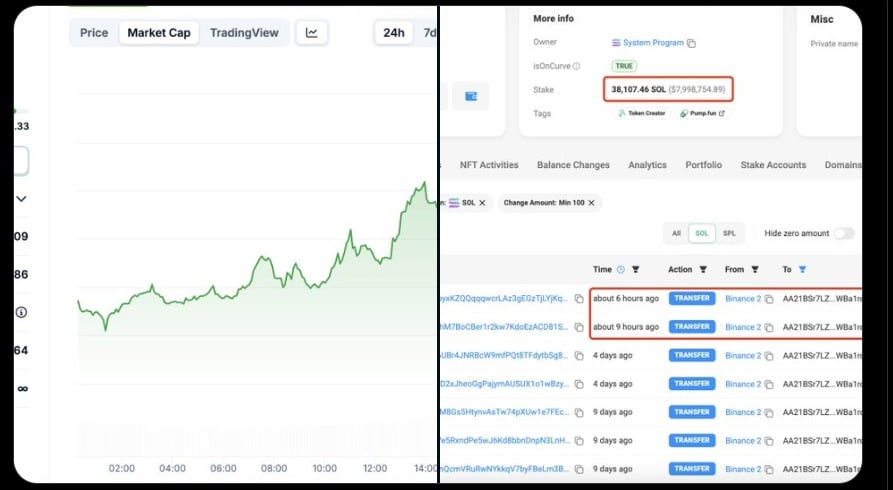

- A Solana whale accumulated 7500 SOL tokens worth $1.57 million over the past 24 hours.

- SOL surged by 27.05% over the past week.

As a seasoned researcher with years of experience navigating the cryptosphere, I can confidently say that the recent surge in Solana (SOL) is indeed intriguing. The 27.05% weekly increase and the 41.12% monthly gain are figures that would catch any investor’s eye.

Over the last month, Solana (SOL) saw a significant rise in value following a previous dip. For the first instance since April, this cryptocurrency has now climbed above the $200 threshold.

At present, I’m observing that Solana is currently being traded at approximately $207. Over the past week, this cryptocurrency has experienced a notable surge, recording a rise of 27.05%. When viewed from a monthly perspective, its growth is even more significant, with an increase of around 41.12%.

There’s been a lot of talk lately about what could be fueling this current upward trend. As per Lookonchain, one possible factor could be an increase in whale activity contributing to the recent surge.

Whales are accumulating Solana

Based on Lookonchain’s data, large investors (referred to as “whales”) have been steadily purchasing Solana (SOL) tokens. In particular, one such whale has amassed a total of approximately 257,599 SOL tokens worth around $54 million since October 22nd.

Also, over the past 24 hours, this whale had accumulated 7500 tokens worth $1.57 million.

Usually, increased whale accumulation reflects the market’s confidence in a crypto’s future value.

Impact on SOL’s charts?

Based on AMBCrypto’s assessment, Solana was benefiting from advantageous market circumstances when the report was published.

It was clear because the Solana’s Relative Vigor Index (RVGI) line, which is green, was positioned higher than its signal line.

As an analyst, I observe that this situation functions as a trigger for me to consider entering the market, particularly for long-term positions. An escalating Relative Volume Gain Index (RVGI) suggests a surge in bullish sentiments and heightened demand from buyers, signaling a potentially profitable opportunity.

Read Solana’s [SOL] Price Prediction 2024–2025

The surge in On-Balance Volume (OBV) from $64.8 million to $71.6 million adds credence to the observation that this market trend is being driven by an increase in trading activities, which have been on the rise.

When the trading volume (OBV) increases, it generally indicates that there’s heightened buyer activity. This increased activity tends to drive prices upwards. In other words, the growing volume serves as a supportive factor for the price rise, which is usually a good indication of robust buying demand.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-11-11 14:15