-

SOL’s Futures Open Interest sat at a two-month low.

There is a possibility the coin slips under $130.

As a seasoned crypto investor with a few years of experience under my belt, I’ve seen my fair share of market fluctuations and trends. The recent decline in Solana’s (SOL) Futures Open Interest and network activity is concerning, to say the least.

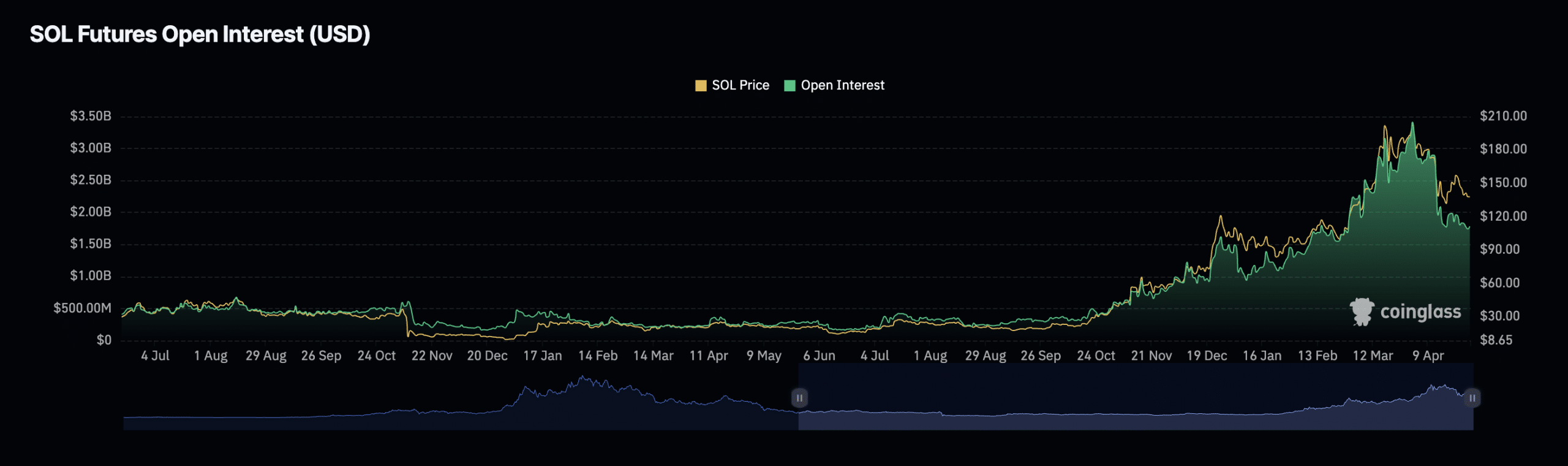

As a crypto investor, I’ve noticed that the futures open interest for Solana’s SOL has plummeted to its lowest point since the 27th of February, based on the data I’ve seen from Coinglass.

The value of an asset’s open Futures contracts represents the current worth of its unfilled contractual obligations in the Futures market.

when it decreases in this fashion, it signifies an increase in the number of market players settling their transactions without initiating new ones.

Based on Coingeasity’s latest figures, the Open Interest for this altcoin’s futures contracts amounted to $1.79 billion as of now. The downturn initiated on April 1st, resulting in a decrease of approximately 47% since then.

Solana saw a decline in April

As a Solana investor, I’ve noticed that the network activity on this Layer 1 blockchain took a dip in April based on my analysis.

Based on The Block’s data report, there was a reduction in the number of active Solana addresses during the past month.

As a researcher studying Solana’s transaction activity, I found that approximately 34 million distinct addresses engaged in transactions throughout the month. However, this figure represented a decline of around 11% compared to the previous month.

As a data analyst examining the blockchain market trends, I’ve noticed that the demand for Solana Network saw a significant decrease in new users in April. Specifically, based on the on-chain data, there were approximately 25 million unique first-time transacting addresses on the network during that month.

In March, there were 28 million new users who carried out at least one transaction on Solana. Subsequently, this number saw a decrease of approximately 11%.

As a crypto investor, I’ve noticed that Solana experienced a considerable decrease in transaction activity during April. The network’s total transaction volume plummeted to $7.32 trillion, marking a disconcerting 95% drop compared to the previous month.

For context, in March, Solana’s transaction volume was $148 trillion.

SOL has two options

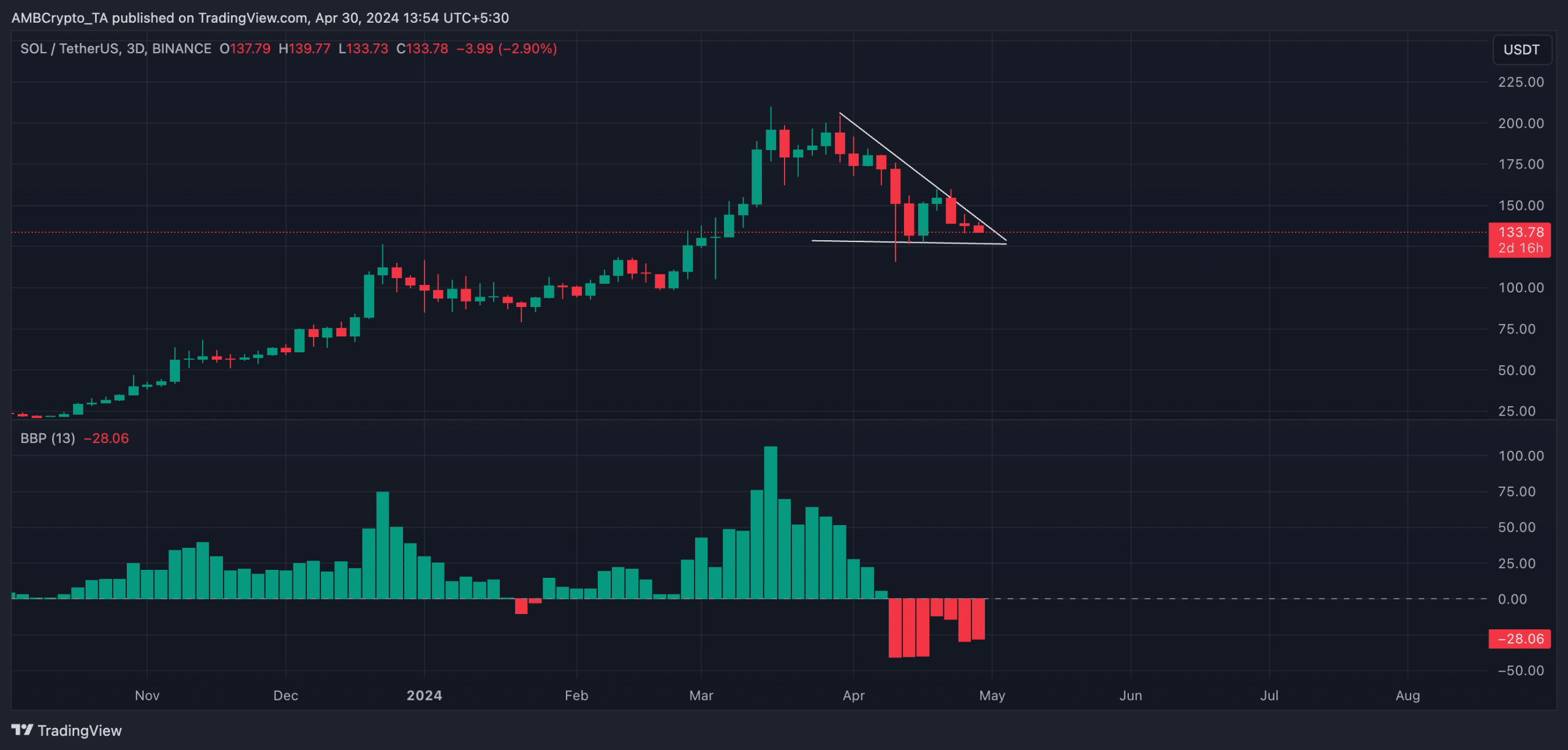

As a crypto investor, I’d say: At the current moment, Solana (SOL) is priced at $135.10 based on market data. However, I noticed a significant decrease in its value within the past week. According to CoinMarketCap’s records, SOL has experienced a drop of more than 30% during this timeframe.

As an analyst, I observed the price movements of Solana’s (SOL) coin over a three-day period. Notably, I identified a descending triangle formation on the chart. This technical pattern indicated downward pressure on SOL’s price. However, at the $128 level, the coin found support and did not break below this price point during my assessment.

If sentiment grows poorer, the coin may retest support and fall below $130.

Based on a swift analysis of market attitudes, it was evident that pessimistic views held sway over optimistic ones among traders and investors.

At the time of composing this text, SOL‘s Elder-Ray Index showed a negative reading, indicating a stronger influence of sellers over buyers in the altcoin market. This trend has persisted since the 12th of April.

Read Solana’s [SOL] Price Prediction 2024-25

As an analyst, when I observe a negative reading for this particular indicator, I can interpret it as the bearish influence holding sway in the market. Consequently, Solana (SOL) may be poised for a potential retest of its support levels or even a slide beneath them.

If the market’s feelings toward the coin shift, it could burst free from the triangle and reach prices of $195 and higher in an upward trend.

Read More

2024-05-01 07:03